It’s a new week, and market watchers are bracing themselves for whatever comes their way. Ahead of the opening bell on Monday U.S. stock futures are up, some welcome news after stocks rounded out the week in the red. The uptick comes as Italy, Spain and New York report death rates are slowing, giving investors a sliver of hope that some headway is being made in the battle against COVID-19.

For those feeling a sense of déjà vu, you’re not alone. Oanda’s senior market analyst for Asia Pacific, Jeffrey Halley, thinks the most recent bump might only be temporary, stating that the disappointing March jobs report from last week implies COVID-19 is wreaking “almost unimaginable havoc on the world’s economy.”

Having said that, while the broader market seesaws between the red and the green, Wall Street pros believe a few tickers are positioned for substantial gains, pointing specifically to healthcare companies taking on the deadly virus.

Using TipRanks’ database, we pinpointed three healthcare stocks fighting COVID-19 that are primed for significant growth. In addition, it revealed what the analyst community has to say about each of the Buy-rated names. Here’s the lowdown.

Kiniksa Pharmaceuticals Ltd. (KNSA)

Through its innovative technology designed to modulate immunological signaling pathways, Kiniksa wants to improve the lives of patients battling diseases with significant unmet medical need. In stark contrast to the broader market, 2020 has been good to this name, with it up 62% year-to-date. Given the company’s update on its COVID-19 treatment, the analysts believe there’s more good news to come.

KNSA recently reported that its anti-GM-CSFRα antibody, mavrilimumab, had been used to treat six severe COVID-19 pneumonia and hyperinflammation patients in a study conducted by Professor Lorenzo Dagna at the San Raffaele University in Italy. To say that the results were promising is an understatement. All of the patients saw their fevers resolved and an improvement in oxygenation within 1-3 days. On top of this, none of the patients needed mechanical ventilation and half were able to be discharged within 5 days.

Weighing in for Wedbush, analyst David Nierengarten points out that COVID-19 causes similar symptoms to other toxicities addressed by mavrilimumab. Cell therapies are sometimes impacted by serious adverse events like cytokine release syndrome (CRS) and neurologic toxicity that can prolong hospital stays, increase treatment costs and even lead to death, but KNSA’s antibody has been shown to reduce the occurrence of these events. This is encouraging as evidence suggests COVID-19 patients have higher levels of pro-inflammatory cytokines that can cause CRS.

Commenting on mavrilimumab, Nierengarten said, “We are intrigued by these early developments and look forward to a possible Phase 2/3 clinical study in the future…While we do not currently value mavrilimumab in COVID-19, we do see these results as a broad validation of the anti-GM-CSFRα antibody’s power in reducing severe inflammation.”

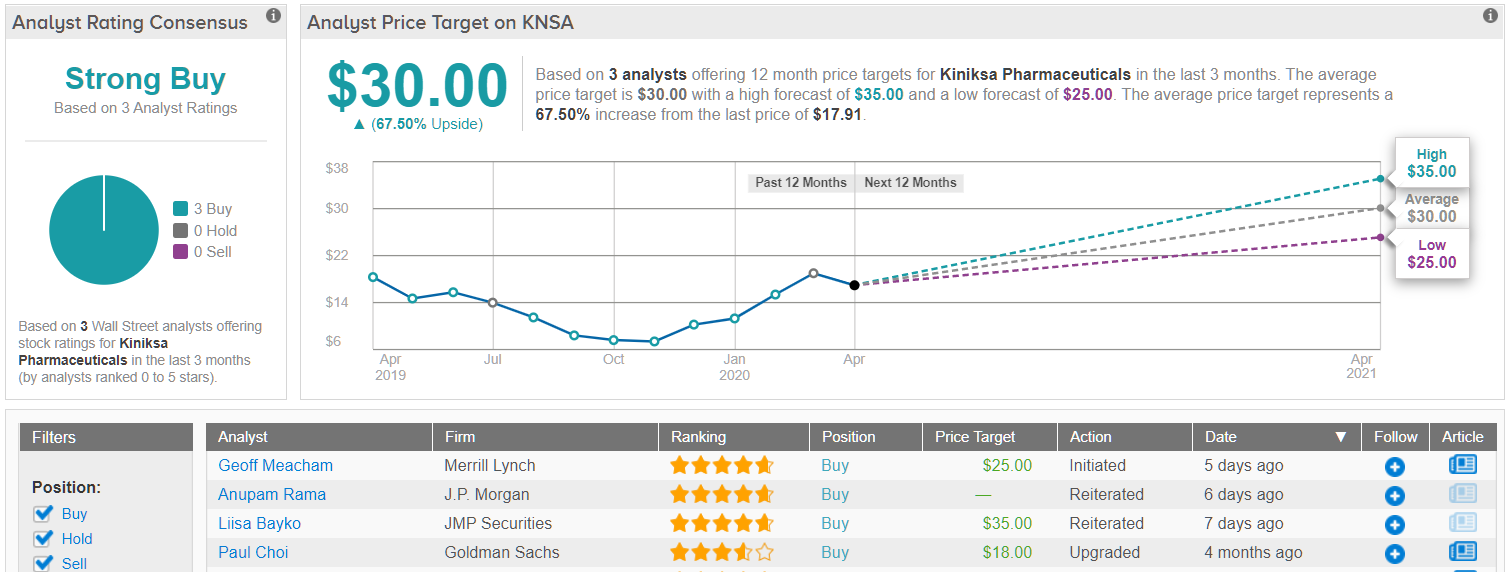

It should come as no surprise, then, that Nierengarten maintained an Outperform rating as well as a $30 price target. Should this target be met, a twelve-month gain of 68% could be in the cards. (To watch Nierengarten’s track record, click here)

All in all, other analysts are on the same page. With 100% Street support, or 3 Buy recommendations to be exact, the message is clear: KNSA is a Strong Buy. At $30, the average price target matches Nierengarten’s forecast. (See Kiniksa stock analysis on TipRanks)

CytoDyn, Inc. (CYDY)

CytoDyn is primarily focused on developing Leronlimab (PRO 140), its once a week CCR5 antagonist-based injection to target the CCR5 receptor, which is seen in many diseases like HIV, GVHD, NASH, stroke recovery, multiple sclerosis, Parkinson’s disease and metastatic cancer. Partly due to the candidate’s possible use in treating COVID-19, shares have soared 179% year-to-date.

The company has recently announced that eight out of ten patients with severe cases of COVID-19 demonstrated a significant improvement in immunologic biomarkers, especially cytokines (including the key inflammation driver IL-6), and some normalization of the CD4/CD8 ratio. The result implies that the therapy was able to restore immune function and mitigate the cytokine storm, which are associated with patient improvement.

Explaining the implications, H.C. Wainwright analyst Yi Chen noted, This conclusion was reaffirmed after noted, “In our view, if leronlimab can consistently demonstrate in the Phase 2b/3 trial that it can help severely ill patients recover from pulmonary inflammation that drives mortality and the need for ventilators and prevent acute respiratory distress syndrome (ARDS), the FDA may grant accelerated approval for this potentially lifesaving drug due to the escalating cases and deaths due to COVID-19 in the U.S., particularly in New York State. In the wake of this update, we have added potential sales of leronlimab as COVID-19 therapy to our valuation, with a 35% probability of approval.”

If that wasn’t promising enough, CYDY plans to enroll patients in both the mild-to-moderately ill and severely ill protocols quickly under the same IND that was provided with a “safe to proceed” letter from the FDA.

Given everything CYDY has going for it, it makes sense that Chen decided to stay with the bulls. Along with a Buy rating, the five-star analyst bumped up the price target from $1.50 to $3. This suggests that shares could move 8% higher in the next year. (To watch Chen’s track record, click here)

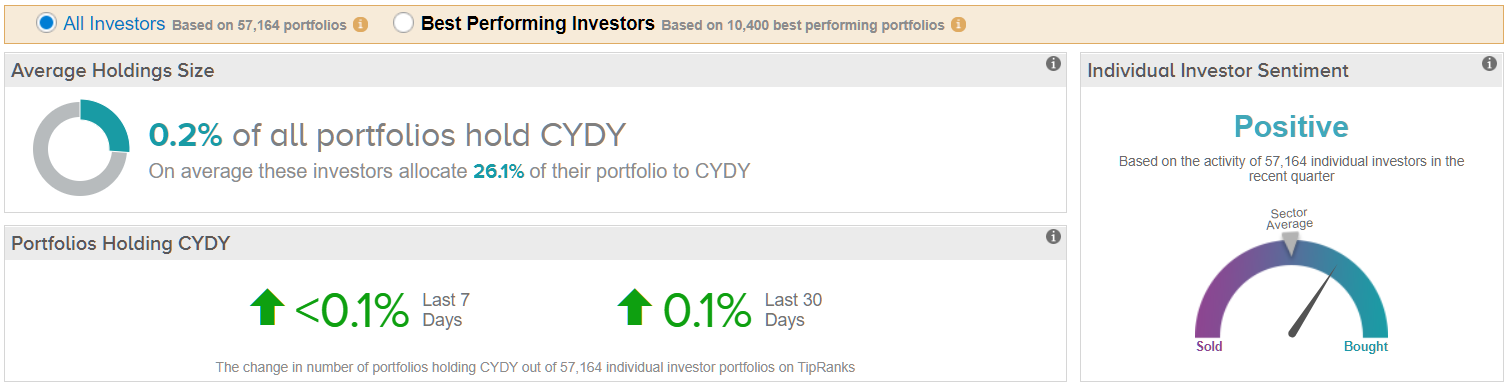

Looking at the consensus breakdown, it has been quiet when it comes to other analyst activity. Chen’s rating is the only recent review, and thus the consensus rating is a Moderate Buy. Unsurprisingly, investor sentiment is positive, with individual portfolios in the TipRanks database showing a net increase in CYDY. (See CytoDyn stock analysis on TipRanks)

BioNTech SE (BNTX)

The last healthcare name on our list wants to provide cancer patients with the ability to individualize treatment based on the specific genetic features of their tumors. Recently, BioNTech has garnered positive attention thanks to its efforts to develop a COVID-19 vaccine, as demonstrated by its 56% year-to-date rise.

Writing for Canaccord, analyst Arlinda Lee has been impressed by BNTX’s collaboration with Pfizer and Fosun in China to develop a vaccine candidate against COVID-19. Kicking off its research program in January, the company designed its mRNA vaccine, BNT162, to induce immunity and prevention of the virus. This candidate is the first to be born out of Project Lightspeed, an accelerated development program featuring BNTX’s mRNA infectious disease platform and GMP manufacturing infrastructure, which can potentially prevent and treat COVID-19.

This prompted Lee to comment, “In our view, the speed to instigate the COVID program and bring a candidate to clinic underscores BNTX’s scientific expertise and the rapidity and efficiency of its platform.”

That being said, Lee believes BNTX’s growth story goes behind this program. Its most advanced candidate, BNT111, is a vaccine designed with antigens commonly expressed in melanomas. With complete Phase 1 data slated for release in the second quarter and a pivotal trial set to start in 2020, this candidate could drive significant upside.

BNTX is also working with Genentech to develop a personalized cancer vaccine RO198457 (BNT122), with ongoing trials in melanoma and solid tumors. Data readouts from these trials could serve as key catalysts for the company as well.

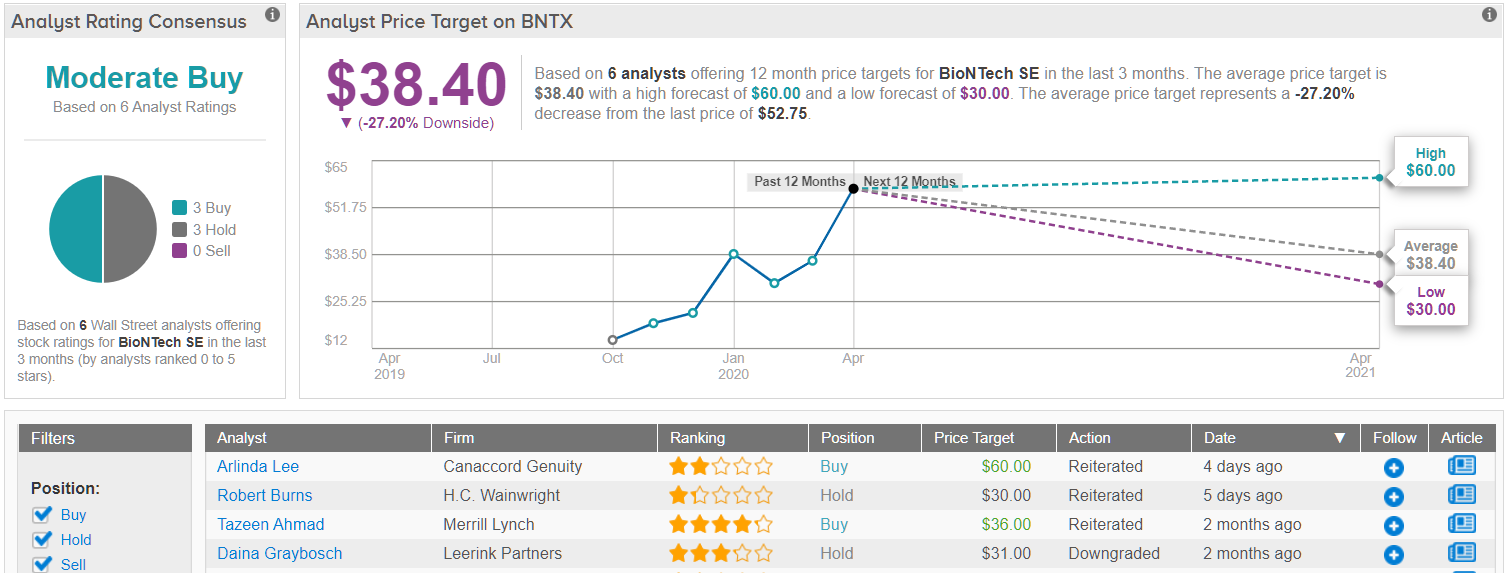

Bearing this in mind, Lee left a bullish call on the stock as well as gave the price target a boost, increasing the figure from $22 to $60. At this new target, the upside potential amounts to 14%. (To watch Lee’s track record, click here)

Turning now to the rest of the Street, opinions are split evenly down the middle. 3 Buys and 3 Holds assigned in the last three months add up to a Moderate Buy analyst consensus. The $38.40 average price target implies downside potential of 27%, but this could change should other analysts update their models to account for the recent share price appreciation. (See BioNTech stock analysis on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.