How do you beat the market? You take some risks along the way. Naturally, with added risk, as well as greater returns, you open yourself up to potential losses.

As we move into 2020, and following a bountiful 2019, it can be hard to tell what the right investment is. Should you pick a stock that has great fundamentals, but for one reason or another has lagged behind the market? Or a beaten-down stock no one has picked up on? That’s one strategy that includes an amount of risk, for sure.

Or maybe a stock that has outperformed the market but still hasn’t attained the status it deserves? With this in mind, and with the new decade in sight, we decided to look at three stocks that beat the market in 2019, but ones whom, according to the Street, are set to add more muscle in 2020.

Coincidentally, according to TipRanks, a company that tracks and measures the performance of analysts, all three currently have a Strong Buy consensus rating. Let’s get started.

Mimecast Ltd. (MIME)

Up by 31% year-to-date and, therefore, just beating the S&P 500’s 29% yearly gain, is cyber security firm, Mimecast. The London, UK, based company offers email and data protection through its cloud-based subscription service.

The cybersecurity sector is a crowded one, with many companies competing for a chunk of the expanding market. The recent earnings season was an uneven one for several cybersecurity players, but Mimecast posted impressive results and outperformed the high end of its guidance. Among the highlights were revenue of $103.4 million, an increase of 29% year-over-year in constant currency, and a beat of the estimate’s $101.7 million. Mimecast’s success in moving up market was demonstrated by the addition of large accounts, with 30 transactions over six figures. With the addition of 800 subscriptions, Mimecast now serves 36,100 customers across 138 countries globally.

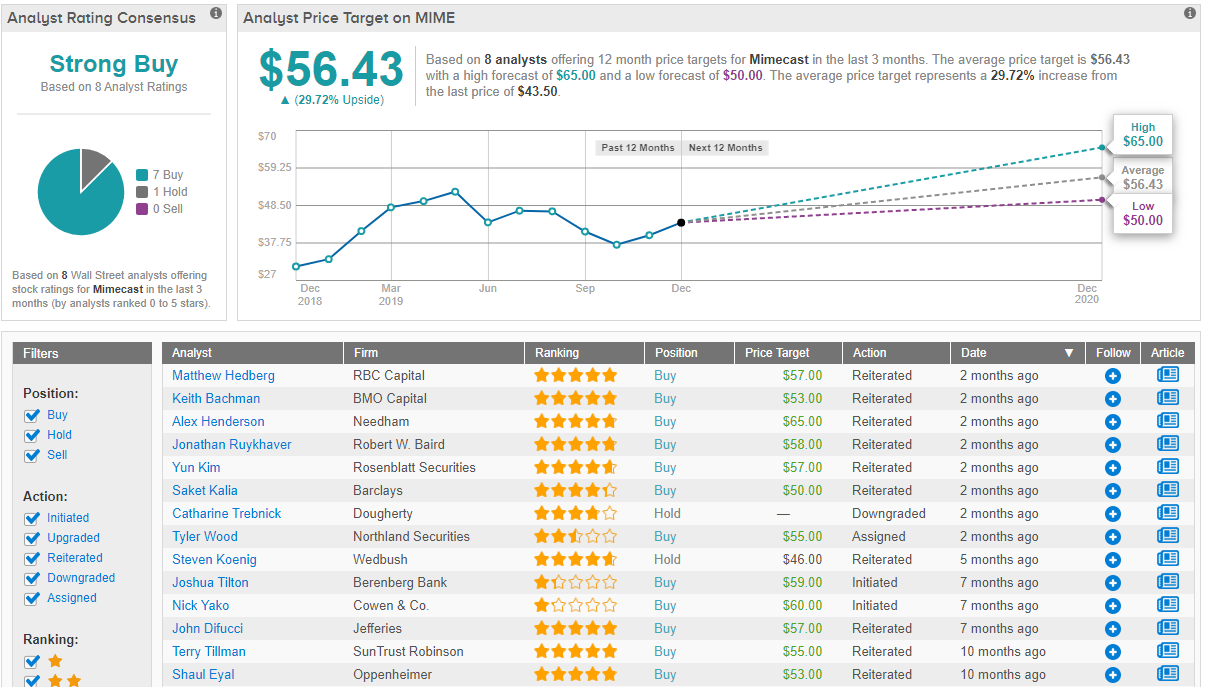

RBC’s Matthew Hedberg is a fan of the company’s “diverse portfolio of mission critical assets,” and believes its “global footprint should allow for continued success.” The 5-star analyst noted, “Mimecast participates in one of our favorite security markets of email protection, email archiving, and email continuity, and we believe a combination of a below-peer valuation and the potential to grow both revenue and margins above our estimates makes Mimecast an attractive investment.”

To this end, Hedberg reiterated an Outperform rating on Mimecast, while also raising his price target from $55 to $57. The target price indicates potential upside of 30%. (To watch Hedberg’s track record, click here)

Mimecast has other fans on the Street, too. 7 Buys and 1 Hold rating given over the last three months provides the email security specialist with a Strong Buy consensus rating. The average price target of $56.43 is just below Hedberg’s and implies gains of 29.7% in the coming year. (See Mimecast stock analysis on TipRanks)

Penumbra Inc (PEN)

Just a little further up the 2019 gains ladder, is medical device maker Penumbra. Specializing in innovative neuro and peripheral vascular therapies, PEN is seeing out the year with a 33% increase to its share price.

A technology leader in mechanical thrombectomy, the company’s two lead products, the Penumbra System (neurovascular) and the Indigo System (peripheral vascular), both remove blood clots, and are in a large and unpenetrated market, estimated to be worth roughly $3.1 billion.

Penumbra has a massive market to address in the treatment of ischemic strokes, too, believed by the company to be worth $7 billion worldwide, and $0.8 billion in the US alone. In July, PEN released its most advanced technology to date – the Penumbra JET 7 Reperfusion Catheter, which is to be used with the Penumbra ENGINE, a system that allows physicians to extract thrombus in acute ischemic stroke patients.

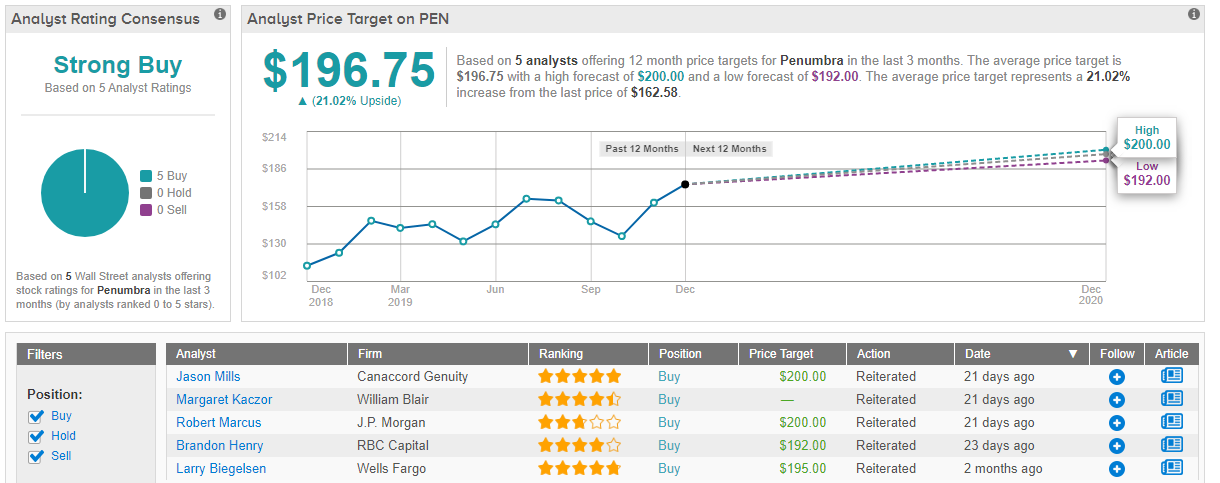

RBC’s Brandon Henry believes PEN’s systems are “superior to the competition.” The analyst noted, “Our model assumes that PEN will grow its revenues in the high teens over the next three years. We assume that it will have low salesforce turnover and continue to innovate its existing product lines, particularly JET-ENGINE and the Indigo System. Additionally, we assume that PEN’s Peripheral Vascular segments will grow more quickly than the market, as the company continues to take share despite competition.”

Therefore, Henry kept an Outperform rating on Pen, along with a target price of $192, implying potential upside of 18%. (To watch Henry’s track record, click here)

It looks like the analysts are unanimous in their current appraisal of Penumbra. The technology leader has a Strong Buy consensus rating, with a breakdown consisting solely of Buys – 5 in fact. The average price target comes in slightly higher than Henry’s, at $196.75, and indicates gains of 21%. (See Penumbra stock analysis on TipRanks)

Quanta Services (PWR)

Saving the best performer for last, we have Quanta Services. 2019 has delivered nice returns of 36% for the infrastructure services provider. With a workforce totaling 40,000, Quanta plans, installs, and maintains almost all types of network infrastructure.

A report by the McKinsey Global Institute projects that over the next 15 years, $3.7 trillion per year will be spent on infrastructure projects, in various sectors such as telecom, water, power, and transport, directly benefitting companies of Quanta’s ilk. Quanta is also set to benefit from current macro trends; With more pipelines being constructed due to rising natural gas production and more wind and solar assets popping up that need new transmission lines, the company’s army of contractors is well-positioned to take its share of the sector’s workload.

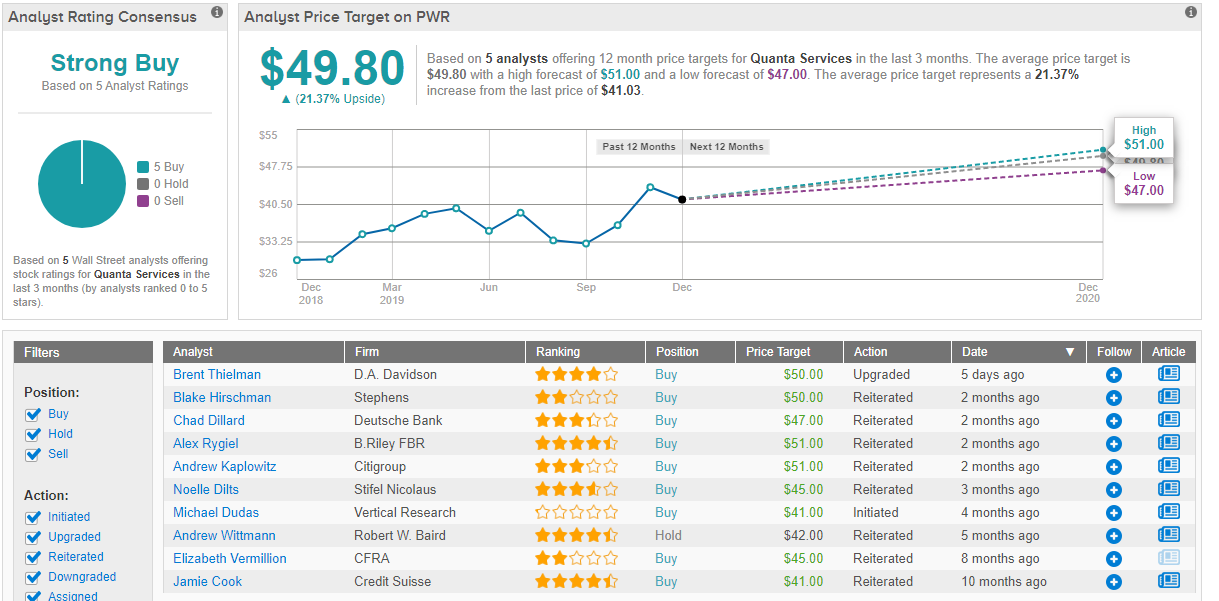

Quanta’s latest earnings report displayed record quarterly revenues, operating income, adjusted EBITDA, and adjusted EPS, causing management to raise its 2019 guidance. The figures and higher expectations were not lost on Deutsche Bank’s Chad Dillard, who said, “We remain constructive on the stock, given a continued focus on de-risking its business and a majority of its end markets seeing acceleration (base business, large projects, telecoms).”

Accordingly, Dillard reiterated a Buy rating on PWR, while also raising his price target from $45 to $47. Should the target be met, investors stand to take home an extra 15% by the end of 2020. (To watch Dillard’s track record, click here)

It appears the Street is confident in the power of PWR, too. All 5 analysts tracked by TipRanks over the last three months rate Quanta as a Buy, therefore bestowing Strong Buy status on the construction contractor. At $49.80, the average price target implies upside potential of 21%. (See Quanta stock-price forecast and analyst ratings on TipRanks)

To find good ideas for stocks trading at fair value or better, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.