Online education stock 2U Inc (TWOU) has reported solid Q1 results with total revenue of $175.5M up 44% year-over-year and beating the Street consensus by $0.18 million. Meanwhile Q1 Non-GAAP EPS of -$0.33 beat by $0.07; while GAAP EPS of -$0.94 fell short of Street forecasts by just $0.01.

“Our first quarter results clearly show the strength, resilience, and relevance of our business and offerings,” said Christopher Paucek, 2U’s Co-Founder and CEO. “We believe the unprecedented impact of COVID-19 will continue to accelerate demand among universities and adult learners for high-quality online education.”

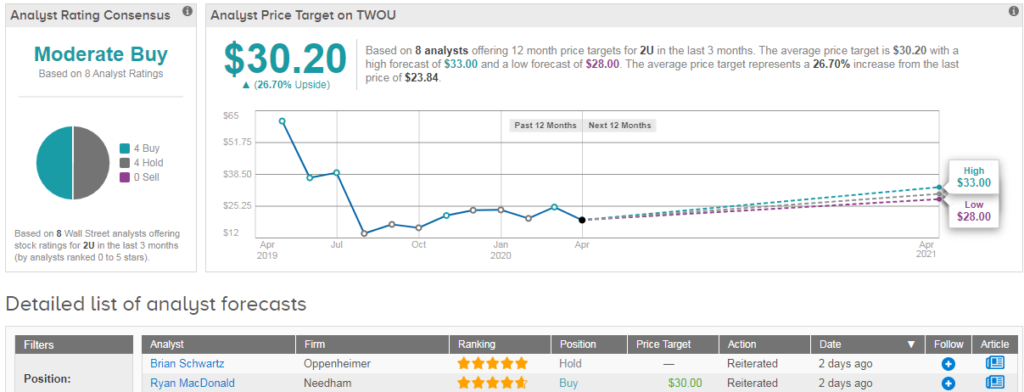

Nonetheless the Street remains divided when it comes to TWOU’s outlook.

Speaking for the bulls, Needham analyst Ryan MacDonald reiterated his TWOU buy rating on May 1 and boosted his price target to $30 from $25. 2U Inc benefits from the increased demand for online education, says MacDonald, particularly in the core degree program segment, and is now introducing new solutions (2UOS Plus and Essential) to meet this demand.

“While boot camps saw a temporary dip in demand prior to transitioning online, the business appears to be rebounding quickly and should be poised to benefit as well, particularly as unemployment continues to rise” says the analyst.

In addition, he notes that the recently completed convertible debt offering provided increased flexibility for 2U to meet this heightened demand. “At a current valuation of 2.2x EV/sales, we find the shares attractive” concludes the Needham analyst.

However, Oppenheimer’s Brian Schwartz takes a more cautious approach: “While believing that demand is increasing for online learning technologies, we continue seeing execution risks with 2U’s business model in transition and a potential negative impact that COVID-19 could have on higher education enrollment and tuition this fall” he says.

What’s more, Schwartz argues that 2U’s core DGP (domestic graduate program) business faces multi-faceted challenges that are unlikely to resolve soon- and that acquired businesses are not large enough to make up for DGP’s downdraft.

Indeed, DGP grew 16% in the first quarter compared to the first quarter of 2019, the slowest since 2U’s IPO in 2014. As a result, the analyst is staying on the sidelines without offering a price target.

Overall, analysts are split 50/50 on 2U Inc- giving the stock a Moderate Buy analyst consensus. With shares flat year-to-date, the $30 average analyst price target indicates upside potential of 27%. (See TWOU’s stock analysis on TipRanks)

Related News:

Tesla Slumps After Elon Musk Calls Stock Price ‘Too High’

Apple Exceeds Expectations With FQ2 Earnings Beat

Boeing Raises $25 Billion in Bond Sale, No Longer Needs Government Aid; Shares Slip