5G is here. The new digital wireless technology first started to make waves in 2017, with connectivity tests in Argentina, Norway, and Poland. By late 2018, active 5G networks were starting to appear on a limited basis in various urban areas, and in 2019 the first nationwide networks went into operation in the US and China. As 2020 matures, industry analysts expect to see these networks expand, as providers move into the mid- and high-frequency bands.

The new network rollout brings with it a slew of opportunities, as does any new technology. Original equipment manufacturers will need new components. The new networks will require a denser network of towers and transmitters, which in turn will require their own hardware. Semiconductor chip makers especially are looking forward to increased sales as the new equipment brings with it needs for updated and upgraded chips.

To this end, we pulled up TipRanks’ database to learn more about two exciting plays in the 5G space. According to the Street, both of the Buy-rated stocks could win big as this new technology trend takes over. Let’s jump right in.

Resonant Inc. (RESN)

Operating on an IP licensing model, Resonant designs filters for radio frequency and front-ends for mobile devices. With the company expected to be a major beneficiary of the 5G rollout as the adoption of XBAR architectures in the mobile handset space ramps up, now could be the right time to pull the trigger.

This is the stance taken by Needham’s Rajvindra Gill. The five-star analyst recently hosted a Zoom investor call with CEO George Holmes, and the analyst walked away more confident that the Chinese smartphone market is rebounding. Back in February, China handset shipments declined by 50% year-over-year, but consumer demand is on the rise once again. While not a full recovery as shipments in March 2020 are still down 20% year-over-year, the rate of decline is slowing, demonstrating that the situation is improving. This is significant as the company relies on China for a significant portion of its revenue.

Expounding on the importance of the market recovery in China, Gill stated, “Through its partnership with Murata, the largest filter manufacturer in the world, RESN’s XBAR technology is largely targeted towards Chinese handset OEMs and the Chinese handset market.” He added, “Moreover, RESN indicated that Tier-1 handset OEMs in China have not made any changes to their 5G handset roadmaps and still are on track to roll-out several 5G models.”

Also encouraging, despite a slight deceleration in Europe, statements from base-station equipment vendors imply that globally, 5G infrastructure deployment is on track. This leaves the door open for RESN, according to Gill. “We view XBAR technology as critical for 5G mobile applications and well-positioned to handle the key 5G requirements of higher bandwidths, rejection of unwanted signals/ noise, and increases in antennas,” he commented.

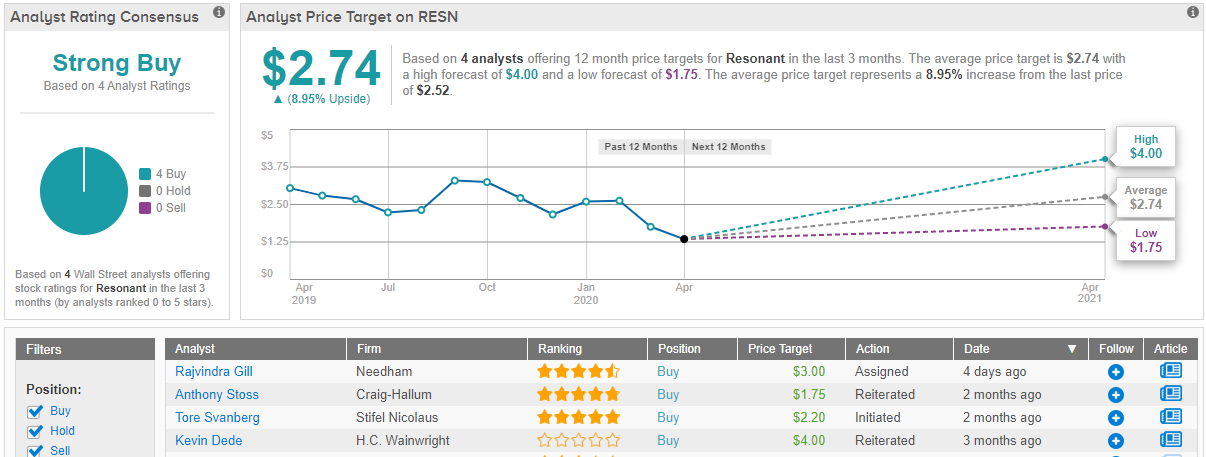

Based on all of the above, Gill’s bullish thesis remains very much intact. He kept both his Buy recommendation and $3 price target as is. This conveys his confidence in RESN’s ability to surge 20% in the next twelve months. (To watch Gill’s track record, click here)

What does the rest of the Street think about RESN’s long-term growth prospects? It turns out that other analysts agree with Gill. The stock received 4 Buys in the last three months compared to no Holds or Sells, making the consensus rating a Strong Buy. At $2.74, the average price target brings the upside potential to 9%. (See Resonant stock analysis on TipRanks)

Xilinx Inc. (XLNX)

As for the second stock on our list, Xilinx is the leading supplier of programmable logic devices (PLDs), a rapidly expanding segment of the semiconductor industry. Given the current economic landscape, one analyst thinks that its standing sets it apart from other players in the space and positions it for success.

Writing for Baird, five-star analyst Tristan Gerra argued, “Xilinx is very well positioned given the current macro environment given its lack of exposure to supply chain disruptions, fabless model not impacted by utilization rate fluctuations, and high infrastructure exposure with notably 5G infrastructure and video streaming which we see as beneficiaries of work-at-home trends.”

While acknowledging that there has been some concern surrounding the level in which XLNX is participating in 5G infrastructure buildouts, Gerra cites its large-scale Samsung win for second-generation 5G as demonstrating the company’s focus on this part of the business. “We continue to believe FPGA opportunities in radioheads will remain long-lasting, while management continues to see 5G as a meaningfully larger opportunity than 4G,” he noted.

Specifically looking at 5G as a growth driver for the company, XLNX is expected to participate in almost 40% of China Mobile’s recent $5.3 billion tender. On top of this, next year, the company will grow its Versal lineup into a much broader product family. Gerra believes this underscores its market share gains.

Even though the company’s fiscal Q1 2021 guidance calls for revenue and GAAP gross margin that comes in below Gerra’s forecasts, the analyst sees XLNX emerging as a long-term winner.

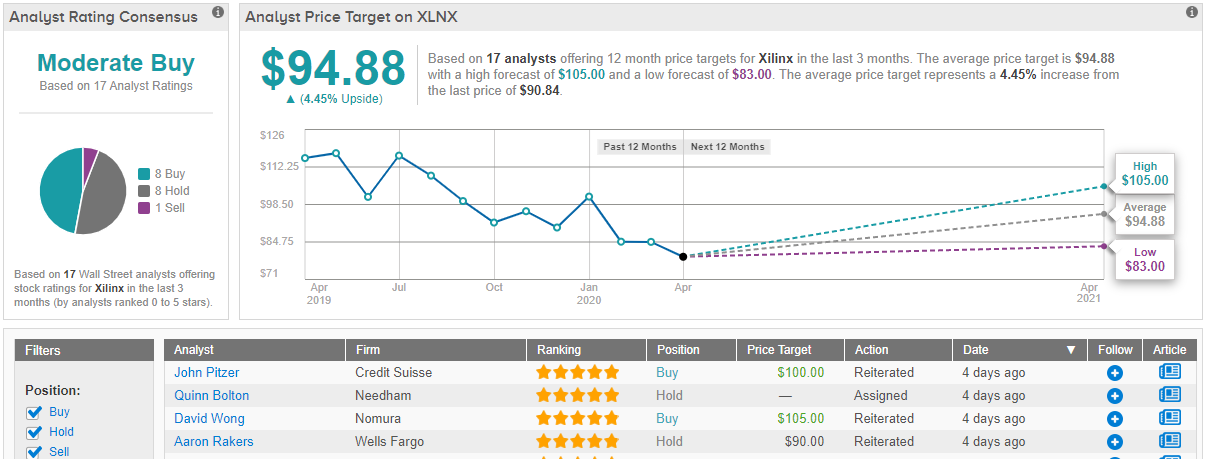

As a result, Gerra stayed with the bulls, reiterating an Outperform rating and $105 price target. Should this target be met, a twelve-month gain of 16% could be in store. (To watch Gerra’s track record, click here)

Looking at the consensus breakdown, other analysts’ opinions are more varied. 8 Buys, 8 Holds and 1 Sell add up to a Moderate Buy consensus rating. Additionally, the $94.88 average price target implies modest upside potential of 4%. (See Xilinx stock analysis on TipRanks)

To find good ideas for 5G stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.