We’re in perplexing times. At this writing, the S&P 500 index stands at 3,201, just 5.5% below its all-time high. That high, reached back in February, came the day before the bottom fell out of the stock market, as the coronavirus crisis triggered the steepest, deepest – and fastest – stock market drop on record. And now we are in the midst of a prolonged bull-rally, as the markets have been trending upwards since bottoming out on March 23.

What’s an investor to do? The natural inclination during a bear market is to defend the portfolio and make conservative plays toward defensive dividend stocks, while the inclination during a rally is to go with the winners and stake positions in the stocks that are climbing most rapidly. The two strategies don’t often overlap, and the future remains clouded even though sentiment is high for now.

At Wells Fargo, strategist Christopher Harvey believes that defensive moves are obsolete for now, and that investors should “start adding risk.”

“We’re starting to price in a less bad scenario. Things are getting slightly better at the margin… A few weeks ago, for the first time in a long time, we went overweight on value. Now, what we are telling [investors] is we want them to start putting risk into the portfolio,” Harvey said.

The strategist is advising investors to look for stocks that are positioned for a strong comeback. These are not necessarily the stocks that have been doing the best in the current rally; rather, they are stocks that will benefit most as the economy reopens. That reopening is happening now, in fits and starts, as some states continue their lockdown policies and others try to get back to business.

With this in mind, we’ve opened the TipRanks database and pulled up three relevant stock calls from three of Wells Fargo’s top analysts. These are stocks with at least 7% dividend yield, and in the eyes of the Wells Fargo analysts, at least 10% upside potential. Let’s take a closer look.

EQT Midstream Partners (EQM)

We’ll start in the energy industry, with a $4.8 billion mid-cap player in the important midstream segment. EQM provides natural gas pipeline and storage services for the Pennsylvania/West Virginia/Ohio sections of the Appalachian basin. This region, in the rugged, low mountains of the East, is one of North America’s richest natural gas production areas, and a center of the fracking industry. EQM is also involved in that latter, providing water supply and waste-water disposal services for gas fracking companies.

EQM holds a sound position in an essential industry, and has been able to maintain revenues and earnings despite the COVID-19 pandemic. Q1 earnings numbers beat the forecast by a wide margin. The $1.08 EPS was well ahead of the 95-cent estimate, while revenues grew 16.25% year-over-year to reach $453 million, 14% ahead of expectations.

In addition, for income-minded investors, the company has made moves to maintain the dividend even in difficult times. Management lowered the payment – never a good look, really – but the new payout of 38.75 cents per share quarterly gives a yield of 7.43% and an annualized payment of $1.55 per share. These are solid numbers that significantly outperform the services industry average yield of 1.4%.

Much of EQM’s potential is tied up in the Mountain Valley Pipeline. This project, in which the company is heavily invested, is delayed by regulatory and permitting hurdles, but is widely expected to come online in 2021.

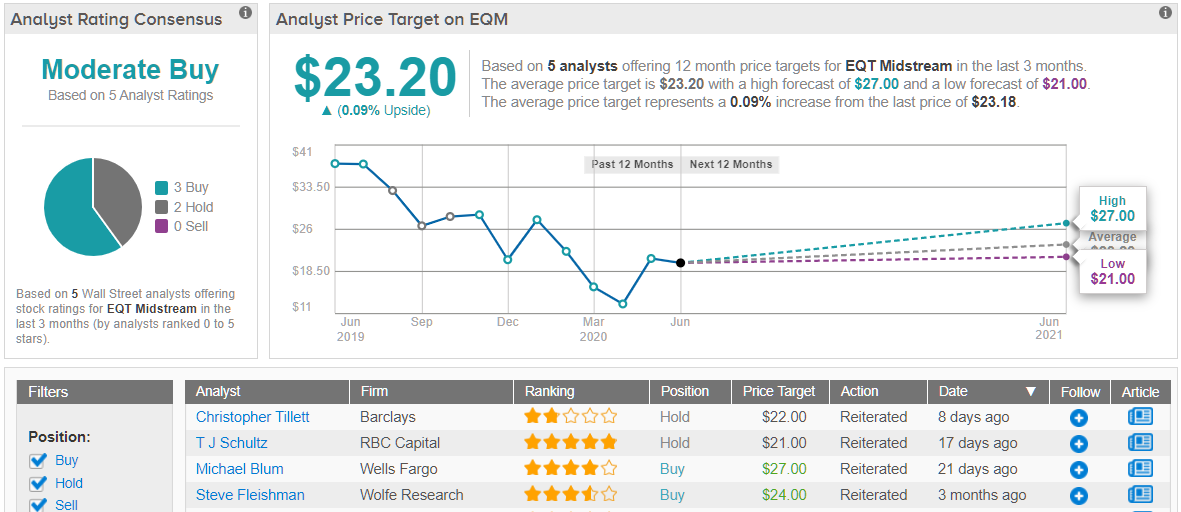

Covering this stock for Wells Fargo is analyst Michael Blum. Noting the pipeline delays, he writes at the bottom line, “EQM is well positioned to benefit from improving natural gas fundamentals heading into 2021 due to the expected decline in associated gas production. We see … the pending completion of MVP as positive…”

Blum sets a $27 price target here, in support of his Buy rating. His target implies a healthy upside potential of 17%. (To watch Blum’s track record, click here)

Overall, EQT Midstream gets a Moderate Buy from the analyst consensus, based on 3 Buy and 2 Hold ratings set in recent weeks. Shares are selling for $23.18, and the $23.20 average price target is less bullish than Blum’s. (See EQM stock analysis at TipRanks)

BP PLC (BP)

Next up, we move from mid-cap to industry-leading giant. BP, with a market cap of $93 billion, is one of the world’s largest oil and gas companies, and reported $278 billion in revenue for 2019. While that was down from the year before, the $10 billion in net profits beat the expected $9.7 billion.

And then came Q1 2020. We all know the story. Back in April, oil prices dropped dramatically, as demand was quenched by the ongoing economic shutdowns. Oil producers don’t have the luxury of simply shutting off the pumps when demand falls; the equipment must be maintained, and it is not easy to restart a well that has been capped. The bounce back in prices since the April low has been helpful, but only partially. Even so, BP saw net profit fall 67% yoy in Q1, from Q1 2019’s $2.4 billion to the current figure of $800 million. Even though Q1 earnings dropped so drastically they remained positive, but looking ahead Q2 is expected to show a loss of 37 cents per share.

Through everything, however, BP has kept up its dividend payment. The company remains committed to the payments, and has even increased its debt load to do so. The current dividend is 63 cents per share quarterly, annualized to $2.52, gives a yield of 9.65%. Compared to the 3% yield among utility peer companies, the attraction is clear.

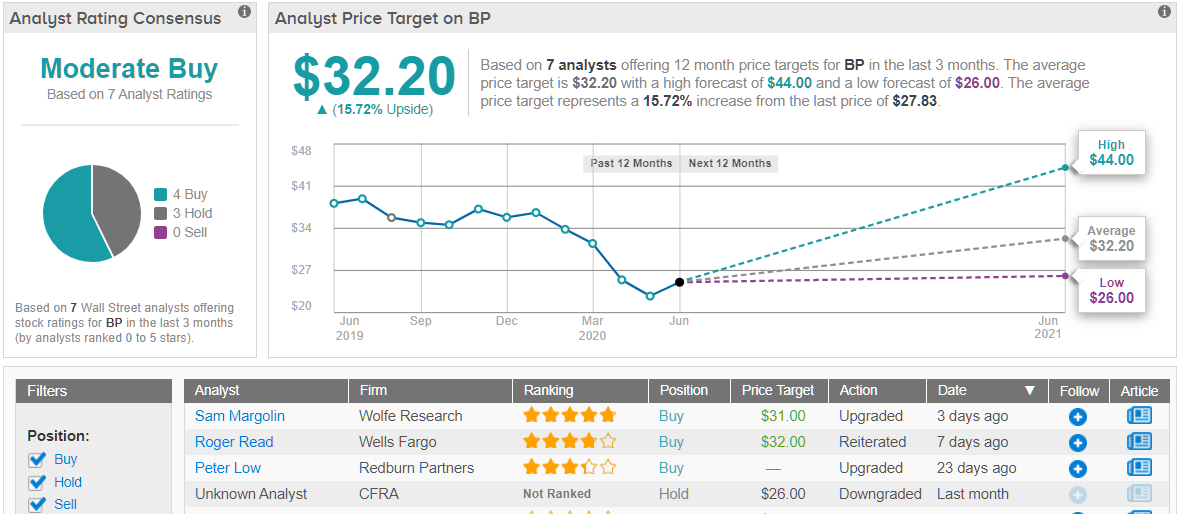

Roger Read, another of Wells Fargo’s analysts, is cautious here but also sees a path forward for BP. He writes, “…BP’s expected free cashflow generation through 2022 should support reductions in leverage and capacity to raise its dividend in 2020 and beyond.”

Read gives the stock a Buy rating, and backs it with a $31 price target implying room for 15% upside growth in the next 12 months. (To watch Read’s track record, click here)

The Moderate Buy analyst consensus rating on BP is derived from 7 reviews, including 4 Buys and 3 Holds. The average price target of $32.20 suggests a 16% premium from the $27.81 current trading price. (See BP stock analysis on TipRanks)

CenturyLink, Inc. (CTL)

The last stock on our list here is a communications services firm, in the cloud-based tech niche. CenturyLink’s products offer customers solutions for networking and online security, a vital industry in today’s connected work environment – and even more vital during the current corona crisis, with so many office workers moving to telecommuting. The urgency of online security is clearer now than ever.

That clear from CTL’s Q1 earnings, which not only grew 12% sequentially, but also beat the forecast by a penny. The 37 cents reported was even 8% higher than the year-ago quarter.

CTL’s steady earnings underlie the company’s dividend. The payment has been stable for 5 quarters – and management recently announced that the next payout, set for June 12, will remain at 25 cents per share, or $1 annually. At this level, the dividend yields 9.43%, a solid return by any standard.

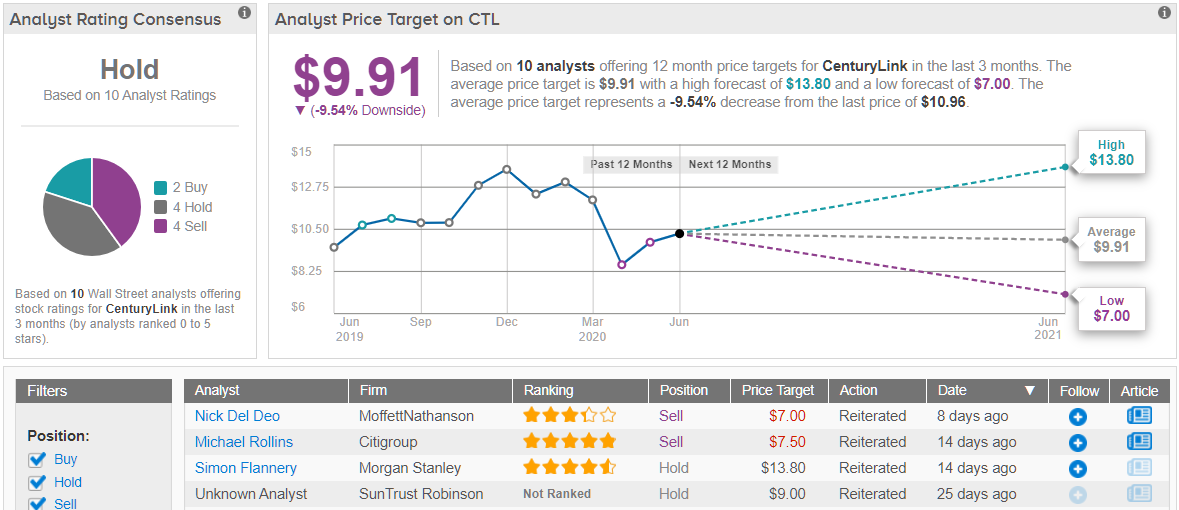

Wells Fargo’s Jennifer Fritzsche, rated 5-stars in the TipRanks database, acknowledges that leading-edge tech company inhabit a capricious landscape, but is optimistic about CTL’s prospects. She writes, “In our view – the co. made its difficult capital allocations decisions last year and we see that dividend as secure near term. If one lesson will be (crystal) clear coming out of this crisis, it is that fiber is critical and necessary ‘railroad tracks’ (to quote WSJ) in our new normal. CTL has more of that asset than any public co.”

Supporting her Buy rating on the stock, Fritzsche gives CTL a $12 price target, indicating room for 10% upside growth. (To watch Fritzsche’s track record, click here)

While Fritzsche is optimistic here, her Wall Street peers remain cautious. CTL shares have a Hold from the analyst consensus, based on 2 Buys, 4 Holds, and 4 Sells. Shares are selling for $10.24, but the average price target is $9.91. Time will tell if Fritzsche’s bullish stance is the correct course for CTL. (See CenturyLink stock analysis at TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.