While hardly any market segment outside the energy and defense spaces managed to navigate 2022’s hurricane-level winds, semiconductor stocks suffered disproportionately. With numerous macroeconomic challenges pressuring the sector, many individual players suffered hideous losses. Still, the chip-manufacturing market represents a vital component of advanced societies. Three tickers in particular – HIMX, VSH, and DIOD – managed to brush past obstacles recently.

To be clear, semiconductor stocks still present great risks for prospective investors. From the top looking down, global recession fears present major challenges for individual chip manufacturers. In particular, semis generally tend to perform better in a controlled-inflation environment.

Another headwind negatively impacting semiconductor stocks stems from the Federal Reserve. With the central bank again raising interest rates by 0.75%, the action results in higher borrowing costs. In turn, this dynamic shrinks liquidity – exactly what the Fed wishes to spark following an unprecedented expansion of its balance sheet in response to the COVID-19 pandemic. Unfortunately, higher rates also kill business sentiment, which doesn’t bode well for semiconductor stocks.

Finally, investors must be aware of sector-specific obstacles. Primarily, semiconductor stocks suffered under the weight of global supply-chain disruptions. As TipRanks reporter Chandrima Sanyal explained, the channels undergirding chip outflows are interwoven and highly convoluted. Further, consumer-facing problems, such as weakening demand for personal computers, impose severe challenges for many chipmakers.

Still, it’s premature to completely give up on this sector. In the digitalized modern economy, practically anything people interact with features semiconductors of various complexities, and some individual players have benefited from a mini-resurgence in the space.

Himax Technologies (HIMX)

Based in Tainan City, Taiwan, Himax Technologies (NASDAQ:HIMX) is a fabless semiconductor manufacturer, meaning that Himax designs and sells hardware but does not actually manufacture the silicon wafers used in the underlying products. For that, Himax outsources the fabrication to a manufacturing plant or foundry.

On a year-to-date basis, HIMX shares slipped over 64%, reflecting broader pessimism toward semiconductor stocks. However, in the trailing month, HIMX gained slightly over 17%. That’s the case even with nearer-term rumblings taking a huge bite out of its recent market returns.

Quantitatively, Himax brings much to the table. Simply put, the company represents a growth and earnings machine. For instance, Himax’s three-year revenue growth rate on a per-share basis stands at 28.2%, ranked better than nearly 86% of the competition. On the bottom line, its net margin is 28%, ranked higher than nearly 91% of other semiconductor stocks.

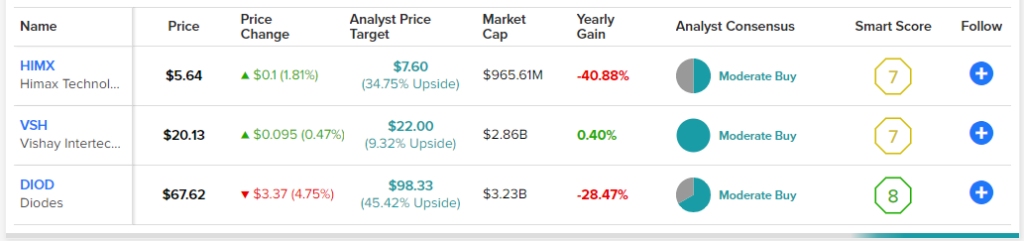

Is HIMX a Good Stock to Buy, According to Analysts?

Turning to Wall Street, HIMX stock has a Moderate Buy consensus rating based on one Buy, one Hold, and zero Sell ratings. The average HIMX price target is $7.60, implying 34.9% upside potential.

Vishay Intertechnology (VSH)

Based in Malvern, Pennsylvania, Vishay Intertechnology (NYSE:VSH) is a manufacturer of discrete semiconductors and passive electronic components. The company produces several products, including rectifiers, diodes, optoelectronics, and selected integrated circuits, among others.

Generally speaking, Vishay managed to weather the storm that’s impacting so many other semiconductor stocks. Since the beginning of the year, VSH stock “only” suffered a loss of just under 8%. In contrast, the benchmark S&P 500 (SPX) lost nearly 22% of its market value over the same period. However, in the trailing month, VSH managed to gain 13.4%.

Fundamentally, Vishay presents an attractive profile for contrarian speculation. For instance, the company’s three-year free cash flow (FCF) growth rate stands at 107%, ranking higher than 95% of competing semiconductor stocks. Also, Vishay features a return on equity of 19.9%, better than 72.5% of its peers. This stat also affirms the enterprise’s status as a high-quality business.

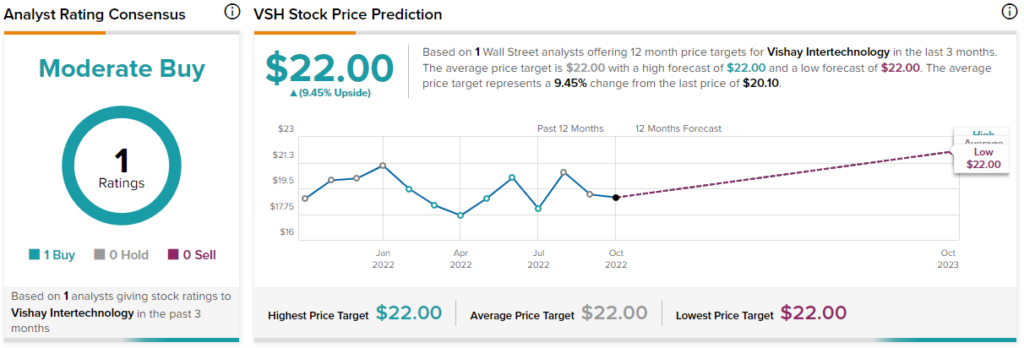

Is VSH a Good Stock to Buy, According to Analysts?

Turning to Wall Street, VSH stock has a Moderate Buy consensus rating based on one Buy, one Hold, and zero Sell ratings. The average VSH price target is $22.00, implying 7.34% upside potential.

Diodes (DIOD)

Headquartered in Plano, Texas, Diodes (NASDAQ :DIOD) is a global manufacturer and supplier of application-specific standard products within the discrete, logic, analog, and mixed-signal semiconductor markets, per its public profile. Diodes serves various industries, including consumer electronics, computing, and automotive.

Similar to other semiconductor stocks, DIOD suffered significantly throughout this year, shedding 38% of its equity value since the January opener. However, in the trailing month, shares gained 4.5%. Also, in the trailing half-year period, the loss that DIOD incurred came out to “only” 10.7%. Therefore, traders could be eyeballing a possible resurgence.

Presently, Diodes features various attractive quantitative statistics. For one thing, the company trades at 11.3x trailing-12-month (TTM) earnings. In contrast, the underlying industry median is 15.6x. Also, the company’s net margin stands at 14.8%, ranked better than 62.5% of competing semiconductor stocks. Finally, on the balance sheet, Diodes’ Altman Z-Score (a solvency metric) is 4.8, reflecting low bankruptcy risk.

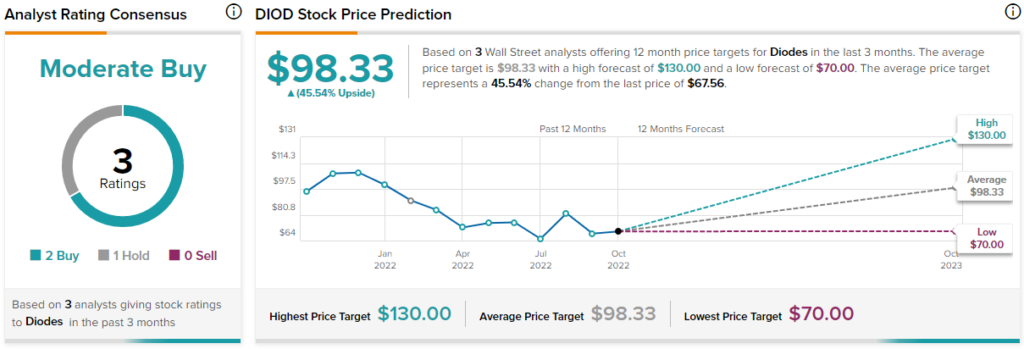

Is DIOD a Good Stock to Buy, According to Analysts?

Turning to Wall Street, DIOD stock has a Moderate Buy consensus rating based on two Buys, one Hold, and zero Sell ratings. The average DIOD price target is $98.33, implying 45.5% upside potential.

Not All Semiconductor Stocks are Built the Same

To be fair, the growth-driven business narratives undergirding large swathes of the broader technology sphere make many semiconductor stocks a risky proposition. Still, not every company operates on the same level of performance or resilience. As the data above demonstrates, certain players enjoy a combination of both resurgent market returns and underlying fundamental justification for said upside.