One thing is clear: investors are constantly searching for serious growth names. These aren’t any old stocks with blink-and-you’ll-miss-it growth narratives. We’re talking about stocks in it for the long-haul, poised to climb higher and deliver returns in the years to come.

For investors that have settled on this strategy, what’s the best way to find these tickers with growth prospects that go above and beyond? Our suggestion: make use of TipRanks. The platform’s Stock Screener tool simplified our research process by allowing us to filter our search results by analyst consensus and upside potential from the current share price. To this end, we were able to pinpoint 3 stocks primed for substantial long-term gains.

With this in mind, let’s get started.

Equinix, Inc. (EQIX)

Equinix is best-known for being the world’s largest data center and colocation provider, with its products enabling speedy application performance and low latency. On the heels of its third quarter earnings, several members of the Street are backing EQIX, which is already up 56% year-to-date.

To kick off the release, the company reported that gross bookings were the highest ever for a third quarter and the second-highest overall. Not to mention EQIX is ahead of its competitors as it boasts 356,000 customer cross-connections, which includes 20,000 virtual connections. If that wasn’t enough, EQIX’s hybrid cloud growth is accelerating due to its recent shift to cloud trends. This resulted in the enterprise segment making up 60% of bookings.

Oppenheimer’s Timothy Horan also points out that while there had been some concern regarding the recently announced Digital Realty (DLR) and InterXion (INXN) merger, it makes EQIX “well-positioned as the only pure-play interconnectivity focused data center”. He notes that as its competitors undergo a complicated integration, there will be a window to take market share.

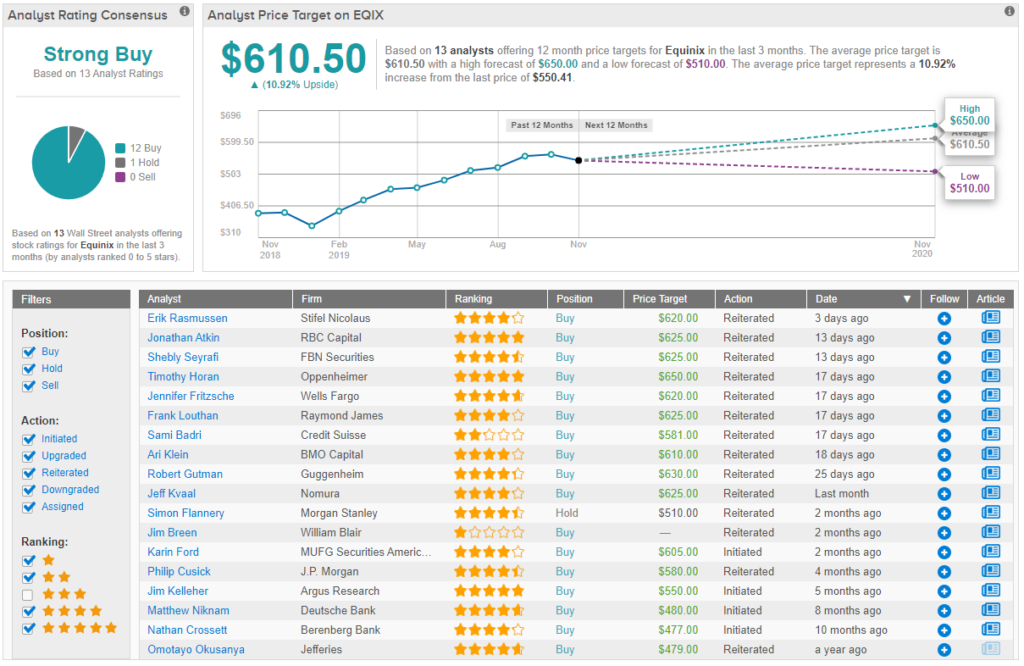

All of this prompted the five-star analyst to not only keep a Buy rating but also to bump up the price target to $650. At this new target, shares could rise 18% over the next twelve months. (To watch Horan’s track record, click here)

Similarly, other Wall Street analysts take a bullish approach when it comes to EQIX. 12 Buys and 1 Hold assigned in the last three months give it a ‘Strong Buy’ consensus. Its $611 average price target indicates 11% upside potential. (See Equinix stock analysis on TipRanks)

ServiceNow, Inc. (NOW)

Originally an IT service automation tool, ServiceNow has become one of the top providers of cloud-based solutions that tracks service issues within businesses as they come up. With shares moving 46% higher year-to-date, Wall Street has its eyes on NOW.

Despite facing foreign exchange (FX) headwinds, the company posted a beat in terms of EPS, subscription billings as well as subscription revenue, which is up 33% year-over-year. Its guidance for fiscal Q4 2019 was also generally better than analysts expected.

Most notably, management addressed the misinformation circling around the Street. Incoming CEO Bill McDermott tells investors that the current situation is much brighter than some may think, citing its “pristine” platform and “amazing” organic growth story. Its CFO search is in fact coming to a conclusion, with a decision expected soon. There also hasn’t been a change to employee attribution rates as 97 out of the top 100 sales staff are staying put.

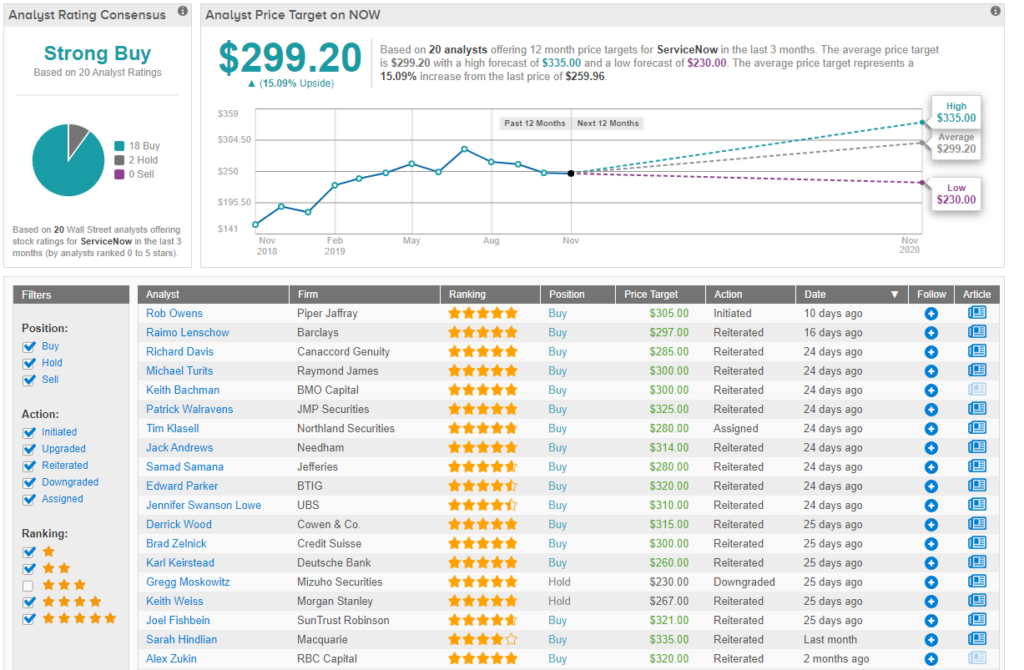

This helped reaffirm Macquarie analyst Sarah Hindlian’s conclusion that NOW is still a Buy. “We are highly confident in ServiceNow’s global strategic positioning and believe an opportunity for entry exists,” she commented. As a result, the four-star analyst attached an increased price target of $336 to her bullish call. This updated target conveys her confidence in NOW’s ability to jump 29% in the next twelve months. (To watch Hindlian’s track record, click here)

Like Hindlian, the rest of the Street is impressed. NOW is a ‘Strong Buy’ based on the 18 Buy ratings and 2 Holds issued in the last three months. In addition, its $229 average price target brings the upside potential to 15%. (See ServiceNow stock analysis on TipRanks)

The Estée Lauder Companies Inc. (EL)

The global makeup and beauty name has taken some heat recently thanks to a fiscal 2020 outlook reset. That being said, one analyst believes that EL’s growth narrative remains strong, with further gains on top of its already achieved 47% year-to-date growth expected.

Part of the concern is related to EL’s 100 basis point reduction in its guidance for global beauty market growth as a whole. This has been blamed on U.S. makeup weakness, as well as some deceleration in China and the travel retail space.

However, Evercore ISI analyst Robert Ottenstein argues that EL has a lot more going for it than the Street realizes. “China actually accelerated (as did the broader Asia-Pacific corridor) supporting the view argued in our initiation, that growth from China will remain stronger for longer than investors appreciate,” he explained.

Ottenstein adds that foundation, or makeup applied to the skin for a more natural look, drove the 4% net makeup sales increase, with skincare sales also ramping up. This is important as skincare margins are 4x higher than makeup and foundations maintain the highest consumer loyalty compared to all other types of makeup. Bearing this in mind, the analyst reiterated his bullish call and $230 price target, suggesting shares could surge 20% over the next twelve month period. (To watch Ottenstein’s track record, click here)

Looking at the consensus breakdown, 8 Buy ratings vs 3 Holds add up to a ‘Moderate Buy’ analyst consensus. On top of this, its $218 average price target puts the potential twelve-month gain at 14%. (See Estée Lauder stock analysis on TipRanks)