Markets finished last year on a high note, with annual gains between 22% on the Dow Jones and 35% on the NASDAQ. But just because the markets overall did well, it does not mean that every individual stock saw big gains. Energy stocks, in particular, had a difficult year.

According to David Rosenberg, chief economist and strategist of Rosenberg Research and Associates, “In a world where everything looks so expensive, energy stocks look downright cheap.” At the same time, he sees the current low prices as a prime time to buy in. He believes that energy stocks are ready for gains.

Defending this belief, Rosenberg points out several factors. First, that US shale companies, which have underperformed the markets due to low oil prices, are working hard to bring investors back in. These companies need capital infusions to maintain operations, and their best path to that is finding a way to push share prices back up.

Second, the sudden easing of US-Iran tensions in the Middle East has eased fears of renewed conflict that could constrict the flow oil in world trade. While such tensions would inflate oil prices, their easing promotes safer shipping and renewed exploration in the theater – both better for the industry in the long run.

As Rosenberg puts it, “In the energy space… all that has to happen is for something bad not to happen and there will be a positive rerating as the end-result.”

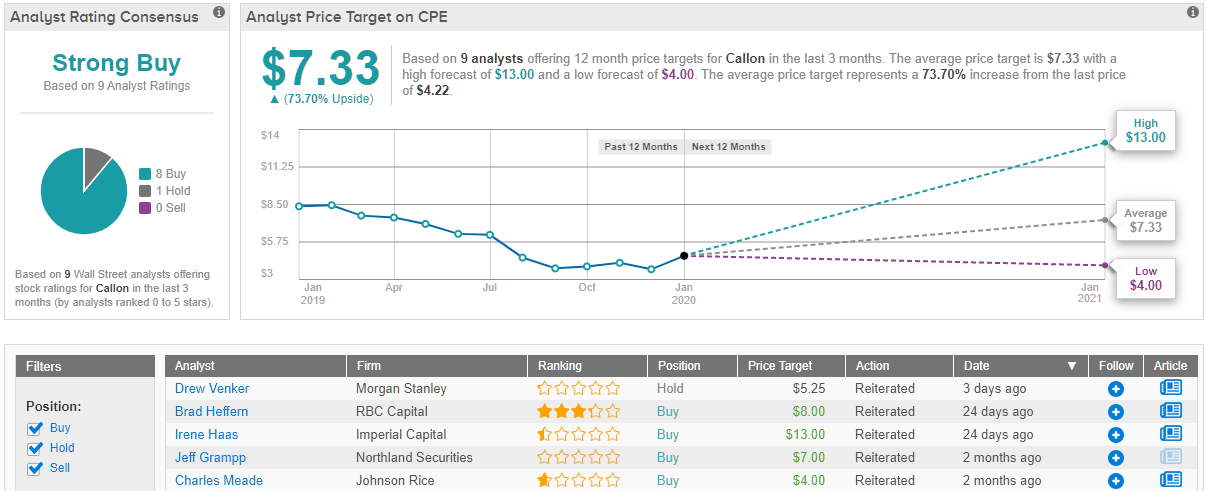

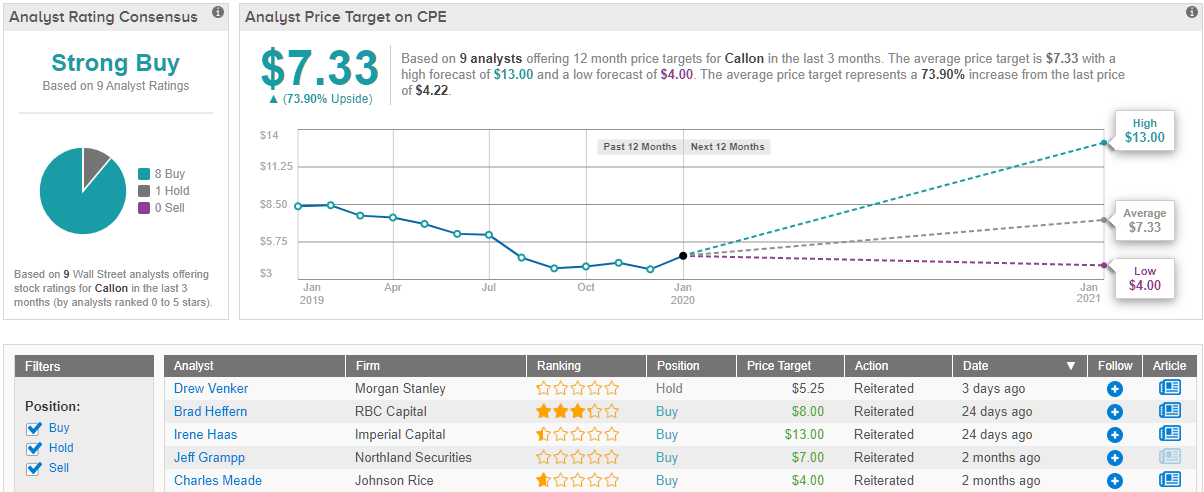

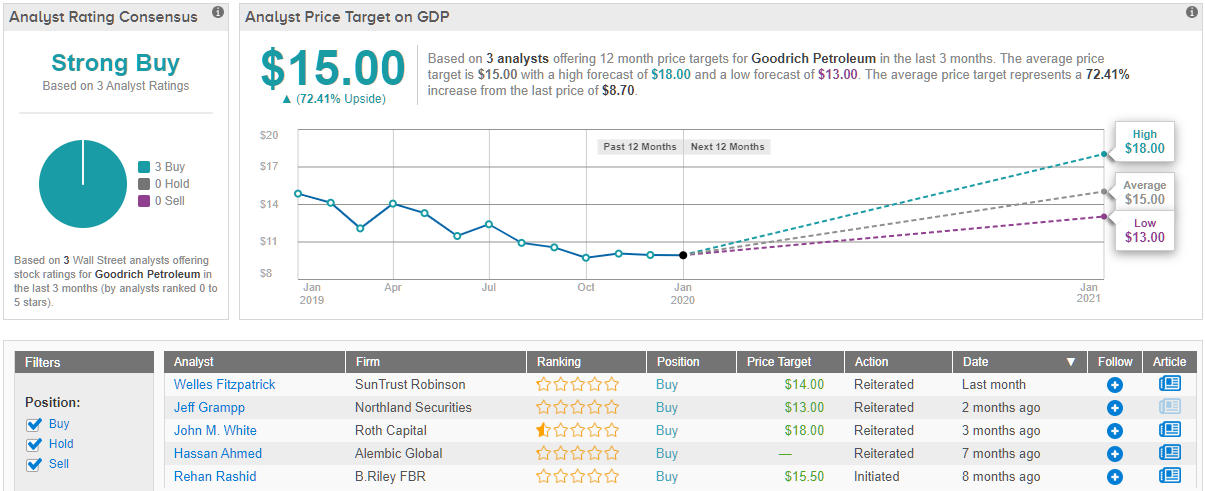

TipRanks, a company that collects and collates reams of real-time information on Wall Streets publicly traded stocks – and analysts – has the data necessary to test this hypothesis. Setting the Stock Screener filters to show only stocks from the basic materials sector, with a Strong Buy analyst consensus and upside potential of 20% or more, we picked three energy stocks that Wall Street’s agree are ready to start climbing.

Callon Petroleum Co. (CPE)

We’ll start with Callon Petroleum, a small-cap oil and gas exploration and development company focused on the Permian Basin of West Texas. Over the past decade, the Permian formation has become North America’s largest proven energy reserve and has pushed the US into position as the world’s top oil producer.

Over the course of 2019, while the oil industry was ramping up production, low prices put a damper on profits. CPE shares slipped 26% during the year on falling revenues.

The falling revenues and share depreciation came even as the company was managing to beat analyst expectations on reported earnings and revenues. In Q3, the most recent reported, CPE showed EPS of 19 cents, 5.5% above expectation, and revenues of $155.4 million, 2% over the forecast. It was the third time in a year that CPE had beaten the EPS forecast.

This could explain CPE’s positive indication from TipRanks’ measurement of investor sentiment. Purchases of the stock are up in both the past 30 days and the past week – a very positive sign for Callon.

The company caught the attention of RBC Capital analyst Brad Heffern. Heffern was attracted by Callon’s placement in Texas’ most productive oil region, as well as the company’s potential for increasing free cash flow. He wrote, “We like the company’s strong asset positions in the Permian and Eagle Ford Basins… we think CPE has successfully transitioned from a Permian pure play growth story, to sustainable corporate return model with asset diversification, centered around sustainable growth and free cash flow generation. As CPE transitions to a free cash flow model, we would expect the company to… ultimately consider implementing a dividend or returning cash to shareholders through a repurchase program.”

Heffern put a Buy rating on CPE, with an $8 price target. His target suggests room for an eye-opening 94% upside growth potential this year. (To watch Heffern’s track record, click here)

Currently, Callon sells for $4.22, a bargain price. The average price target of $7.33 shows the stock’s potential – an impressive 74% upside. The Strong Buy analyst consensus rating is based on 8 Buys against a single Hold. (See Callon’s stock analysis at TipRanks)

QEP Resources, Inc. (QEP)

Our second stock, QEP, is another exploration and development company, working in crude oil, natural gas liquids, and dry gas deposits. With headquarters in Denver, Colorado, QEP has oil and gas operations in both the Texas Permian Basin and North Dakota’s Williston Basin.

Ending 2018, QEP had proven reserves of 658 million barrels of oil equivalent, and in Q3 2019 produced 8.4 million barrels. The production breakdown for the quarter was 67% oil, 16% natural gas liquids, and 17% dry gas. During the same quarter, QEP bet the forecasts on EPS despite slowing production outputs. QEP had a strong cash position at the end of Q3, also, with $92.4 million on hand and borrowing against its revolving credit line.

QEP shares dropped steadily in 2019, but turned up sharply in December. That gain mitigated the year’s loss, holding it to 21%. The recent tensions in the Middle East hurt the oil industry generally, including QEP shares – but QEP has not lost as much in January as it had gained the month before.

Piper Sandler analyst Kashy Harrison was impressed with QEP’s overall position. Harrison believes the company has a solid foundation to improve the balance sheet, and that its prospects going forward depend more on management execution than anything else. He writes, “We think QEP looks cheap as long as it executes on the forward outlook. Notably, recent execution from new management coupled with a conservative approach toward forward guidance improves our confidence in the outlook… We expect FCF generated in the near-term will primarily clean up the balance sheet…”

Harrison’s Buy rating is backed up with a $6 price target, indicating room for a 54% upside. (To watch Harrison’s track record, click here)

Like CPE above, QEP sells for a bargain price – this time, just $3.89. The average price target of $5.63 suggests room for a robust 44% upside. The Strong Buy analyst consensus rating is based on 4 reviews, including 3 Buys and 1 Hold. (See QEP’s stock analysis at TipRanks)

Goodrich Petroleum Corporation (GDP)

Third on our list is a micro-cap company, of just $105 million market cap, based in Texas and Louisiana. Unlike the companies above, Goodrich does not operate in the Permian Basin– it is focused on the Eagle Ford formation of East Texas. The company also has operations in Louisiana, where the majority of its operations are focused on natural gas exploitation in the Haynesville Shale.

Goodrich saw strong production in Q3 2019, the most recent reported, with natural gas output reaching 136 million cubic feet per day in the quarter. This was a 61% year-over-year increase. Earnings came in at 14 cents per share based on $2 million net income, missing the forecasts however. The company’s higher output overbalanced lower gas prices to generate the positive earnings and avoiding a net loss.

The third quarter may have been adequate, but 2019 as a whole was not good for GDP shares. The stock lost 32% during the year, and has started 2020 with further losses. The result is an energy company with a depressed share price – and rising output on expanding exploration areas. This solid base has attracted attention from Wall Street analysts.

Writing from Roth Capital, John White is impressed with Goodrich’s management. He said, after the quarterly earnings call, “[The] 2020 plan continues GDP’s allstar execution and prudent management practices, focused on cash flow and balance sheet strength while still achieving production growth.”

White puts an $18 price target on GDP, implying a whopping 110% upside growth potential and supporting his Buy rating. (To watch White’s track record, click here)

Northland’s Jeff Grampp agrees that GDP is a Buy proposition. He weighed in at the same time, and wrote, “The company’s 2020 development program assumes 13 gross (5.8 net) wells are placed to sales (72% of net wells operated) with an average lateral length of 8,500 feet… We think the new guidance implies an attractive financial position for GDP. FCF is expected… to yield ~16% at the midpoint. Additionally, leverage is expected to end 2020 at ~1x and there is solid downside protection with 45%-50% of natural gas production hedged.”

Grampp’s Buy rating is supported by a $13 price target – which indicates his confidence in 51% growth to the upside. (To watch Grampp’s track record, click here)

Goodrich has a unanimous Strong Buy consensus rating, based on 3 Buy reviews from Wall Street. Shares are cheap, at just $8.56, and the $15 average price target suggests an upside potential of 72% – most impressive indeed. (See Goodrich’s stock analysis at TipRanks)