One phrase comes to mind when you think of hedge fund Two Sigma: quantitative powerhouse. Founded in 2001 by John Overdeck and David Siegel, the hedge fund startup has become a $60 billion quant shop that uses a technology-based approach to guide its investing strategy. Its innovative use of fields like machine learning and distributed computing has enticed a host of blue-chip clients as well as first-rate talent.

Based on the $15.2 billion net gain generated for its investors in the last 18 years, Two Sigma earned a spot on LCH Investments’ annual list of the most successful hedge funds of all time. No wonder the Street’s focus locks in on Overdeck and Siegel when the fund makes a portfolio addition.

Bearing this in mind, we wanted to take a closer look at 3 trending stocks the fund added to its basket of holdings. With the help of TipRanks’ Stock Screener tool, we discovered that all of these names are buy-rated and boast substantial upside potential (depends who you ask) from the current share price. Here’s the lowdown:

Roku Inc. (ROKU)

For those just tuning in to Roku now, the streaming player company has captured Wall Street’s attention with its massive 372% climb year-to-date. While some bears have pointed to the recent dip as a cause for concern, the bulls believe that Roku is charging full speed ahead.

With this in mind, Two Sigma has initiated position in ROKU, snapping up 177,100 shares in Q3. This puts the value of the purchase at more than $18 million.

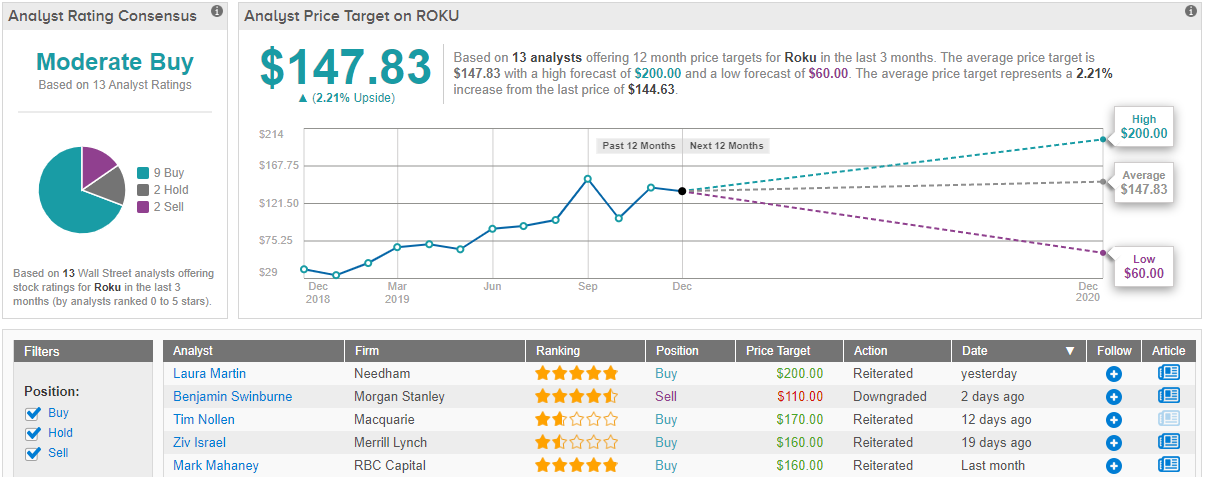

Needham analyst Laura Martin cites accelerating subscription video on demand revenues as the key upside valuation driver for Roku in 2020, noting that this actually decreases the investment risk. Roku is the largest aggregator of ad-driven TV and film content, with Martin estimating it will report about $850 million of total advertising revenue in 2020.

“The enormous amount of money at stake (ie, $70B/year vs the tiny amount OTT TV and film ad inventory) and the growing inability of brands to follow viewing behind a growing number of SVOD pay walls makes OTT ad units more valuable, especially the young wealthy viewers who are more likely to view streaming content,” the analyst explained.

On top of this, Martin sees Roku as the primary beneficiary of new streaming services from Disney+, Apple+, Peacock/CMSCA and HBOMax/AT&T thanks to the 32 million U.S. connected-TV homes that make up its installed base. Based on all of the above, the five-star analyst kept her Buy rating, while boosting the price target to $200 (from $150). At this target, shares could rise 38% in the next twelve months. (To watch Martin’s track record, click here)

Like Martin, Macquarie’s Tim Nollen has high hopes for Roku. “We believe connected TV (CTV) device usage and advertising growth will continue to rise exponentially, and Roku is in prime position to both drive and harness this,” he wrote in a note in which he maintained his bullish call and bumped up the price target to $170. (To watch Nollen’s track record, click here)

Looking at the consensus breakdown, not everyone on the Street is on the same page as the analysts. The average 12-month price target on the stock stands at $148, which implies a modest 2% increase from its current price. This is based on 9 “buy,” 2 “hold,” and 2 “sell” ratings received in the last three months. (See Roku stock analysis on TipRanks)

Facebook (FB)

Overdeck and Siegel’s fund just upped the ante by snapping up 1,306,250 shares of Facebook with a value of over $232.6 million, increasing the holding by a whopping 711%.

Indeed, when it comes to the social media giant, some analysts tell investors the outlook for 2020 plus the current attractive share price equals a Buy.

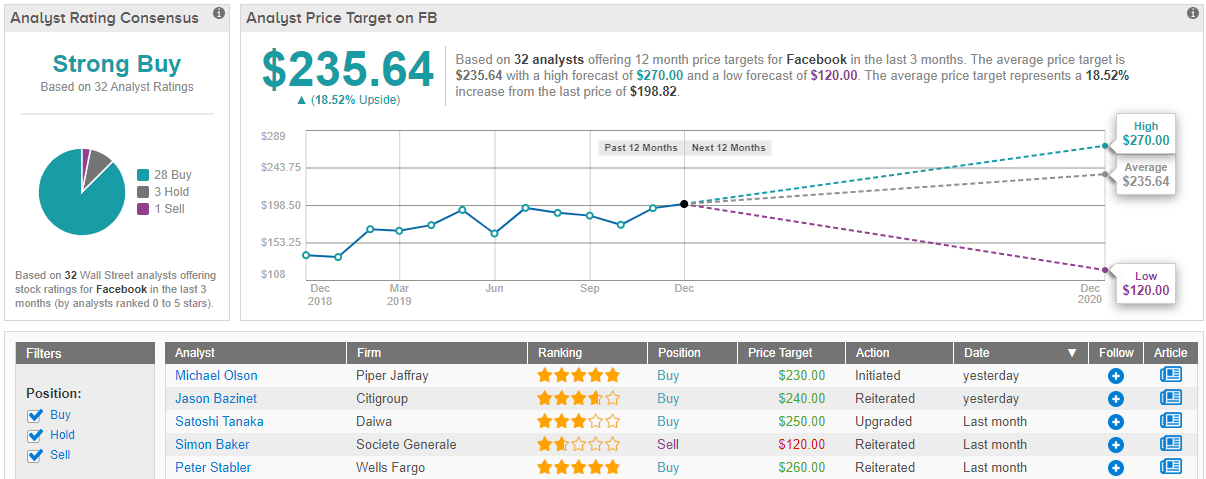

Part of the bullish sentiment on Wall Street comes as a result of its advertising segment. In its third quarter, FB’s ad growth remained at more than 30%, with 2020 guidance landing in-line with investors’ expectations. Susquehanna’s Shyam Patil thinks that this target is achievable or even beatable as Instagram Stories monetization continues to scale and incremental growth drivers like Instagram Shopping as well as Explore begin to accelerate. The analyst puts his rating where his mouth is, reiterating a Positive rating alongside a price target of $245. (To watch Patil’s track record, click here)

Like Patil, Morgan Stanley’s Brian Nowak is especially excited about user engagement as it creates a “layer cake of monetization.”

“Engagement creates monetization opportunities and FB continues to excel at innovative monetization. Looking ahead to ’20 and beyond, we remain bullish about the still untapped engagement/use cases to monetize including Instagram Explore, commerce across FB Marketplace and Instagram, product sponsorships, video and Instagram TV…and (over the long-term) messaging,” he explained. To this end, Nowak decided to stay with the bulls. According to the five-star analyst’s $250 price target, shares could surge 26% in the next twelve months. (To watch Nowak’s track record, click here)

In general, other Wall Street analysts take a similar approach. With 28 Buys, 3 Holds and 1 Sell, the verdict is that Facebook is a Strong Buy. Its $236 average price target implies a potential twelve-month gain of 19%. (See Facebook stock analysis on TipRanks)

Snap Inc. (SNAP)

The company behind the famous photo-sharing app has certainly impressed Wall Street with its 171% year-to-date gain. Despite less than ideal user growth in the U.S., some analysts argue that this is nothing to get scared about.

With this background, Two Sigma just scooped up a chunk of Snap shares. We’re talking about a total of 5,528,277 or $87.3 million-worth.

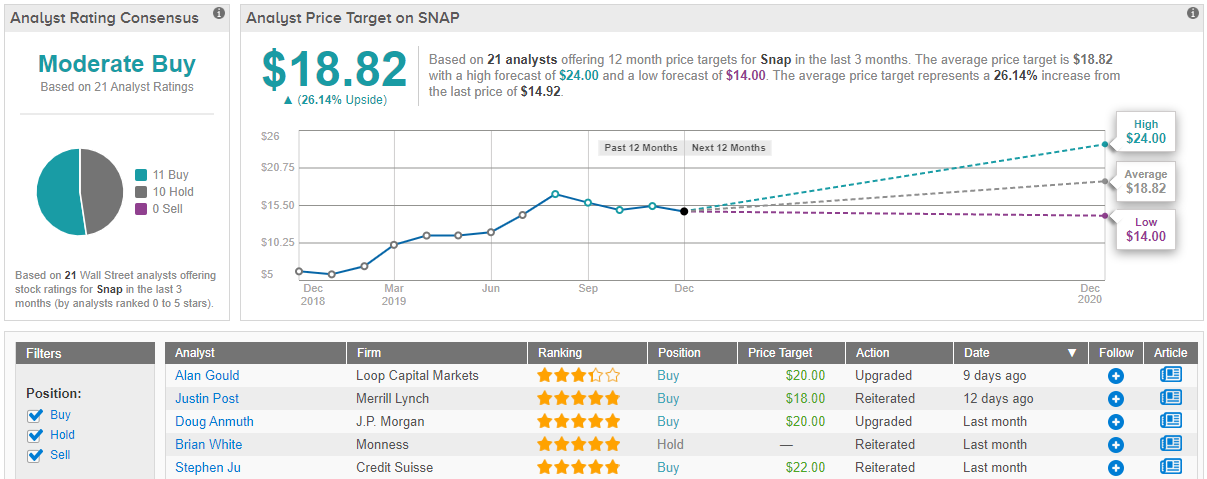

Kevin Rippey, an Evercore ISI analyst, reminds investors that revenue growth accelerated for the third quarter in a row to 50% year-over-year and losses narrowed to less than $50 million on an adjusted EBITDA basis. While acknowledging that the 1 million quarter-over-quarter U.S. user growth most likely drove the post market selloff, he claims that management’s guidance still reflects ongoing momentum in audience trends. This prompted the analyst to comment, “We’re a bit surprised to not see more initial enthusiasm given aggregate user trends and guidance, as it’s increasingly clear that the accelerative dynamics in SNAP’s business are sustainable.” As a result, Rippey’s Outperform rating and $20 price target on Snap stock remain unchanged. (To watch Rippey’s track record, click here)

Another Snap bull, Guggenheim’s Michael Morris, thinks that Snap has what it takes to further monetize its core platform: “We also have confidence that Snap will continue to monetize its core platform while creating incremental pathways to scale revenue and complement the user experience – particularly given untapped revenue opportunities within AR, Maps, and Games.” Morris adds that Snap’s “unique scale among valuable younger audiences,” lends itself to a foundation for sustained equity appreciation. To this end, the four-star analyst maintained his bullish thesis and $22 price target, bringing the upside potential to 47%. (To watch Morris’ track record, click here)

In terms of Snap’s Street consensus, analysts are split almost right down the middle. Out of 21 total analyst ratings published in the last three months, the Buys beat out the Holds by just 1, making the consensus a Moderate Buy. In addition, the average price target of $19 amounts to 26% upside potential. (See Snap stock analysis on TipRanks)