While the U.S. Federal government doesn’t appear any closer to approving cannabis, Congress does appear set to tackle the regulations holding back widescale sales of cannabidiol or CBD. The passage of the 2018 Agriculture Improvement Act (farm bill) legalized hemp production setting the market up for a strong sales ramp, but the U.S Food and Drug Administration squashed the growth opportunity by blocking CBD used as dietary supplements.

Hemp contains less than 0.3% of tetrahydrocannabinol (THC), whereas marijuana contains up to 30% of the psychoactive compound. CBD is increasingly presumed to contain properties for wellness and pain management increasing the attractiveness of hemp-infused CBD products. Unfortunately for the market, the FDA continues to question the lack of safety research on CBD products and placed into question the approval of edibles.

For this reason, the large proclamations for huge CBD sales have taken a hit. National retailers haven’t stocked edible products due to the potential ire of the FDA causing pure CBD companies to miss sales targets in 2019.

The industry has high expectations for substantial sales with the FDA eventually allowing CBD in food and supplements. Combined research from Roth Capital Partners, Brightfield Group and Cowen predicted a CBD market of ~$17 billion with Roth predicting a market potential to achieve sales in the $40 billon range.

Last week, Congress appeared to have wide support for H. R. 5587. The bill hopes to remove the FDA stance that CBD needs testing before approval in dietary products due to the item being previously listed as a controlled substance based on the provision in the Federal Food, Drug, and Cosmetic Act. At the same time, some members of Congress appear unwilling to overstep the boundaries of the FDA considering the legitimate concerns of the long-term safety impact of prolonged CBD usage.

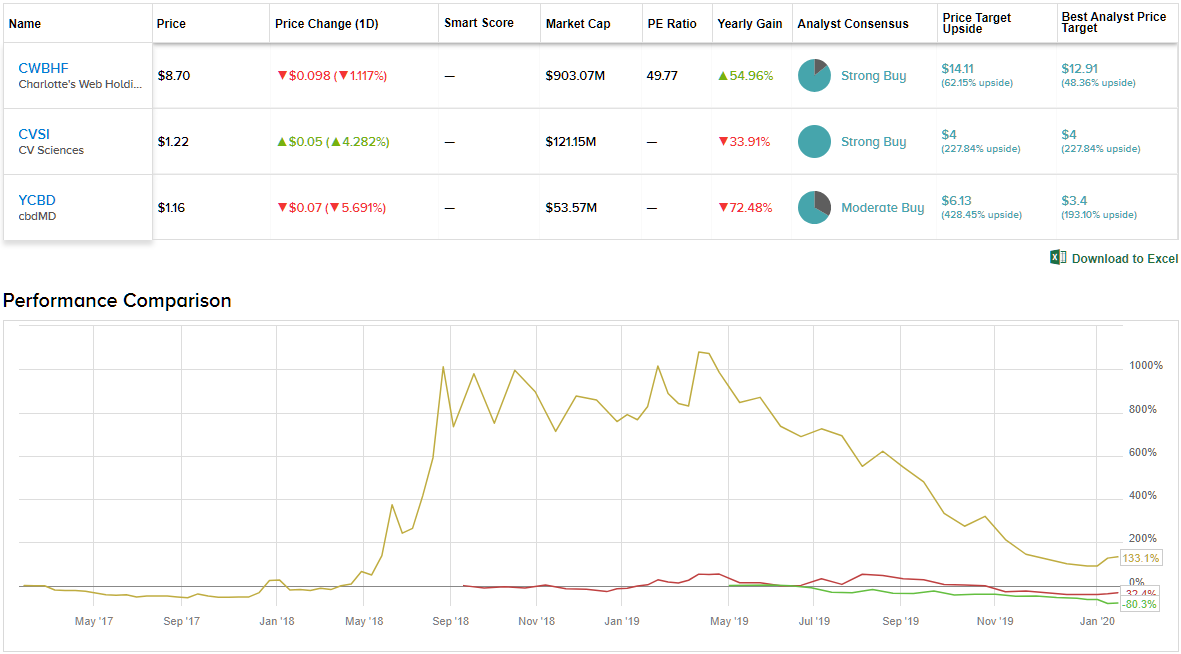

We’ve delved into three U.S. companies poised to benefit from a Congress willing to direct the FDA to allow the wide use of CBD in food products. Using TipRanks’ Stock Comparison tool, we lined up the three alongside each other to give us an idea of what the Street thinks is in store for the trio in the year ahead.

Charlotte’s Web Holdings (CWBHF)

Charlotte’s Web is the unofficial leader in the CBD space with a market valuation approaching $1 billion after this rally. Despite disappointing Q3 results due to national retailers pulling back from offering hemp-infused edibles, the company still generated $25 million in sales.

The stock has soared off the lows near $6 recently to top $9 in a matter of days this week. CWH traded above $25 back in the Summer when the market expected the CBD company to hit 2020 revenue targets reaching $350 million.

The company has a lot at stake with whether the FDA approves CBD infused in food and supplements. Management estimated that small independent retailers willing to sell the full scope of their products obtained up to 85% of sales from the items questioned by the FDA.

CWH has seen retail doors reach the 10,000 level. Unfortunately, the growth is mainly within the FDM channel unwilling to risk ire with the FDA due to the lack of regulatory clarity on ingestible products.

The CBD producer recently raised about $50 million in an equity offering at $10 per share plus warrants exercisable in the future. CWH is best positioned to expand when the FDA no longer stands in the way.

All in all, CWH sells for a bargain $8.72, a price that is especially attractive when the upside potential is taken into account. The average price target, $14.11, indicates room for over 60% growth to the upside in this stock. The Strong Buy analyst consensus is based on 6 “buy” and 1 “hold” ratings set in the last two months. (See CWH’s price targets and analyst ratings on TipRanks)

CV Sciences (CVSI)

CV Sciences has a robust retail distribution count at 5,435 stores as of September 30 with plenty of national retailers signed up. As with CWH, the company saw Q3 sales hit by the FDAs view on CBD products while the retail store count topped 5,700 in November.

Despite the retail store increase, sales declined in the September quarter to only $12.6 million. The revenue miss pushed CV Sciences into a $1.1 million net loss.

The company ended the quarter with a cash balance of $14.4 million and a diluted share count of nearly 116 million shares. CVI Sciences guided to 2019 revenues in the range of $55 million to $57 million suggesting December revenues of only $11.6 million.

Analysts expect a ramp to 2020 sales of $75 million, but the target is highly in question considering the FDA restrictions and the competitive market. Last year, analysts were predicting sales of around $120 million in 2020 as an indication of where the growth potential exists without the FDA blocking key food and dietary supplements from the market.

Judging from the consensus breakdown, it has been relatively quiet when it comes to analyst activity. Over the last three months, only 3 analysts have reviewed the CBD oil maker. All three are bullish, making the consensus a Strong Buy. On top of this, the $4.00 average price target puts the upside potential at 230%. (See CV Sciences’ stock-price forecast and analyst ratings)

cbdMD (YCBD)

cbdMD is a prime example of a company impacted by the delayed CBD market despite revenue growth. After a bad Q3 report in December, the company was recently forced into selling 16.0 million shares with an over-allotment of 2.4 million shares at $1.00 per share, raising ~$18.4 million before fees. The stock traded above $6 for a couple of months in 2019 so raising funds at this level was very dilutive for shareholders with only ~45 million shares outstanding prior to the offering.

For the FQ4 ended September 30, cbdMD reported sales of $9.5 million and a total of $23.7 million for the fiscal year. The company suggests pro-forma sales for the year of $26.8 million as sales slowly ramped during the year with $8.0 million in the prior quarter.

While sales increased during the year, gross margins for FQ4 were down to only 56.7% versus 63.0% in the prior quarter. In addition, the company cut back FY20 revenue guidance to between $62 million and $70 million, down from prior guidance of $80 million to $90 million.

The problem here is the substantial operating loss from operations. cbdMD had annual gross profits of only $14.5 million with operating expenses up at $28.9 million. The management team forecast reaching positive cash flows by October and this goal is clearly very important considering the recent equity raise.

For now, the restrictive FDA and unknown CBD bill outcome makes the stock too risky. cbdMD will greatly benefit from a less restrictive FDA, but investors must wait on this one until the risk is removed with actual passage of a bill.

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.