With the number of global coronavirus infections now exceeding 93,000, Wall Street observers aren’t sure that monetary policy will be enough to limit an economic slowdown. Yesterday, the Federal Reserve cut US rates by 50 basis points, a level not seen since the 2008 economic crisis.

Despite briefly rallying on the announcement, things took a turn, leaving bank stocks hit especially hard. The situation wasn’t helped by the fact that for the first time in history, the benchmark 10-year Treasury yield fell below 1%, although the yield was back above 1% by the end of the session.

“The fact is, we’re coming into this crisis with far less ammunition globally. It’s not just Europe or Japan, even in China they have much less ammunition than the last time they had to launch a stimulus package,” J.P. Morgan Private Bank’s head of investment strategy Alex Wolf stated.

As so much about COVID-19 remains unknown, it has become a race against the clock to find solutions. The CDC’s test for coronavirus was given emergency use authorization from the FDA, but there currently aren’t any vaccines or therapies available. Against this backdrop, 3 healthcare companies have sprung into action, hoping to develop an effective vaccine for the virus that has put the world on edge.

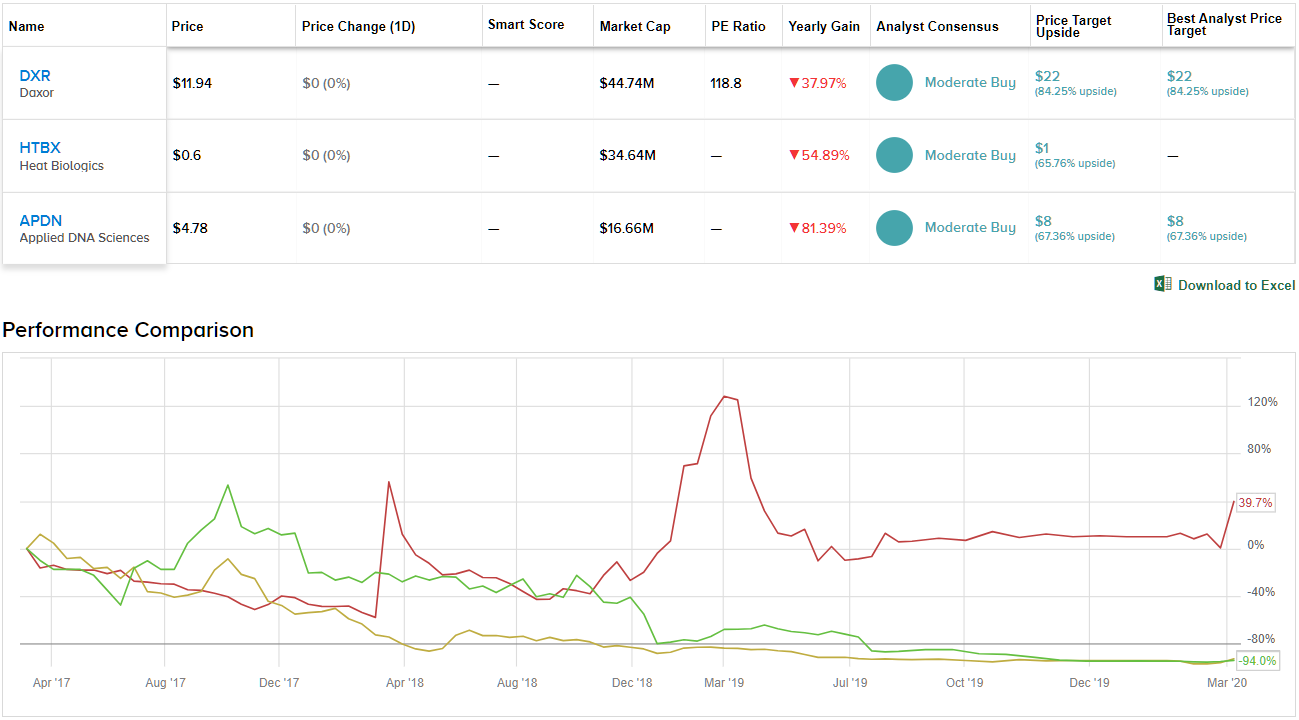

Using TipRanks’ Stock Comparison tool, we were able to evaluate these 3 Buy-rated stocks alongside each other to get a sense of what the analyst community has to say. Here’s what we found out.

Daxor Corporation (DXR)

Daxor is a cutting-edge biotech company that specializes in blood volume measurement. Using its technology, it developed the first diagnostic blood test approved by the FDA for blood volume status and composition, called BVA-100 (Blood Volume Analyzer). Given that its BVA system could potentially be used to treat the coronavirus, it’s no wonder DXR shares are up 27% year-to-date while the broader market has fallen.

These gains haven’t gone unnoticed by the pros on Wall Street. Maxim analyst Anthony Vendetti notes that DXR’s BVA technology was designed to help care for severely-ill patients experiencing blood volume imbalances caused by viral agents like the coronavirus. He points out that the company is reaching out to hospitals already using BVA devices to try and limit the number of deaths as the virus spreads in the U.S. On top of this, the biotech has a contract with the Department of Defense and finished its first Small Business Innovative Research (SBIR) program with the agency.

“We believe the company’s BVA system can significantly improve the treatment of severely-ill patients with blood volume imbalances, such as those caused by viral agents (e.g., the coronavirus),” Vendetti noted.

While Vendetti does acknowledge that its fourth quarter earnings results were somewhat disappointing, he thinks the print wasn’t all bad. DXR grew its test kit sales by 7% year-over-year, but it was hampered by supply-chain issues. The analyst argues that “if not for these supply-chain issues, DXR would have grown consumable kit sales at a much higher rate.”

“Daxor signed up five new hospital centers in 2019, and received licensing for a central lab for BVA testing to facilitate work at hospitals that currently do not have its testing equipment on-site, opening up an additional source of revenue. Management anticipates several new product enhancements to the existing technology to be implemented in 2020, which we believe should improve product usability and increase BVA traction,” Vendetti added.

In line with his optimistic take, the four-star analyst stayed with the bulls. Along with his Buy rating, Vendetti kept the $22 price target as is, suggesting 84% upside potential. (To watch Vendetti’s track record, click here)

Judging from the consensus breakdown, it has been relatively quiet when it comes to other analyst activity. Over the last three months, only 2 analysts have reviewed Daxor. Both of which, however, were bullish, making the consensus a Moderate Buy. On top of this, the $21 average price target puts the upside potential at 75%. (See Daxor price targets and analyst ratings on TipRanks)

Heat Biologics (HTBX)

Thanks to its proprietary T-cell Activation Platform (TCAP), Heat Biologics has been able to develop therapies designed to stimulate a patient’s immune system to fight off cancer cells. Its two platforms, ImPACT and ComPACT, were created based on the heat shock protein, gp96, giving the company its name. Like Daxor, HTBX stock skyrocketed on Monday due to the technology’s potential use in the battle against coronavirus.

According to Heat’s latest 8-K filing, it has submitted a provisional patent application for its immune system activating technology for the treatment or prevention of SARS-CoV-2 virus infection, which can cause the coronavirus. While no other details have been provided, Jason McCarthy of Maxim sees this development as a potential catalyst.

“We do note that the gp96 immune therapy/ vaccine platform technology has been used in the past for developing viral targeting therapies including HIV, SIV and Zika (all preclinical). The key takeaway is that while gp96, which is the foundation of oncology programs IMPACT and COMPACT for Heat Biologics, may be applicable to viral diseases as well,” McCarthy commented.

Part of what makes its technology ideal in targeting the coronavirus is the immunogenic properties of heat shock proteins. Specifically looking at gp96, the protein is unique in that it can target both the innate and adaptive immune system arms. This allows it to effectively target tumors, and in coronavirus’ case, pathogens.

Based on all that Heat Biologics has going for it, McCarthy tells investors that his bullish thesis remains very much intact. It makes sense, then, that the analyst reiterated a Buy recommendation as well as his $1 price target. This conveys his confidence in HTBX’s ability to rise 67% over the next twelve months. (To watch McCarthy’s track record, click here)

As McCarthy is the only analyst to offer up a take on this healthcare name, the consensus rating is a Moderate Buy. However, given its potential with respect to coronavirus, this could change very soon. (See HTBX stock analysis on TipRanks)

Applied DNA Sciences (APDN)

Last but certainly not least is Applied DNA Sciences, a company that uses biotech to provide security solutions. Having said that, it has found itself under the Street’s microscope after surging over 40% year-to-date on its DNA manufacturing technology’s possible use in a coronavirus vaccine candidate.

On March 2, APDN broke the news of its collaboration with Takis Biotech, which has designed four experimental vaccines to target the coronavirus. Vendetti, who also covers this stock, tells clients that these candidates were created around the virus’ spike protein, a surface protein that plays a significant role in viral entry into host cells, and will be produced using linear PCR.

Vendetti argues that several features of the approach, which involves targeting telomerase, could give APDN a leg up in the race to develop a vaccine.

“This vaccine candidate has been shown in animal models of colorectal cancer to not only eliminate cancer cells, but prevent disease via prophylaxis, or ‘vaccinating’ against the cancer. As such, this is suggestive of immune memory using the APDN/Takis vaccine approach which could be beneficial if applied to COVID-19,” Vendetti said.

Additionally, the analyst tells investors not to underestimate the importance of the linear DNA approach when it comes to developing an effective coronavirus vaccine. APDN’s linear PCR can target available virus sequences to quickly produce a vaccine. This is important as the coronavirus will most likely develop mutations as it replicates.

Should this be the case, the vaccine could require a reformulation every year, and according to Vendetti, APDN is up for the challenge. “Given the speed at which the APDN platform generates linear DNA-based vaccines, APDN could alter the vaccine based on new strains very quickly, perhaps faster than anyone in the vaccine space, in our view,” he explained.

To this end, Vendetti left both his Buy rating and $8 price target unchanged. At this target, the upside potential lands at 67%.

Looking at the consensus breakdown, APDN follows the pattern established by the two other names on our list to a T. With only Vendetti’s call, the word on the Street is that APDN is a Moderate Buy. (See APDN price targets and analyst ratings on TipRanks)