After a period of cooling off its impact on the markets, fear of the coronavirus played havoc on Wall Street again today. Consequentially, the tech heavy Nasdaq 100 had its worst day for almost a month, dropping by almost 3%. Companies with heavy exposure to China such as AMD and Nvidia are the most heavily affected.

Nevertheless, tech companies have provided investors with plenty to shout about over the last 12 months and the sector can always be depended upon to present various compelling plays.

In fact, using TipRanks’ Best Stocks to Buy tool we managed to pinpoint 3 stocks in the sector that currently present perfect investing opportunities — all receive a score of a “perfect 10.” Let’s get the lowdown.

Lumentum Holdings (LITE)

Lumentum has had a phenomenal 2019, with shares up over 90%. Increasing demand for its offerings, especially amongst consumer electronics stalwart like Apple – for which it supplies 3D sensing technology – plus better than expected earnings results, helped the stock beat the market considerably.

In the latest earnings report, the company posted revenue of $457.8 million, a year-over-year increase of 23%, beating the consensus calls for $452 million. A beat was posted by EPS, too; the estimate of $1.29, below the reported $1.53. Lumentum’s balance sheet looks in rude health, as well: the company ended the quarter backed with $1.3 billion in cash and short-term investments.

Goldman Sachs’ Rod Hall is impressed with the print. In fact, in addition to keeping his Buy rating intact, the results meant the 4-star analyst nudged his price target upwards, too; from $77 to $102. The implication? Further upside of 28%. (To watch Hall’s track record, click here)

Hall believes Lumentum will see further growth in margins driven by the rising mix of Datacom chip and 3D sensing revenue and the exit from legacy products. Furthermore, the company’s conservative guidance means room for share appreciation. Hall explained, “FQ3 EBIT margin implies more weakness in Telecom gross margins than can be explained by the coronavirus risk alone. We model FQ3 Telecom gross margin at just 38.0%, down from 45.5% in FQ2 in spite of higher revenues. Even this large drop still puts our forecast closer to the high end of the 21%-23% EBIT margin guidance range at 22.7%”.

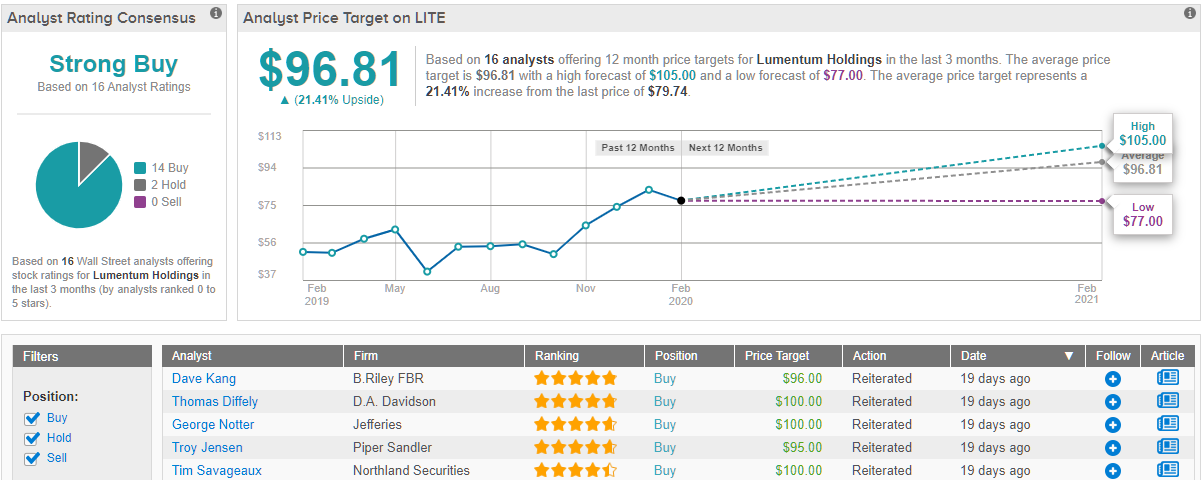

Overall, Lumentum’s momentum won’t be halted, according to the analysts; 14 Buys and 2 Holds converge to a Strong Buy consensus rating. At $96.81, the average price target indicates possible gains in the shape of 21% over the next 12 months. (See Lumentum stock analysis on TipRanks)

Wix.com (WIX)

Wix stock took a hit last week following the release of its quarterly results. Despite posting year-over year growth of 25%, which amounted to fiscal 2019 revenue of $761.1 million – investors were let down by the disappointing guidance; Wix sees Q1 revenue of between $215 to $217 million, while the consensus calls for $217.8 million.

The print, though, also exhibited some strong numbers. The addition of 89,000 premium subscribers in the fourth quarter was a 13% year-over-year increase and adds to a total of 4.5 million paying customers. Wix now has 165 million registered users, a rise of 16% from 2018. Additionally, the quarter saw Wix introducing Editor X, an innovative web design and creation platform for web agencies and designers.

Deutsche Bank’s Lloyd Walmsley is staying with the bulls. The 5-star analyst thinks “the customer support, agency sales and partnership initiatives” can all pay dividends in 2020.

Walmsley further added, “We see preliminary 2020 guidance as more conservative than in the recent past given a series of new products out that have unknown ramp paths, most notably the EditorX and Payments, both of which could ultimately scale well in our view… we believe EditorX can have a more immediate path to financial contribution and is not yet fully reflected in the guide… We continue to see a potential inflection in payments, particularly if Wix eventually forces adoption on the platform, which is not currently contemplated in guidance.”

Walmsley, therefore, reiterated a Buy rating on Wix. The mixed print, though, means a slight reduction in the 5-star analyst’s price target, down from $170 to $166. The new figure could still yield returns of 28% over the coming year. (To watch Walmsley’s track record, click here)

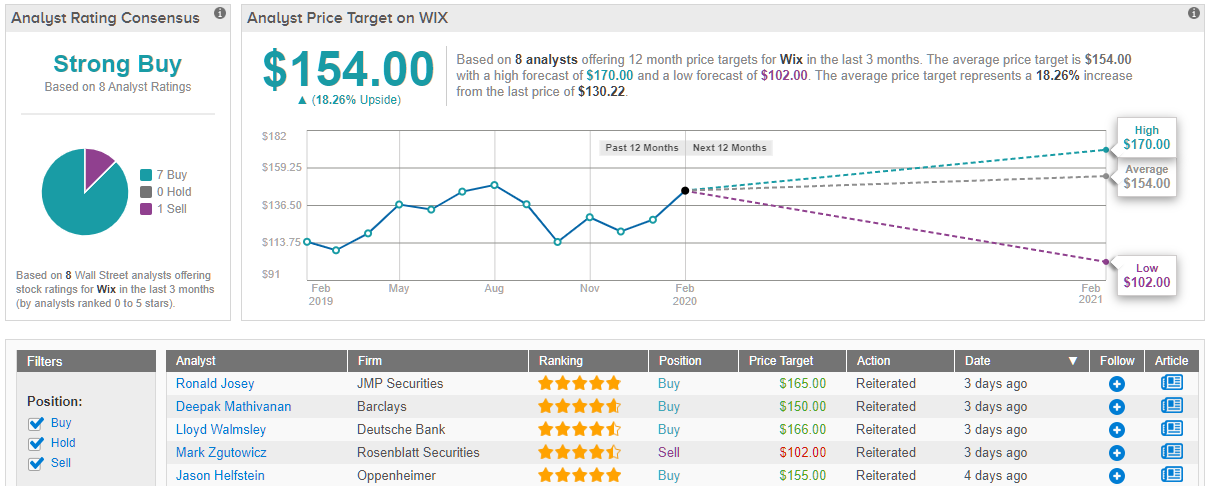

Most of the Street have not given up on the company just yet, as TipRanks analytics showcase WIX as a Strong Buy. Out of 8 analysts polled in the last 3 months, 7 are bullish on the stock, while only 1 remains sidelined. With a potential upside of 18%, the stock’s consensus target price stands at $154. (See Wix stock analysis on TipRanks)

Western Digital (WDC)

Completing the list is hard disk drive manufacturer and data storage specialist Western Digital. The San Jose based company provided investors with plenty to smile about last year; the stock added 74% to its share price in 2019.

WD’s latest earning results delivered the goods across the board. WDC reported fiscal Q2 revenue of $4.23 billion, beating the street’s call for $4.22 billion. Likewise, the company posted a beat with EPS: $0.62 vs the Street’s estimate of $0.58, Gross margins came in at the high-end of guidance at 25.9%.

For the current quarter, WDC expects revenue to come in between $4.1 to 4.3 billion and EPS between $0.85 and $1.05 ($0.95 at midpoint). The Street is calling for $4.23 billion and $0.78, respectively. Gross margins are expected to improve quarter-over-quarter to between 28.5 and 29.5%

RBC’s Mitch Steves applauded the print: “Western Digital reported a solid quarter and guidance came in notably ahead of expectations from an EPS perspective. Specifically the company notes: 1) the NAND environment is improving faster than they originally expected and anticipate solid strength through CY20, 2) WDC is seeing continued momentum in NVMe enterprise SSds, 3) they anticipate doubling enterprise SSD revenue in 2020, 4) gaming flash demand should begin in June of 2020 and 5) gross margin are seeing notable improvements with WDC guiding to 29% at the mid-point for Mar qtr.”

Down to the nitty gritty, what does it all mean? It means Steves keeps his Outperform rating as is, while boosting his price target upwards; $64 is upgraded to $85 and implies potential upside of 33%. (To watch Steves’ track record, click here)

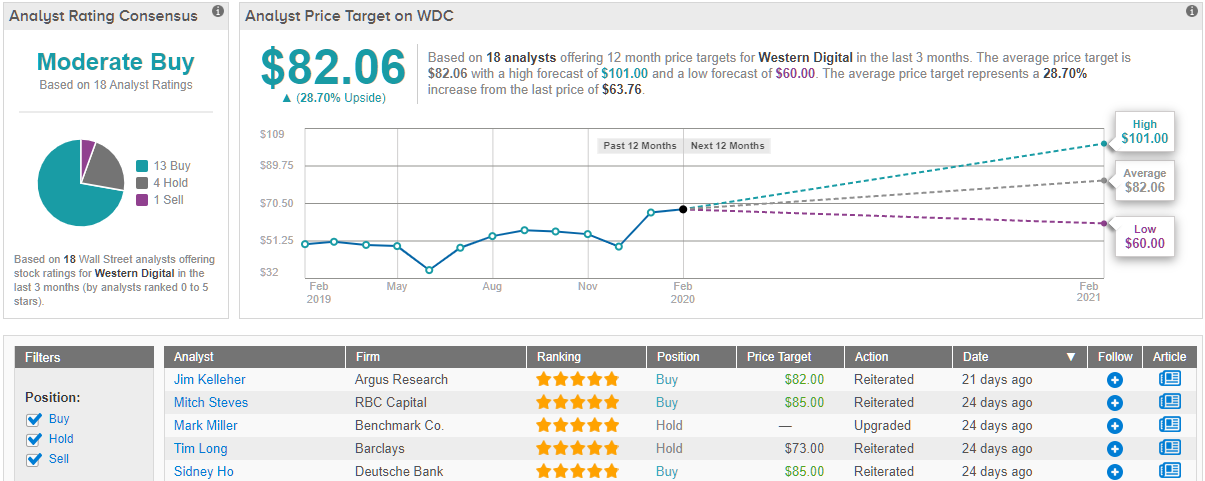

The storage specialist’s Moderate Buy consensus rating currently breaks down into 13 Buys, 4 Holds and a single Sell. The average price target comes in at $82.06 and suggests possible returns of 22.5%. (See Western Digital stock analysis on TipRanks)