It’s a leap year, and our quadrennial ritual of self-government is right around the corner. The USA goes to the polls on November 3 for a Federal election – and most importantly, to decide if President Donald Trump should have a second turn. His Democratic Party opponent, former Vice President Joe Biden, is coming out to make the case that Trump has proven incapable of running the country; the President will rebut by pointing to the booming economy of 2018 and 2019, and the V-shaped recovery of the past few months. The coronavirus and the government’s response – or lack thereof – will be a major ballot issue, too.

No matter who wins when the voters are heard, investors will need both caution and up-to-date information to make sense of the markets. The TipRanks database collects and collates the latest stock data, and gives investors the tools they need to find order in the mass of information. Taking the data, together with analysis from some of Wall Street’s best analysts, we’ve pulled up seven stocks that will bear watching as the election season reaches its climax.

Part 1: A Biden Administration Bodes Well for these 3 Stocks

Democratic challenger Joe Biden, who is in effect running for a ‘third Obama term,’ brings to the campaign one of the longest records of any candidate. His 36 years in the Senate, and 8 years as Vice President, make him both highly qualified for office and an open book. He has something of a minefield to walk, as many of his and his party’s platform positions are in direct opposition to stances he took earlier in his long career.

But Joe Biden has a reputation for being business-friendly, and with the Democratic Party swinging to the left, that reputation is a valued commodity. Centrist Democrats hope that Biden will be a moderating influence on the party.

Cowen’s Seiberg writes of Biden, in contrast to the Trump Administration, “…Biden would bring stability. We would expect a return to a multi-lateral approach to trade. That means fewer trade wars and less use of tariffs. We also don’t see Biden singling out companies for criticism or stoking discord.”

While Biden and the Democrats are seen as probable stabilizers on matters of trade policy, the public perceives them as disruptive forces for the energy sector. The truth may be milder, as John Walsh of Credit Suisse explains: “Our understanding is that many of [his] proposals would require the approval of Congress to fully enact. As with many energy efficiency initiatives, we are seeing States already take the lead, and we think incremental investment at the Federal level would help accelerate these programs.”

The upshot is, that despite extreme anti-business rhetoric emanating from the Democrats’ far left flank, a President Biden is expected to temper the party coalition’s socialists and move the whole toward the center. That would be good for business, and good for investors. And on a more concrete level, it would be good for individual companies, like these three.

Valero Energy Corporation (VLO)

The oil sector may not seem like a good place to find stocks set to gain from a Biden win. After all, the Democrats promise to push Green Energy: solar and wind, and a switch from fossil fuels to cleaner renewables. A petroleum refiner like Valero would likely have a rough time in that environment.

Except that Valero also has a growing biofuel business. Call it the company’s hedge, their protection against policy moves to limit hydrocarbons. The company regularly uses corn-based ethanol in its gasoline blends, and is a major producer and shipper of biodiesel fuel. Clean energy has an appeal all its own – pollution is real, and we humans have a natural interest in reducing that – but there is no doubt that a Biden Administration would be a boon for Valero’s biofuel segment.

The first half of 2020 was hard on energy companies, as the economic crisis put a damper on fuel prices and demand but a premium on storage space. Revenues slipped, and EPS turned negative in the second quarter. At the same time, the company’s ethanol and renewable diesel segments both showed strong gains. Ethanol income increased from $7 million in 2Q19 to $91 million for 2Q20, while biodiesel fuel production was 795K gallons per day in the second quarter, far above the 26K gallons reported in the year-ago period. Biodiesel income was up to $129 million.

In another sign of overall strength, Valero paid out its regular quarterly dividend in early September. That payment, a 98 cents per common share, has been kept steady throughout the ‘corona half;’ the company has made no move to slash the dividend, in keeping with its 11-year history of dividend reliability. The current payment annualizes to $3.92 per share, and yields a strong 8.7%.

All of this has RBC’s Brad Heffern bullish on Valero. He is particularly upbeat about the company’s biofuel growth, writing, “We believe if Biden wins the 2020 election this favors VLO, as Vice President Biden has historically been in favor of next generation biofuels. VLO is the 2nd largest renewable diesel producer in the world and the largest renewable fuels producer in North America. VLO continues to expand its renewable diesel footprint and is targeting 675 million gallons of production capacity per year over the next few years.”

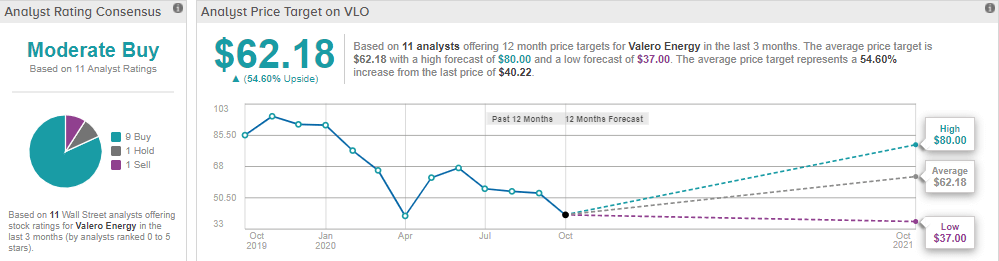

Heffern sets $63 price target to support his Buy rating on the stock. This implies a robust 40% upside potential for the stock in the next year – especially should Biden win. (To watch Heffern’s track record, click here.)

Writing form JPMorgan, 5-star analyst Phil Gresh gives a more cautious take on that optimism. He sees lower refining margins as the key factor, offsetting some of the biofuel gains. It’s important to note, however, that when he lowered his price target, the $59 target he set still shows a potential for 31% upside growth over the next 12 months.

Valero Energy has a Strong Buy rating from the analyst consensus, based on 10 positive reviews and 1 negative. The stock’s $69.70 average price target suggests it has room for a 55% potential upside form the current share price of $44.82.

Schlumberger Limited (SLB)

Our second ‘Biden winner’ is another unlikely scenario. Schlumberger is an oil field services company, providing the ancillary services that make it possible for drilling companies to operate their wells and extract the crude oil from the reservoirs. It’s big business – Schlumberger saw $33 billion in total revenue last year.

In a Biden Administration, should his promise to shut down drilling and ban fracking hold firm, the oil patch would see a real contraction. On its face, that would harm a company like Schlumberger, except for two factors. First, even during such a policy shift and industry contraction, production will still be required as the economy will need petrofuels until alternatives are available in larger quantity. This process will likely take years, at least the better part of a decade. And second, as the oil patch shrinks, the mess will have to be cleaned up, and that work will fall to the oil field services companies. For the mid-term prospect, at least, a Democratic win in November could open up new lanes for Schlumberger and its peers.

Like Valero, Schlumberger has seen a fall-off in revenues and earnings during 2020. The company has avoided slipping into negative EPS, however, and in CYQ2 reported a 5-cent per share profit. The company showed particular strength in its cash flow, generating a total cash flow from operations of $803 million, with over half, $465 million, as free cash.

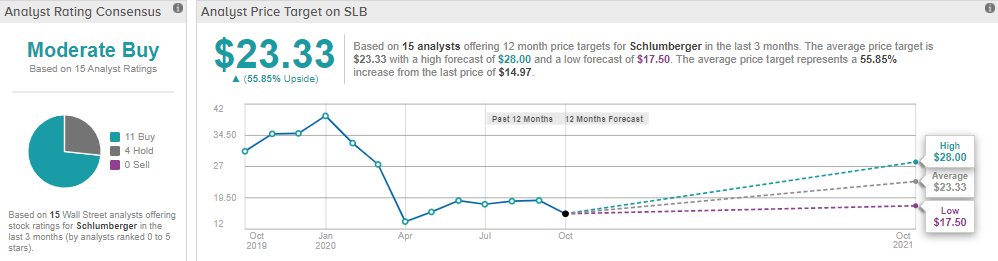

That free cash flow prompted Wells Fargo analyst Christopher Voie to upgrade his stance on the stock, from Neutral to Overweight (i.e. Buy). In his comments, Voie said, “Higher free cash flow conversion should partially offset a lower growth outlook.” But even for growth, Voie remains bullish – his $28 price target implies an upside of 70% for the stock going into 2021.

Schlumberger shares hold a Strong Buy rating from the analyst consensus, based on 10 Buys and 3 Holds. The stock is selling for $16.45 and the average price target, at $23.96, suggests a 45% one-year upside.

Summit Materials (SUM)

Last on our list of stocks that look to profit during a Biden Presidency is Summit Materials, a supplier of aggregates to the construction industry. Summit’s products include asphalt, cement, and ready-mix concrete – everything needed to pave roads and pour foundations. In the past few months, as unemployment has fallen and the housing sector has started to heat up, Summit’s prospects have also improved.

The company’s revenues and earnings both rose sequentially from Q1 to Q2. EPS saw the stronger gain, going from a 48-cent loss to a 50-cent profit, while the second quarter revenues of $631 million was higher than both previous quarters.

In recent weeks, two news items have come out from Summit, and both have had a positive effect on the company. In the first, Anne Noonan was named CEO, replacing Thomas Hill, whose retirement was effective on the first of September. The transition has been smooth, with Noonan bringing long experience as chemical industry executive, and Hill remaining on in an advisory capacity until summer of 2023. In the second news item, Summit held a successful debt issue, offering $700 million 5.25% senior notes due in 2029. The new issue will redeem $650 million worth of 6.125% notes, as well as cover fees.

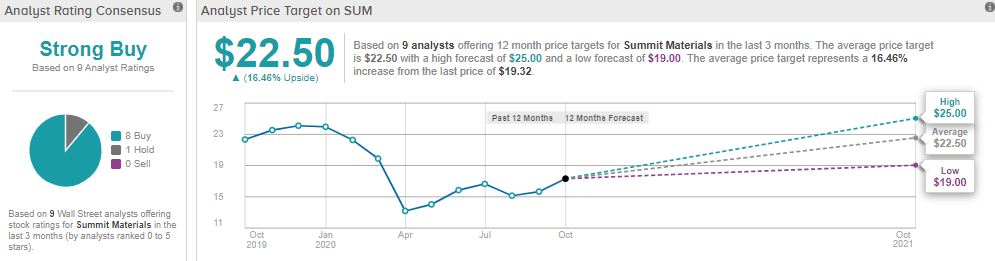

Summit shares remain depressed in the wake of the coronavirus crisis, but Deutsche Bank analyst Seldon Clarke, rated 4-stars, believes this gives investors a chance to buy low. He writes, “[The] outlook for both resi and public highway spending continues to improve from the trough in April. Moreover, state budgets are in a considerably better position with Summit’s top four states – which account for ~60% of net revenue – experiencing little to no impact on state highway spending or letting activity…”

Clarke gives SUM a $24 price target, suggesting it has a 42% upside potential, to back his Buy rating. Referring to COVID-19, Clarke said that the pandemic had “no meaningful impact” on Summit’s long-term business.

The analyst consensus rating on Summit is a Strong Buy, derived from 9 Buys versus a single Hold. The stock is currently priced at $16.83. The average price target is $22.56, giving the stock a 34% upside from current levels.

Part 2: A Win for President Trump May Boost these Stocks

Where Joe Biden is running as the candidate of moderation, and promising a ‘return to normalcy,’ President Trump is more the ‘bull in a China shop’ candidate. In his first administration, he has rushed headlong to carry out his campaign promises – and truth be told, he has had some successes. His ‘America First’ slogan, derided as nationalistic jingoism, turned out to be nothing more than putting every policy to a simple question: does it help American interests?

His successes have been greater in the foreign policy arena, traditionally a preserve of the Presidency. The NAFTA renegotiation, resulting in the USMCA (US, Mexico, Canada) agreement, is arguably a better deal for American workers, and Trump’s ‘trade war’ towards China has helped to check that country’s unbalanced trading policies. In the Middle East and Eastern Europe, the Trump Administration has acted as an honest broker in recent deals involving Israel and the Arab states, and Serbia and Kosovo. As a result, Trump has received three nominations for the Nobel Peace Prize, belying the media portrayal of him as ‘unpopular overseas.’

So, a second Trump term could augur well for the stock market. Aggressively promoting American interests, and pushing peace on the international scene, are always good for American business. Returning to Cowen analyst Jaret Seiberg, looking ahead, “Donald Trump preserves the lower corporate tax rate and ensures the bank deregulation adopted to date remains in place. That includes the more flexible capital framework… He also is likely to seek more political control of the Federal Reserve over monetary policy.” And here some stocks that Wall Street’s analysts see taking advantage of that situation.

Altice USA, Inc. (ATUS)

This telecom company provides cable TV services to 5 million customers in 21 states. Altice owns several cable broadcast brands, and operates both local and international news networks. Altogether, Altice is consistently ranked among the five largest cable providers in the US. The company boasts a market cap over $15 billion.

Altice weathered the corona crisis – and its associated economic contraction – well. The company’s revenues remained stable, at $2.45 billion and $2.47 billion in Q1 and Q2, compared to $2.44 billion and $2.47 billion in Q3 and Q4 of 2019. EPS rose sequentially from a loss in Q1 to a 19-cent gain in Q2. Cash flows were strong, with operating cash gaining 15% year-over-year to $877 million. The company’s free cash flow saw even more impressive yoy gains, of 49%, reaching $707 million.

This company would do well from a Trump win, and the reason is simple: The Trump Administration, keeping a campaign promise, has been proactive at cutting red tape and canceling old regulations. Coming into office, Trump promised to remove 2 old regs for every new one written; his Administration has bested that promise, cutting up to 20 regulations for every one published. Trump’s base loves the policy, as do heavily regulated industries – of which cable TV is a prime example.

Covering this stock for RBC, analyst Kutgun Maral writes, “ATUS remains our preferred pick given the subscriber and financial benefits we expect from the nascent growth initiatives that will start to more meaningfully flow through fundamentals exiting 2020…”

Maral’s optimism supports his Buy rating on this stock, and his $33 price target implies an upside of 24% for the year ahead.

ATUS shares have a unanimous Strong Buy analyst consensus rating, based on 10 Buys set in recent weeks. This stock’s $34.89 average price target is only slightly higher than Maral’s $33, and suggests a one-year potential upside of 31%.

Energy Transfer (ET)

Wall Street’s analysts don’t always agree – shocking, we know. While several see key points of the energy industry benefitting from a potential Biden win, others see the vast hydrocarbon midstream sector gaining steam in a second Trump term. Energy Transfer, a midstream company operating in 38 states, from the Rocky Mountains to the MidWest to the Gulf Coast, and even up to northern Alberta, is an excellent example.

The company owns and operates a wide range of assets, including pipelines, terminals, and storage tanks, for the holding, transport, processing, and delivery of natural gas and crude oil. The oil industry has felt severe pressure from the corona-influenced economic turndown, and in the second quarter, despite the economy starting to reopen, ET saw steep yoy drops in both earnings and revenue. The bottom line fell 60%, to 13 cents per share; the top line fell 47% to $7.33 billion. While profits have been down in 1H20, the company’s cash reserves, at more than $5.5 billion, are deep enough to see it through the crisis, even if earnings decline into Q3.

Even with earnings falling off, the company remains confident that it has a path forward. This is clear from the dividend, which has been kept stable at 30.5 cents per quarter, for 11 straight quarters, with no cuts made in deference to corona. The annualized dividend payment of $1.22 gives a sky-high yield of 21%. This is 10x the average yield found among S&P listed companies.

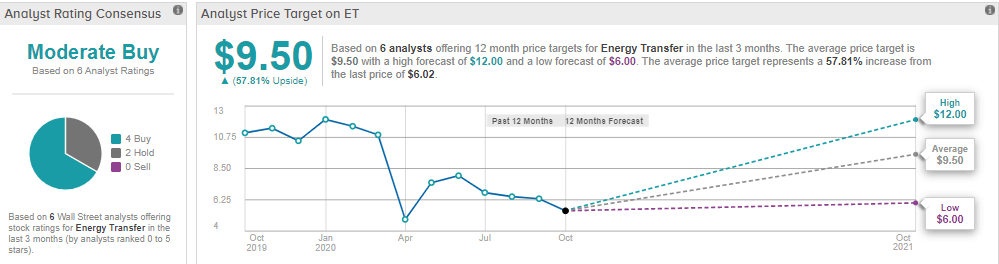

5-star analyst of Elvira Scotto, who covers the energy sector for RBC, is bullish on ET – and its dividend. She writes, “We believe ET is well-positioned to generate meaningful cash flow growth as large-scale growth projects come online over the next few years. Moreover, we expect growth capex to slow in the coming years, which should allow ET to reduce leverage and return more cash to unitholders via distribution increases and/or unit repurchase.”

Getting into details about the coming year, Scotto adds, “ET has vast footprint of assets across geographies and the hydrocarbon value chain. In addition, under a Trump presidency, we believe headwinds around the DAPL pipeline would subside.”

Scotto gives ET an Outperform (i.e. Buy) rating. Her $10 price target indicates the extent of her confidence, implying an impressive one-year upside of 80%.

The analyst consensus on Energy Transfer is split, with 4 Buys and 3 Holds giving the shares a Moderate Buy rating. The stock sells for $5.55 per share and it has a $9.57 average price target implying a upside of 72%.

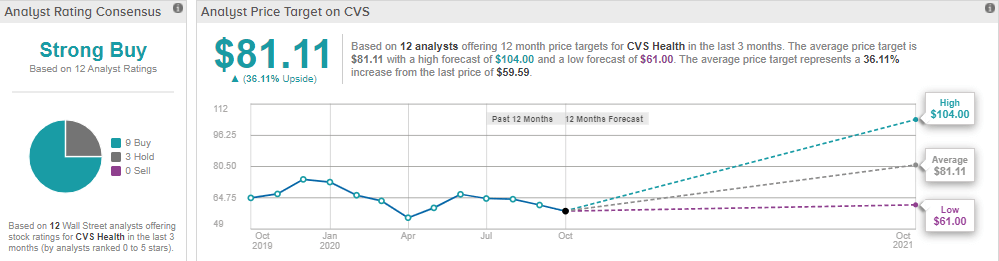

CVS Health Corporation (CVS)

The third stock on our list of likely gainers in a second Trump term is a retail staple. CVS is best-known for its eponymous pharmacy chain – an asset that proved invaluable during the corona crisis, as pharmacies were considered essential businesses. A pandemic has proven profitable for CVS, and the company has seen strong sequential EPS gains in both Q1 and Q2 this year. Q2 earnings topped out at $2.64 per share. This was up 38% sequentially, and 39% year-over-year.

The top-line revenues saw slight declines through the first half, but taking a longer view, and looking at the last four quarters, revenue has remained in a narrow range between $64.5 billion and $67.7 billion. The Q1 and Q2 revenues fell in the middle of that range.

CVS has used its solid earnings position to keep up a valuable dividend. The company pays out a steady 50 cents per common share quarterly, or $2 per year, and has a 15-year history of dividend reliability. The yield, at 3.5%, is well above average.

A.J. Rice, a 4-star analyst from Credit Suisse, has been increasingly positive on CVS since the spring. Back in May, upgraded his stance on the stock, moving from Neutral to Buy, and wrote at the time, “CVS’ Pharmacy Services Segment is Outperforming Expectations, as PBM Selling Season Shaping up Nicely. CVS is seeing an easing of rebate guarantee pressures which it saw peak in 2019, become less of a headwind in 2020, and are expected to be de minimis in 2021… CVS has remained on track-to-ahead of its synergies, modernization, and transformation initiatives, which could provide future upside.”

More recently, this past August, Rice reiterated his previous comments and raised his price target from $75 to $90. At this level, his target implies a 55% upside growth potential in the next year. (To watch Rice’s track record, click here.)

CVS gets a Strong Buy rating from the analyst consensus, with 8 Buys and 2 Holds. The stock’s average target of $3.63 suggests a 44% upside from the current share price of $57.94.

Part 3: Some Stocks Will Win No Matter What

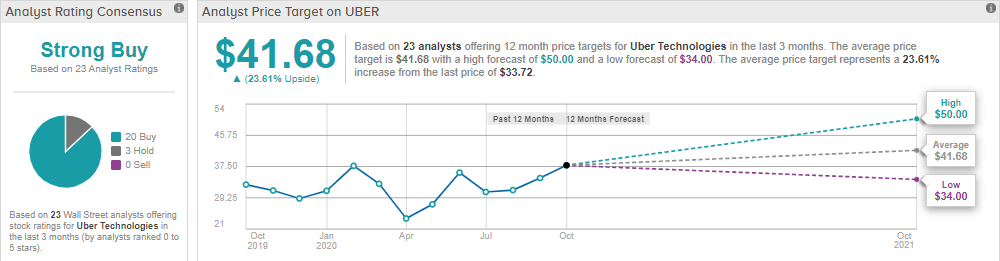

That’s just a fact. There are some companies that have found – or created – niches which can be expanded whether the government follows Democratic or Republican platform policies. Uber, the rideshare app provider, is one such.

Uber Technologies (UBER)

Uber Technologies has seen both opportunity and danger in the corona virus pandemic. The company has clearly benefited from the social lockdowns, as its ability to deliver a range of products on demand became a clear asset – but even so, EPS remained negative, and revenues have fallen sequentially in the last three quarters, from $4 billion to $3.5 billion to $2.24 billion.

Uber has faced a number of headwinds in recent months, including the failure of its attempt to acquire Grubhub, and the passage of AB5 in California. The second may be more severe – California is a huge market, a state of 40 million people, and the AB5 bill effectively outlaws freelance gig work in the state. This is a direct blow at Uber, and nearly shut down its California business – but a judicial ruling has temporarily halted implementation of the bill, and the state legislature is debating a list of exemptions.

Despite the headwinds, Uber retains the confidence of Wall Street’s analyst corps. Writing from Loop Capital, 5-star analyst Rob Sanderson says, “The stocks may remain volatile, with swings in expectations for a return to normal activities. The rideshare business has been hamstrung by declines in rides volume of over 20%, though we believe that the reduction in total addressable market will not be nearly as material on the other side of COVID.”

Sanderson gives UBER shares a price target of $40, implying a 12% upside.

Even more bullish here is Mark Mahaney, a 5-star analyst with RBC. Mahaney sees Uber doing well in the potentially less regulated environment of a Trump second term, and writes simply, “Uber is our favorite…” His $50 price target suggests a robust upside of 40% for the stock.

Wall Street likes UBER shares. The stock has no fewer than 23 Buy ratings, opposed to only 3 Holds, making the analyst consensus view here a Strong Buy. Uber’s average price target of $42.09 suggests a 18% upside from the trading price of $35.56. (See Uber’s stock analysis at TipRanks.)

TipRanks analyzes over 6,900 Wall Street analysts, rating them based on their success rates and average returns. This article featured comments and stock ratings by 9 analysts from our database, 6 of them rated at 4- or 5-stars. These are analysts with some of the best records on Wall Street – the most frequent stock reviews, the highest success rates, and the best returns, all collected in one database, so you can find the best reports from the analysts you can trust.