There are over 2,800 stocks traded on the NYSE, and thousands more on the world’s other stock exchanges. But with so many stocks out there, and so much information coming in, how do you make sense of it? TipRanks has an answer for that.

The Smart Score brings together the disparate data streams in the TipRanks database and distills them down to a single number – a score that you can use to get a sense of what the data means. The analyst consensus, TipRanks’ original rating derived from the published notes of Wall Street’s financial analyst corps, is of course included, but it’s combined with 7 additional factors. The opinions of financial bloggers – another 7,000 experts who follow the markets closely – are considered, as are the sentiment of news articles, the trading moves of corporate insiders, and the activity of individual investors. Movements in traditional technical and fundamental factors are also added in.

The resulting score gives a macro view of the stock, based on the most current data available. The Smart Score isn’t a perfect predictor, but it can indicate a direction – will your favorite stock outperform the market, stay neutral, or underperform? It’s the question you need to answer before you put your money down.

Today, we’ll look at three tech stocks, each with a “Perfect 10” according to the Smart Score. We’ll see why these companies scored so highly, and what Wall Street’s analysts have to say about it.

SS&C Technologies Holdings, Inc. (SSNC)

Connecticut-based SS&C is a software and SaaS company with global reach and offices across the Americas, and in Europe, Asia, Australia, and Africa. The company offers products for the financial industry, in fund administration, investor services, wealth management, and property management. SS&C has a history of growth by acquisition, fending off potential competitors by buying them out. In 2018, the company made its largest ever move of this type, spending $5.4 billion to buy DST Systems, and earlier this fall SS&C announced that it will be purchasing Algorithmics Assets from IBM.

In Q3 2019, SS&C reported solid results in terms of both EPS and gross revenues. The bottom-line earnings came in at 93 cents per share, 4 cents over the estimate and 14 cents over the year-ago figure. Revenues, at $1.15 billion, were 15% higher year-over-year. It was the third time in three quarters that the company had beaten the quarterly forecast.

Turning to the Smart Score for SSNC, we find that the analysts, the bloggers, and the news are all bullish on the stock. News sentiment is 100% positive, meaning that there have been no negative articles on SSNC in the last week. This compares to a sector average of 63% bullish. The financial bloggers have also been 100% positive, against a sector average or 67%.

Writing for Deutsche Bank, analyst Ashish Sabadra says, “Despite the recent run-up, SSNC stock is trading at a significant discount to peers and historical multiples due to concerns about organic revenue growth in 2020. We believe the pricing increase should help improve organic growth…” In line with that expectation, Sabadra has set a Buy rating and raised his price target from $64 to $75, implying a 25% upside potential for the stock. (To watch Sabadra’s track record, click here)

SS&C’s Strong Buy consensus rating is based on 8 reviews, including 6 Buys and 2 Holds. Some analysts are still cautious due to the stock’s late-summer doldrums, but the majority agree with Sabadra’s estimate that this company will take off in the coming year. The average price target, $65, implies an upside of 9% from the trading price of $60.10. (See the SS&C Technologies stock analysis at TipRanks)

Lattice Semiconductor Corporation (LSCC)

This mid-cap chip company focuses on programmable logic devices and design-oriented intellectual property software. This niche, aimed at the market for customizable processor chips, has been highly successful, and Lattice has posted an astounding 192% gain in 2019. In ordinary numbers, the stock has risen from $7 in January to over $20 today. It’s a truly impressive performance.

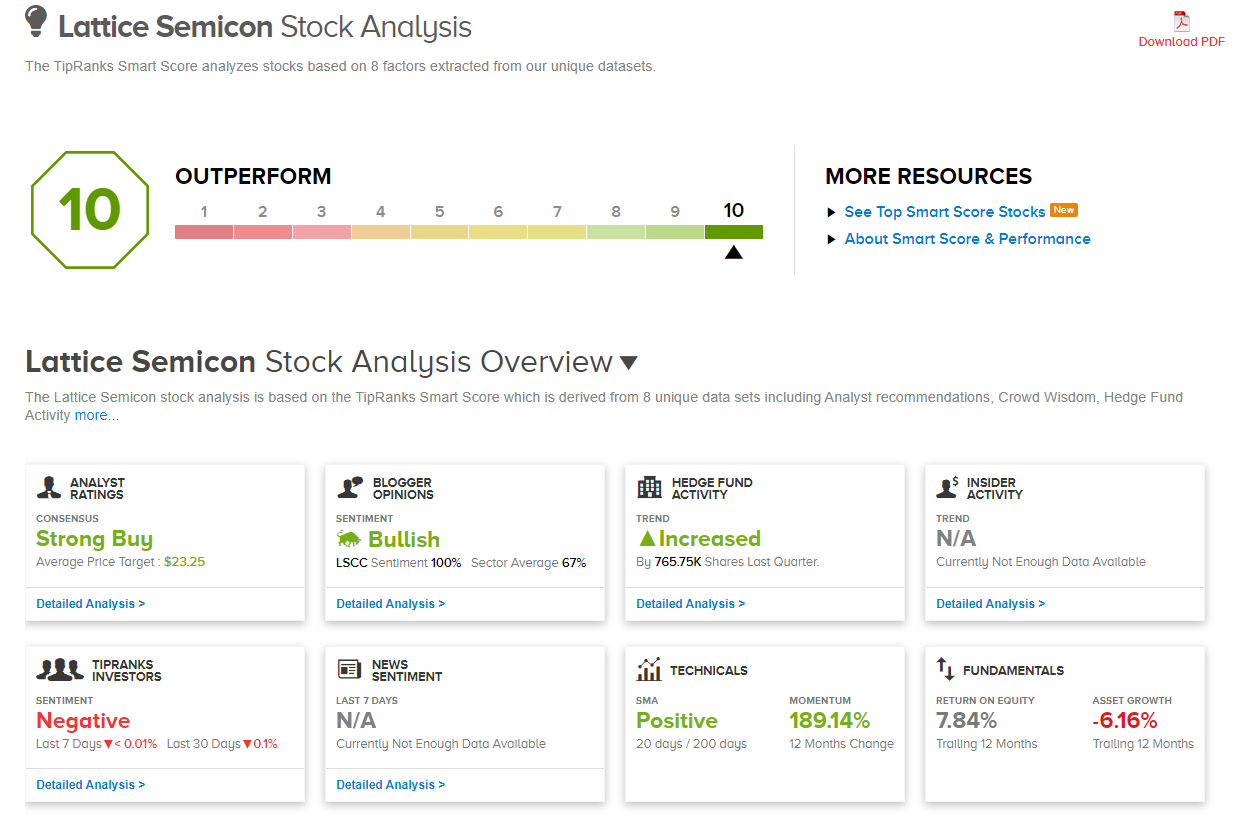

The Smart Score on LSCC reflects this. The analysts are bullish, and the bloggers have been giving positive reviews for the last 9 months. The year-to-date gain gives the stock high momentum, as nothing will attract investors faster than a visible winner. A survey of the hedge fund market shows that purchase activity in LSCC increased since the last quarter.

Lattice’s Q3 results, like those for SS&C above, beat the forecasts in both earnings and revenues. EPS came in at 17 cents, against a 15-cent estimate and an 11-cent year-ago number. Gross revenues were reported at $103.5 million, a 1.9% gain from the previous year. LSCC is a stock that is clearly heating up, and shows no sign of slowing.

Matt Ramsay, 5-star analyst with Cowen, attended Lattice’s most recent product launch last week and gave the stock a Buy rating. He’d come away from the session with a favorable impression, and wrote after the event, “Management debuted NEXUS, its next-gen platform for low-power/small footprint FPGAs. We came away impressed and believe the platform represents a critical milestone in the company’s acceleration…” Ramsay’s bumped his price target up from $23 to $25, showing confidence in a 24% upside. (To watch Ramsay’s track record, click here)

Lattice gets a unanimous Strong Buy consensus rating from the analysts, as 5 of Wall Street’s experts have rated the stock a Buy in the last three months. The stock’s $23.25 average price target suggests a premium of 15% to the current share price of $20.20. (See the Lattice Semiconductor stock analysis at TipRanks)

Rapid7, Inc. (RPD)

In today’s digital world, cybersecurity is an ever-growing need, and a company which can provide it is likely to have a path forward to success. Rapid7 provides just that, through data and analytic software solutions. RPD’s products and services collect and analyze data, provide context to the results, and give customers the ability to reduce exposure to digital threats and detect system compromises is real time.

At a $2.8 billion market cap, Rapid7 is a mid-sized company holding its own in a large field. The company’s Q3 earnings showed a net profit where the Street had expected a loss. While modest, that 1-cent per share gain was far better than the 2-cent loss which had been predicted. The earnings were supported by gross revenues of $83.2 million, 3.7% higher than the $80.2 million estimate, and 33% higher year-over-year. Customer growth was up 17% from the year-ago quarter, and most importantly, annualized recurring revenue (ARR) gained 43%, reaching $310.2 million. In response to the strong quarter, management raised the forward guidance for 2019 revenue growth to the 32% to 33% range.

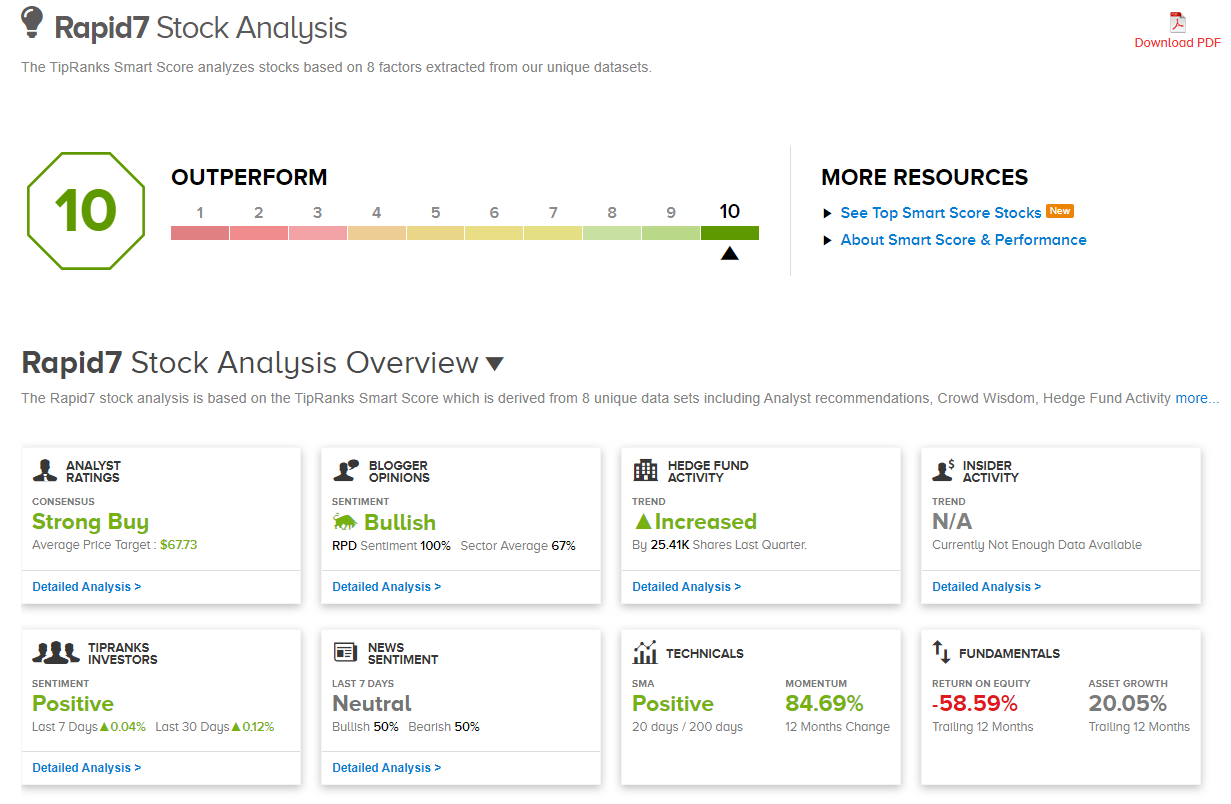

As expected for a stock showing strong earnings and revenues, RPD is up for the year. The 80% gain in 2019 is almost triple the 27% gain on the S&P – and the year is not quite over yet. A look at RPD’s Smart Score demonstrates what is going right for the stock in the larger picture. The analyst consensus, blogger opinions, and hedge activity are all positive, but the most interesting factor may be the individual investors. The individual investor metric shows modest gains at both the 7 and 30-day time horizons.

Top analysts are attracted to RPD shares. Matthew Hedberg, rated #9 overall in TipRanks’ analyst database, met with company management recently and looked at the Q3 numbers and forward guidance. He writes, “After spending the day with management, we feel better about the company’s ability to deliver sustainable, above-market and profitable growth supported by several waves of product innovation.”

In his investment thesis, Hedberg lays out the case for buying into RPD: “Its value proposition is to utilize massive amounts of data collected from the network and endpoints to help customers proactively prevent security breaches. ARR growth is the key metric, as management expects it to remain at or above 30% through 2020.” As expected, Hedberg gives this stock a Buy rating, and his $81 price target suggests a 45% upside potential. (To watch Hedberg’s track record, click here)

RPD’s analyst consensus rating of Strong Buy reflects the stock’s strong performance. 10 out of 11 Wall Street experts have set Buy ratings on this stock in the past three months, while only 1 has put a Hold. The shares trade for $56, so the average price target of $67.73 implies a potential for 21% upside growth. (See the Rapid7 stock analysis at TipRanks)