A sense of cautious optimism is looming over the Street given the progress in the reopening of the U.S. economy, and while the recent uptick isn’t necessarily indicative of a full recovery, it’s certainly a step forward.

Jefferies equity strategist Steven DeSanctis opined, “The market is a forward-looking mechanism. They see six months from now, nine months from now there will be more semblance of order. The economy will be coming back, and earnings will be coming back. Estimates have stopped going down,” DeSanctis added, “All of that outweighs what’s going on…The big thing with social unrest is in two weeks from now, if we get an uptick int the virus and that delays openings, that is something that impacts markets.”

Against this backdrop, Wall Street pros argue that certain sectors are holding up substantially better than the rest, and within these areas, compelling plays can be found. Highlighting the healthcare space, the pros say there are names that have not only received a lot of love from the analyst community, but also stand to deliver hefty returns through 2020 and beyond.

Setting out on our own search, we used TipRanks’ database to pinpoint three compelling healthcare stocks that won’t break the bank. Each of these tickers, which trade for less than $5 apiece, boasts tremendous growth prospects as well as a “Strong Buy” consensus rating from the analyst community.

Neuronetics Inc. (STIM)

We will start with Neuronetics, a medical device company that designs, develops and markets products that could potentially improve the quality of life for patients with psychiatric disorders. Currently going for $1.80 apiece, several members of the Street believe that now is the time to snap up shares.

Writing for Canaccord, 5-star analyst Jason Mills acknowledges that COVID-19 has taken a toll on the company. In order to preserve its balance sheet, STIM had to restructure, which meant layoffs and furloughs, as well as a new plan to reduce operating expenses, including delaying certain projects and reducing marketing spend. As a result, the salesforce was consolidated and went through a re-alignment process, but this isn’t necessarily a bad thing, in Mills’ opinion.

“The company is now vertically integrating BDMs, NPCs, and CTCs under one regional sales manager, which we believe could drive some future synergies. Further, the company is focusing on continuing to drive volume across the rapidly growing TMS-only provider segment of the market, a much more efficient model for STIM’s smaller sales organization, and a model that can drive leverage going forward, as these TMS-only providers are relatively self-sufficient and do not require the level of support that smaller centers need,” Mills explained.

It should be noted that TMS therapy has been heavily impacted by the pandemic, with a third of STIM’s customers temporarily suspending treatment and new patient starts declining. Having said that, Mills argued, “We think the long-term trends on the other side of COVID bode well for STIM, as the current crisis both drives the prevalence of depression and places a larger focus on mental health.”

The analyst added, “Additionally, given STIM is isolated from the hospital setting, we expect on a relative basis STIM’s volumes to trickle back at a faster rate than the med-tech average and accelerate going forward due to the bolus of patients built up in the interim… Post-COVID, we continue to like STIM, given the large and still highly underpenetrated MDD TAM (not to mention STIM’s targeted pipeline TAMs – bipolar depression and PTSD) and STIM’s technology platform, clinical evidence, and clinical support ecosystem.”

To this end, Mills kept his Buy recommendation and $4 price target as is. Should this target be met, a twelve-month gain of 122% could be in store. (To watch Mills’ track record, click here)

In general, other analysts echo Mills’ sentiment. 3 Buys and 1 Hold add up to a Strong Buy consensus rating. Based on the $6.33 average price target, which is significantly more aggressive than Mills’, the upside potential comes in at 252%. (See Neuronetics stock analysis on TipRanks)

Kindred Biosciences Inc. (KIN)

Operating as a companion animal health company, Kindred Biosciences focuses on bringing small molecule and monoclonal antibody products to market. Even though its Q1 2020 performance was somewhat of a mixed bag, some analysts believe that it’s undervalued at its current $4.82 share price.

On April 15, KIN finalized its sale of Mirataz, its first approved product, to Dechra for an upfront payment of $43 million, with the deal also including additional royalties on global net sales. On top of this, the company released encouraging results from the pilot field efficacy study of its canine IL-4/13 SINK molecule, a canine fusion protein targeting IL-4 and IL-13 for the treatment of atopic dermatitis in dogs. The data indicated a higher treatment success in the KIND-025 group compared to the placebo group as well as positive efficacy signals.

If that wasn’t enough, KIN is focused on advancing its KIND032 program, a fully canonized monoclonal antibody targeting IL-4R over the IL-4/13 SINK, the timeline for KIND-030 in parvovirus is on schedule and its cash position of $54.6 million could support operations through 2022.

The strength of its development pipeline prompted Cantor analyst Brandon Folkes to reiterate an Overweight rating (i.e. Buy) along with a $25 price target. This target puts the upside potential at a whopping 420%. (To watch Folkes’ track record, click here)

Folkes comment, “We believe KIN’s pipeline of novel animal health drugs will drive long-term shareholder value beyond levels reflected in the current stock price. As KIN advances its pipeline, investors should begin to appreciate its ability to unlock value in the pipeline as significant partnerships evolve. With animal health companies trading at 4.5-8.5x estimated 2020 revenue, and with business development playing a significant role in driving long-term growth for these larger animal health companies, we believe KIN’s pipeline offers a unique suite of meaningful revenue opportunities for larger companies, if KIN can deliver on its pipeline’s potential.”

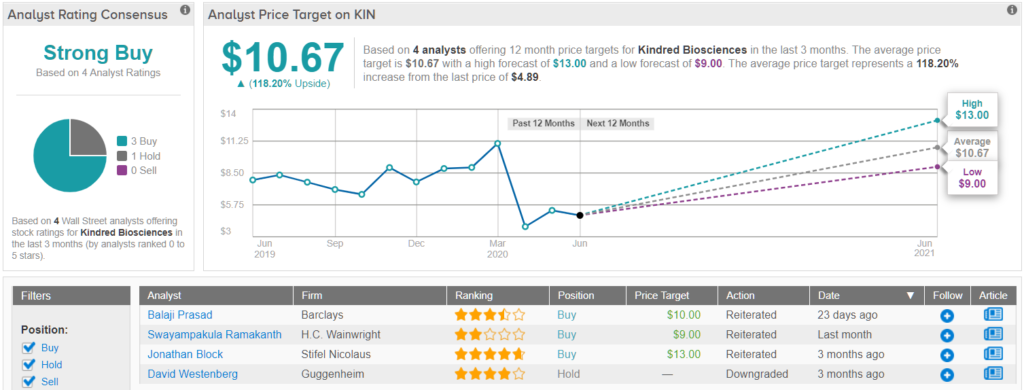

For the most part, other analysts are on the same page. With 3 Buys and 1 Hold, the word on the Street is that KIN is a Strong Buy. At $10.67, the average price target brings the upside potential to 118%. (See Kindred stock analysis on TipRanks)

Actinium Pharmaceuticals (ATNM)

Actinium Pharmaceuticals develops ARCs, or Antibody Radiation-Conjugates, capable of combining the targeting ability of antibodies with radiation’s cell killing ability. Given that the company recently strengthened its balance sheet, the analyst community sees its $0.21 share price as reflecting the ideal entry point.

ATNM has raised $31.6 million through equity financing in April. Maxim analyst Jason McCarthy believes that this is important because it frees the company up to focus on the Phase 3 Sierra trial, which is a single pivotal trial evaluating Iomab-B as a treatment for patients age 55 and up with r/r AML. McCarthy commented, “While it’s been a bumpy road on multiple fronts for Actinium that has pushed the shares to near its 52-week low, management has continued to execute, positioning the company for the home stretch to get to pivotal Phase 3 data.”

Looking at the data that has been released so far, McCarthy stated, “The 50% enrollment BMT numbers tell us the trial has an inherent imbalance, not by the design, but by the fact that sadly these patients are so sick that the chemo arm mostly won’t make it to BMT. This is what was observed with only 7/38 making it vs. 31/31 in the Iomab arm.” The fact that most patients had been heavily pretreated and had relapsed/refractory disease made this result unsurprising.

It should be noted that there are 80 days left to reach the six-month time for the durable complete remission (dCR) endpoint, and the Iomab arm currently has six times more patients than the chemo arm. “Assuming this trend continues to the 100 patient mark (ad hoc data analysis in 2Q20 that would be reported in 4Q20) or the top-line data for all N=150 in 2021, the probability of reaching the primary endpoint with statistical significance should favor Iomab,” McCarthy said.

This combined with a cash runway that should extend into 2021 and through both the SIERRA Phase 3 top-line data readout and potential BLA filing, McCarthy concluded, “As such, we see an attractive option for investors, in what is a tough COVID environment, to build positions in ATNM and await the interim data later this year.”

Bearing this in mind, McCarthy reiterated a Buy rating and $1.50 price target. The five-star analyst’s target implies shares could soar 603% in the next year. (To watch McCarthy’s track record, click here)

Like McCarthy, other analysts also take a bullish approach. ATNM’s Strong Buy consensus rating breaks down into 3 Buys and zero Holds or Sells. Given the $2.75 average price target, shares could skyrocket 1,172% in the coming twelve months. (See Actinium stock analysis on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.