Will the rally ever end? Stocks continue to climb to record levels. Boosted by strong economic data and the promise of U.S.-China trade talks, the S&P 500 is now up 26% year to date. That means upside potential can look limited from these lofty heights and finding stocks to buy seems a daunting task.

Fortunately, the TipRanks’ Stock Screener tool enables you to search for stocks with a bullish rating from the Street’s best analysts. Plus you can screen for only stocks with 20% upside potential and above.

The tool searches a database of more than 6,400 publicly traded stocks, putting Wall Street’s data markers are your fingertips. A simple search refinement, for ‘Moderate Buy,’ small- and mid-cap stocks with upwards of 20% upside potential will narrow the selections to a more manageable 504 choices. From this list, we picked three stocks that have underperformed the markets and have shown drastic losses in share value through 2019, leaving them trading now at discount prices. Let’s check out the details.

Dropbox (DBX)

We’ll start with Dropbox. The company offers the web-based file-hosting service of the same name, making available personal cloud storage, file sharing, and file syncing to individual and business customers. The company is based in San Francisco, and unlike some bigger names in Silicon Valley tech, it has a high rating from privacy protection.

In Q3, DBX beat the Street’s estimates, showed 19% yearly revenue growth, and raised 2019 revenue guidance for the second quarter in a row. And through all of that, the stock has fallen more than 17% this year. What’s up with that?

Three factors are weighing on DBX and making investors nervous. First, and most worrisome, the company still runs a GAAP loss. In Q3, the net loss in GAAP terms was $17 million – almost triple the $5.8 million loss from one year earlier. Continuing and increasing losses do not inspire confidence. On the plus side, Dropbox’s non-GAAP performance has been consistently profitable.

Second, Dropbox is facing increasing competition. Giant companies like Alphabet and Microsoft are also offering cloud storage services, and Dropbox is hard-pressed to compete. This may be the factor that DBX is best positioned to meet, however. The company offers good products and has a firm customer base of 600 million registered users. Even with though only 3% are also paying users, it’s enough to push revenues toward $2 billion annually.

Finally, while DBX has been growing consistently for years, its growth is slowing. In 2017, the company’s $1.1 billion in revenues was up 31% year-over-year; in 2018, $1.4 billion in revenues translated to a 26% gain; and for 2019, the $1.66 billion guidance indicates a 19% growth rate.

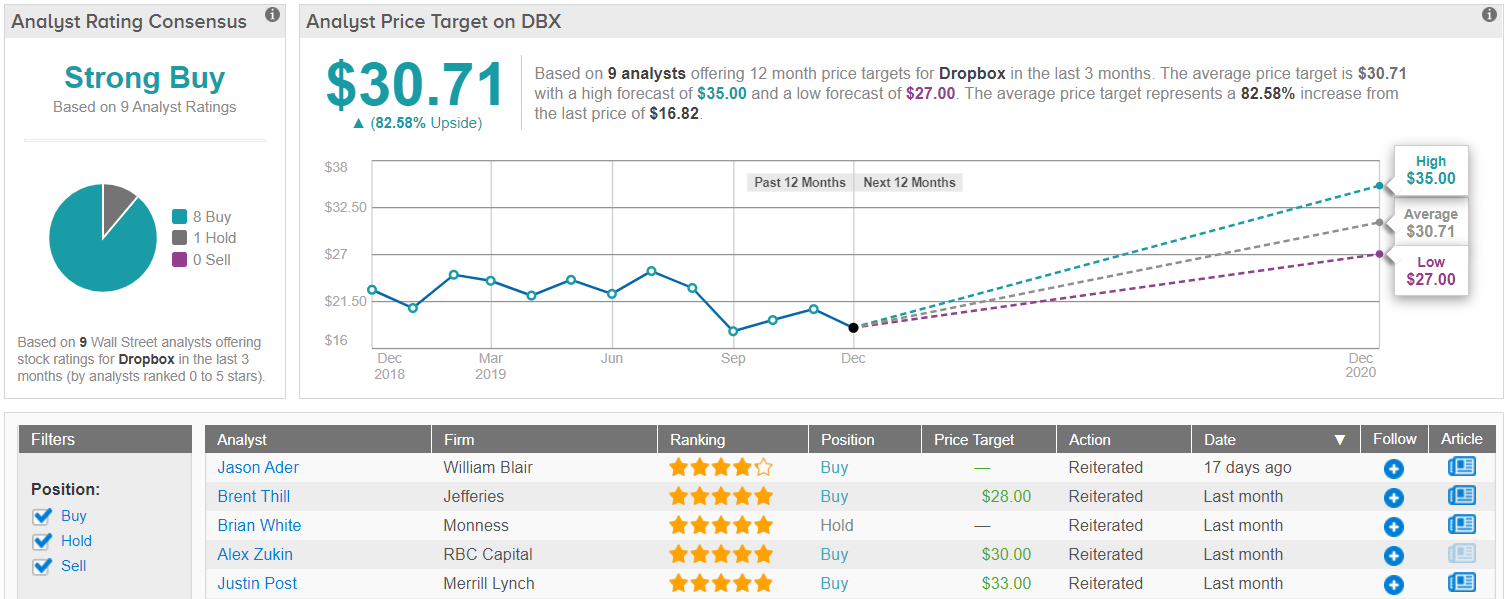

Writing for the bulls, William Blair’s 4-star analyst Jason Ader says, “We continue to believe that Dropbox is an underappreciated growth story and that its product pivot increases the prospects for sustained 15-20% top-line growth, and thus improves the risk/reward profile of the stock, which trades at a hefty discount to the SaaS peer group.” Ader does not set a specific price target on the stock, but he does give it a solid Buy rating. (To Watch Ader’s track record, click here)

Also weighing in on DBX for the bulls is Patrick Walravens, 5-star analyst with JMP Securities. Walravens says of DBX, “We like how Dropbox has repriced and repackaged its solutions and how the change is flowing through the base, and we are optimistic about the way the new Dropbox helps to bring all of a user’s content together, whether in the cloud or in traditional files.” Walravens puts a high $37 price target on DBX, implying a strong 102% upside to the stock. (To watch Walravens’ track record, click here)

On average, Dropbox has a Strong Buy from Wall Street’s analysts. The stock holds 8 “buy” ratings against a single “hold,” indicating that even though it has fallen in the markets, the analysts still see a clear way up for DBX. The average price target, $30, suggests an upside of 68% from the $18 trading price. (See Dropbox stock analysis on TipRanks)

Green Dot Corporation (GDOT)

You might not know Green Dot’s name, but there is a good chance you’ve used their products. The company operates at the junction of financial tech and bank holding, and is the world’s largest issuer of prepaid debit cards. It also controls a payment processing platform, and its technology is used by a number of big-name customers, including tech giant Apple for the Apple Pay service.

This has been a bad year for GDOT investors. Shares have definitely stumbled year-to-date as the stock is down 67% over 2019. It’s OK to wonder why – because in Q1, Q2, and Q3 Green Dot has been consistently beating the revenue estimates, and only missed on EPS once. The disappointment came in the full-year guidance, which the company lowered in the first and second quarters. Predicting lower future revenues and earnings failed to inspire investors, and GDOT fell 26% after the Q1 report, and 35% after Q2.

The Q3 report did not have as much of a negative impact on the stock. The company affirmed its previous guidance, rather than lowering it again, and revenues and EPS both beat the estimates by wide margins. Still, investors remained cautious and GDOT has been mostly flat since early October.

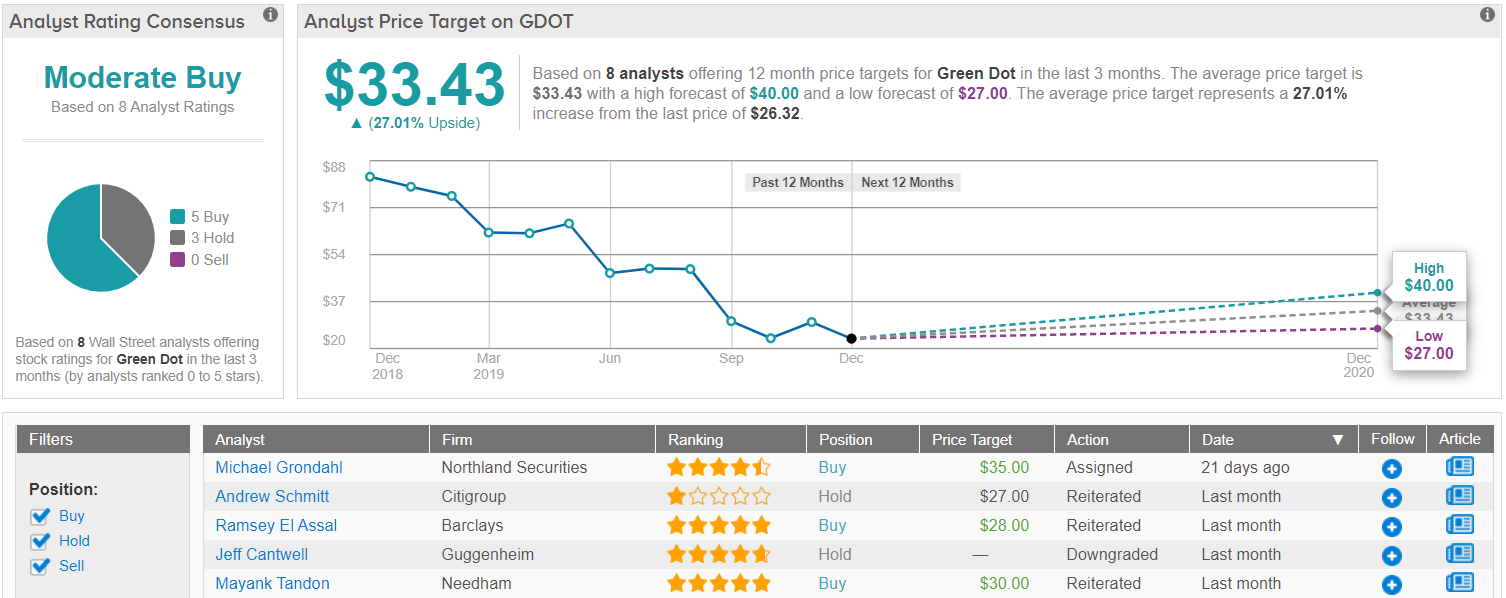

Michael Grondahl, 5-star analyst with Northland Securities, sees GDOT’s current weakness as a chance to buy in a remarkably low cost of entry. He writes, “Recall, GDOT’s Banking-as-a-Service business is helping Uber, Apple, Intuit, Walmart, Stash and many others with a direct deposit/debit card product offering… We continue to like the risk/reward for GDOT going forward.”

Grondahl gives GDOT a Buy rating and $35 price target, suggesting an upside potential of 35%. (To watch Grondahl’s track record, click here.)

All in all, the bulls rule the majority, with 5 analysts rating GDOT a Buy, while 3 suggesting Hold. The average price target stands tall at $33.43, impaling an upside of 27% from current levels. (See Green Dot stock analysis on TipRanks)

NexTier Oilfield Solutions (NEX)

The American oil industry has seen a rebirth in the last decade, as new extraction technologies have opened up vast shale formation for drilling. NexTier is one of many companies that has evolved to service the oil industry, offering a wide variety of support services and technologies to the oil drillers. The low cost of oil, however, has been pressing down hard on NEX, as drillers have scaled back the number of active wells – and reduced their need for ancillary services.

Still, there is always a need for oil in today’s world, which means that the oil companies will need someone to provide those ancillary services – fracking requires water, pipelines, pumps, tubing, trucks – the list is nearly endless. As the oil industry finds an equilibrium with the current price regime, they should also find one with supporting companies like NexTier.

The Q3 report shows that this might be happening. After steep losses in Q2, NEX reported a net profit of $3.6 million in the third quarter, with revenues rising from $427.3 million to $444 million. CEO Robert Drummond said, “Our business performed well throughout the third quarter of 2019, as we extended our track-record of delivering on our commitments despite a challenging market backdrop.”

Along with the upbeat Q3 numbers, on October 31, NexTier completed a merger between Keane Group – the company’s previous name – and C&J Energy Services. The newly merged company, officially named NexTier Oilfield Solutions Inc. and trading as NEX, expects to see significant cost efficiencies in the next twelve months.

That good news – both Q3 and the successfully completed merger – gave the stock a much-needed boost at the beginning of December. Shares are down 23% year-to-date, but up 37% from their November 20 low point. So, based on past performance, the risk factor for NEX is high – but as with many risky stocks, the potential upside is just as high.

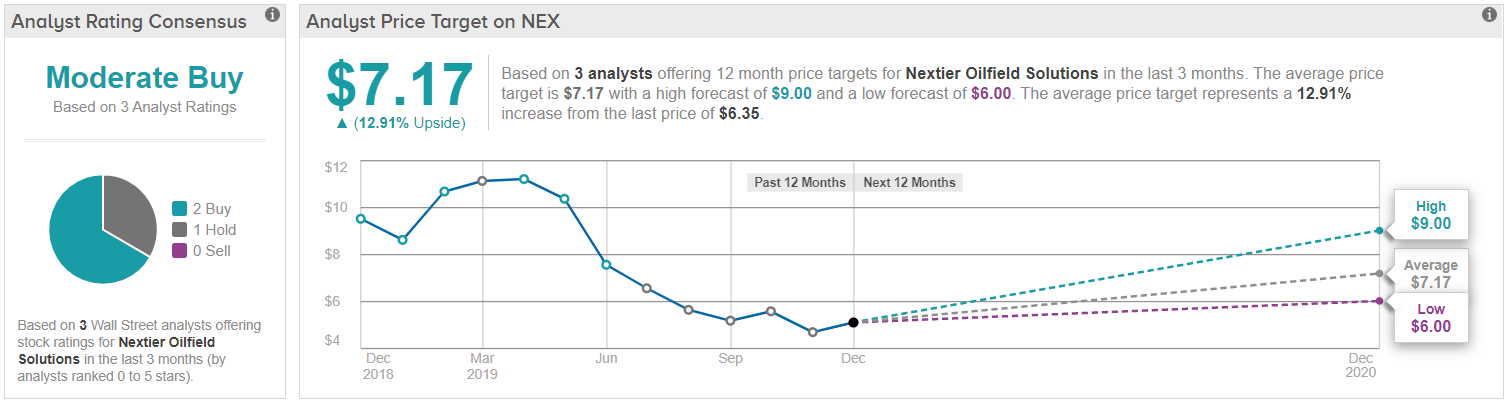

J.P. Morgan analyst Sean Meakim believes that NEX is poised to show hefty gains in the coming months. He says, “We believe the company’s scale and high-efficiency operations make it a formidable competitor. From any angle, NexTier Oilfield looks cheap within the frac space.”

Meakim initiated coverage with an Overweight rating and $9 price target, highlighting its solid potential upside of 44%. (To watch Meakim’s track record, click here.)

All in all, NEX has a cautiously optimistic Moderate Buy consensus rating from the Street. This breaks down into 2 “buy,” and 1 “hold” ratings. We can also see from TipRanks that the average analyst price target is $7.17 – 13% upside from the current share price. (See NexTier’s price targets and analyst ratings on TipRanks)