Weighing in on the markets from investment firm Oppenheimer, John Stoltzfus of Asset Management believes that now is the time to “build shopping lists of what you may have missed and regretted missing just a few weeks ago when the market was moving up every day.” He added that certain sectors – technology, industrials, financials, and consumer products – would face heavier pressure, and offer greater opportunities.

Stoltzfus notes that Oppenheimer is making these moves, in preparation for a bull market that may lie in the near future. “It’s not a huge list, but it’s a shopping list of companies that we would like to add to positions that we already hold. Some of them [we] opened new positions. Things that might have gotten away.”

“The market foresees that there’s a light at the end of the tunnel, and it’s not a railroad train about to bear down on this. It’s light of day instead,” Stoltzfus added.

So, let’s take a look at some of the stock picks that Oppenheimer analysts are tagging for Stoltzfus’ shopping list. The TipRanks database allows us to find their similarities: they show impressive dividend yields above 11% and offer an upside potential of at least 30%. It’s a combination of factors that make them attractive as defensive portfolio moves in a bearish market.

WhiteHorse Finance (WHF)

We’ll start with a financial stock, one of the sectors that Stoltzfus tapped as particularly strong opportunity. WhiteHorse specializes in business development financing, in the small-cap company market. WHF focuses its investments in the $10 million to $50 million range, on companies with market caps between $50 and $350 million, stable cash flows, low tech exposure risk, and strong direct customer relationships. WHF provides loans and capital access.

A look at WHF’s quarterly earnings history shows the success of the company’s model. WhiteHorse has been consistently profitable, and frequently beats the forecast by a wide margin. WhiteHorse uses its sound earnings to fund a reliable dividend. The company has a long history of maintaining reliable payments – in recent years, it has kept the payment at 35.5 cents per share quarterly, with one dip to 20 cents during 2019 to adjust for the payout ratio. The annualized payment is $1.42, which gives a simply stellar yield of 18.8%. The average dividend yield among S&P listed stocks is only 2% – WhiteHorse beats that by well over 9x.

5-star Oppenheimer analyst Chris Kotowski saw fit to upgrade WhiteHorse from Neutral to Buy in his recent review of the stock, after the bear market slide had started. He noted that the company has largely avoided tapping into its own credit facilities, and that the combination of low leverage and a strong portfolio makes WHF a fine investment with solid return potential. He writes, “We view WHF as a high-quality BDC that has been able to generate assets with above-industry average yields but thus far minimal realized losses… the BDC has covered the base dividend out of core NII on a cumulative basis since 2015 and following recent portfolio growth trends, we see continued dividend coverage in coming quarters.”

Kotowski sets a $13 price target on the stock, indicating his confidence in an impressive 72% upside potential (To watch Kotowski’s track record, click here)

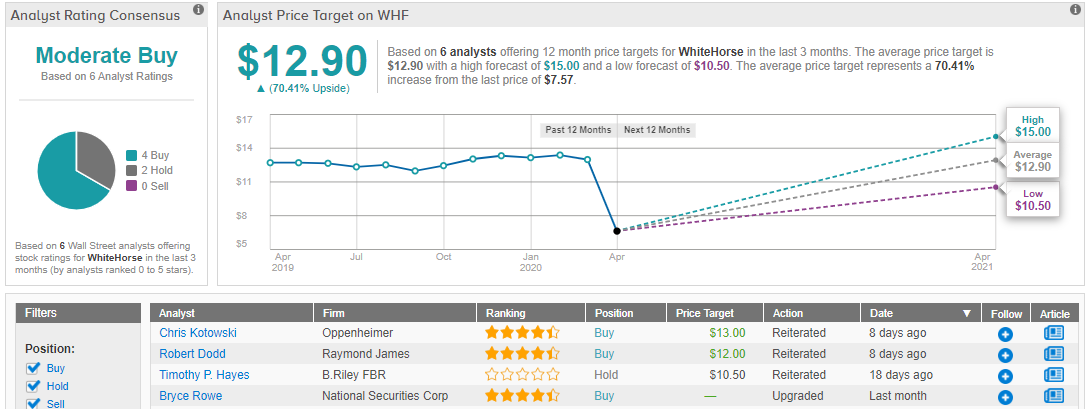

It appears consensus sentiment matches well with Kotowski’s eager chip eyes, with TipRanks analytics showing WHF as a Buy. Based on 6 analysts polled by TipRanks in the last 3 months, 4 rate the stock a Buy, while 2 remain sidelined. The 12-month average price target stands at $12.90, marking a whopping 70% upside from where the stock is currently trading. (See WhiteHorse stock analysis on TipRanks)

Monroe Capital (MRCC)

The next stock on our list, Monroe Capital, is private equity firm that invests in the tech, health care, media, and retail sectors. The company focuses on businesses with employee stock ownership plans, as well as women and/or minority ownership; these are demographics that sometimes have difficulty accessing capital, and Monroe aims to fill that gap.

That the business model works is clear from MRCC’s own financial footing. The company consistently reports profitable earnings; the most recent report, in Q4, was typical, with the 37 cents reported beating the 35-cent forecast. Revenue rose 21% year-over-year to reach $17.99 million. These results are in-line with forward guidance – the consensus on Monroe’s prospects this year is for $17.5 million in Q1 revenue with quarterly EPS of 35 cents, and $71.2 million in full-year revenue, and $1.40 EPS for CY2020.

For stock investors, however, Monroe’s primary vehicle of returns is the dividend. The company pays out reliably, and earnings have covered the payment since 2H14. At 94%, the payout ratio is high – nearly maxed out – but also shows that the dividend is affordable with current earnings. The actual payment is 35 cents per quarter, or $1.40 annually, and gives a yield of 19.7%. Yields of this magnitude are among the best returns that investors are likely to find; now that the Fed has but interest rates to the bone in response to the COVID-19 pandemic, Treasury bonds are yielding less than 1%.

Oppenheimer’s Chris Kotowski reviewed this stock, too, and came away impressed. In fact, in the very title of his note he cites Monroe’s 23 consecutive quarters of dividend coverage. In line with his upbeat view of the stock, Kotowski reiterates his Buy rating and sets a $10 price target that suggests a 42% upside potential. (To watch Kotowski’s track record, click here)

Getting to specifics, Kotowski writes, “As we have said many times, over time the dividend accounts for the vast majority of a BDC’s returns. Given MRCC’s depressed stock price at 88% of NAV, the dividend amounts to a [19%] yield, outstanding given that we have a high degree of confidence that it will be maintained.”

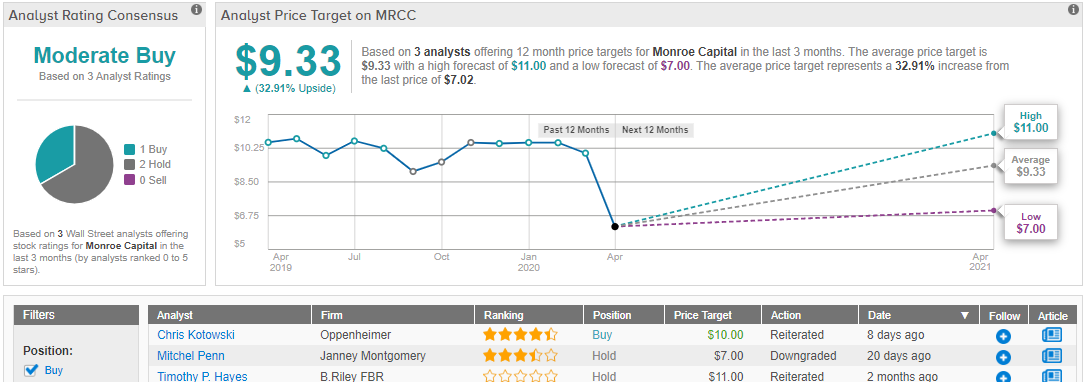

Overall, the analyst consensus rating on this stock is a Moderate Buy, and is based on 1 Buy rating and 2 Holds. Wall Street gives the stock an average price target of $9.33, for an upside potential of 33% in the coming year. (See Monroe Capital stock analysis on TipRanks)

Outfront Media, Inc (OUT)

Last on our list is a company with an interesting niche. Outfront Media specializes in billboard marketing and transit and advertisement posters. Even in today’s digital age, billboards and posters, strategically located, remain an important part of major marketing campaigns, while electronic and digital tech can update these traditional forms of marketing. Outfront operates as an REIT, owning the advertising properties and leasing them to the advertisers.

The economic reversal of the first quarter has hit Outfront hard. With so many areas under lockdown, travel and business restricted, and many businesses unable to operation normally, outdoor advertising has been one of the first expenses to feel the axe. Outfront’s stock dropped over 50% by mid-March, badly underperforming the overall stock market. Since bottoming out on March 20, the stock has bounced back 66%.

That rebound shows the company’s underlying resilience. OUT consistently beats its quarterly earnings expectations, and 2019 revenue reached $1.8 billion, growing 11% from the year before. While this first quarter was flat-out bad, the stock market’s bounce, the prospect of an effective treatment for COVID-19, and the beginning of discussions on how to reopen the economy all bode well for OUT in 2H20.

Even with the difficult quarter now, Outfront Media has maintained its generous dividend. The yield comes in at 12.8%, and the annualized payout lands at $1.52.

Ian Zaffino, covering OUT for Oppenheimer, noted, “Overall, OUT could see meaningful headwinds from the outbreak and a speedbump in its transit and digital initiatives. However, management is taking actions to reduce fixed costs and mitigate the impact to profitability. Further, the company maintains solid liquidity—e.g. ~$534M of cash-on-hand—and has cushion against its covenants. Additionally, the nearest debt maturity isn’t until 2024 ($500M senior notes).”

In line with his cautiously positive outlook, Zaffino maintains the Buy rating on OUT shares. Even while lowering the price target in deference to the pandemic, Zaffino’s new target, $20 per share, suggests a strong 68% upside potential. (To watch Zaffino’s track record, click here)

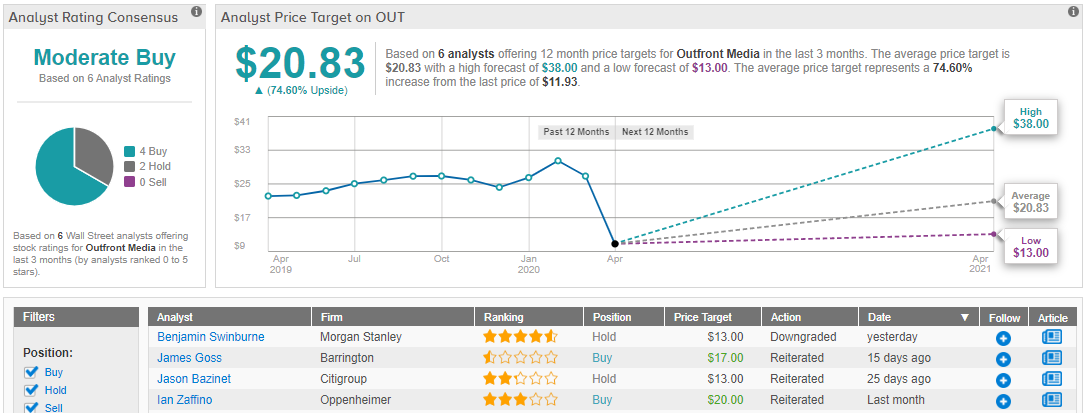

The analyst consensus here agrees with Zaffino; Outfront gets a Moderate Buy rating, based on 4 Buys and 2 Holds set in recent weeks. Shares are priced at $11.93 after the recent growth noted by Zaffino, while the $20.83 average price target suggests a robust upside potential of 75%. (See Outfront Media stock analysis on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.