In uncertain times, investors may find it difficult to choose which stocks to purchase; this is where the TipRanks Top Smart Score Stocks tool can be useful. The tool helps identify stocks with the potential to generate returns higher than market averages. Based on eight different factors, the tool assigns a score to stocks between 1 and 10, with 10 being the best.

Using this tool, we’ve looked up two stocks sporting a Perfect Score – Veeva Systems (NYSE:VEEV) and Duolingo (NASDAQ:DUOL). It is worth mentioning that shares with a “Perfect 10” Smart Score have historically outperformed the S&P 500 Index (SPX) by a wide margin.

Let’s take a closer look at these stocks.

Veeva Systems, Inc.

VEEV stock was added to the Perfect 10 list yesterday. The stock has a Positive signal from retail investors and hedge funds. Our data shows that hedge funds bought about 68,800 shares of the company in the last quarter. The stock also enjoys bullish Blogger sentiment and Positive News Sentiment on TipRanks. The efficiency of Veeva is further demonstrated by its ROE of 14.72%.

The company has an impressive revenue growth track record. In the past five years, its topline has witnessed a compound annual revenue growth rate of 20.1%. Given the economic uncertainty, Veeva’s prospects might look dull in the near term, but the expected rebound in corporate spending as well as the company’s efforts to launch new solutions may support performance going forward.

It is worth highlighting that ahead of the company’s fiscal first-quarter earnings release on May 31, VEEV stock received Buy ratings from two analysts in the last three days. One of the analysts, Joseph Vruwink from Robert W. Baird, commented on the approaching results and predicted that the business would publish “better-than-feared” Q1 earnings.

What is the Price Target for VEEV Stock?

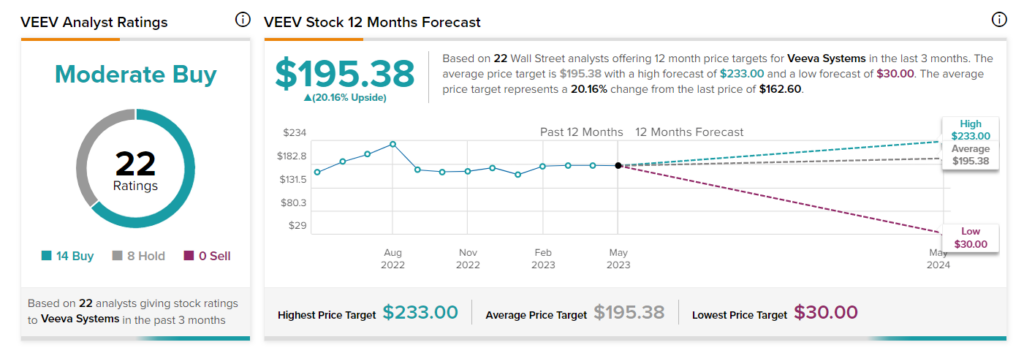

VEEV stock has a Moderate Buy consensus rating on TipRanks. This is based on 14 Buy and eight Hold recommendations. The average price target of $195.38 implies 20.2% upside potential from current levels. The stock has gained about 2% so far in 2023.

Duolingo Inc.

DUOL was also added to the Perfect 10 list yesterday. Our data shows that retail investors and hedge funds are currently bullish on the stock, as they bought 112,600 shares of the company last quarter. Also, the bloggers sentiment is more Bullish than other stocks in the technology sector.

The free language-learning app provider has been able to increase its user base in seven consecutive quarters. Further, DUOL’s debt-free position remains another key positive factor. Also, the company’s partnership with OpenAI to provide customers with a new premium subscription option indicates bright prospects ahead.

Following the better-than-expected first-quarter earnings release on May 10, six analysts rated DUOL stock a Buy. Among these, Needham analyst Ryan MacDonald believes that the company has the potential to outperform growth and profitability expectations based on accelerating daily active users and monthly active user metrics.

Is DUOL a Good Buy?

DUOL stock has a Strong Buy consensus rating on TipRanks, based on six Buy and two Hold recommendations. The average price target of $152.63 implies 3.5% upside potential from current levels. The stock has witnessed an impressive 108% year-to-date rally.

Ending Thoughts

Investors looking for growth-oriented stocks might want to consider Veeva and Duolingo stocks. The highest Smart Score on TipRanks suggests that these stocks could outperform the broad market averages.