When it comes down to it, investors are focused on a single factor: a stock’s ability to deliver returns. As Wall Street observers gauge the strength of a particular investment opportunity, often, they will filter out the noise and instead, concentrate their attention on its long-term growth prospects. We are referring to whether or not a name can achieve sustainable growth over the long haul, handsomely rewarding investors in the years to come.

So, with this goal in mind, what’s the first step for investors ready to get down to business? It’s narrowing down the multitude of tickers traded in the public market to a select few that represent the pick of the bunch. To make it into this exclusive group, these names should not only have strong long-term growth narratives, but also the analyst community’s support.

Setting out on our own search, we used TipRanks’ Stock Screener tool to pinpoint 3 stocks that have earned “Strong Buy” consensus ratings from the analysts and boast substantial upside potential from current levels.

Let’s get started.

Selecta Biosciences (SELB)

Selecta Biosciences believes that its ImmTOR immune tolerance platform can help patients fight rare diseases. Currently, biologic drugs can trigger neutralizing antibodies (NAbs) that work against the therapy, but ImmTOR technology allows for immune tolerance of the therapy. With this biotech already having gained 107% over the last twelve months, investors want to know if there’s more fuel left in the tank.

According to Mizuho Securities analyst Difei Yang, the answer is yes. She highlights the COMPARE trial as being the driving force behind her bullish thesis. The Phase 2 clinical trial is evaluating its lead candidate, SEL-212, in patients with chronic refractory gout, specifically looking at its efficacy in resolving symptoms like flares and gouty arthritis. Based on earlier clinical data, a combined therapy of ImmTOR and pegadricase, the current uricase therapy approved by the FDA, was able to reduce the occurrence of gout flares. As a result, the data allowed SEL-212 to proceed to a head-to-head COMPARE trial, the enrollment of which was completed back in December.

Yang argues that the “encouraging” interim data increases the therapy’s likelihood of FDA approval. When looking at the big picture, she is optimistic about the platform as it may lead to a re-dosing of gene therapy. Additionally, she points out that the company was able to cut its financing overhang.

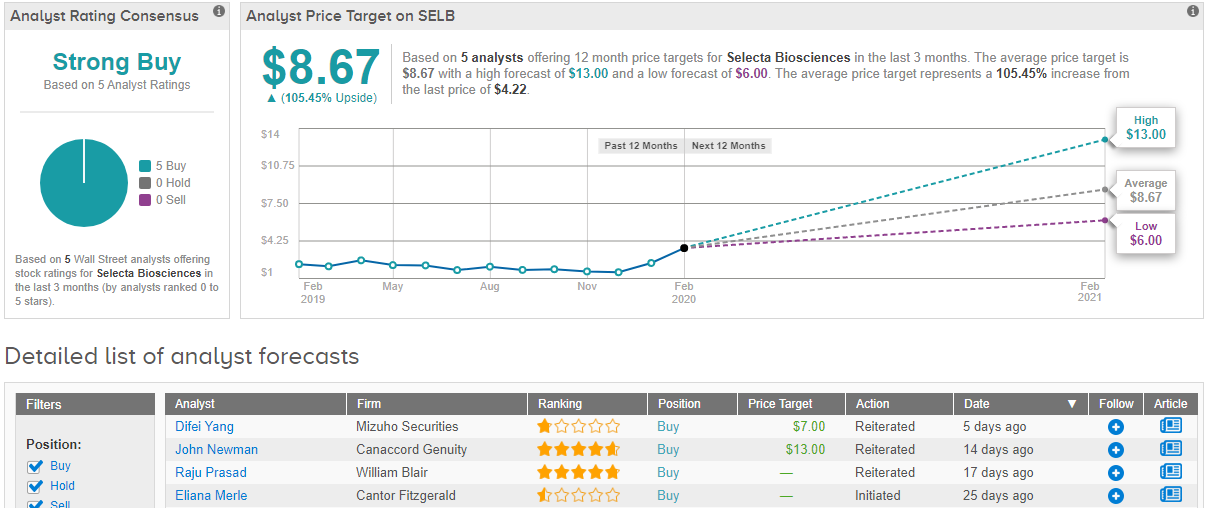

Given Yang’s high hopes for SELB, it makes sense that she stayed with the bulls. Not only did she maintain a Buy rating, but she also bumped up the price target from $4 to $7. This new target conveys her confidence in the biotech’s ability to climb 66% higher over the next year. (To watch Yang’s track record, click here)

What does the rest of the Street have to say? As it turns out, when it comes to SELB, other analysts are also on board. With 5 Buy ratings assigned in the last three months compared to no Holds or Sells, the word on the Street is that the stock is a Strong Buy. Not to mention the $8.67 average price target puts the potential twelve-month gain at 105%. (See Selecta stock analysis on TipRanks)

Ocular Therapeutix (OCUL)

This biopharma uses a hydrogel platform to develop innovative treatments for various eye diseases. While its DEXTENZA insert has received FDA approval for the treatment of inflammation and pain following ophthalmic surgery, analysts point to its development pipeline as being capable of driving further growth on top of its already posted 57% one-year rise.

On February 7, the company released data from the Phase 1 clinical trial for its OTX-TIC candidate at the Glaucoma 360 conference in San Francisco. The trial is studying the long acting travoprost intracameral implant’s ability to reduce intraocular pressure (IOP) in patients with primary open angle glaucoma or ocular hypertension.

The data readout was a major positive for the company, as the candidate was not only able to lower IOP levels very fast, but it also sustained these reduced levels for significant periods of time, 18 months in one case. Adding to the good news, OTX-TIC was found to be well tolerated and safe, with no serious adverse events reported. It should also be noted that OCUL has kicked off the third and fourth cohort enrollment for the Phase 1 trial, and it will continue to monitor the first two cohorts long-term.

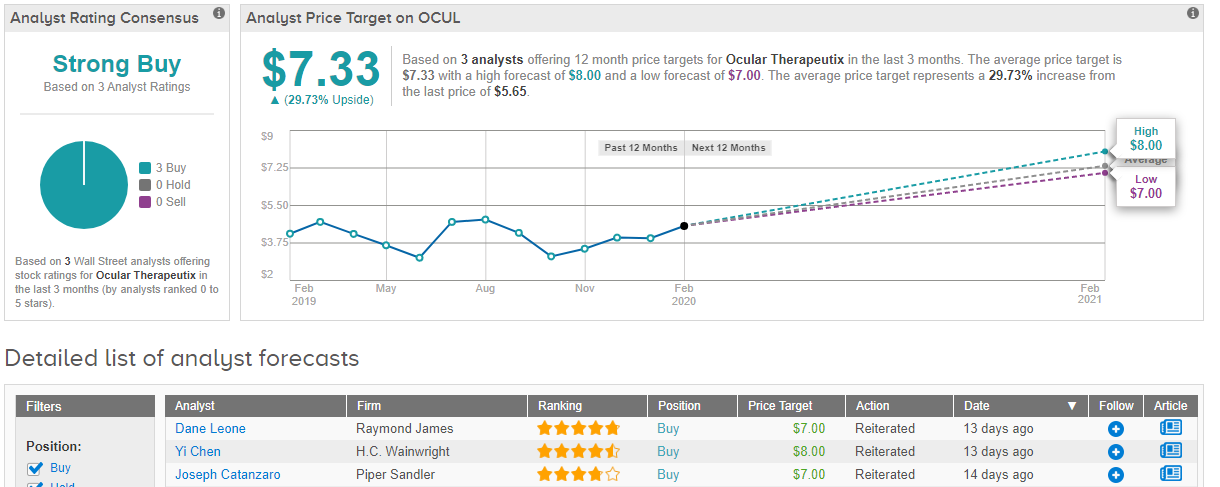

This trial outcome has certainly impressed Wall Street analysts, namely Yi Chen of H.C. Wainwright. Thanks to the positive data announced so far, the five-star analyst argues that the candidate is more likely to receive approval from the FDA, increasing the pobability from 20% to 30%. To this end, Chen boosted the price target by $2 in addition to reiterating his Buy recommendation. At $8, the new target implies that shares could surge 42% over the next year. (To watch Chen’s track record, click here)

Like the H.C. Wainwright analyst, Piper Sandler’s Joseph Catanzaro believes that the data was promising enough to warrant a price target increase. Along with his Overweight rating, the four-star analyst lifted the price target from $5.50 to $7. (To watch Catanzaro’s track record, click here)

When looking at other analyst activity, it has been relatively quiet as only one other analyst has published a recent review. That being said, the call was also bullish, making the consensus rating a Strong Buy. Given the $7.33 average price target, a 30% twelve-month gain could be in the cards. (See Ocular Therapeutix stock analysis on TipRanks)

Lithia Motors (LAD)

Switching gears now, we move on to Lithia Motors, one of the largest car retailers in the U.S. While the name has taken some heat recently, several analysts still see more growth in store for the company, which has already posted a 46% twelve-month gain.

In 2019, Lithia became the broadest coast-to-coast car retail network after it expanded its reach to include 92% of the U.S. Currently, the company’s physical network is comprised of 189 stores located across the U.S., with 21 brands of vehicles being represented in California alone.

That being said, the auto retailer isn’t finished growing just yet. Last week, Lithia announced that it had acquired two Lexus stores in Sacramento and Roseville, California. According to statements from President and CEO Bryan DeBoer, these two locations could see revenue reach $160 million.

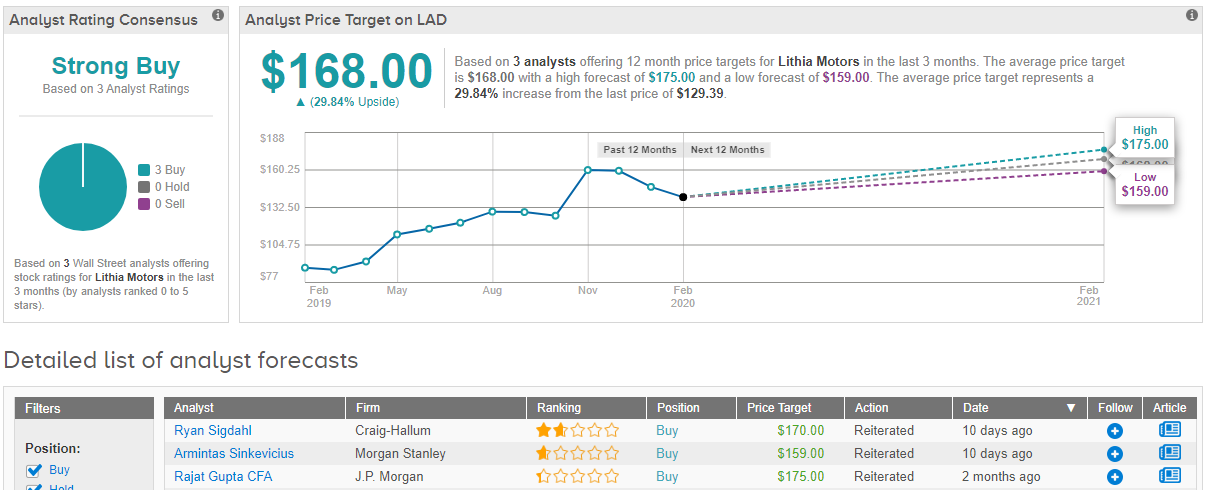

Craig-Hallum analyst Ryan Sigdahl doesn’t dispute the fact that the temporary pressure on margins caused him to assume a lower premium to comps. He does remind investors, though, that overall, the company’s most recent quarter was solid. During the quarter, Lithia Motors was able to generate “strong” 7% year-over-year same-store sales growth in a slowing SAAR environment as a result of strength in its used vehicle business. Additionally, the analyst argues that the reason its profits took a hit was its integration of recent acquisitions and its efforts to position itself for a “banner year of growth”.

In line with his optimistic approach, Sigdahl tells investors that the recent weakness presents an attractive entry-point. Along with his Buy rating, though, the analyst did reduce the price target from $200 to $170. However, the target still leaves room for a possible twelve-month gain of 31%. (To watch Sigdahl’s track record, click here)

Looking at the consensus breakdown, it appears that other Wall Street pros are on the same page. As 100% of the analysts that have issued a recent recommendation see the stock as a Buy, the message is clear: LAD is a Strong Buy. On top of this, the $168 average price target suggests 30% upside potential. (See Lithia Motors stock analysis on TipRanks)