The biggest news in the cannabis sector for January is the starting of recreational cannabis sales in Illinois. Sales started on New Year’s Day and several companies are already reporting closing stores due to a lack of enough inventory.

Outside of eventual U.S. federal approval, the cannabis companies can benefit greatly from the legalization of cannabis sales at the state levels whether for medical or recreational purposes. Illinois and Michigan recently added recreational use to existing medical cannabis approvals while Florida remains the biggest state with the potential to add recreational sales to a thriving medical cannabis business.

Over the initial days of January, Illinois sold over $11 million worth of legal weed from 55 dispensaries. Illinois has the potential of reaching $4 billion in annual sales and building on an existing minimal $250 million medical cannabis market.

Analysts have forecasted U.S. cannabis sales topping $16 billion in 2020 while the total global sales may not even reach $20 billion following the weak recreational sales in Canada and the slow rollout of Cannabis 2.0 products. The Illinois market has the potential of matching the current international market of only a few billion dollars highlighting the massive opportunity for U.S. multi-state operators (MSOs).

MSOs already in the Illinois market have first mover advantage in this market of 13 million residents and 117 million tourists annually. In addition, the companies with the most cultivation capacity have the potential to thrive while others lack inventory.

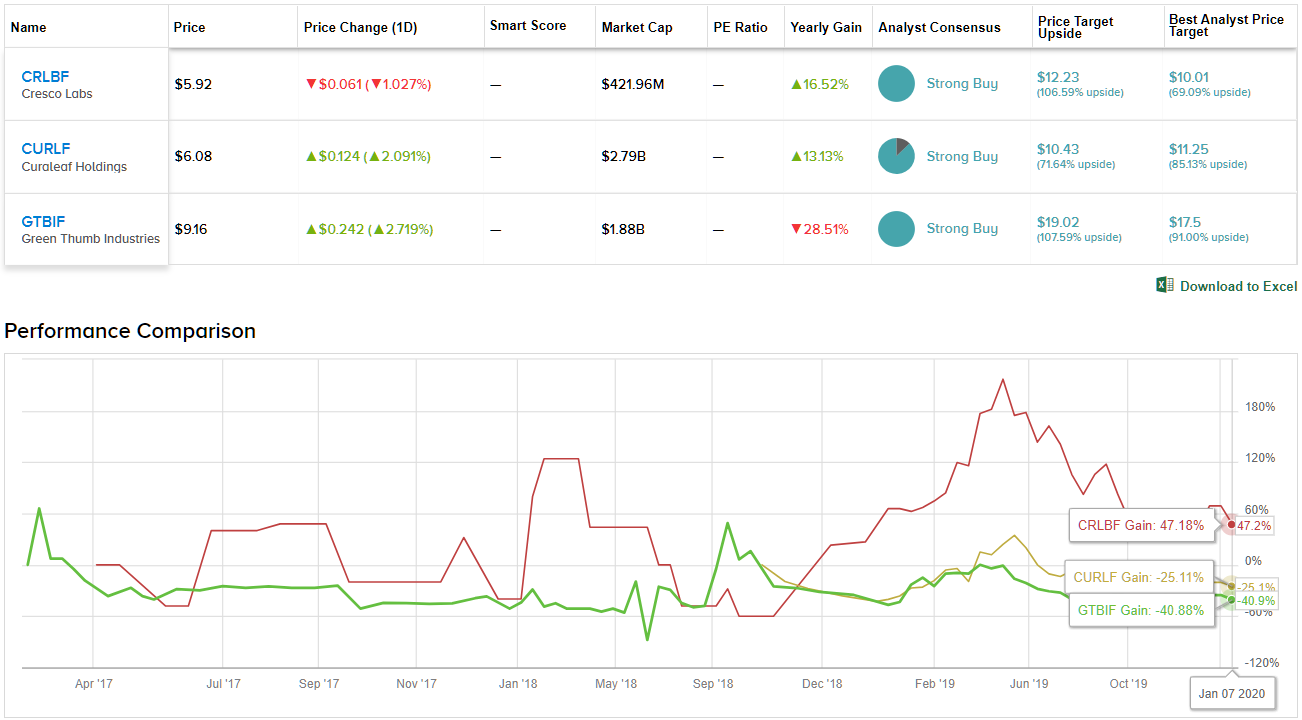

We’ve delved into these three U.S. cannabis MSOs with a strong market position in Illinois that will benefit from the opening up of the adult-use market. According to TipRanks’ Stock Comparison tool, all three currently have a Strong Buy consensus rating and over 70% upside potential.

Cresco Labs (CRLBF)

Cresco Labs is the proclaimed leader in the Illinois market with 25% market shares. The company has another key opportunity to further grow market share due to three cultivation licenses in comparison to the two licenses listed by other players.

The company has the ability to expand to 630,000 square feet of product capacity to become the largest cultivator in the crucial state home to Chicago. Cresco Labs has the ability to supply the other retail dispensaries unlike most competitors.

Cresco Labs served 3,145 people on New Year’s Day at five retail dispensaries for an average customer count 629 per store. In total, the company sold 9,258 products with an average ticket price of an incredible $135.

The company is in the process of opening five more stores. In total, Cresco Labs obtains over 65% of current revenues from wholesale sales so the company isn’t as focused on pure store openings as most other companies in the industry.

Despite the huge benefit of the large Illinois market opening up to recreational cannabis, the stock trades near the yearly lows at about $6.

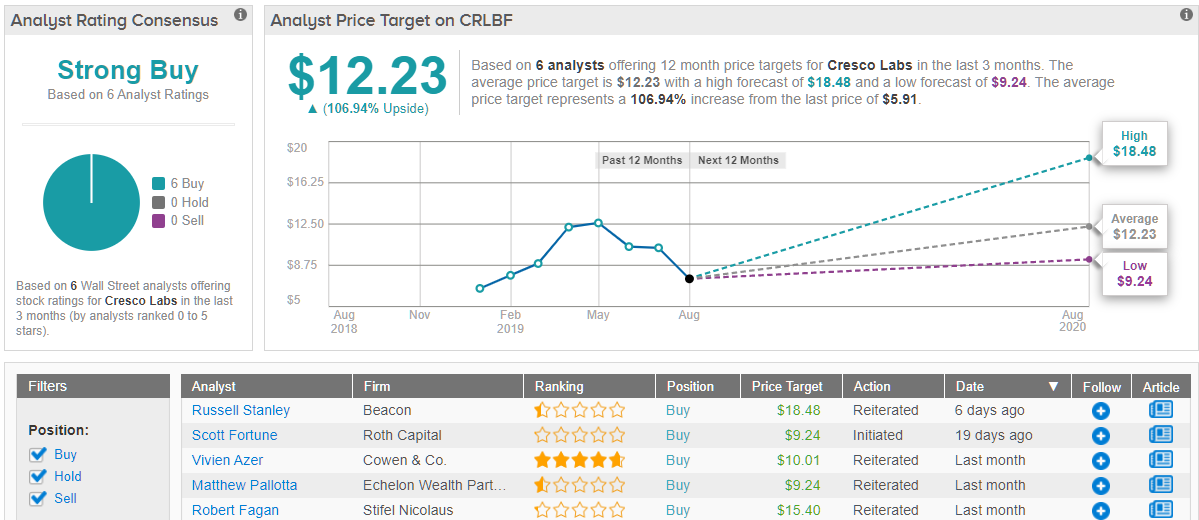

The cannabis producer looks like a very compelling investing opportunity, as TipRanks analytics showcasing the stock as a Strong Buy. With an average price target of $12.23, analysts are predicting massive upside potential of over 100%. In total, Cresco stock has received 6 “buy” ratings with no “holds” or “sells” in the last three months. (See Cresco’s price targets and analyst ratings on TipRanks)

Curaleaf (CURLF)

Curaleaf sits as the burgeoning giant in the cannabis sector and Illinois plays a huge role in their growth path. The planned acquisition of Grassroots offers the company prime operations in Illinois to add to an already large revenue base.

The company reported Q3 pro-forma revenues of $129 million. Analysts have revenues surging to $199 million in Q2, $236 million in Q3 and $290 million next Q4. The growth is based highly on the acquisitions of Select and Grassroots combined with the addition of substantial revenues from recreational cannabis in Illinois.

The Grassroots deal is expected to close during Q1 shortly after the state opened up for recreational cannabis use. A prime driver of 2020 revenue estimates in a range of $1.0 billion and $1.2 billion and analyst goals for $1.5 billion in revenues by 2021 is the growth opportunity in Illinois.

With the closing of the Acres Cannabis deal in Nevada, Curaleaf has 52 existing dispensaries and access to over 130 locations. Grassroots has four stores open in the state that were serving the medical cannabis market and the company is allowed to open four more stores including two in the key city of Chicago. A total of 8 stores in the big Illinois market is a huge positive for the stock.

The U.S. MSO stock continues to bounce around $6 as the benefits of the Illinois market are too reliant on the closing of the Grassroots deal providing the stores in Illinois. The Acres deal closing helps provide some confidence in closing the Select and Grassroots deals, but the market is very hesitant on sector stocks until these mergers are closed and integration begins.

Curaleaf has a fully diluted market value of $2.8 billion based on 464 million shares outstanding. The deals push the diluted share count to 668 million shares including the 41 million contingent shares for Select. The stock has the potential for a total market value approaching $4.0 billion or only 2.5x 2021 sales estimates.

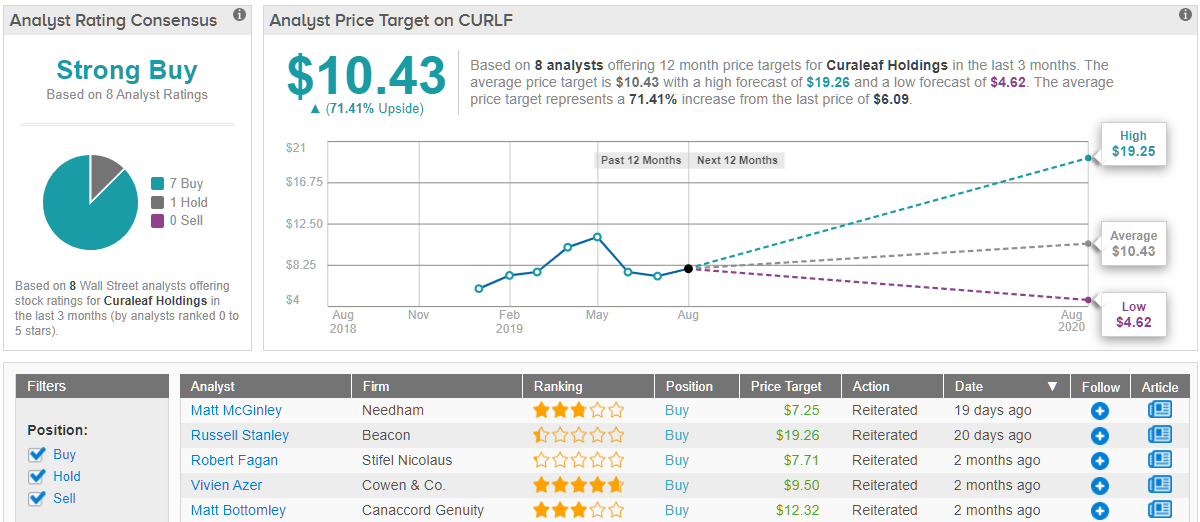

Wall Street is on the same page. This ‘Strong Buy’ received 7 “buy” ratings vs only one “hold” over the last three months. Not to mention its $10.43 average price target suggests 71% upside potential from current levels. (Discover how the overall stock-price forecast for Curaleaf breaks down here)

Green Thumb Industries (GTBIF)

Similar to Cresco Labs, Green Thumb Industries promoted a successful start to the recreational business in Illinois. The company opened the sixth store in the state just in time for adult-use cannabis sales.

The MSO located in Illinois has a listed market value of $1.9 billion and expects to open another store in Quincy within days. In total, GTI will have 10 stores in the state selling cannabis and served thousands of customers on the New Year’s Day without addressing specifics.

With the opening of the adult-use store in Joliet, the company now has 40 stores open. GTI has licenses to reach 96 dispensaries in the next couple of years.

As mentioned, the stock has a market value of $1.9 billion with revenues estimates set to double to over $475 million in 2020 and reaching $728 million in 2021. The stock trades at a similar multiple of ~2.6x 2021 sales estimates without the same risk of closing pending deals in order to access this key Illinois market.

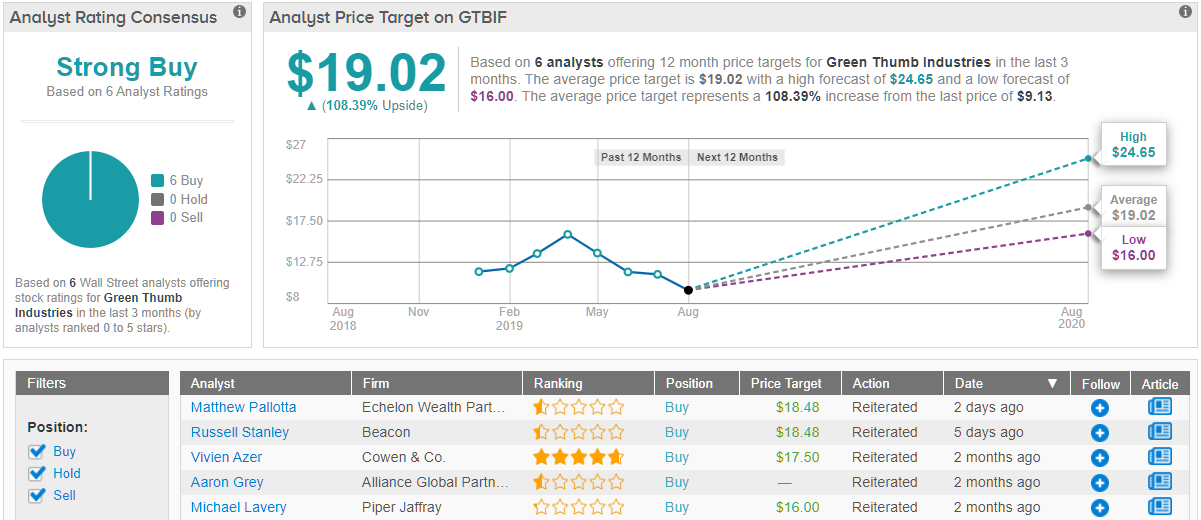

Looking at the consensus breakdown, Wall Street takes a bullish stance on GTI. 6 “buys” issued over the previous three months make the stock a ‘Strong Buy.’ It should also be noted that its $19 average price target suggests 108% upside from the current share price. (See GTI price targets and analyst ratings on TipRanks)