One area of the market that has been gaining steam: biotech stocks. A flurry of deals, FDA approvals, and recent innovations in the biotech space have seen the Nasdaq Biotechnology Index exhibit a quarterly uptick of 24%, easily beating the S&P 500’s 8.3% quarterly gain. The recent surge has helped the sector close the gap on the S&P 500’s stellar 2019, and a 27% year-to-date increase brings it into the realm of the major index’s 29% yearly gain.

While earlier in the year, the sector as a whole may have lagged behind the general market trend, the biotech industry’s infamous volatility still managed to produce some outstanding performers in 2019. According to the analysts, some are set for further growth in 2020.

Based on the information provided by the Stock Screener tool from TipRanks, a company that tracks and measures the performance of analysts, three companies appear ready to take advantage of the sector’s upturn. As it happens, all three currently have a Strong Buy consensus rating from the Street, too.

Alexion Pharmaceuticals (ALXN)

Interestingly enough, one biotech yet to match the sector’s performance this year is Alexion Pharmaceuticals. Although its share price is up by 13% year-to-date, the figure is significantly below the biotech industry’s yearly gain. Some on the Street, though, think that is about to change.

ALXN is a leading developer of drugs for rare and ultra-rare indications, especially in neuromuscular diseases. The company’s most successful drug is Soliris, a treatment for a number of conditions including rare blood disease, hemolytic uremic syndrome (HUS). Other products include Ultomiris, a treatment for adults with PNH (Paroxysmal Nocturnal Hemoglobinuria), and Strensiq, a treatment for infantile and juvenile onset hypophosphatasia (HPP).

Alexion recently entered into an option agreement with Stealth Biotherapeutics for elamipretide, a therapy for primary mitochondrial myopathy (PMM). In return for a $30 million investment, the companies will co-develop and co-promote elamipretide in the U.S., and Alexion will receive the exclusive rights to the drug for the rest of the world. It is thought that around 40,000 people in the U.S. are affected by the disease, which is characterized by debilitating skeletal muscle weakness.

Nomura’s Christopher Marai thinks elamipretide could see global sales of over $2 billion. The 4-star analyst noted, “We anticipate the Ph3 data imminently (in late Dec/early Jan); this offers a near-term catalyst on what could be ALXN’s next blockbuster drug opportunity. We expect the next few earnings quarters for ALXN to be positive, with continued MG, NMOSD, and Ultomiris conversion-based rev. growth providing a solid valuation foundation and few near-term negative-catalyst risks.”

Marai has no issue, then, in maintaining his Buy thesis on Alexion. The accompanying target price of $165 conveys Marai’s belief that the share price could increase by 50% over the next year. (To watch Marai’s track record, click here)

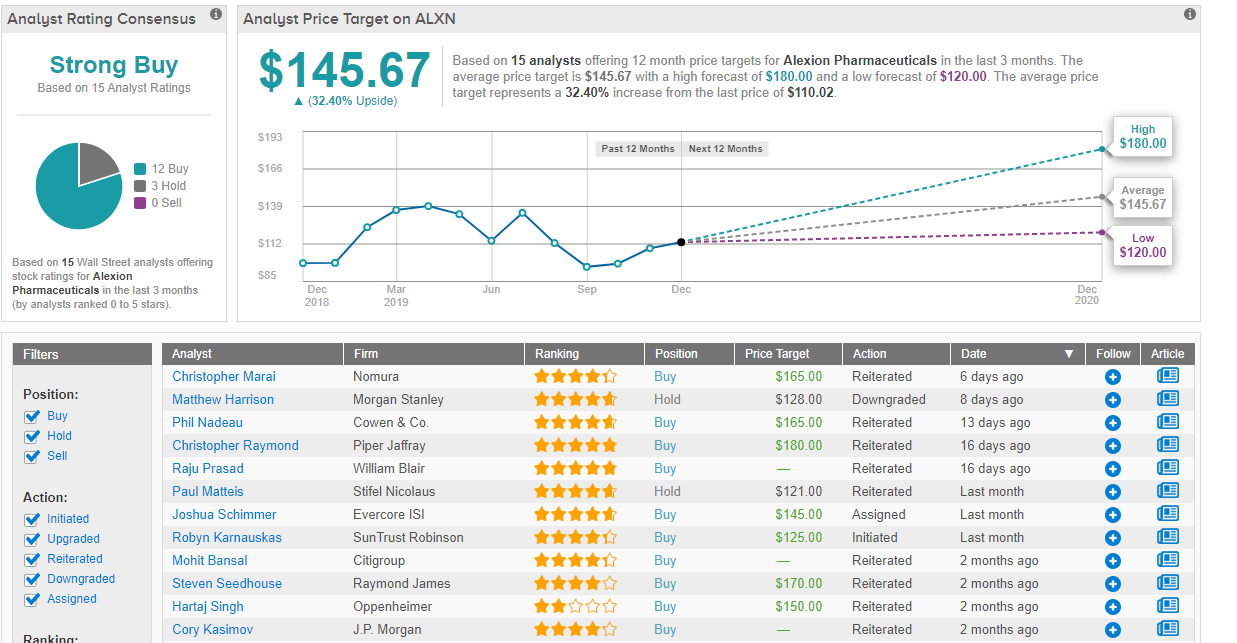

Alexion has healthy support from the rest of the Street, too. A breakdown of the company’s Strong Buy consensus rating exhibits 12 Buys and 3 Holds. The average price target of $145.67, indicates there is room for an additional 32% increase over the next 12 months. (See Alexion stock analysis on TipRanks)

Exact Sciences Corporation (EXAS)

Completely ignoring the notion that biotechs have lagged behind the market is Exact Sciences. The cancer prevention focused company is up 53% year-to-date.

The company’s flagship product is the colon cancer test, Cologuard. According to CEO Kevin Conroy, the next few years should see the drug’s current 5% market penetration increase to 40%. The US alone has a population of 105 million who are eligible to use the test, indicating a market in the range of $20 billion for the company to get a piece of.

In recent news, November saw the company close the $2.8 billion acquisition of genomic diagnostics maker Genomic Health. The deal expands Exact Sciences’ presence to more than 90 countries.

According to Cowen’s Doug Schenkel, EXAS is severely undervalued. The 5-star analyst thinks, “EXAS is positioned to generate organic revenue growth of ~25-50% annually over at least the next 5-years while generating solid [free cash flow].”

Schenkel further added, “EXAS remains our favorite large-cap, growth stock pick. We see a path to ~50% upside from current levels over the NTM. We expect robust Cologuard growth that exceeds Street expectations, are increasingly positive on how much GHDX can help EXAS commercially and operationally, believe the product pipeline is under-appreciated, and feel concerns are disproportionally captured in current valuation.”

No surprise, then, to learn Schenkel maintained an Outperform rating on EXAS, while reducing the price target by $5 to $130. With EXAS stock currently trading at $96.50, this implies upside of 35%. (To watch Schenkel’s track record, click here)

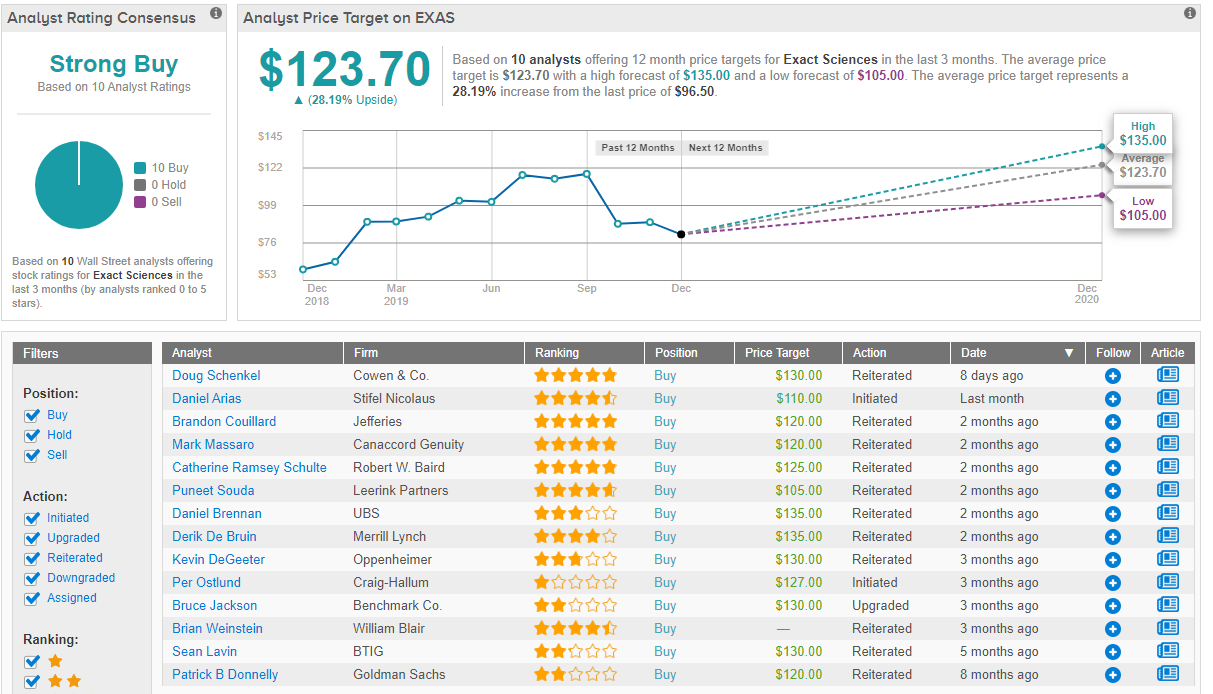

Does the rest of the Street concur? Yes, it does, in no uncertain terms. A unanimous 10 Buys form a Strong Buy consensus rating. The average price target of $123.70 indicates a possible 28% increase in the coming year. (See Exact Sciences stock analysis on TipRanks)

See also: 3 Market-Beating Stocks to Snap Up for 2020

Zealand Pharma A/S (ZEAL)

Another company totally outperforming the market in 2019 is the metabolic and gastrointestinal disease specialist, Zealand Pharma. The Denmark based biotech’s main area of focus is on the discovery, design, and development of peptide-based medicines. Zeal has got a lot of investors excited, as its share price has risen an outstanding 183% year-to-date.

So, what’s the fuss all about? The company’s recent 3Q report gives an indication of the volume of activity at Zeal. Among the highlights were the positive results of the Phase 3 clinical programs for dasiglucagon, the company’s treatment for hypoglycemia. The focus now turns to preparation of the NDA for submission in early 2020.

Zealand also completed its first ever acquisition of Encycle Therapeutics, in a deal that could potentially cost $80 million. The Toronto based biotech provides technology to synthesize macrocyclic peptides with drug-like properties. Furthermore, Zealand secured private funding from Van Herk Investments, in the shape of about $83 million. The additional funding will go towards supporting Zealand Pharma’s peptide platform and to speed up current development of late stage assets.

All the positive developments haven’t gone unnoticed by Goldman Sachs’ Graig Suvannavejh, who noted the company’s increasingly positive pipeline and commercial execution. The 4-star analyst thinks Zealand Pharma “finds itself on the cusp of transforming” into a commercial stage company in the foreseeable future.

To this end, Suvannavejh upgraded his rating from Neutral to Buy and set a price target of $41, implying the Danish biotech has room for growth in the shape of another 25%. (To watch Suvannavejh’s track record, click here)

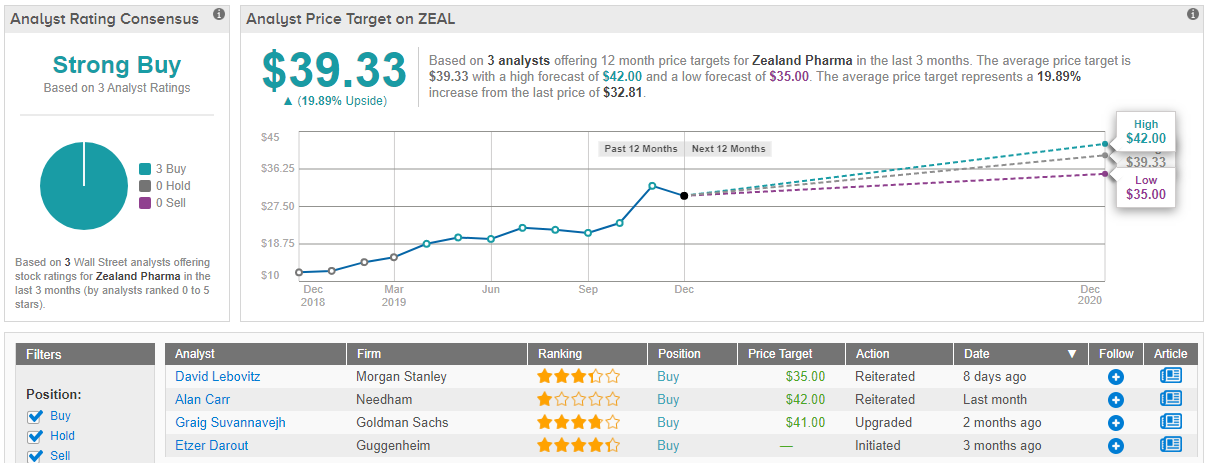

2 other analysts have chimed in with a view on Zealand in the last three months, both also giving the biotech a thumbs up. The Strong Buy consensus rating is accompanied by an average price target of $39.33, implying upside potential of 20%. (See Zealand Pharma price targets and analyst ratings on TipRanks)

Check out these 5 ‘Strong Buy’ stocks that top Wall Street analysts recommend.