The market is on the move, and this time stocks took off on an upward trajectory. On Wednesday April 29, all three of the major U.S. stock indexes posted gains at the closing bell, climbing higher on encouraging data from the government trial for Gilead Sciences’ COVID-19 treatment, remdesivir. The antiviral therapy met its primary endpoint, and while there’s still a long way to go until it could be available for use, it’s exciting progress. Stocks were also helped by the Federal Reserve’s statement that it will keep rates close to zero for as long as it takes and provide the economy with additional help.

However, it should be noted that this surge came as investors brushed off weak U.S. gross domestic product, with the figure’s first quarter decline bigger than expected and marking the largest contraction of economic activity since the financial crisis.

So, is it still possible to find stocks going up, up and away? Wall Street pros say yes. They argue that in spite of COVID-19’s impact on the broader market, several healthcare names are undervalued as they have held up strong and are set to deliver even more returns in the long run.

Heeding this advice, we used TipRanks’ database to zero in on three healthcare stocks that are poised to rip higher and handsomely reward investors over the long-term. Not only have all of the tickers amassed enough bullish calls from analysts to be given “Strong Buy” consensus ratings, but each could also see substantial share price appreciation in the next year. Here’s the lowdown.

Fate Therapeutics (FATE)

Fate Therapeutics is at the forefront of the cellular immunotherapy space, with it taking healthy donor cells, which are then modified ex vivo using pharmacologic modulators, to improve the cells’ biological properties and therapeutic function. Despite already rising 48% year-to-date, several analysts believe its growth story is only just beginning.

Part of the excitement surrounding this name is related to its collaboration with Janssen to develop iPSC NK and T-cell therapies against four tumor-associated antigens. As per the terms of the agreement, FATE will be paid $50 million in cash up front and receive a $50 million equity investment. In addition, FATE is eligible for as much as $1.8 billion in developmental and regulatory milestones and $1.2 billion in commercial milestones, with $898 million applying to the first candidate.

Only when the company gets reimbursed for preclinical development going as far as the IND filing will Janssen get an exclusive option to assume development and commercialization. It should also be noted that FATE will have an option for U.S. co-commercialization or mid-teen royalties when proof-of-concept data is available for each candidate.

Weighing in for Piper Sandler, five-star analyst Edward Tenthoff also sees potential stemming from its FT596 asset. “Encouragingly, the first patient was dosed with FT596 in a Phase I study of B-cell malignancies and chronic lymphocytic leukemia… We could see first-ever data at ASH in December pending enrollment impact with respect to COVID-19,” he wrote.

To top it all off, Tenthoff thinks there are additional potential catalysts that could be capable of catapulting shares. FATE is focusing FT500 on non-small-cell lung carcinoma (NSCLC) with stable disease in 4/8 monotherapy and 2/3 CPI combo patients initially and data for its FT516 candidate in AML and B-cell lymphoma could be released in December.

While management stated that COVID-19 could affect clinical trial enrollment, Tenthoff points out that FATE remains on-course to file INDs for FT538 and FT819. To this end, he stayed with the bulls, reiterating an Overweight rating. He also bumped up the price target from $57 to $63, implying 117% upside potential. (To watch Tenthoff’s track record, click here)

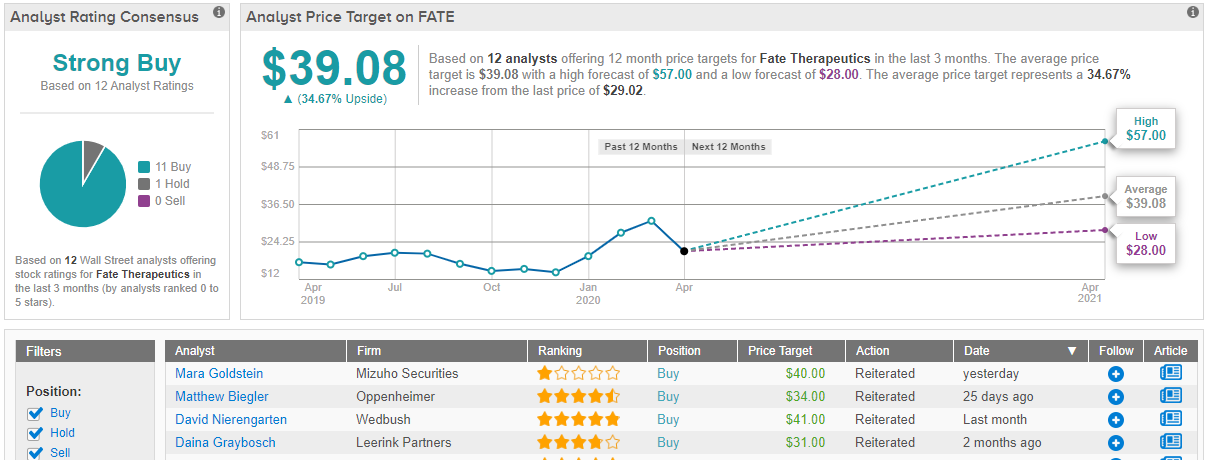

Meanwhile, the rest of the Street also likes what it’s seeing. 11 Buys and a single Hold add up to a Strong Buy consensus rating. At $39.08, the average price target puts the upside potential at 35%. (See Fate Therapeutics stock analysis on TipRanks)

Cytokinetics Inc. (CYTK)

Using its differentiated muscle biology platform, Cytokinetics develops therapies for cardiac and skeletal muscle diseases. Since the start of 2020, shares have climbed 53% higher, and market watchers want to know if there’s more fuel left in the tank.

Cantor Fitzgerald’s Charles Duncan says yes. The five-star analyst tells investors that ahead of the Phase 3 GALACTIC-HF readout for its Omecamtiv mecarbil (ome’) drug in heart failure, he sees a significant opportunity, with the “binary and potentially transformational milestone” potentially coming earlier than he expected in Q4 2020.

Expounding on this, Duncan stated, “Additionally, we believe that the probability of success (PoS) for GALACTIC-HF, which is being conducted by partner Amgen, is underappreciated and that current powering assumptions provide a degree of ‘immunity’ against potential confounding results with CV-driven death/hospitalizations due to COVID-19… To us, robust powering suggests that a risk-mitigating buffer is in place if the pandemic drives missing data or adjudicated events that reduce the number of patients used in per-protocol primary or secondary efficacy analysis. In addition, we note that the FDA recently issued guidance on clinical trial conduct, including amended data management and/or statistical analysis plans, protocol-specified clinical visits and method of drug/pbo distribution, which can further mitigate COVID-19 risk.”

Speaking to the trial’s design, Duncan is also optimistic when comparing it to two other heart failure studies, the VICTORIA-HF trial for vericiguat and PARADIGM-HF trial for ENTRESTO. “We believe that the GALACTIC-HF study has enrolled an at-risk population that falls between the two other studies, which will facilitate a clear signal-to-noise readout and clinical interpretation, in our view. We believe that this factor, in combination with the nuanced patient inclusion/exclusion criteria, including NT-proBNP cutoff specifically for pts with atrial fibrillation/flutter and systolic blood pressure cutoffs among others, increases the PoS for this study, which we believe should enhance PoS for a positive readout,” he commented.

Both the study’s design and overall patient population prompted Duncan to increase the PoS, and thus the price target also gets a boost. In addition to his Overweight call, he lifted the target from $12 to $23, suggesting 41% upside potential. (To watch Duncan’s track record, click here)

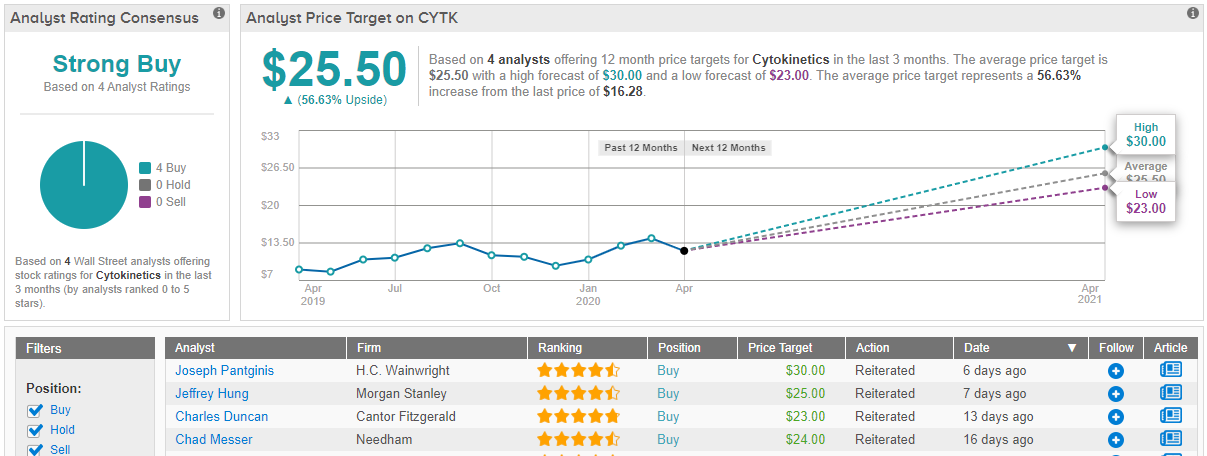

Looking at the consensus breakdown, the stock has earned 100% Street support, or 4 Buy ratings to be exact. Therefore, the message is clear: CYTK is a Strong Buy. Based on the $25.50 average price target, shares could rise 57% in the next year. (See Cytokinetics stock analysis on TipRanks)

Iovance Biotherapeutics (IOVA)

Fighting the good fight against cancer, Iovance is developing transformative immuno-oncology tumor-infiltrating lymphocytes (TIL) therapies that harness a patient’s own immune system. Up 21% year-to-date, several members of the Street think that IOVA’s future is only going to get brighter.

Writing for H.C. Wainwright, five-star analyst Joseph Pantginis points to the Moffitt study results as renewing his confidence. On April 28, Moffitt Cancer Center, IOVA’s partner, provided an updated glimpse at the Phase 1 trial evaluating TILs plus nivolumab in CKI-naïve metastatic NSCLC patients. Delivering strong results, efficacy was seen in 25% of patients, with the therapy demonstrating two complete responses (CRs). Additionally, ongoing clinical responses were witnessed in half of patients and one active response is pending.

The outcome gets even better. “Although TIL clonotype persistence declines with time in the blood of these patients, persistent and stable levels of infused T cells associated with higher tumor killing and response. Thus, we believe that methods to enrich for these TIL populations, such as Iovance’s next generation TILs could be critical to drive better clinical responses,” Pantginis said. It should also be noted that TILs were capable of spurring an immune response against several cancer clones, which could produce better clinical outcomes.

Even though some investors expected data from a larger number of patients with a longer follow-up date, Pantginis argues that the results should be viewed as encouraging. He added, “We remind investors that metastatic NSCLC is not an easy indication: (1) most patients rapidly progress; and (2) low activity of CKI. Thus, achieving a DCR of 50% is still meaningful, in our belief. More importantly, the study is ongoing with 8 clinical responses underway.”

It should come as no surprise, then, that Pantginis left a Buy recommendation on the stock. Along with his bullish call, he attached a new $48 price target, up from $36. Should this target be met, a twelve-month gain of 44% could be in store. (To watch Pantginis’ track record, click here)

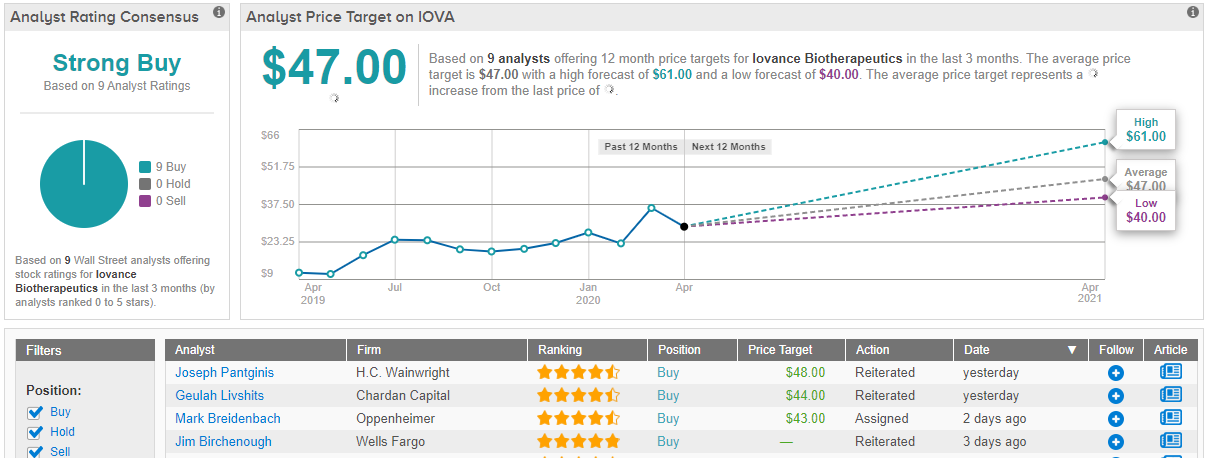

Turning now to the rest of the Street, other analysts have also been impressed with IOVA. Only Buy ratings have been assigned, 9 in the last three months. As a result, the healthcare name gets a unanimous Strong Buy consensus rating. With a $47 average price target, the upside potential comes in just below Pantginis’ forecast at 41%. (See Iovance stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.