Which investing strategy can yield big rewards? Several Wall Street pros tell investors the most compelling investments are often the names with above-average growth prospects. We mean the stocks primed to deliver massive returns through 2020 and beyond.

That being said, finding stocks growing at lightening fast speeds is no simple task. Fortunately, TipRanks has made it a little easier. We were able to pinpoint 3 tickers with strong growth narratives by using the platform’s Best Stocks to Buy tool.

Following impressive quarterly results, each of the stocks have had their price targets hiked up by the Street’s best performing analysts, indicating they now see even more upside in store. Not to mention all of the names have amassed enough bullish recommendations over the last three months to snag a “Strong Buy” consensus rating. With this in mind, let’s jump right in.

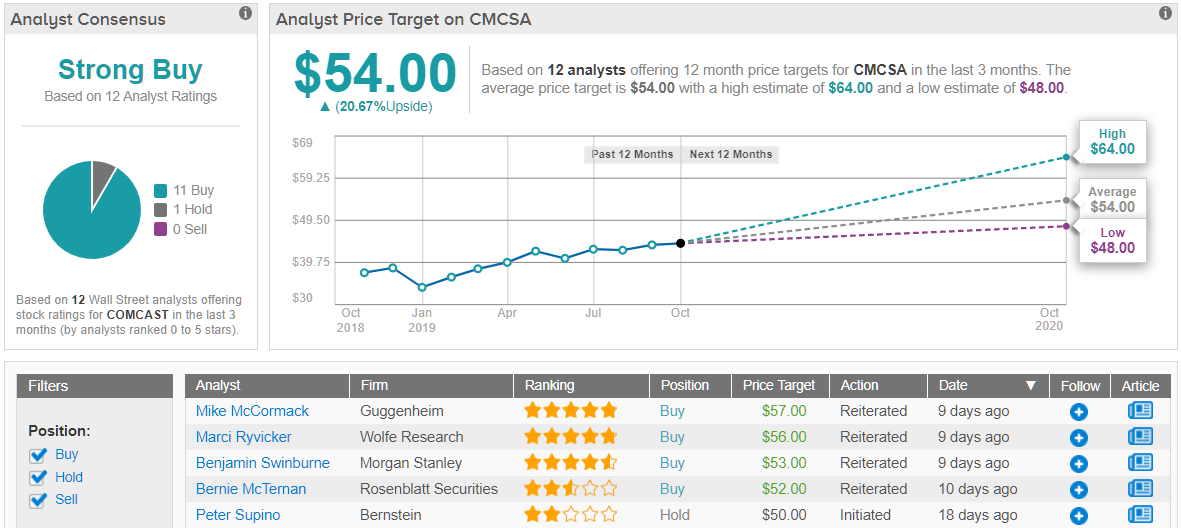

Comcast (CMCSA)

On the heels of a third quarter revenue and earnings beat, it’s no wonder Wall Street is tuning in to Comcast.

The telecommunications giant reported on October 24 that its top and bottom-line results surpassed the consensus estimates. On top of this, CMCSA posted 379,000 net adds for high-speed internet users, which also came in ahead of the expected 344,000.

While theatrical revenue for NBCUniversal dipped almost 9% from the year before thanks to a tough film slate, its recently announced streaming service, Peacock, could drive substantial gains. The new service, which was unveiled back in September, will be supported by both ads and subscriptions and is slated for an April launch. Additionally, its content lineup is packed with fan favorites like “Parks and Recreation” and “The Office”.

In response to the earnings results, one top analyst bumped up his price target. Guggenheim’s Mike McCormack cites the company’s pivot away from video as well as its strides related to high-speed internet as outweighing any losses caused by previous obstacles.

“We expect free cash flow to improve through a combination of lower capex intensity and moving past the working capital headwinds related to film and TV. We believe the company will continue to press on broadband, generating margin benefits from the shift away from video,” he explained. This prompted the five-star analyst to keep a Buy rating as well as raise the price target from $52 to $57. Based on this updated target, McCormack thinks shares could surge 27% over the next twelve months. (To watch McCormack’s track record, click here)

Similarly, other analysts have high hopes for CMCSA. As 11 Buy ratings and only 1 Hold were assigned in the last three months, the stock is a ‘Strong Buy’. The upside potential also comes in at 21%. (See Comcast stock analysis on TipRanks)

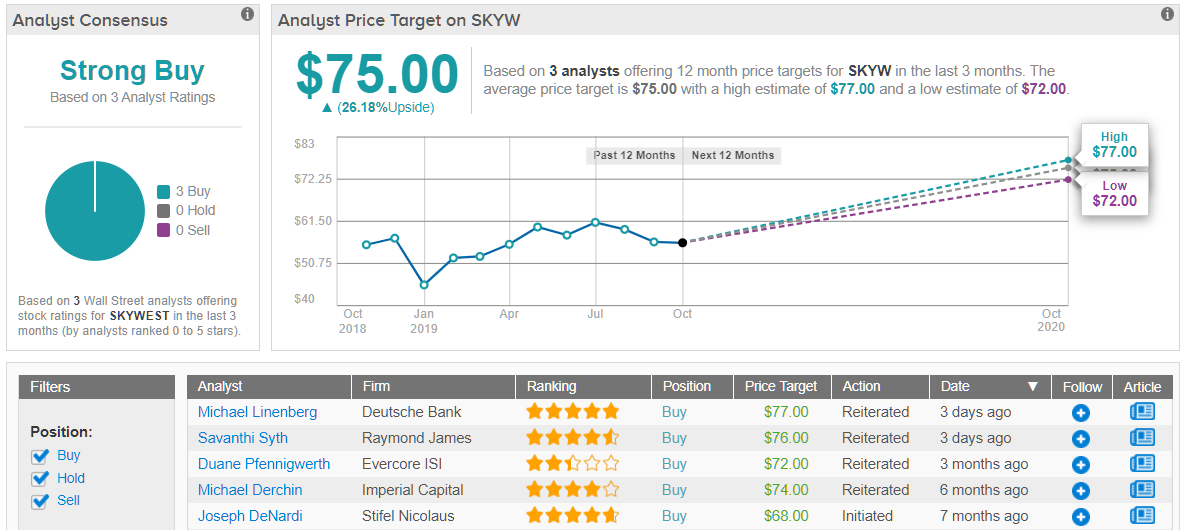

SkyWest (SKYW)

SkyWest is best known for operating a North American regional airline as well as an aircraft leasing company. Following an impressive performance in its most recent quarter, Deutsche Bank analyst Michael Linenberg believes that SKYW is a “best-in-class regional airline”.

The analyst points out that better-than-expected revenue fueled the airline’s earnings beat. Nonetheless, he is particularly excited about its positioning within the industry.

“As the largest owner/operator of Bombardier CRJ aircraft (-200s, -700s and -900s) as well as a sizable Embraer E-175 fleet, SkyWest, in our view, has more opportunities and flexibility than any other regional carrier to address the fleet solution needs of its major airline partners. This is further bolstered by its strong pipeline of pilots,” Linenberg commented.

If that wasn’t promising enough, SKYW is now starting to generate significant free cash flow. As a result, the-five star analyst sees its $3 billion in debt decreasing to less than $2 billion by the end of 2022.

Bearing this in mind, Linenberg reiterated his bullish call while telling investors SKYW is poised for even more gains than he originally thought. After lifting the price target from $72 to $77, the upside potential now lands at 30%. (To watch Linenberg’s track record, click here)

With 100% Street support, the message is clear: SKYW is a ‘Strong Buy’. It should also be noted that the $75 average price target suggests 26% upside from the current share price. (See SkyWest stock analysis on TipRanks)

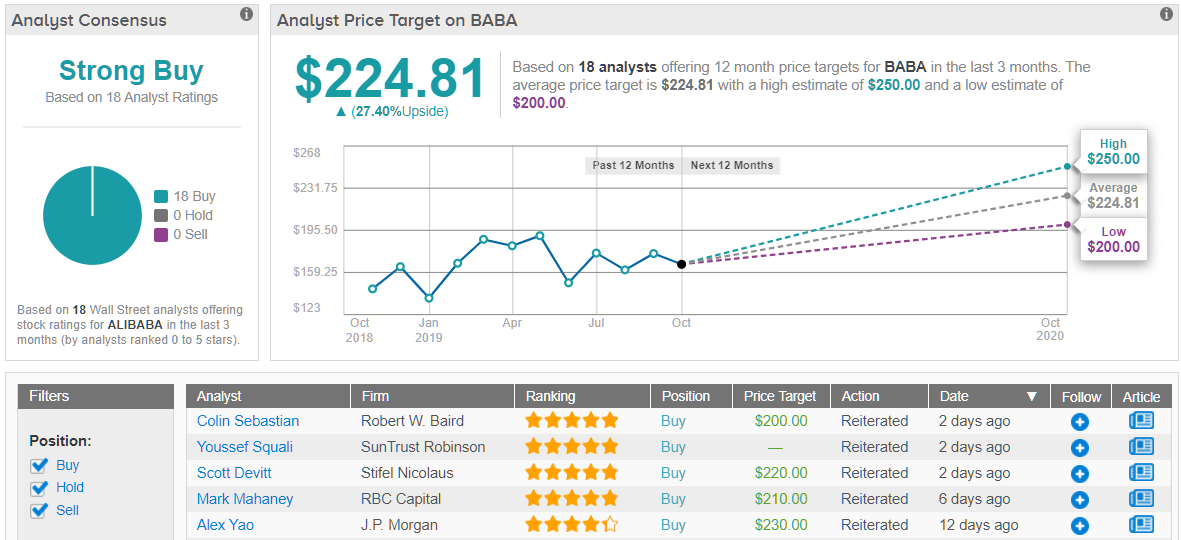

Alibaba (BABA)

Known as the Amazon of China, Alibaba has become a stand-out in its own right. This fact hasn’t gone unnoticed by the Street, with several analysts stating that they are expecting big things from the company.

In its fiscal second quarter, strength in its core commerce segment was the driving force behind the 40% year-over-year revenue gain. While its cloud business also performed solidly, analysts are singing BABA’s praises based on its ability to make strategic investments.

The company highlighted key areas of focus going into the second half of the fiscal year. Not only does BABA plan on making a significant effort to improve the user experience and fuel operating efficiencies through synergies across segments, but it will also aggressively reinvest discretionary profits.

Although the planned aggressive spending has posed a cause for concern among some investors, these investments stand to increase its reach within sizeable addressable markets and generally strengthen the platform.

All of the above factors lend itself to RBC Capital analyst Mark Mahaney’s conclusion that BABA is a long-term winner. “We are increasingly positive on BABA. Alibaba appears to have a rare luxury of balancing aggressive strategic investments while generating robust profit growth,” he wrote in a note to clients. Taking this into consideration, the five-star analyst maintained his Buy rating and boosted the price target by $30. His new target of $240 implies 36% upside potential. (To watch Mahaney’s track record, click here)

With 18 bullish calls compared to no Holds or Sells being published in the last three months, the rest of the Street is clearly on the same page. Adding to the good news, its $225 average price target implies 27% upside potential. (See Alibaba stock analysis on TipRanks)