When a stock goes up, that’s good. We all like to “buy low” and “sell high.” Problem is, that’s not always the way things work out. Sometimes, you buy a stock low, and it fails to become high. In fact, sometimes it goes… lower!

So how do profit when a stock stubbornly refuses to go up? How do you mitigate the damage of a stock that sinks instead of rising? How do you guarantee that you make a profit no matter what?

One word: Dividends.

Using TipRank’s Stock Screener tool it’s possible to identify and invest in stocks paying dividends rich enough to deliver something close to the stock market’s promised “10% long-term average return” out of dividend income alone. And if, in an ideal situation, the stock both pays its dividend and goes up in stock price? Why then, you should be well ahead of the game. Here are three stocks offering such double-whammy profit potential.

Saratoga Investment (SAR)

Beginning at the top, Saratoga Investment is a corporation that makes investments (Surprise!). Specifically, it’s a business development company that specializes in lending money and making equity investments to facilitate leveraged and management buyouts of smaller companies — companies doing at least $2 million in annual earnings before interest, taxes, depreciation, and amortization (EBITDA).

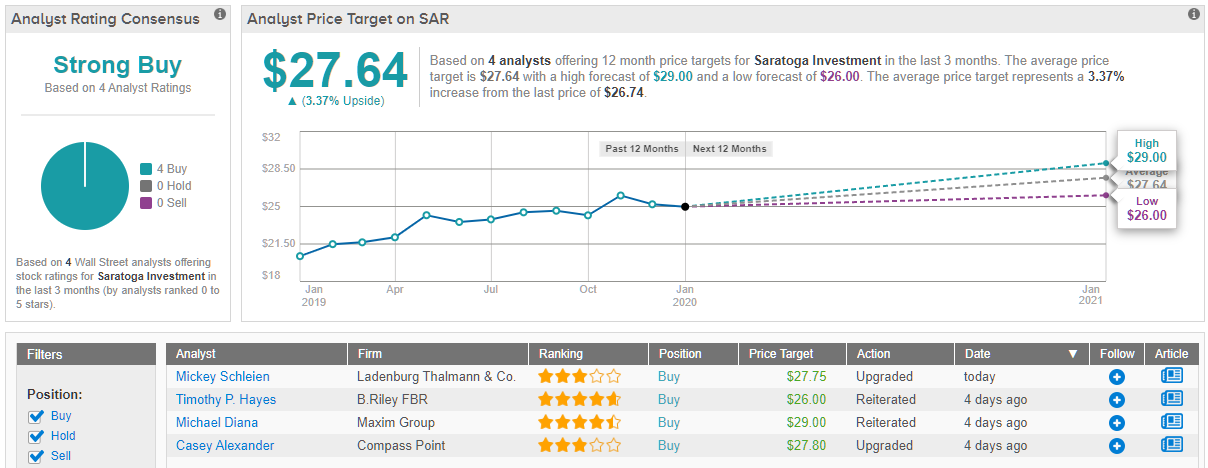

Last week, Saratoga Investment was brought to our attention by Maxim analyst Michael Diana, when he noted that two recent investment “exits” had provided enough liquidity to raise the company’s net asset value by about 9% — prompting a price target hike to $29 a share. Saratoga closed trading Friday at $26.74, so that’s a target price about 8.5% above current market price. (To watch Diana’s track record, click here)

But as I’ve already implied, price target isn’t the only attraction at Saratoga, which also pays a big dividend yield of 8.7%. That’s more than 4x the going rate on the S&P 500, and as Diana points out, Saratoga grew its dividend payout for 20 consecutive quarters before taking a “pause” in fiscal Q3 2020. What’s more, once Saratoga has had an opportunity to reinvest the cash raised from its recent exits, Diana anticipates we’ll see further dividend hikes in this company’s future — perhaps as soon as fiscal 2021.

This prospect appears to have attracted the attention of other analysts as well. In addition to Maxim, two other investment banks, B. Riley FBR and Compass Point, have issued buy ratings on the stock in the past week. With an average target price of $27.60, Wall Street seems in agreement that this stock is worth at least 3% more than it’s selling for today, and with its dividend added in, should deliver a total expected return on the order of nearly 12% over the next year. (See Saratoga stock analysis at TipRanks)

Ares Capital Corp (ARCC)

A second company in the business development biz is Ares Capital Corporation, and like Saratoga, it’s a generous dividend payer — 8.6%. Un-like Saratoga, Ares Capital is a much larger fish, boasting a market capitalization of $7.9 billion, versus Saratoga’s market cap of just $260 million.

With much more capital to work with, Ares also fishes in deeper waters. A specialist in business acquisitions, recapitalizations, and restructurings, this company makes investments as large as $400 million at a time — and in companies doing up to $250 million in EBITDA — both through the extension of direct loans, and also by participating in syndicated loans (loans extended by a group of companies acting in concert, and spreading around both the risk and the profit).

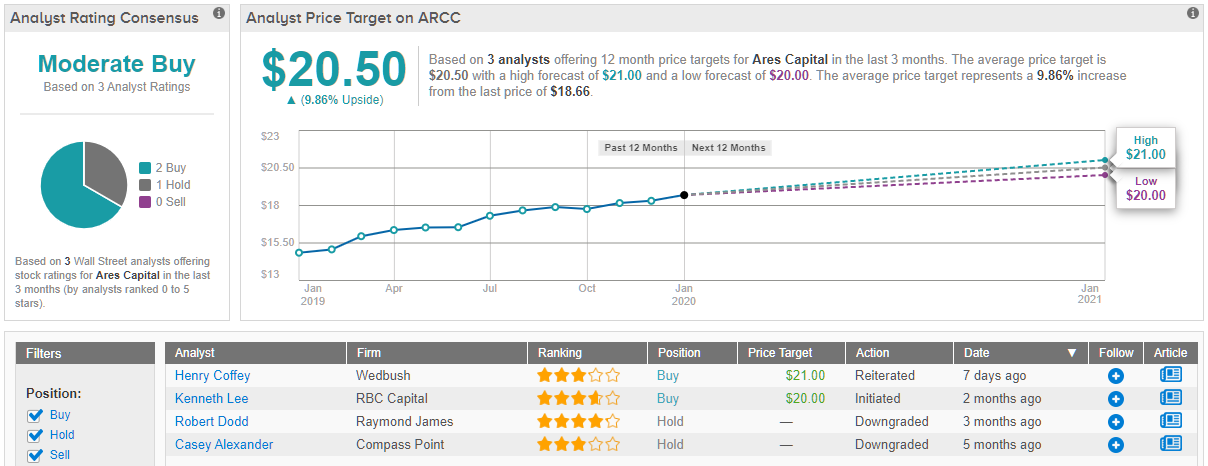

Earlier this month, Ares, too won an endorsement on Wall Street, when Wedbush analyst Henry Coffey bumped his its 12-month price target by 5% to $21 a share, implying 12.5% upside to the shares. (To watch Coffey’s track record, click here)

Whereas Maxim believes that Saratoga will resume raising its dividends next year, Coffey is optimistic that Ares will hike its dividend this year, and not by a little either, but from $0.40 to $0.47 per share — a 17.5% increase.

Incidentally, Coffey’s price target is now the highest on Wall Street — but others do share his sentiment. On average, analysts see about 10% upside to $20.50 for this stock, and the most recent rating prior to Coffey’s was likewise a “buy” — from RBC Capital analyst Kenneth Lee. (See Ares Capital stock analysis at TipRanks)

Global Net Lease (GNL)

Shifting gears a bit here at the end, our third and final 8%-plus payer of the day is not a business development company, but a real estate investment trust (REIT) instead.

Focusing on the leasing of commercial office space (52% of assets), industrial and warehouse space (43%), and retail (5%0, Global Net Lease is a globe-spanning corporation with $1.8 billion in market cap, $300 million in revenue, and operations in seven different countries in Europe and North America. In line with the well-publicized struggles of brick-and-mortar retail in the U.S., Global Net Lease has been gradually reducing its exposure to this aspect of the market, in particular, divesting 32 Family Dollar locations in the final quarter of 2019.

The company still does good business with the properties it’s keeping, however, and indeed has 99.6% of the properties on its books leased and generating rental income.

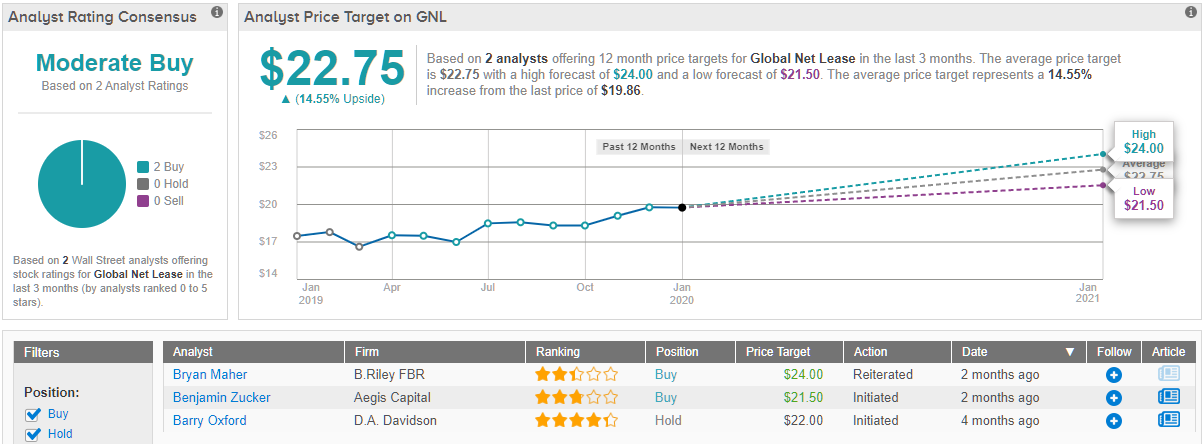

Speaking of which, Global Net Lease stands out on today’s list as the only company that currently pays out more money in dividends than it makes in profit — a point of some concern inasmuch as the company needs to earn profits if it’s to maintain its generous 10.5% dividend yield. No to worry, though. In a note issued in November, B. Riley FBR analyst Bryan Maher assured investors that recent purchases of “12 net lease properties in the U.S.” and planned purchases of 17 other properties in the U.S., Italy, and Canada, have Global Net lease “on pace to [earn enough money to] cover its dividend by mid-2021.”

Accordingly, Maher maintains a “buy” rating on the stock with a $24 price target that implies nearly 21% upside to the stock. (To watch Maher’s track record, click here)

Judging from the consensus breakdown, it has been relatively quiet when it comes to other analyst activity. Over the last three months, only 2 analysts have reviewed the real estate firm. Both of which, however, were bullish, making the consensus a Moderate Buy. On top of this, the $22.75 average price target puts the upside potential at ~15%. (See GNL stock analysis at TipRanks)