On Wall Street, some things never change. Public health crisis or not, the fact of the matter remains that healthcare stocks are the epitome of risk/reward plays. Why? It comes down to the nature of the industry itself.

Healthcare companies are unique in that their financial performances aren’t necessarily the most important piece of the puzzle. Rather, a few key factors like clinical data readouts or regulatory approvals indicate whether or not a particular name will be able to generate sustainable revenues in the long run. As such, any development, good or bad, can act as a catalyst that launches shares in either direct.

So, which strategy can help investors find the healthcare stocks poised to blast off on an upward trajectory? One approach is to follow the pros on Wall Street.

We used TipRanks’ database to lock in on three healthcare stocks that have been given the Street’s blessing, and come with an affordable price tag. Each ticker trades for less than $5 per share and has earned a “Strong Buy” consensus rating from the analyst community. The icing on the cake? Serious upside potential is on the table.

Galmed Pharmaceuticals (GLMD)

Focused on the development of its product candidate, Aramchol, Galmed Pharmaceuticals wants to provide patients with a more effective therapy for the treatment of Non-alcoholic Steatohepatitis (NASH). Given its recent addition to its product lineup and its $4.50 share price, the healthcare name is scoring major points with the Street.

Back in May, GLMD unveiled Aramchol meglumine, which is an Aramchol salt version that is more soluble than the free acid version, with it also showing improved PK characteristics. The therapy is eligible for New Chemical Entity (NCE) designation and additional patent protection.

Weighing in on the impact of this revamp, five-star analyst Yasmeen Rahimi calls the candidate GLMD’s “new star,” arguing it “can raise the bar for Aramchol’s efficacy in NASH and potentially add a layer of patent protection.” The analyst points out that the company has already placed a significant focus on protecting its intellectual property, with patents maintained in 37 territories in the EU, as well as other countries including Canada, Australia, China and Japan. In addition, patent discussions are taking place in the U.S.

Speaking to the improved PK characteristics, Rahimi highlights that when compared to the Aramchol free acid version, Aramchol meglumine produced nearly identical AUCs following a single dose, but a higher AUC after multiple doses, and Meglumine had an identical half-life at both the single and multiple doses.

“Importantly, Aramchol meglumine demonstrated three-fold lower variation in concentration during multiple dosing, which hints at a potential for more steady concentrations in patients treated with meglumine and Aramchol meglumine’s Cmax was higher during multiple dosing or steady state administration,” the analyst added.

As for how COVID-19 affects this trial, Rahimi told clients “GLMD is taking a diligent approach to maintaining execution of Phase 3 ARMOR.” These efforts include temporarily halting the screening of new patients into ARMOR to minimize potential COVID-19 exposure, taking this time to advance the opening of new sites in preparation for when screening and randomization is possible and reducing its costs.

To this end, Rahimi rates GLMD a Buy, along with a $33 price target. This figure conveys her confidence in GLMD’s ability to soar 622% in the next twelve months. (To watch Rahimi’s track record, click here)

Turning now to the rest of the Street, other analysts also like what they’re seeing. 6 Buys and a single Hold add up to a Strong Buy consensus rating. Given the $19.86 average price target, the upside potential comes in at 334%. (See GLMD stock analysis on TipRanks)

ImmunoGen (IMGN)

Utilizing antibody-drug conjugates, or ADCs, ImmunoGen hopes its therapies will be able to disrupt the progression of cancer. Ahead of key data readouts, several members of the Street believe that at $4.22, its share price reflects an attractive entry point.

Pointing to the FORWARD II study, five-star analyst John Newman, of Canaccord, tells clients that its mirvetuximab asset, which was evaluated in combination with Avastin, generated encouraging results. In addition to exhibiting strong efficacy and safety, a 64% Overall Response Rate (ORR) among Folate Receptor alpha high platinum agnostic patients was witnessed.

Newman also noted, “Importantly, mirvetuximab + Avastin demonstrated a 59% ORR for FRa high patients that were platinum resistant, comparing well to ~27-28% for bevacizumab + chemotherapy in a similar population. In addition, ORR was similar between platinum-resistant and platinum-sensitive patients (59% vs 69%), suggesting encouraging efficacy for mirvetuximab in both populations.”

As for what these results mean, Newman argues that they suggest mirvetuximab will eventually be approved and used in all lines of ovarian cancer, underscoring the importance of its safety in combination with other drugs.

Going forward, enrollment for the Phase 3 MIRASOL trial and Phase 2 SORAYA trial is underway, with top-line data for SORAYA still slated for release in mid-2021. This will be followed up by MIRASOL’s top-line data readout in the first half of 2022.

“Importantly, mirvetuximab is known to be a highly active agent in ovarian cancer, which should support robust enrollment. Also, we remind investors that the FORWARD I trial enrolled ahead of schedule in 9 months. We recognize that the COVID-19 pandemic may have some effect on clinical trial enrollment, but we believe the effects can be mitigated,” Newman commented.

The analyst is expecting positive data from both trials, with the Phase 2 data potentially supporting accelerated approval and the Phase 3 results supporting full approval. “Importantly, we see multi-leg long-term growth potential for mirvetuximab in ovarian cancer based on expansion into earlier lines of therapy, and eventual combination with platinum therapy in the front-line setting,” he stated.

Everything that IMGN has going for it prompted Newman to leave a Buy rating and $12 price target on the stock. Should the target be met, a twelve-month gain of 183% could be in store. (To watch Newman’s track record, click here)

Do other analysts agree with Newman? They do. Only Buy ratings, 3, in fact, have been issued in the last three months. At $10.50, the average price target puts the upside potential at 147%. (See ImmunoGen stock analysis on TipRanks)

Matinas BioPharma (MTNB)

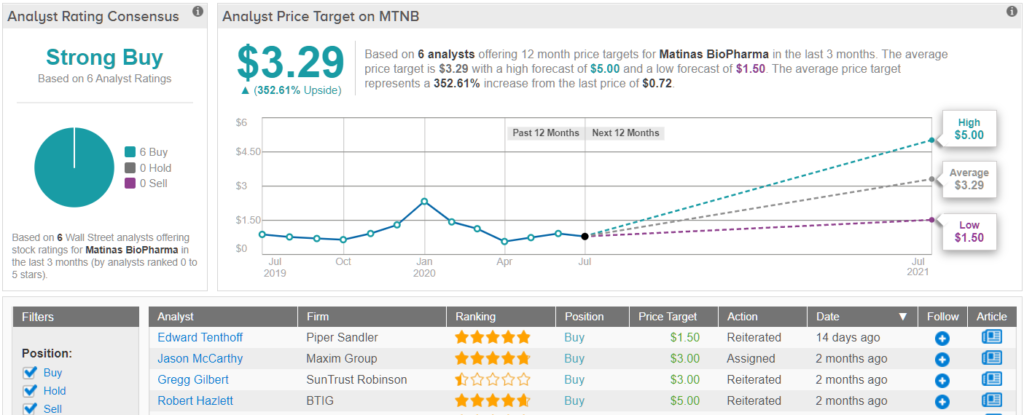

The last healthcare stock on our list, Matinas BioPharma, brings cutting-edge technology to the table, with the goal of developing therapies capable of overcoming the limitations associated with existing options. Even though COVID-19 impacted its clinical activity, multiple analysts believe that its $0.72 share price presents investors with a unique buying opportunity.

As a result of the pandemic, the trials for MTNB’s two leading programs, MAT9001 and MAT2203, were delayed. That said, management recently stated it plans to restart the enrollment of ENHANCE-IT for MAT9001 and EnACT for MAT2203. Writing for BTIG, five-star analyst Robert Hazlett noted, “These two programs, especially MAT9001, are core value drivers for Matinas, and trial progress is welcome news.”

Looking more closely at the trials, ENHANCE-IT is a head-to-head open-label, 28-day crossover trial featuring patients with elevated triglycerides designed to assess the pharmacodynamic (PD) effects of MAT9001 compared to Amarin’s Vascepa. Hazlett points out that the company has added two additional clinical sites to the program to compensate for the delay.

Speaking to the strength of its MAT9001 asset, Hazlett believes the fact that its composition includes DPA, a more potent TG lowering Omega-3, sets it apart from the competition. In addition, the therapy doesn’t increase LDL, with it able to achieve substantially higher blood levels of EPA than Vascepa. “MAT9001’s positioning as a more potent, yet differentiated EPA-based omega 3 has become even more important under the lens of recent Vascepa patent trial challenge… We believe ENHANCE-IT can further differentiate MAT9001, and project material potential for this program, with estimate peak revenue of greater than $1.5 billion,” Hazlett said.

As for EnACT, it is an open-label, sequential cohort study evaluating MAT2203, its liposomal nanocrystal (LNC) technology candidate which allows for oral delivery of the potent anti-fungal amphotericin B. It was designed for the treatment of HIV patients with cryptococcal meningitis. “Cryptococcal meningitis represents a beachhead for broader antifungal consideration of MAT2203 over time,” Hazlett commented. It should be noted that the CF Foundation has supported the therapy’s preclinical development, and MTNB has submitted a proposal to receive funding for MAT2501 through Phase 2.

To this end, Hazlett rates MTNB a Buy along with a $5 price target. Shares could appreciate by 586%, should the analyst’s thesis play out in the coming months. (To watch Hazlett’s track record, click here)

Looking at the consensus breakdown, the rest of the Street agrees with Hazlett’s assessment. With 6 Buys and no Holds or Sells, the word on the Street is that MTNB is a Strong Buy. The $3.29 average price target implies shares could skyrocket 362% in the next year. (See MTNB stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.