How do you bullet-proof your portfolio? Defensive stocks are one strategy – shares in companies whose businesses tend to remain profitable in a recession. The use of such defensive stocks has been a matter of long-running debate, with proponents claiming that they are a hedge against losses, while detractors demonstrate that defensive stocks really just lose a bit less when the markets turn down. Let’s unpack the TipRanks data on three big-name defensive stocks, and see how they fare.

Here we turn to the TipRanks data to analyze where these defensive stocks are heading now:

Papa John’s International, Inc.

Start with the pizza. Just a flat dough, some sauce, and some cheese, and yet everyone loves it. A delicious pizza is a thing of glory all unto itself, but that famous pie can even support some unexpectedly strong stock buys.

Papa John’s (PZZA – Research Report) has been in the pizza business since 1984 and has a history of clever innovations. In 1985, it was the first pizza chain to introduce dipping sauce for pizza slices – a gimmick that quickly became very popular. In 2002, it made another first by offering online ordering, something we now all take for granted. The company currently has 5199 locations, mostly franchises but including approximately 250 ‘company owned’ outlets.

All of this gives PZZA a deep foundation, with Stephen’s Will Slabaugh (Track Record & Ratings), writing “the long-term earnings power of Papa John’s current store base … is being undervalued.” Longbow Research’s Alton Stump (Track Record & Ratings) adds that “a sales recovery is now underway at Papa John’s and should continue in coming quarters.” His price target on this stock is $61.

Domino’s Pizza, Inc.

Domino’s (DPZ – Research Report) was founded in 1960 and is now the world’s largest pizza chain, reckoned by sales volume. The company started as a small business in Ypsilanti, Michigan, catering to the students at nearby Eastern Michigan University.

As the company has expanded, it has also developed a reputation for using gimmicky publicity and marketing promotions. In 2009, after surveys rated the company’s pizza dead last in customer taste tests, Domino’s began a series of light-hearted, self-deprecating ads and at the same time launched new recipes with higher-quality ingredients. By 2010, the campaign had produced a 14% quarterly jump in sales. In 2016, Domino’s used autonomous robot vehicles to deliver pizzas in selected German and Dutch cities, while in New Zealand it set a record with the world’s first UAV drone pizza delivery.

DPZ has a high share price of $259, but an analyst consensus of ‘Moderate Buy’ and an average upside prediction of 15%, at $299. Alton Stump (Track Record & Ratings) sees DPZ as a purchase opportunity, pointing out, “a survey of US based Dominos franchisees that indicated same store sales are up 7.5% to 8.0%. This is ahead of consensus at 6.5%.” Alton gives Domino’s a $336 target.

Phillip Morris International, Inc.

Cigarettes have been getting a bad rap for decades – and the health dangers are undeniable. Consumer demand for the products remains high, however, and the introduction of e-cigarettes gives the industry a tool to counter concerns over the health risks of tobacco smoke. Like pizza chains, cigarette companies have tended to enter portfolios as defensive investments.

Phillip Morris (PM – Research Report) owns and markets dozens of brands around the world, outside of the United States (in the US, the name operates as a subsidiary of Altria – MO), including the famous Marlboro. In addition to ordinary cigarettes, and in response to public concern over health issues, Phillip Morris produces and markets a variety of e-cigarettes – so-called ‘vaping’ products – that provide users with the nicotine but not the smoke of a cigarette. PM is also developing a ‘heat-not-burn’ line of products, which heat the tobacco at lower temperatures. Like vaping, these products are intended to provide users with nicotine without the smoke.

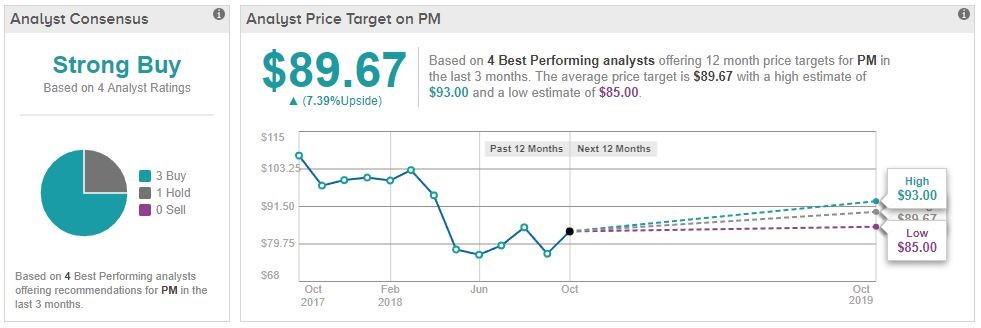

Overall, analysts see PM as under-performing and holding considerable room for stock growth. Downward price pressure in the market came from recent US FDA guidelines released on e-cig regulation, but that pressure is generally seen as an overreaction. Three months ago, Argus Research’s David Coleman (Track Record & Ratings) gave PM a $91 target price, for a 9% upside from the current $83 share price. He said, “the company’s core cigarette business is strong, and consumers are likely to continue paying a premium price for a superior product. Philip Morris’ cigarette alternative initiative is ‘promising’ and comes at a time of increasing health awareness.”

Enjoy Research Reports on the Stocks in this Article:

Domino’s Pizza, Inc. (DPZ) Research Report