E-commerce stocks across the board have endured a vicious valuation reset over the past year. Nonetheless, this piece will discuss three e-commerce stocks to add to your cart — AMZN, JD, and PDD, according to analysts. With tech valuations eroding and concerns that consumer sales could slip drastically once a recession hits, it’s not a mystery why the once-glorified e-commerce scene is under so much pressure.

In any case, e-commerce stocks still have the same growth runways they had before they fell off a cliff last year. Some may be in a spot to improve their growth profiles and expand their total addressable markets (TAMs).

For e-commerce firms, it’s about balancing near- and medium-term headwinds with longer-term secular tailwinds. With so much in the way of longer-term growth, I’d argue e-commerce stocks are great pick-ups for bargain-seeking investors.

Wall Street analysts are very bullish on some of the e-commerce leaders while they’re in the gutter. With “Strong Buy” ratings on each name, let’s check out the stocks mentioned above.

Amazon.com (NASDAQ:AMZN)

Amazon is a disruptor that’s grown to become more than just an e-commerce company. Still, its other impressive growth driver, AWS, is also feeling the drag of macro headwinds. Such headwinds may not last longer than a year as we finally do fall into a recession.

Many analysts have had the opportunity to factor in slowing growth over at AWS and the e-commerce business. Though there’s not much CEO Andy Jassy and company can do this year to turn the tide, I do think their long-term focus will pay dividends a few years down the road.

Amazon managed through the dot-com bust, only to come surging out of the gate many years later. This time around, investors should expect Amazon to keep investing in its disruptive capabilities, even if the call on the Street is to cut headcount and other expenditures.

The recession will be felt by many firms. Amazon isn’t just best-positioned to survive the headwinds; it will have a chance to give rivals a squeeze.

For example, the company’s “Buy with Prime” offering is a service that Amazon’s e-commerce rivals could struggle to compete against over the next few years. Despite the growth such a service can provide, investors still seem worried that the firm is losing its disruptive edge amid warehouse closures and layoffs.

In fact, the lean Amazon is still very much disruptive. If anything, higher rates make Amazon’s size a greater advantage as it looks to take market share.

What is the Price Target for AMZN Stock?

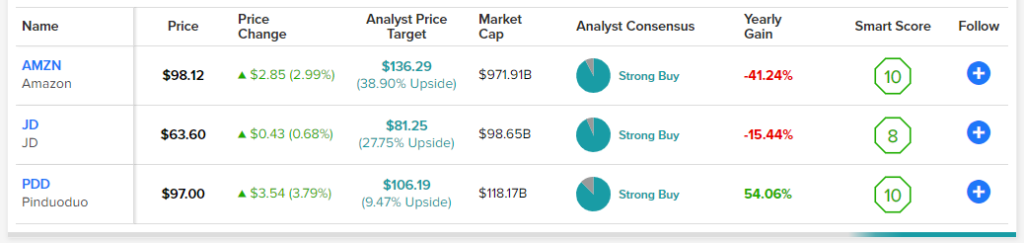

Wall Street may have lowered its price target on Amazon, but they still expect great things from the firm in 2023. The average AMZN stock price target remains high at $136.29 (38.9% gain expected).

JD.com (NASDAQ:JD)

JD.com is a lesser-known Chinese e-tailer that’s stumbled since peaking in 2021. Though gains posted in recent weeks are encouraging, it’s unclear as to how much of the headwinds are baked in. The stock trades at around 0.7 times sales and 16 times cash flow. Indeed, JD is a tricky name to value when the tides turn against it.

With China scrapping its zero-COVID policy, a wave of new COVID-19 cases could hinder a recovery over the coming weeks and months. Beyond that, the Chinese consumer may have the ability to sustainably recover.

Undoubtedly, dark times will precede any better days. Regardless, JD is one of the e-commerce companies that could be well-positioned to come roaring back in the second half.

For now, investing in Chinese stock continues to be a risky proposition. Regardless, Wall Street maintains a “Strong Buy” consensus rating on JD.

What is the Price Target for JD Stock?

Wall Street sports 14 Buys out of 15 ratings. The average JD stock price target of $81.25 implies 27.75% upside potential from here.

Pinduoduo (NASDAQ:PDD)

Pinduoduo is another Chinese e-commerce play that’s been roaring higher of late. Since bottoming earlier last year, PDD stock has more than quadrupled. Indeed, Pinduoduo has always been one of the choppiest movers in the market.

Powering Pinduoduo’s recent rally are very strong quarterly beats. The third-quarter numbers ($0.93 EPS vs. $0.72 estimate) were amazing, causing many analysts to hike their price targets.

Undoubtedly, PDD stock is the spiciest e-commerce play on the list, but it may also be the one with the greatest upside now that its historic 89% crash is in the rear-view mirror.

Beyond China-reopening optimism, Pinduoduo has been continuing to add to its arsenal of services. Like Amazon, PDD hasn’t lost its disruptive spirit. That alone may make PDD stock well worth the 7.0 times sales multiple.

What is the Price Target for PDD Stock?

Wall Street is sticking with Pinduoduo shares. The average PDD stock price target of $106.19 implies 9.5% upside potential based on 14 Buys and two Hold ratings.

The Takeaway

All e-commerce plays are trading at intriguing multiples. However, of the three names mentioned, AMZN stock has the greatest upside potential, according to analysts.