Everyone has to start somewhere. As is often repeated, today’s biggest companies came from humble beginnings, a garage being the initial home for mega corporations like Microsoft, Amazon and Disney.

While it is common knowledge that the smaller the market cap, the larger the volatility, the opposite also rings true – the bigger a company becomes, the harder it gets to multiply its market cap, and therefore its share price. The trick, then, is to catch a promising stock before it explodes and to be able to reap the rewards its growth provides. But then follows the eternal question: how do we find one?

TipRanks – a company that tracks and measures the performance of analysts – has a variety of tools at its disposal to find an undervalued stock. The site’s Analysts’ Top Stocks tool, which has filters such as market cap and sector, unearthed three such stocks. All three, coincidentally, currently have a Strong Buy consensus rating from the Street. Let’s get the lowdown.

Dine Brands Global Inc (DIN)

Despite a volatile 2019 for restaurant owner, Dine Brands, its share price is still up a very respectable 22% year-to-date. With a market cap of just $1.4 billion, the word on the Street is that the company is on its way to outstripping its small-cap status.

Dine owns and franchises two restaurants, Applebee’s Neighborhood Grill + Bar and International House of Pancakes (IHOP), which number in the thousands and are mostly based across the US.

The company, though, has been expanding its international presence, and just this week announced the opening of its first IHOP restaurant in Lima, Peru. The new restaurant marks Dine’s 62nd restaurant in Latin America.

The expansion follows October’s announcement of a deal with TravelCenters of America to open 94 IHOP restaurants at TA and Petro-branded interstate travel centers across the U.S. The agreement is IHOP’s largest in its history and significantly expands on the current 4 units at TravelCenters’ locations

Raymond James analyst Brian Vaccaro thinks the expansion bodes well, noting, “We believe IHOP remains an under-appreciated part of the Dine Brands story (even though it contributes approximately two-thirds of consolidated EBITDA) and that an acceleration in net new unit growth would benefit both EBITDA growth and broader investor sentiment towards the story.”

To this end, Vaccaro reiterated an Outperform rating on DIN, alongside a price target of $95, indicating upside potential of 16%. (To watch Vaccaro’s track record, click here)

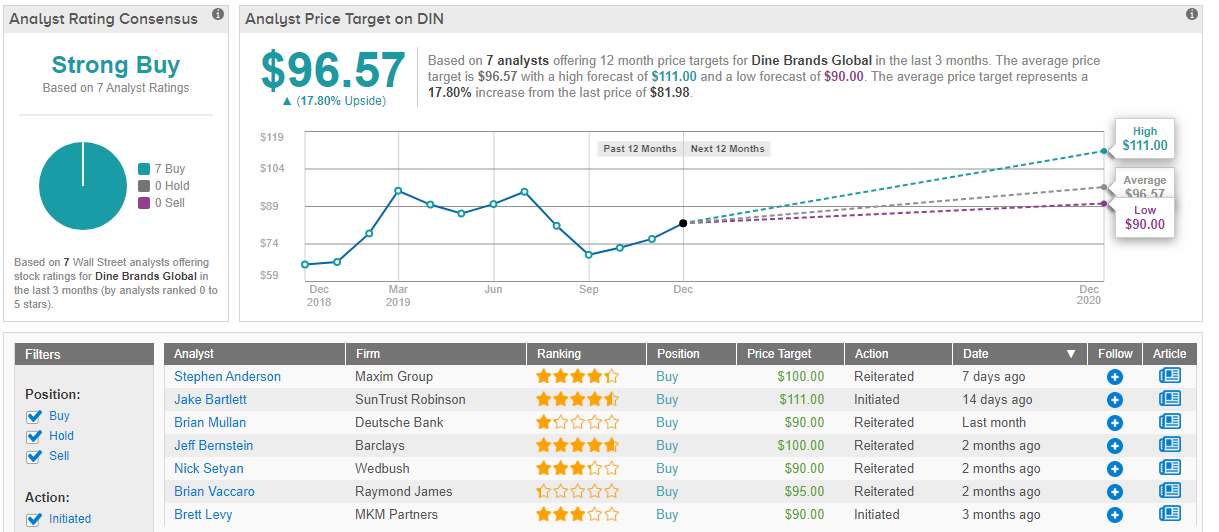

Is the rest of the Street hungry for some Dine Brands? It appears so. A full house of 7 Buys bestows Strong Buy status on the restaurant owner. The average target price is $96.57, expressing the analysts’ confidence in an 18% increase over the next 12 months. (See Dine Brands stock analysis on TipRanks)

Homology Medicines Inc (FIXX)

With a market cap coming in at $966 million, this promising biotech has ample room for growth.

Homology’s prime focus is on genetic medicines for patients with rare diseases. The company has several gene therapy and gene editing candidates in the pipeline. Recently, early efficacy and safety data from a clinical trial for HMI-102, its gene therapy for adults with PKU (phenylketonuria), exhibited promising signs. Further data is expected in mid-2020. The treatment is set to provide competition to BioMarin’s PKU gene therapy, BMN-307, which enters the clinic next year.

Evercore’s Joshua Schimmer thinks “for now the FIXX horse is definitely in the race,” adding that “while the data is early, it is clearly encouraging.”

“Fixx is developing a unique gene therapy and gene editing platform, with its proprietary AAVHSC vectors licensed from the City of Hope. The company will be initially targeting adult PKU patients using its gene therapy approach, with the aim of eventually advancing to pediatric patients with gene editing. Beyond PKU, excitement for the company stems from the potential to correct a wide range of genetic diseases with high precision,” the 5-star analyst said.

Unsurprising, then, to find Schimmer reiterating an Outperform rating on FIXX, alongside a price target of $29. Should the target be met, investors stand to take home a nice 32% gain. (To watch Schimmer’s track record, click here)

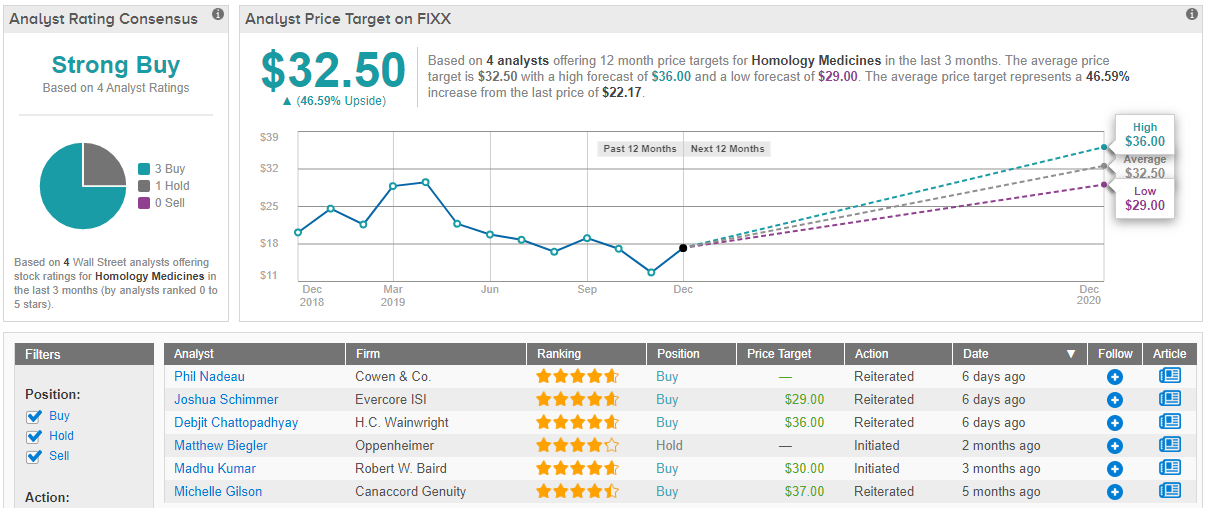

The Street is mostly in agreement with Schimmer on the early stage biotech. A Strong Buy consensus rating breaks down into 3 Buys and 1 Hold. An average price target of $32.50 indicates upside potential of 47%. (See Homology Medicines stock analysis on TipRanks)

LiqTech International Inc (LIQT)

The final ticker on our list has the smallest market cap of the lot. At $108 million, LiqTech qualifies rather as a ‘micro-cap’.

Headquartered in Denmark, the clean technology company specializes in products for the environmental industry including ceramic membranes for liquid filtration and diesel particulate filters to control soot from diesel engines.

LiqTech’s recent 3Q report included record quarterly revenue and net income. Revenue for 3Q19 was $9.7 million, representing a third consecutive quarter of record revenue. This figure is up from $9.3 million in the previous quarter and represents a 189% increase from 3Q18. Net income came in at $656,000, improving dramatically from a net loss of $922,000 in last year’s third quarter, and a big step up from $147,000 in 2Q.

The fourth quarter, though, has seen LiqTech experience mechanical issues in two of the company’s four new furnaces on order. Nevertheless, Lake Street analyst Robert Brown expects LiqTech to overcome the issues. The first furnace is set for installation before the end of the year and should provide the company with an additional “$15M-$16M in quarterly revenue capacity.” With the IMO (international maritime organization) sulphur limit deadline of January 1, 2020 quickly approaching, the analyst notes “LiqTech’s demand trends remain strong.”

Therefore, Brown kept a Buy rating on LiqTech and a price target of $10.00, suggesting upside potential of a grand 89%. (To watch Brown’s track record, click here)

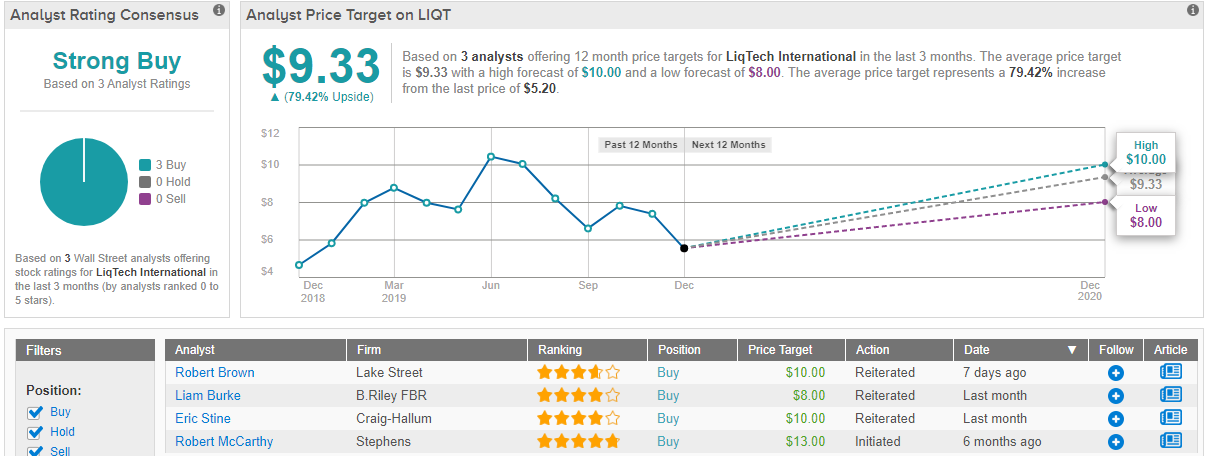

According to Brown, then, LiqTech won’t be a micro-cap for much longer, but what do his colleagues think? Only 2 other analysts have kept tabs on the Scandinavian filtration wiz, but both deem LiqTech a Buy, therefore handing it a Strong Buy consensus rating. An average price target of $9.33 implies gains of 79% could be in the cards over the next year. (See LiqTech price targets and analyst ratings on TipRanks)