Finding solid returns is the goal of the game when it comes to stock investing, and investors of all stripes are always on the lookout for a reliable strategy. One common mode, followed by retail investors seeking accurate clues for stocks on the way up, is keep track of insider trades.

Corporate insiders are company officers, in high positions, with responsibility to Board members and shareholders alike for bringing in profits and stock price gains. Their positions give them a deeper knowledge of their companies’ inner workings, knowledge that can inform their opinions on where the company’s stock is likely to go.

In short, insiders have a leg up when trading in their own company’s stock. And to prevent that becoming an unfair advantage, governmental regulators require them to regularly publish their trading activity. This is public info, and careful investors can watch it for hints – based on insider buying patterns – of stocks primed for gains.

Bearing this in mind, we used the Insiders’ Hot Stocks tool from TipRanks to point us in the direction of two stocks flashing signs of strong insider buying that warrant a closer look. It also doesn’t hurt that both are high-yield dividend payers. Let’s take a closer look.

Black Stone Minerals (BSM)

First up is Black Stone Minerals. Based in Houston, Texas, this firm operates as a mineral rights company, buying tracts of land in energy-rich production regions – and holding the royalty rights on the hydrocarbons (crude oil and natural gas) that the production companies pull out of the ground. Black Stone’s footprint exceeds 20 million acres and spreads across 41 states; the company’s largest holdings are in Alabama-Mississippi, Arkansas-Louisiana-Texas-Oklahoma, and North Dakota-Montana.

Black Stone has been a beneficiary of both its own ongoing efforts at land-rights acquisitions, and the relatively high price of oil and gas over the past year. With one blip – a sequential drop in Q1 of this year – the company has seen consistently rising revenues for the last several years. In 3Q22, the last quarter reported, the company had a top line of $216.4 million, more than triple the $59.8 million reported in 3Q21. Black Stone’s net income came in at $168 million, compared to just $16 million in the year-ago period, and the diluted EPS, at 75 cents, was far higher than the 5-cents reported one year earlier.

Of particular interest to dividend investors, the distributable cash flow hit $116 million in Q3, a company record and up 9% quarter-over-quarter. The distributable cash flow is used to support the dividend, which was recently declared for 4Q22 at 45 cents per common share. This was up from 42 cents in Q2, and up an impressive 80% from 2Q21. At the current rate, the 45-cent payment annualizes to $1.80 and gives a robust yield of 9.8%.

Turning to the insiders’ trades, we find that CEO and Chairman, Thomas Carter, last week spent $968,500 to buy up 50,00 shares of BSM.

Analyst Eduardo Seda covers this stock for Jones Trading, and he likes what he sees – especially in the company’s ability to expand its footprint for new development.

“Development activity remained robust across BSM’s acreage, and royalty volumes benefitted from new wells brought online… on high interest acreage in the Shelby trough. As a result, BSM experienced an increase in royalty production in 3Q22 compared to a year ago and 2Q22. We note that there were now 92 rigs operating across BSM’s acreage, a solid increase from the 81 rigs in 2Q22 and a significant increase from the 59 rigs a year ago. Overall, with continued development activity across its acreage, and as the commodity price environment for crude oil and natural gas remain at elevated levels (despite some pullback), BSM produced strong operating results,” Seda opined.

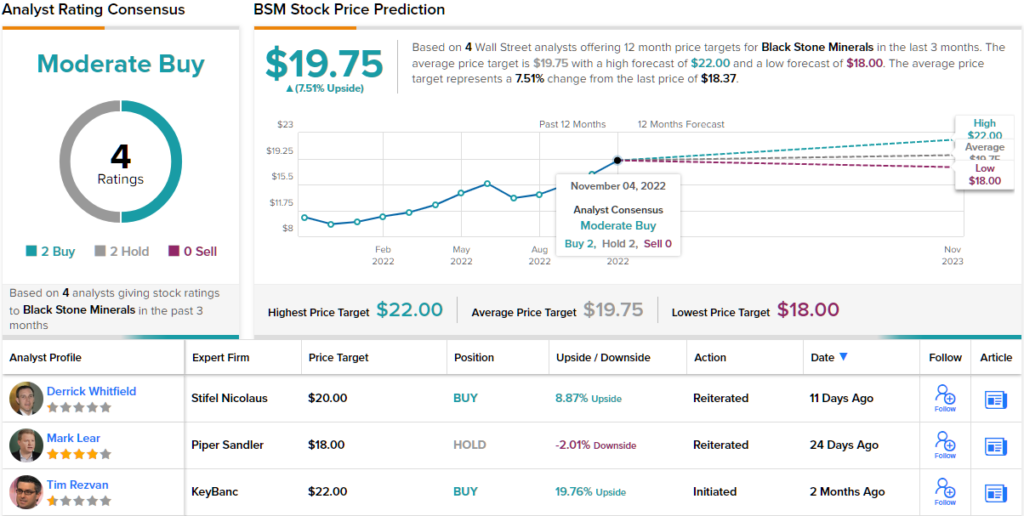

In line with his positive view of Black Stone’s position, Seda rates the shares a Buy. His $23 price target implies it has room for ~20% upside in the coming year. (To watch Seda’s track record, click here)

Among Seda’s colleagues, BSM has a Moderate Buy consensus rating, based on an evenly split 2 Buys and Holds, each. (See BSM stock forecast on TipRanks)

National Storage Affiliates (NSA)

For the second stock, we’ll turn to the real estate investment trust (REIT) sector, and to National Storage Affiliates. This company specializes in the acquisition, ownership, and operation of self-storage facilities located in high-quality, high-growth markets. National Storage touts this niche as particularly useful in the current economic clime, as self-storage has proven to be recession-resistant over the long term.

Recession resistance can be backstopped by scale, and National Storage takes this to a high level. The company can boast of 1,100 properties across 42 states plus Puerto Rico, with a total of 71.5 million rentable square feet in the portfolio. More than 200 of these locations are in Texas, with 98 in California, and 90 in Florida. National Storage also has a substantial footprint in Louisiana, Alabama, Georgia, Tennessee, and North Carolina; it is no coincidence that the company has an extensive presence in the Southeast, one of the country’s fastest growing regions.

Earlier this month, National Storage reported its 3Q22 results. In the release, the company reported having bought 23 new properties during the quarter, for a total price of $321.8 million. The company also reported a net income of $40.2 million for Q3, down slightly from the year-ago quarter. EPS, at 21 cents, missed the 28-cent forecast.

National Storage found support for its finances from an increase in same-store net operating income, of 12% compared to the third quarter of last year. Same-store total revenues were also up, by 10.7% year-over-year.

Also in Q3, the company repurchased nearly 1 million shares under a previously authorized share buyback policy. The repurchase program is capped at $400 million.

The subject of purchases brings us to management’s capital return policy, which also includes a 55-cent per common share dividend. This was declared and paid in September. The payment has been raised 5 time in the last six quarters, and the current rate, annualized at $2.20, gives a yield of 5.4%. The yield is almost triple the average found in the broader markets, and comes with a 7-year history of reliability.

This stock’s insiders sentiment is very positive, the highest possible, after a series of informative buys this week. These buys ranged from $11,032, for 292 shares – to a $2 million buy from Arlen Nordhagen, executive chair and member of the Board. Nordhagen bought 53,000 shares for that outlay, which turned insider sentiment positive on the stock.

The insiders aren’t the only bullish voices here. 5-star analyst Steve Manaker, from Stifel, rates NSA shares a Buy, while his $50 price target implies a gain of 22% in the next 12 months. (To watch Manaker’s track record, click here)

Backing his stance, Manaker write, “We like the strategy; the REIT brings sophisticated analytical tools to markets that have few players using them (or that havetools as sophisticated as the REITs), and this should lead to outsized growth. In addition, National Storage faces less competition for assetsin these markets. Many institutional investors are not as focused on them as they are on the top 25. Despite the strong prospects and (albeit short) history of double-digit, bottom-line growth, we believe National Storage shares are attractively priced.”

This is another stock with an even split in the analyst reviews. The 6 on file include 3 to Buy and 3 to Hold, for a Moderate Buy consensus rating. (See NSA stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.