We’re in perplexing times. At this writing, the S&P 500 index stands at 3,153, just 7% below its all-time high. That high, reached back in February, came the day before the bottom fell out of the stock market, as the coronavirus crisis triggered the steepest, deepest – and fastest – stock market drop on record.

“After a 40%-plus rebound in the S&P 500 since March, stocks became stretched to the upside and vulnerable to bad news,” SunTrust chief market strategist Keith Lerner noted.

Lerner doesn’t see any pullback as a problem, however. Rather, he views it as a chance for investors to take advantage of lower points of entry, and realize strong gains as stock return to the upside.

His colleagues at SunTrust agree, and have pointed out several stocks that are not just poised to make gains, but are also showing dividend yields in excess of 6%. It’s an unbeatable combination for income-minded investors: share appreciation and high-yielding dividend returns.

We’ve pulled three of SunTrust’s stock recommendations from the TipRanks database, to find out what else makes them compelling buys.

PennantPark Investment (PNNT)

PennantPark is a business development company, with a diverse portfolio of senior debt, subordinated debt, and equity in middle market companies.

PennantPark’s earnings were stable from Q4 through Q2, at 15 cents per share. Management, to keep the dividend stable, cut the payment back to 12 cents per share, effective with the July 1 payment. This gives an annualized payment of 48 cents, and an impressive yield of 13.9%. At current levels, this dividend payment is sustainable – and estimates for forward earnings are 16 cents per share in Q3.

5-stars SunTrust analyst Mark Hughes has been impressed by PennantPark’s management and believes that the company’s $3.40 share price presents a unique buying opportunity.

Hughes notes that the company has adjusted its portfolio to mitigate risks during COVID-19, and that only 11% of the company’s investments are in high-risk categories. He writes, “While management has accepted lower yielding investments that are consistent with PNNT’s lower risk mandate, we believe the BDC should be able to maintain an average 7.2% to 7.4% calculated portfolio yield through the end of F20…”

To this end, Hughes rates PNNT a Buy along with a $4 price target, suggesting room for 18% upside growth this year. (To watch Hughes’ track record, click here)

Overall, based on 2 Buy ratings and 1 Hold, the analyst consensus rates PNNT a Moderate Buy. Meanwhile, the average price target, which comes in at $4.33, implies shares could rise by 27% over the coming months. (See PNNT stock analysis on TipRanks)

SL Green Realty Corporation (SLG)

Real estate investment trusts are known for their high dividend yields. SL Green is able to base its operations in one of the most dynamic real estate markets in the world: New York City. The company owns over 40 properties in Manhattan, including such notable addresses as 100 Park Ave, 125 Park Ave, and One Vanderbilt Ave.

With such strong properties in the portfolio, totaling over 14 million leasable square feet, it’s no wonder that SLG has remained profitable during the coronavirus era. The company saw earnings spike to $2.08 per share in Q1, more than enough to support the 29.5 cent monthly dividend payment. At $3.54 annually, this dividend gives a strong yield of 6.8%. Compared to the 2.16% average yield among peer companies in the financial sector, the attraction is obvious.

The attraction is clear to SunTrust’s Ki Bin Kim, who writes, “We understand the risk inherent in a Manhattan landlord with relatively high financial leverage and ambitious development plans. That said, SLG is increasing already-substantial liquidity and we believe there is more potential upside in the stock as we look out 12 months beyond the pandemic than there is further downside. COVID-19 is a unique disruption, but we expect workers to eventually return to NYC office buildings…”

As a result, Kim rates SLG a Buy alongside an $80 price target. This figure implies a powerful upside potential for the stock of 54% in the coming year. It’s a ringing endorsement of the recovering potential in NYC’s real estate market. (To watch Kim’s track record, click here)

SunTrust takes a much more bullish position here than Wall Street generally. SLG has a Moderate Buy consensus rating, based on 3 Buys and 9 Holds. The average price target is $51.13, suggesting a 18.5% upside form the $51.87 share price. (See SLG stock analysis at TipRanks)

TPG Specialty Lending (TSLX)

Last up is TPG, a specialty finance company. TPG provides credit and capital access to middle market companies, offering financing and funding solutions for complex business models. It’s an important niche, as the mid-market is engine of American small business. .

The coronavirus epidemic derailed TSLX in the first quarter, and the shares lost 48% in the February/March market slide. They have since rebounded, gaining 60% from their trough. In each case – the slide and the rebound, the stock showed greater movement than the broader markets.

For Q1, TSLX reported 51 cents per share earnings, which was stable sequentially and in line with expectations. At that level, earnings are clearly enough to support the regular dividend, which was declared for Q2 at 41 cents per share base. The company has a history of also paying out special dividends when it is able. The current dividend yield is 9.56%, impressive by any standards.

Mark Hughes, cited above, likes TSLX shares, and rates them a Buy. In his recent research note, Hughes noted, “We believe management continues to skillfully navigate an increasingly competitive market with widening lending spreads with its conservative originations approach, especially in a period where some of their portfolio companies could be severely impacted from the COVID-19 fallout… We are increasing our 2021 NII/share estimate to $1.86 from $1.67 contemplating higher portfolio yields despite a slightly smaller portfolio. We believe the yield forecast in particular has the potential for upside, due to the embedded call protection that is packaged in almost every loan…” (To watch Hughes’ track record, click here)

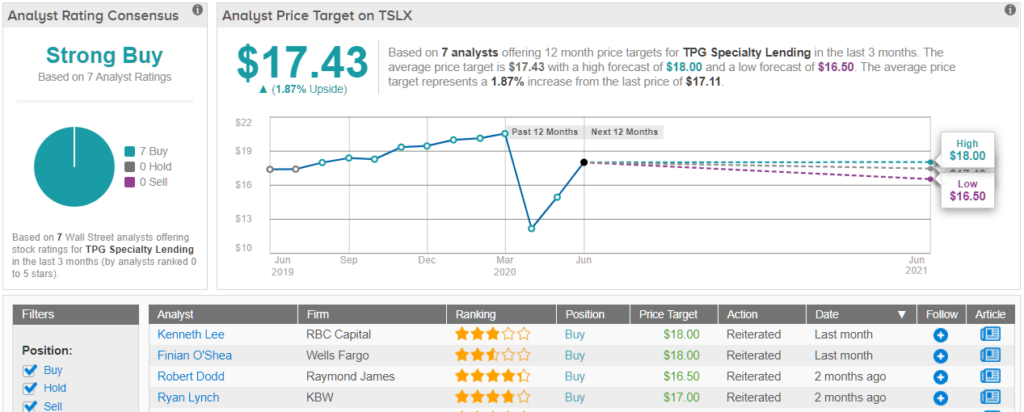

All in all, Wall Street likes TSLX shares, as shown by the unanimous Strong Buy consensus rating, based on 7 Buys given in the last two months. Yet, shares are currently priced at $17.16, and the $17.43 average price target suggests a modest upside. (See TSLX stock-price forecast on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.