Let’s talk about keeping safe. It’s a topic we can all relate to, these days, as reports of the coronavirus crisis continue to come in. Cases are rising in the wake of economic reopenings and wide-spread protests, but the fatality rate of the disease appears lower than had initially been feared. Still, social distancing seems to be the order of the day, as a precaution.

You can stay safe in your investing, too. ‘Safe’ dividends come from companies that managed to avoid payout cuts during the height of the corona crisis – an important point, as many previously reliable dividends were suspended or slashed in recent weeks. They also feature low payout ratios, indicating that the paying company can easily afford them.

Using TipRanks database, we’ve pinpointed three ‘safe’ dividend stocks with yields starting at 5%, an upside potential starting at 25%, and ‘Moderate or Strong Buy’ consensus rating from Wall Street’s analyst corps. These are stocks that will both grow the portfolio and provide a steady income – and success on multiple fronts is a key strategy to surviving a difficult market environment.

Xperi Corporation (XPER)

First on the list is a Silicon Valley tech licensing company, Xperi. The company made news late last year when it merged with TiVo, with combined entity using the Xperi name. That merger was completed on June 1 of this year. Xperi has its hands in communications, data storage, memory, and mobile computing, among other fields, and its licensed products are found in the automotive, imaging, and semiconductor industries. Xperi boasts a $1.7 billion market cap, and showed full-year billings of $413.9 million.

The company’s strong growth helped it weather the corona storm in Q1. Despite a sequential drop in earnings, first quarter billings beat the forecast by a wide margin, coming in at $112.8 million. The company sees Q2 showing billings in the $85 to $90 million range, in line with estimates.

The important metric for our purposes is the dividend, which was paid out at 20 cents per share back in March, and again at 20 cents in May. Xperi has a 6-year history of maintaining its dividend payment, and the payout has been steady at 20 cents quarterly for the past three years. The payout ratio is only 29%, showing that the payment is clearly affordable under current earnings. The yield is excellent, at 5.56%.

Craig-Hallum’s 5-star analyst Richard Shannon sees the TiVo acquisition as the key factor in XPER’s current outlook. He writes, “The stock has traded down since the acquisition closing, and with such negative sentiment being priced in we don’t think it would take much for the stock to correct to a more reasonable 10x multiple (~40-50% upside) once the acquisition is better understood…”

To this end, Shannon rates XPER a Buy along with a $20 price target, which suggests an upside of 37% for the stock over the coming year, (To watch Shannon’s track record, click here)

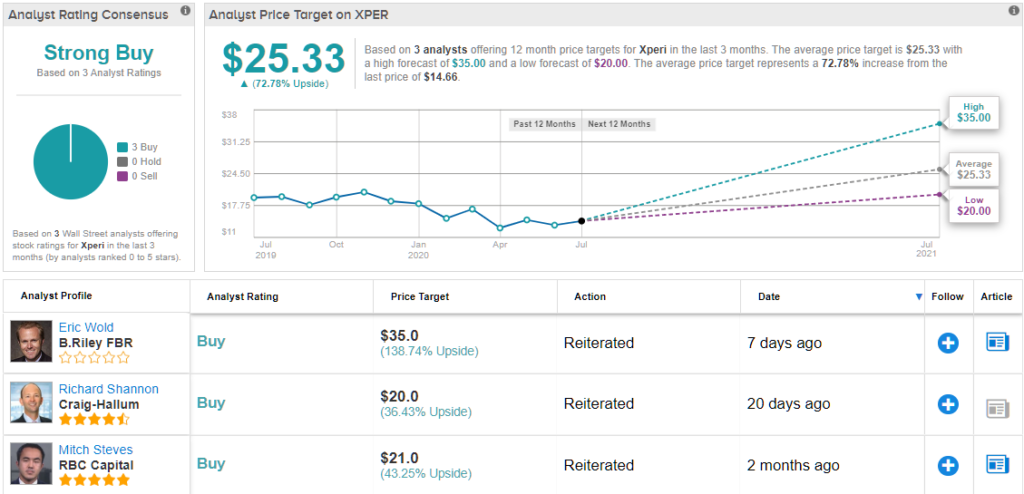

Overall, Xperi holds a Strong Buy rating from the analyst consensus, and Wall Street is unanimous, with 3 Buy ratings on the stock. Shares are priced at $14.38, and the average price target of $25.33 indicates a very bullish 73% upside potential. (See Xperi stock analysis on TipRanks)

Solaris Oilfield Infrastructure (SOI)

Moving on, we come to the oil industry. Solaris is an infrastructure company, providing the gear and equipment that the extraction companies need to pull out and gas out of the ground. The company offers solutions for enhanced drilling, well completion and cleaning, and safety features. Solaris is a small-cap player, with just $322 million in market cap, but boasts that its products are key to increasing efficiency in the North American shale oil sector.

Solaris’ stock has underperformed the overall markets, and SOI is still down 45% from its February peak levels. A strong Q1 earnings report could only partially offset downward pressure. The company reported over $11 million in net cash provided by operations, and ended the quarter with $11 million in positive free cash flow. The solid cash position bolstered SOI’s quarterly dividend, which was held steady at 10.5 cents per share. The most recent payment was made in June.

Solaris has been operating publicly for less than two years; its June dividend payment was only the company’s seventh since the IPO. During that time, the dividend has been increased once, and currently features a low payout ratio of 32% and a high yield of 5.9%.

Analyst Tom Curran, of B. Riley FBR, has an upbeat opinion of this stock, writing, “Given its pristine balance sheet, highly FCF generative, specialty-rental business model, and #1 market position that should strengthen and grow, we continue to recommend SOI for investors trying to identify attractively valued, secular winners in the U.S. land OFS space.”

Curran puts solid numbers with his Buy recommendation, including an $11 price target that implies a one-year upside of 56%. (To watch Curran’s track record, click here)

Wall Street is somewhat more divided on SOI shares, a circumstance reflected in the Moderate Buy analyst consensus rating. That rating is based on 7 reviews, including 4 Buys and 3 Holds. Shares are priced at $7.04, and the average price target suggests an upside potential of 29% for the next 12 months. (See Solaris stock analysis on TipRanks)

Paramount Group, Inc. (PGRE)

Last on our list is a real estate investment trust. Paramount owns and operates commercial office space in some of the country’s most desirable locations, including addresses on Broadway, Avenue of the Americas, and Fifth Avenue in New York City, Market Plaza in San Francisco, and Pennsylvania Avenue in Washington, DC.

The sheer quality of the company’s portfolio allowed it to post a modest earnings gain during the first quarter, a time when many REITs found themselves under pressure from reduced incomes as tenants and clients had difficulties paying bills. PGRE saw earnings rise modestly from 26 cents per share to 27 cents during the quarter.

In better news for investors, Paramount kept up its dividend. The current payment is 10 cents per common share, paid quarterly. It has been held at this level for the past two years, and the payout ratio of 37% suggests that it can easily remain so. The dividend yield, at 5.26%, compares favorably to most common investments; the average dividend yield among S&P companies is only 2%, and the Treasury bonds are yielding less than 1% in most cases.

Reviewing the stock for Wells Fargo, Blaine Heck wrote, “[We] believe that despite tough leasing and operating conditions in the NYC office market for the foreseeable future, shares trade at a meaningful discount to fair value, the company is poised to reap the rewards of previously executed leasing progress in its NYC portfolio, and more recently at 300 Mission (formerly 50 Beale) in San Francisco, and we’re positive on the company recycling capital … into the [strong] San Francisco office market…”

Heck backs his assessment, and his Buy rating, with a $15 price target, suggesting a 99% upside potential for the year ahead. (To watch Heck’s track record, click here)

PGRE shares have a 2 to 1 split between the Buys and the Holds, giving the stock an analyst consensus rating of Moderate Buy. The average price target is $11, which indicates room for 46% growth from the current share price of $7.60. (See Paramount stock-price forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.