It’s going to be a busy week on Wall Street. Several industry heavyweights, including four of the five FAANG stocks, are gearing up to release their quarterly numbers, and investors are anxiously waiting to see the extent of COVID-19’s impact on profits.

With the ongoing public health crisis forcing several names to cut quarterly guidance, it’s no wonder investors are concerned. Against this backdrop, research firm Canaccord Genuity reevaluated several names in its coverage universe to see how they stack up ahead of their earnings releases. Ultimately, Maria Ripps, one of the firm’s analysts, concluded that there are still exciting opportunities out there, pointing specifically to three FAANG stocks.

Bearing this in mind, we used TipRanks’ database to find out what the rest of the Street has to say about the three FAANG stocks’ prospects going into their earnings releases. The platform revealed that each has received enough bullish calls to earn a “Strong Buy” consensus rating. Here’s the lowdown.

Facebook (FB)

The first of Canaccord’s picks is social media titan Facebook, which is preparing for its earnings release on April 29. The company already provided investors with a brief business update at the end of March, but the firm is looking forward to a more in-depth look at the state of its affairs during the global pandemic.

Canaccord’s Maria Ripps says that she’ll be looking out for further detail on the impact of social distancing on user engagement. It should be noted that according to the company’s March update, FB saw a significant rise in engagement across its family of apps, particularly its messaging services in several of the countries impacted the most by COVID-19.

Based on this, the analyst predicts global MAU growth in Q1 2020 will reach 8.1%, up from 7.6% in the previous quarter. Additionally, Ripps thinks that because “virtually all social interactions have been moved online during the pandemic”, engagement is slated to get a boost of 30 basis points sequentially, or 100 basis points on a year-over-year basis.

However, when it comes to FB’s advertising segment, it’s an entirely different story. Expounding on this, Ripps stated, “Despite the surge in user engagement, COVID-19 has created a significant amount of economic uncertainty globally, and Facebook has observed a weakening of its advertising business as a result. We are forecasting advertising revenue growth to decelerate to ~17% year-over-year in Q1 2020 (vs. 24.6% reported and 26% ex-FX in 4Q19) on the heels of this economic weakness, particularly given Facebook’s exposure to small- and medium-sized businesses, along with anticipated advertising targeting headwinds.”

Having said that, the social media giant is expected to provide a glimpse of the progress it has made integrating and testing shopping features within Instagram. With online shopping surging as consumers are forced to stay at home, Ripps believes the update could be a positive one. Management’s outlook for the second quarter and full year 2020 as well as an update on CCPA implementation should also provide more clarity on FB’s standing within the market.

Taking all of this into consideration, Ripps kept her Buy rating and $230 price target as is. Should this target be met, a twelve-month gain of 23% could be in the cards. (To watch Ripps’ track record, click here)

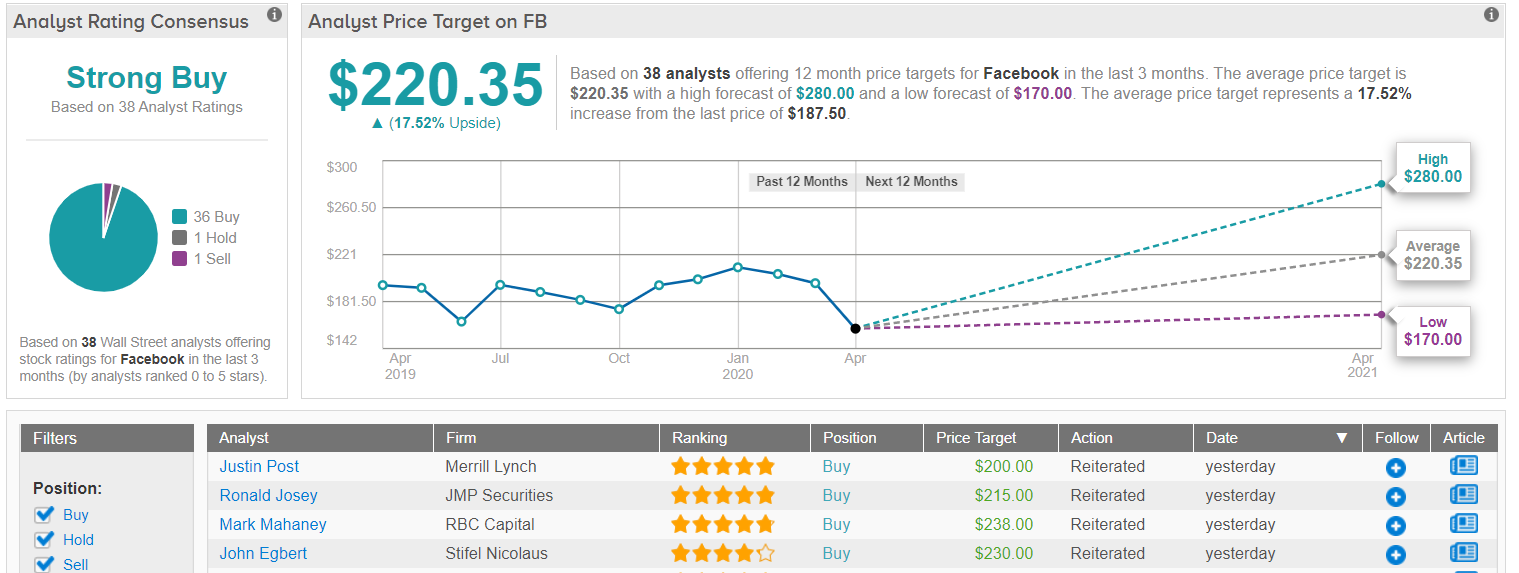

In general, other analysts are on the same page. With 36 Buy ratings, 1 Hold and 1 Sell assigned in the last three months, the word on the Street is that FB is a Strong Buy. The $220.35 average price target brings the upside potential to 17.5%. (See Facebook stock analysis on TipRanks)

Amazon (AMZN)

Moving right along to one of the “A’s” in FAANG, we come to eCommerce and web services behemoth Amazon. The company is set to report its first quarter 2020 results after the closing bell on April 30, and with it already up 30% year-to-date, investors are cautiously optimistic.

As a result of the COVID-19 pandemic, there has been a surge in the demand for essential products like groceries, healthcare products and other household items, which bodes well for the company’s eCommerce segment. Ripps points out the company has made a significant investment to ensure it’s able to meet this demand.

“The company has taken several steps to ensure its customers are receiving these much-needed deliveries as quickly as possible, including the hiring of more than 100,000 new full- and part-time associates and delayed fulfillment of non-essential products, and has implemented a number of changes to its operations to ensure the safety of all employees, particularly those in warehouse and fulfillment roles,” Ripps explained. She added, “Over the long-term, we anticipate that the COVID-19 pandemic will accelerate existing eCommerce trends, benefitting platforms such as Amazon.”

This should translate to hefty revenue gains, in the Canaccord Genuity analyst’s opinion. Ripps estimates that the total revenue growth rate will come in at 22% year-over-year, which is at the high end of management’s guidance. As for AWS, the news is also expected to be good. “For AWS, we see revenue growing 36% year-over-year (vs. 34% in Q4) as demand for cloud computing also spiked in Q1 due to COVID-19, leading to pricing power that should drive AWS operating margin back to 27% (vs. ~26% in full year 2019),” the analyst commented.

That being said, fulfillment costs are expected to increase thanks to mounting expenses as the company tries to keep pace with the demand. Like FB, its digital advertising business could also take a hit due to the effects of the pandemic. However, with respect to the former, Ripps thinks the expansion of AWS margin will offset growing fulfillment costs, with the analyst calling for a sequential consolidated operating margin expansion of 120 basis points.

To this end, Ripps stayed with the bulls, reiterating a Buy recommendation and $2,600 price target. This target implies shares could surge 9.5% in the next year.

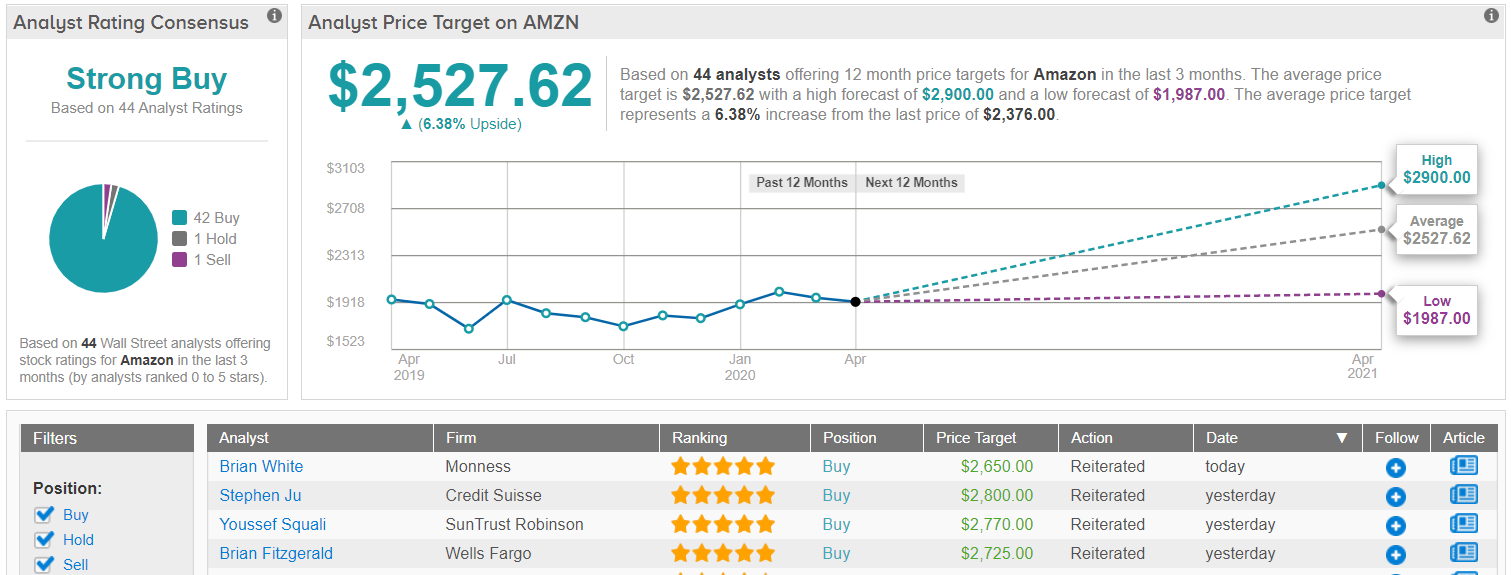

Looking at the consensus breakdown, out of 43 total reviews published recently, 42 were bullish. As a result, AMZN earns a Strong Buy consensus rating. At $2,527.62, the average price target suggests 6% upside potential. (See Amazon stock analysis on TipRanks)

Alphabet (GOOGL)

Last but certainly not least we have Alphabet, Google’s parent company. It’s scheduled to release its first quarter numbers on April 28, and like other digital platforms, Wall Street observers have their eyes on advertising revenues.

Amid the ongoing public health crisis, businesses globally have been forced to shut down, consumer spending on non-essentials has declined and movements and travel have largely been restricted, hitting the advertising space hard.

“The global digital advertising landscape has been negatively impacted by the economic weakness caused by the coronavirus, and we anticipate Google’s advertising revenue growth will decelerate in Q1 and will decline year-over-year in Q2. In particular, we see the company’s exposure to the travel vertical and SMBs driving a significant portion of the decline as businesses in these key segments pull back on advertising budgets,” Ripps noted. As a result, the analyst is calling for 11% year-over-year advertising growth, reflecting a deceleration from 16.7% in Q4.

However, there are several positives when it comes to GOOGL’s growth story. “Somewhat offsetting these advertising trends, we also see COVID-19 likely driving heightened demand for cloud computing as some online businesses see a surge in demand from increased time spent at home while others are forced to migrate systems and employees to remote operations,” Ripps argued. In addition, heightened levels of engagement are expected, especially on YouTube, thanks to lockdowns and social distancing measures.

It should also be noted that management could provide an update on how it will integrate Fitbit into its health and fitness offerings, along with how Waymo is holding up during the pandemic.

Based on all of the above, Ripps maintained a Buy rating. Setting a $1,550 price target, shares could climb 22% higher in the next year.

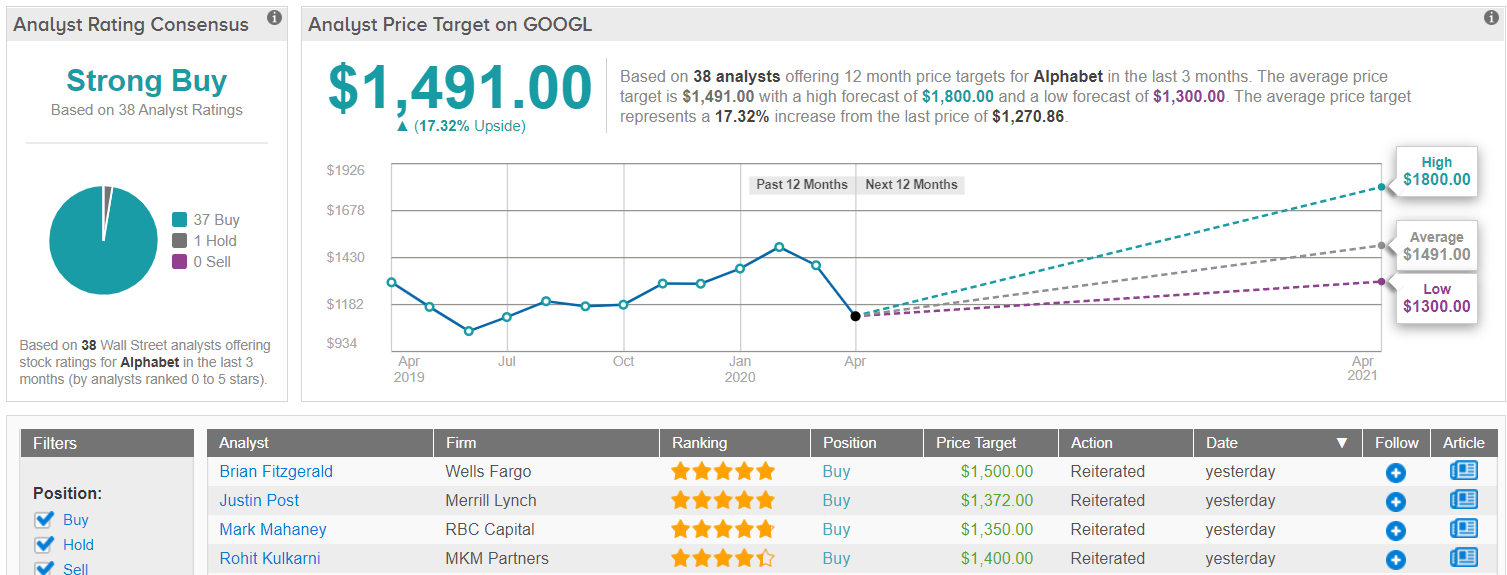

Turning now to the rest of the Street, other analysts take a similar approach. 37 Buys and a single Hold assigned in the last three months add up to a Strong Buy analyst consensus. Not to mention the $1,491 average price target implies 17% upside potential. (See Alphabet stock analysis on TipRanks)

To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.