In this piece, we’ll make use of TipRanks’ Comparison Tool to have a glance at two stocks in the healthcare sector — CVS Health (NYSE:CVS) and Pfizer (NYSE:PFE) — that are trading at fairly reasonable multiples. Wall Street analysts remain upbeat on each name as we close the book on a brutal 2022 (no Santa Claus for investors this year) for financial markets.

Healthcare stocks are a great place to seek shelter from market volatility. Though many health names may be able to help dampen the choppy moves a recession will bring, investors must pay extra attention to the price they’ll pay. Indeed, 2022 saw quite a rotation out of high-growth areas like tech toward more defensive value-oriented sectors.

With interest rates on the ascent, you’ll pay a bit more of a premium for the names that can fare well in an economic downturn. Pay too high a premium, though, and investors could still experience considerable downside risks.

CVS Health

Shares of pharmacy and healthcare services behemoth CVS have outperformed the broader S&P 500 this year, now down just north of 10% year-to-date. Undoubtedly, the stock could have escaped 2022 at breakeven had it not been for the latest December slide.

With an outstanding third quarter ($2.09 EPS vs. $2 estimate) in the books and a freshly-hiked 2022 EPS and operating cash flow outlook, CVS seems like a firm that not even a recession can stop. Despite the recession-resilient characteristics of the firm, the stock doesn’t trade at too high a premium.

At writing, CVS stock goes for 39.7 times trailing earnings and 0.4 times sales. With a dividend yield above 2% and a low 0.7 beta, it’s hard to find a better way to play defense in the face of what could be a considerable drop-off in earnings.

Earlier this month, CVS announced its very first MinuteClinic location in northern Delaware. The clinic is situated within certain CVS pharmacies, making for a convenient option for eligible patients. For now, care is being offered to adults with specific conditions.

Over time, it will be interesting to see how the firm looks to grow the concept. I think MinuteClinic could be the start of something special. As valuations continue to contract across the market, look for CVS to continue taking advantage of acquisitive opportunities. With nearly $20 billion in cash as of September 2022, CVS has plenty of dry powder that it could put to good use.

What is the Price Target for CVS Stock?

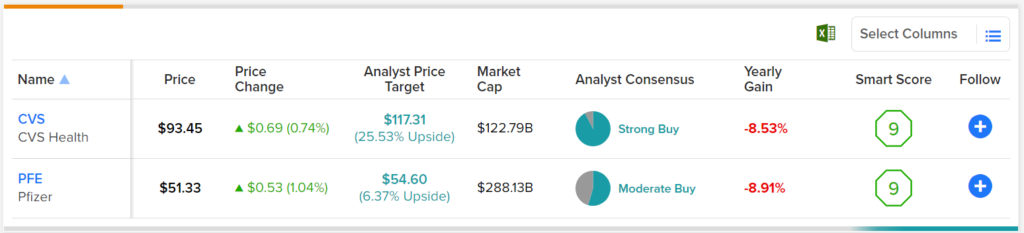

Wall Street remains incredibly bullish (Strong Buy consensus rating) on the name. The average CVS stock price target of $117.31 implies a solid 25.53% gain, which is impressive for such a low-beta name ahead of a recession year.

Pfizer

Pfizer is a pharmaceutical kingpin that many investors may be quick to forget now that the COVID-19 pandemic is beginning to wind down. While the coronavirus is still at large, many may be sick of all the measures to prevent the spread. As we head into yet another year of a pandemic, the importance of vaccinations could be key to preventing a horrific resurgence of new variants. Undoubtedly, Pfizer will play a key role in keeping populations boosted.

Beyond COVID-19, Pfizer has a lot of irons in the fire. Since spinning off Upjohn, the Pfizer of new is more capable of greater growth. Still, key patent losses will kick in come 2025. Fortunately, Pfizer’s drug pipeline is full and could yield products that take the place of drugs due to face a surge in generic competition.

It’s not just the pipeline that could help power sales growth; Pfizer’s been active on the M&A front. The recent acquisition of Biohaven’s migraine franchise is intriguing. As more cash flows from the COVID-19 business, expect Pfizer to continue wheeling and dealing.

If a recession brings forth pain for various biotechs, expect Pfizer to get a better bang for its buck. More recently, Pfizer announced a collaboration with Oric Pharmaceuticals (NASDAQ:ORIC) to help advance its multiple myeloma offering. Pfizer has a 12% stake in Oric. Indeed, Oric stock has crumbled violently and could make for a compelling value at these depths if its promising offering continues to move forward.

Pfizer stock sports a generous 3.13% dividend yield and a low 0.66 beta, making it a great place to dampen recession and rate-induced market volatility in the new year. At 9.7 times trailing earnings, PFE stock is a bargain that investors are discounting heavily. Between the peaked COVID-19 business and a coming patent cliff, Pfizer has its fair share of headwinds. Regardless, I continue to favor the name for investors seeking defensive value.

What is the Price Target for PFE Stock?

Wall Street’s upbeat on Pfizer, with a Moderate Buy consensus rating based on six Buys and five Holds assigned in the past three months. The average PFE stock price target is $54.60, implying 6.37% potential upside.

Conclusion: Analysts Prefer CVS Stock

Healthcare is still rich with value, even with a recession knocking on the door. At this juncture, Wall Street prefers CVS to PFE stock.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.