The stock market is an endless source of data – reams of it, constantly generated and updated as investors and markets move in a stately pas-de-deux through an ever-changing stage of prices and signals, financial reports and economic news. The sheer quantity of data can be intimidating, but successful investors learn how to navigate a way through.

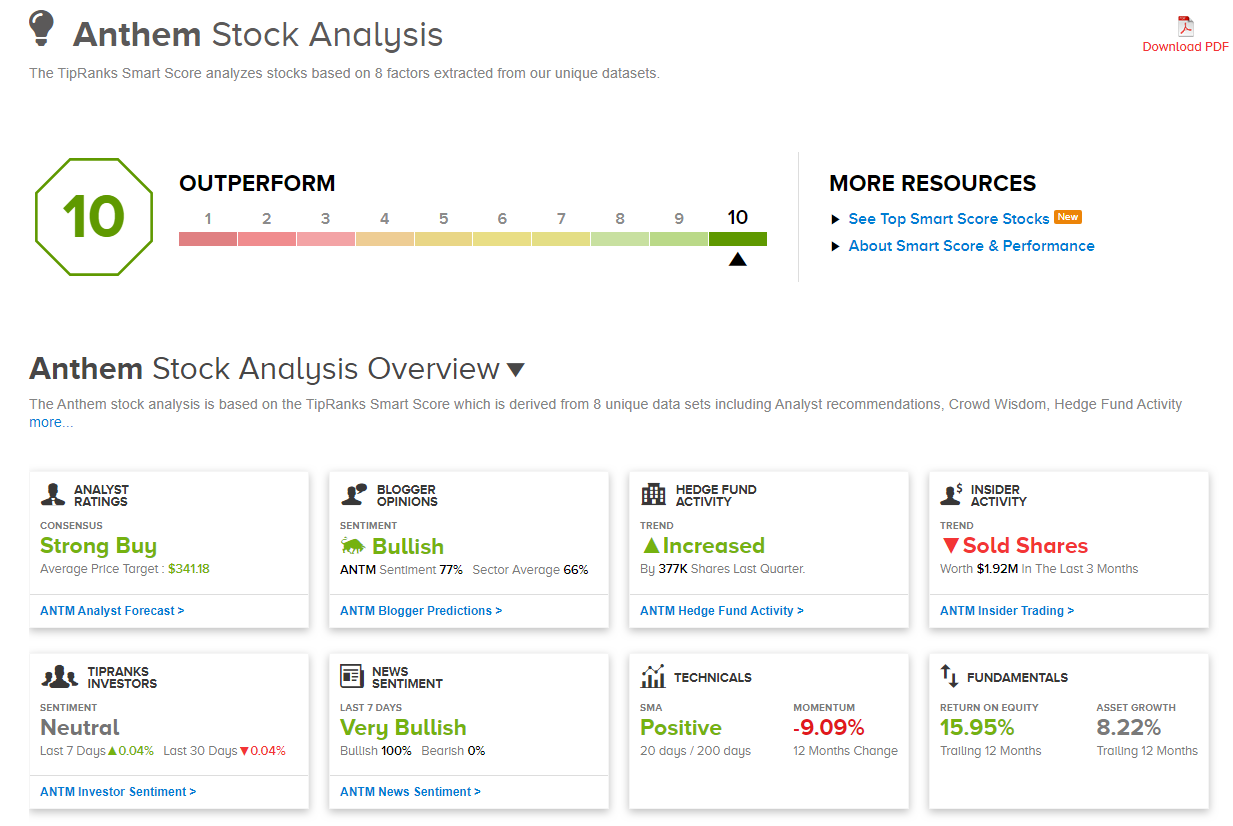

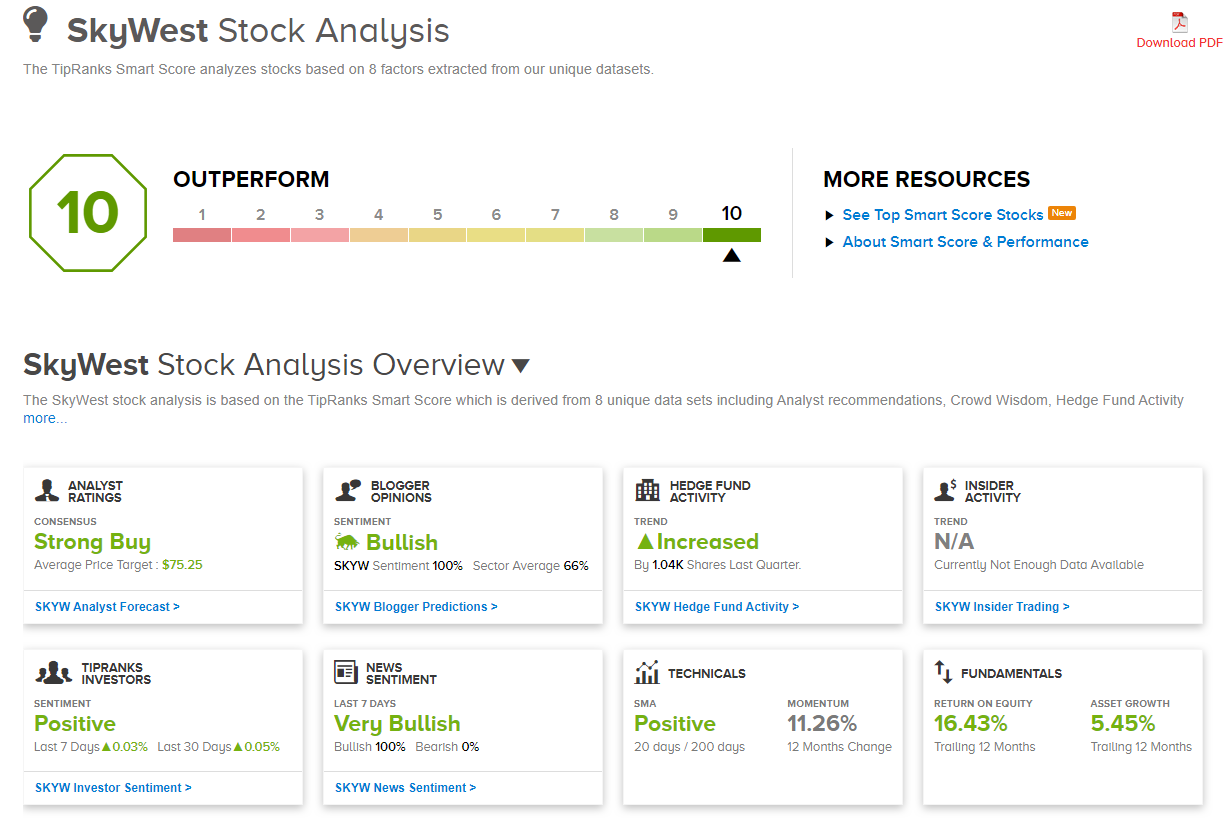

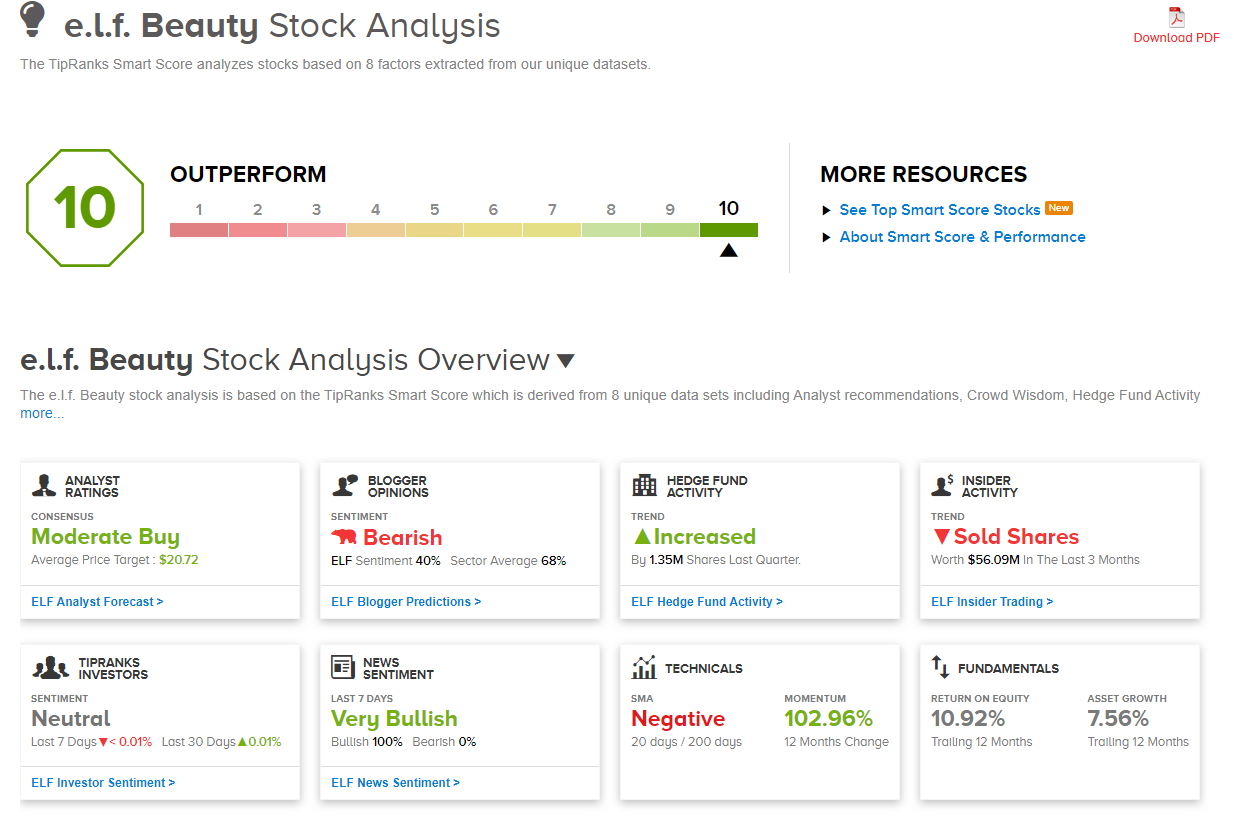

The Best Stocks to Buy feature from TipRanks is a valuable tool for plotting a viable course. Pulling data from eight separate streams, the stock analysis generates a single score for every stock in the TipRanks database – more than 6,500 all told. This score, the Smart Score, provides an indication of the stock’s likely movements over the coming 12 months, all at a glance.

A perfect Smart Score, a 10, points to a strong likelihood that the stock in question will outperform the markets. We’ve pulled up three ‘Perfect 10’ stocks to see what Wall Street’s analysts have to say about them.

Anthem, Inc. (ANTM)

We’ll start with Anthem, a staple of the S&P 500 and a major health insurance provider in the US. The company boasts over 40 million insurance customers and brought in over $103 billion in revenues in 2019. That revenue number indicated 13% year-over-year growth, and capped a 2019 solid performance.

Drilling down slightly, Anthem’s Q4 numbers showed an EPS of $3.62, and the company used the strong number to back a dividend increase of nearly 19%, to 95 cents per share. It was the fourth dividend raise in the last three years, and brings the yield to 1.39%, about equal to US Treasury bonds.

While the dividend is modest, ANTM really rewards investors with the long-term share appreciation. The stock is up 109% over the past five years, and has maintained its value despite facing high volatility in the past 12 months.

A look at the Smart Score underscores Anthem’s strengths. Anthem inspires bullish sentiment from financial bloggers and news reporters, much more so than average, while hedge funds increased holdings of the stock during the last quarter.

Writing on the stock after hearing the Q4 earnings conference call, Evercore ISI analyst Michael Newshel cited “continued above-average Medicare enrollment growth” as a reason for optimism, and pointed out that “the Medicaid margin recovery remains on track.”

Newshel maintained his Buy rating on ANTM shares and set a price target of $340, suggesting room for an upside of 18%. (To watch Newshel’s track record, click here)

Overall, Anthem stock receives a Strong Buy from the analyst consensus, with 10 Buy reviews against a single Hold. Shares are priced high, at $287.33, and the $341.18 average price target indicates an upside potential of 19%. (See Anthem stock analysis on TipRanks)

SkyWest, Inc. (SKYW)

From health insurance, we move to airlines. Specifically, the regional carrier segment of the industry. SkyWest, based in Utah, serves as a connector carrier for major airlines such as Air Alaska, American, Delta, and United. The company will operate under various names – for example, it is a Delta Connection when working with Delta – but SkyWest remains the name of the holding company. The airline operates over 2,200 flights daily to 250 locations in the US, Canada, and Mexico, mainly carrying passengers between small regional airports and major hubs.

In the fourth quarter, SKYW beat the forecasts on EPS and revenues. EPS, at $1.43, was 1.4% higher than expectations, and an impressive 12% above the year-ago number. Revenue came in 1% above the forecast, at $743.6 million. Better, from an investor point of view, was the 9.4% drop in operating expenses, combined with the acquisition of ten E175 and seven CRJ900 aircrafts during 2019.

SkyWest’s stock analysis shows a wide range of data points supporting the ‘perfect 10’ Smart Score. Fundamental factors, such as return on equity and asset growth, are strongly positive, while individual investors have shown a positive sentiment by increasing holdings in the stock.

Covering the stock for Deutsche Bank, 5-star analyst Michael Linenberg sees room for continued growth. He writes, “We are maintaining our full year 2021 EPS estimate of $6.45, which we view as conservative in light of the 20 incremental American E175s announced in the earnings release. Furthermore, there could be other growth opportunities for SkyWest as other aircraft transition to/from major airline partners over the next few years as well as further upside at the company’s nascent aircraft and engine leasing business.”

Along with his positive outlook, Linenberg gives the stock a Buy rating and a price target of $75. This price target implies a possible upside of 26%. (To watch Linenberg’s track record, click here)

SKYW has 4 recent Buy ratings, making the Strong Buy consensus view unanimous. Shares are affordably priced at $59.72, and the $75.25 average price target suggests an upside potential of 26% here. (See SkyWest stock analysis on TipRanks)

elf Beauty, Inc. (ELF)

Third on today’s list is e.l.f. Beauty, a small-cap cosmetic company based in Oakland, California. In today’s tech-heavy world, this may not seem like the go-to investment – but e.l.f. has just received two ratings upgrades from the analysts. Clearly, there is more to this stock than meets the eye.

ELF has beaten quarterly earnings estimates in every report over the past two years, a bravura performance for any stock. For fiscal Q3, released on February 5, the company posted net sales of $81 million, up 8% from the prior-year quarter. Not to mention gross margin rose from 60% to 65%. With these kinds of numbers behind them, it’s no surprise that shares are up 8% to start 2020.

The stock’s momentum is behind the Smart Score of 10. At a nearly 103% change in the past 12 months, ELS shares are on an upward trajectory. News sentiment and hedge funds are also bullish.

Turning to analyst reviews, we find the two recent upgrades. Writing on the stock for Piper Sandler, analyst Erinn Murphy says “the brand is poised to gain market share.” With this in mind, she bumped up the stock to Buy from Neutral, and set a price target of $19. (To watch Murphy’s track record, click here)

Also bullish is Stephanie Wissink, from Jefferies. She goes into greater detail, writing in a recent note, “Underlying demand remains robust (+DD) and we expect tracked channel data to reflect a more normalized pattern of takeaway over the next 10-12 weeks. Lapping hero SKU and related earned media benefits in March-May will create a data gap but benefits from new product releases, 2H19 pricing increase, and anniv. store closures should offset…”

Wissink also raised her stance from Neutral to Buy. Her price target is slightly more bullish; at $20, it implies an upside of 15%. (To watch Wissink’s track record, click here)

ELF shares maintain a Moderate Buy rating from the analyst consensus, based on 8 Buys against 3 Holds. For a stock with such strong prospects, it is a bargain at $17.34. The $20.72 average price target suggest room for 19% upside growth. (See e.l.f. Beauty stock analysis on TipRanks)