Money doesn’t grow on trees even though we all wish it would. But one place it does grow is on well-placed investments that generate strong, stable, recurring streams of revenue. Buy the right stock at the right time and you’ll reap the rewards. And one of the best times to do so, is just before the holiday season.

“But what about the trade wars with China and the declining stability in the US economy”, you ask? Regardless of the current economic uncertainty, consumers are already out there shopping and filling up their baskets with new gifts before time runs out. These same consumers are also light on the trigger when it comes to online shopping, now more than ever.

And the numbers don’t lie. According to a study performed by the National Retail Federation, 33% of American consumers are expected to spend a minimum of $1000 on gifts this holiday season, with the remaining 66% expected to spend between $100-$999 on gifts.

With this in mind, we’ve gathered the most attractive investments based on overall analyst consensus and narrowed down the list for you by using the TipRanks’ stock screener. Investors can use the screener to filter stocks by analyst consensus, upside potential, market cap, and etc.

Let’s take a closer look at two consumer stocks to fill your own holiday baskets with:

Alibaba Stock Remains a Top Pick

E-commerce giant Alibaba Group (BABA) is what many believe to be the ‘heavyweight champion’ of the consumer goods space. Even after the recent departure of the company’s co-founder and executive chairman Jack Ma, Alibaba continues to stand strong and is showing no signs of a future slow-down. BABA has grown 24% year-to-date, with analysts predicting the stock to continue outperform the broad market.

After visiting the Alibaba Investor Day in September, 5-star Raymond James analyst Aaron Kessler reiterated a bullish ‘strong buy’ rating on the stock. (To watch Kessler’s track record, click here)

“Alibaba remains our top Internet mega-cap pick given [that] we expect continued solid China e-commerce growth with Alibaba as the biggest winner at a 60% market share.” Kessler stated. “We believe take rate upside is underappreciated and that the valuation is attractive with 20%+ expected long-term growth.”

Echoing and confirming Kessler’s bullish thoughts, 5-star Stifel Nicolaus analyst Scott Devitt added, “We are encouraged by Alibaba’s continued expansion of consumer and enterprise services, steady market share gains, and a long-term investment focus on cloud, international, local services, offline retail, and innovation. Alibaba remains one of our favorite large cap ideas and is a Select List pick. Alibaba has runway to expand market leadership, user penetration, and synergies across businesses.” Devitt rates BABA stock a Buy, with $225 price target.

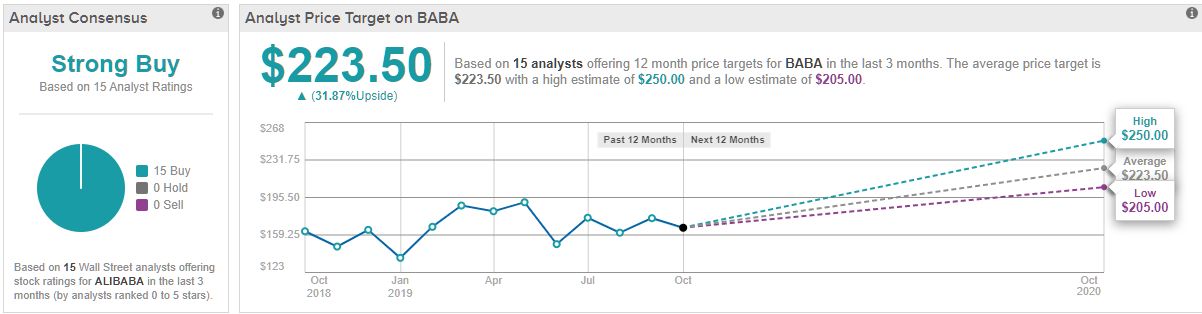

All in all, this ‘Strong Buy’ stock is no Wall Street secret. After all, in just three months, the stock has attracted 15 ‘buy’ ratings. With a return potential of 32%, the stock’s consensus price target stands at $223.50. In other words, optimism backs this Chinese e-commerce titan. Analysts are keen on BABA stock and you should definitely take notice. (See BABA’s price targets and analyst ratings on TipRanks)

The Beauty of Estée Lauder Stock

For many women (and some men) around the world, the Estée Lauder (EL) brand needs no introduction. Consumers worldwide have been enjoying the offerings of one of the world’s leading manufacturers and marketers of quality skin care, makeup, fragrance, and hair care products for the past 73 years.

It’s not surprising that the bulls are focusing on EL heading into the pivotal holiday shopping season, sending the stock rising about 50% year-to-date.

EL ended its fiscal year 2019 with a bang, posting tremendous growth outlook. Specifically, the company delivered a high quality 4Q EPS beat ($0.64 vs. Street $0.53) — and more importantly — Q4 strength is set to continue in Q1.

“We argue that the outlook for Q1 F20 sales, more than the magnitude of Q4 earnings beat, best indicates EL’s 2020 earnings power and reflects mgmt. assessment of the return on its reinvestments to prolong 1) Asia’s momentum; 2) stabilize and turnaround the U.S. business,”, Evercore ISI analyst Robert Ottenstein opined. With his bullish thesis reaffirmed, Ottenstein reiterated a ‘buy’ rating on EL stock, along with a $230 price target.

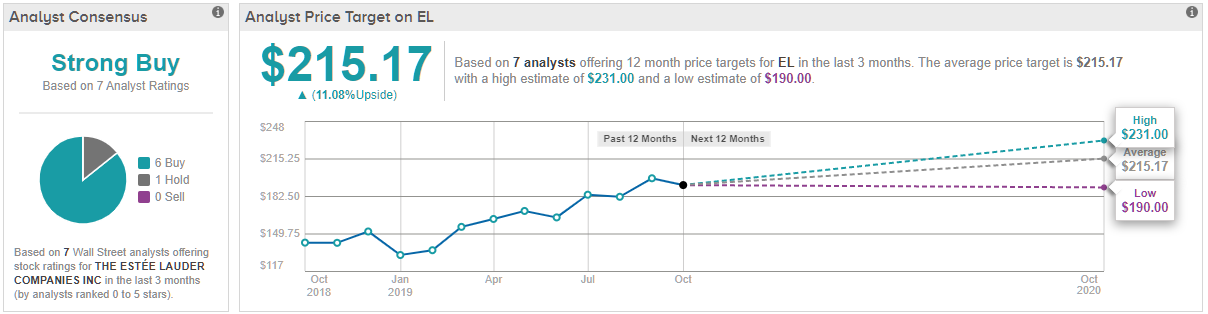

All in all, Wall Street’s confidence backing this beauty giant is strong, with TipRanks analytics showcasing EL as a Strong Buy. Based on 7 analysts polled in the last 3 months, 6 rate the stock a Buy while only one suggests Hold. Meanwhile, the 12-month average price target stands at $215.17, marking a nearly 11% upside from where the stock is currently trading. (See EL’s price targets and analyst ratings on TipRanks)