Everyone is talking about artificial intelligence (AI) right now- with many predicting that AI will lead the next wave of economic growth and productivity for the next couple of decades at least.

AI refers to the use of data to simulate human intelligence processes including learning, reasoning and self-correction by machines. AI is making its way into almost every industry. Data collection and collation, automation systems from factories to self-driving cars, even online shopping site – they all benefit from AI applications. With IDC predicting that worldwide spending on AI will be nearly $98 Billion in 2023, the implications of this technology are massive.

And this has not been ignored by Wall Street. Analysts say that plenty of compelling investments can be found within this space. With this in mind, We’ve opened up TipRanks’ database, and pulled three AI stocks that are on the leading edge of the technology. Importantly, all 3 have amassed enough bullish calls from analysts to be given “Strong Buy” consensus ratings.

Yext, Inc. (YEXT)

So much of the digital world depends on image, making branding a valuable commodity. Yext works in the niche, offering on-line brand management for clients like Ben & Jerry’s ice cream, T-Mobile, Taco Bell, and Roots clothing. Yext is a heavy user of AI tech, employing it alongside data from heavy hitters such as Google, Apple, Amazon, and Facebook, to add context to searches for better results in real time. By using AI to combine brand management with SEO, Yext makes it possible for customers to better control what their customers see online.

Yext grossed $228.3 million in revenue for fiscal 2019, up 34% from the previous year. The most recent quarterly report, for Q4, showed quarterly revenues above the forecast at $81.4 million. EPS showed a net loss, as expected, but at 27 cents the loss was a 28% sequential improvement from Q3. The company’s balance sheet is strong, with zero debt, $256 million cash on hand, and a credit facility up to $50 million.

Mark Mahaney, 5-star analyst from RBC Capital, is impressed by Yext, and believes the shares have a clear path for forward growth in the mid- to long-term. He says of the company, “Although Yext’s growth has slowed as of late, we think the company is capable of sustaining +20% growth over the next several years given that Yext Answers may potentially be a strong new product for the company… It is still an open question whether/when Yext’s investments in International expansion and salesforce ramp will translate to growth, but we remain optimistic and expect that these investments will start to pay dividends in FY21.”

Mahaney’s bullish stance is backed by an $18 price target that implies a robust upside of 43% for the next 12 months. (To watch Mahaney’s track record, click here)

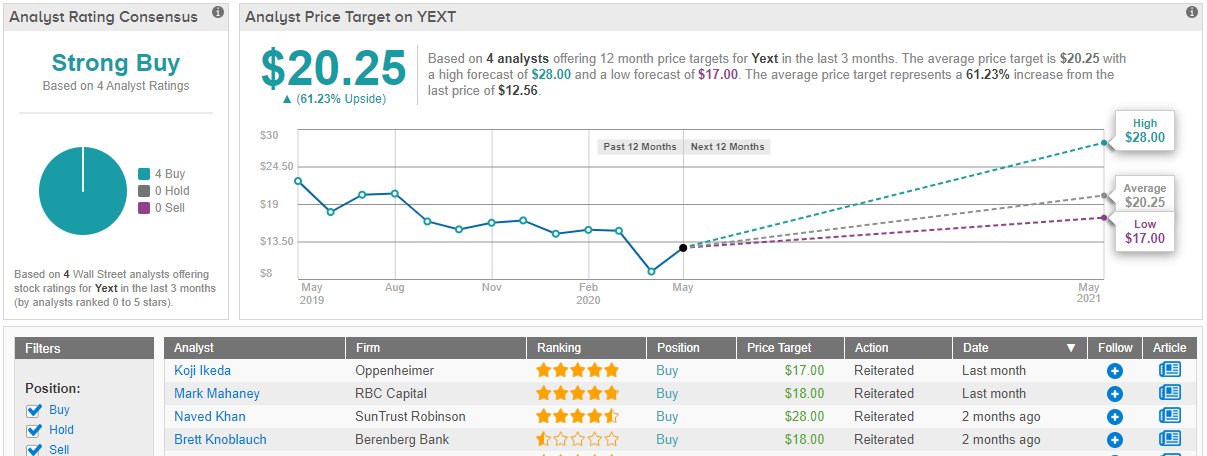

Overall, Yext stock has been endorsed with “buy” ratings by all four of the analysts who have voiced an opinion on the shares over the past three months. Meanwhile, the consensus estimate of analysts polled is that Yext shares should rise a 61% to hit $20.25 within a year. (See Yext stock analysis on TipRanks)

Dynatrace, Inc. (DT)

This software company went public less than a year, just last August, and its main product is an AI software used to both monitor and manage cloud infrastructure. In-house cloud infrastructure support allows companies to minimize the strain on their networks, by finding potential problems before they cause severe disruptions of the systems. Dynatrace’s AI product gave a strong boost to company share values in the fourth and first quarters, when DT shares doubled in just four months.

Dynatrace posted a quarterly profit, in its last report, of 6 cents per share. This was double the 3 cents expected, and up dramatically from the 53-cent loss posted in the previous quarter. Looking forward, DT is expected to show another profit, of 3 cents per share, in for the first quarter of 2020, despite the coronavirus hit.

In fact, the current share price may present an opportunity. Keith Bachman, 5-star analyst with BMO Capital, says it explicitly, writing of DT, “While we lower our estimates as a result of ongoing COVID-19 impacts, we… believe current trading levels present an attractive buying opportunity for investors… We anticipate durable revenue growth and FCF margin improvement during our forecast period. Further, we think DT can comfortably realize FCF of 30%…”

Bachman’s Buy rating comes with a price target that has been reduced from $40 to $35 – but even that lower level suggests a 24% growth potential for the stock. (To watch Bachman’s track record, click here)

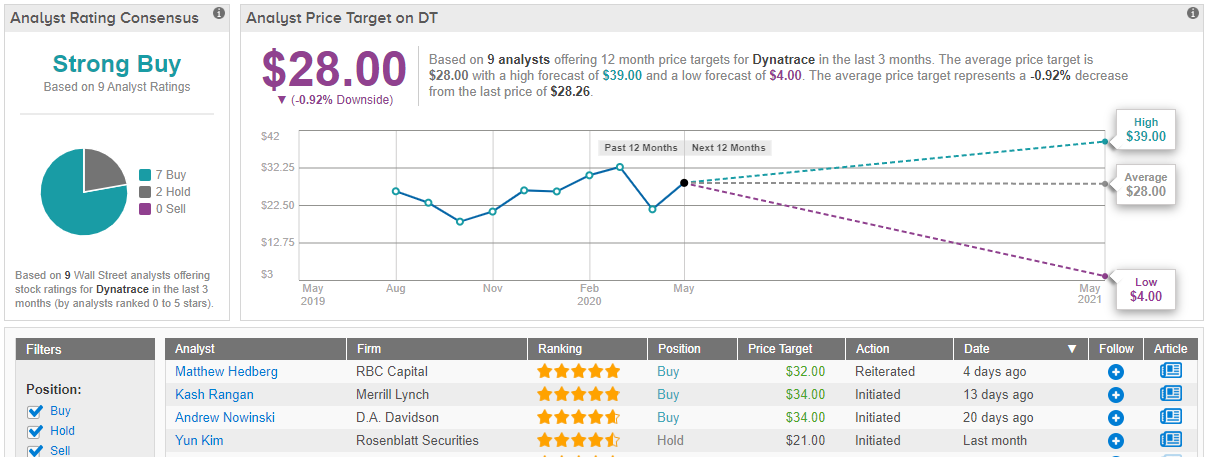

With 9 ratings from Wall Street, including 7 Buys against just 2 Holds, DT shares have a Strong Buy rating from the analyst consensus. The share price, at $27.16, is affordable, while the average price target is far more conservative than Bachman’s. At $28, it implies a modest downside of 1%. If Dynatrace continues to outperform, expect the analysts to adjust their targets upwards. (See Dynatrace stock analysis on TipRanks)

Synopsys (SNPS)

Last but not least is Synopsys, a company that provides software and intellectual property solutions for the design and testing of chips (integrated circuits) and computer systems. The company’s technology is present in artificial intelligence, self-driving cars, and Internet of Things (IoT) consumer products.

The strength of the company’s niche is clear from its recent stock performance. Where the S&P 500 is still down 16% from its late-February peak, SNPS shares have outperformed – the stock has rebounded more than the general market. The company’s most recent quarterly report, for fiscal Q1, beat the forecasts on both the top and bottom lines. Revenue came in at $834.4 million, and EPS at $1.01. In addition, revenues were also up year-over-year, by 1.7%. It was a strong Q1 performance, especially after the company finished fiscal 2019 with $3.3 billion in total revenue.

High stock performance is an attraction for investors, but SNPS also offers predictability, which is sometimes lacking in the fast-changing tech world. Synopsis’ business model is based on three-year customer subscriptions, which cannot be canceled. It gives the company a short-term consistency in earnings, that makes it easier for investors to predict profits.

Wells Fargo 5-star analyst Gary Mobley points out another piece of ‘predictability’ in his recent note on SNPS. He writes, “SNPS typically starts a quarter with 90% of expected revenue coming from backlog… We believe, worst case, SNPS could see some short-term erosion in backlog because of customers’ concerns over COVID-19. However, we also believe this may be short-lived as chip design activity must march on as the semiconductor industry is highly competitive, and chip companies must remain focused on staying ahead of the pack.”

Mobley likes this stock, and rates it a Buy, with a $180 price target that suggests room for a 19% upside. (To watch Mobley’s track record, click here)

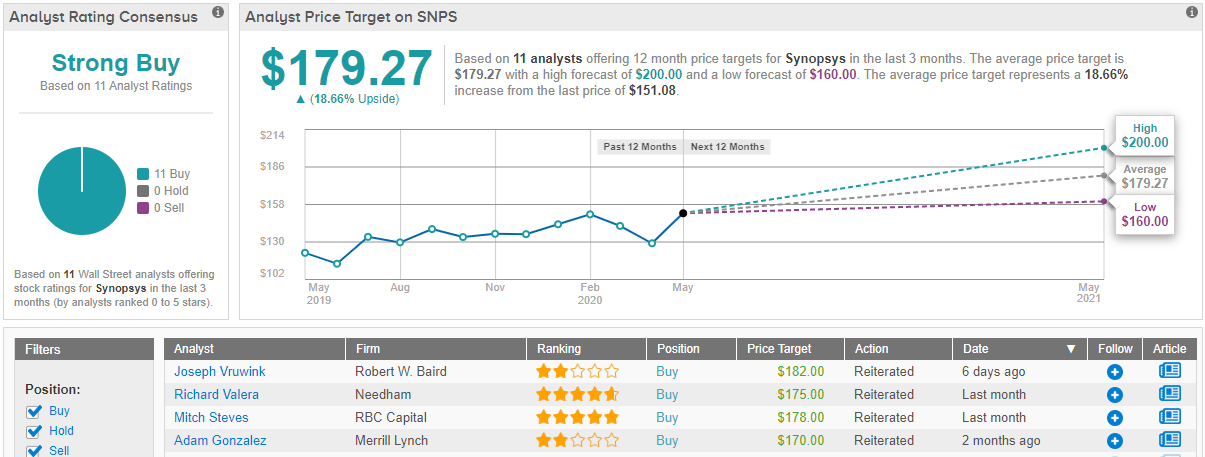

Synopsis’ Strong Buy consensus rating is unanimous: 11 analysts have weighed in and rated this stock a Buy. Shares are trading at $149.64, and the the $179.27 average price target is in line with Mobley’s, and predicts a 19% upside potential for the coming year. (See Synopsis stock analysis on TipRanks)

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.