The objective of any investor is a simple one: to make money.

While this objective couldn’t be clearer, it is much harder putting it into action. How is one to spot the potential of a stock on a downward spiral or one which has been rising high yet still has more fuel in the tank? Or what about the investor’s holy grail; Catching a stock before it takes off and then reaping its multiplying rewards?

TipRanks’ Stock Screener comes in handy here. The tool includes filters such as price target, analyst consensus and news sentiment, amongst others, to help investors get the lowdown on a stock.

So, we opened up the Stock Screener to zoom in on 3 tickers that have the potential to soar over the next 12 months. And by soar, we mean soar till you can see them no more. The out of sight types with potential for triple-digit returns. Moreover, currently on the Street, these 3 choices all have a Strong Buy consensus rating. Let’s have a look.

RedHill Biopharma (RDHL)

It has been a busy few months for gastrointestinal disease specialist, RedHill Biopharma.

In November, the biotech secured FDA approval for Talicia, the company’s treatment for Helicobacter pylori infection in adults. The drug’s approval marked the first instance of a rifabutin-based therapy receiving the FDA’s blessing.

The positive development followed October’s announcement of a $36 million strategic investment by Cosmo Pharmaceuticals, which includes an exclusive license agreement for the U.S. rights to Aemcolo, Redhill’s treatment for travelers’ diarrhea, a condition bought on by non-invasive strains of E. coli in adults. The deal leaves Redhill’s balance sheet debt free and well positioned for the launch of Talicia.

Nomura’s Christopher Marai thinks “Talicia is undervalued” and argues that the company has what it takes to execute the drug’s launch. The 4-star analyst said, “RDHL has ~40 sales reps, and its HQ in Raleigh, NC, and has been prepping for the Talicia launch for over three years. RDHL is actively targeting ~10,000 HCPs and has relationships with top payers and PBMs, representing ~80% of commercial lives. RDHL is capable of launching this drug in the U.S. without a partner and, thus, should be able to keep 90% margins. The ramp of the launch may be slow, but RDHL is already doing outreach.”

The company has several other treatments in the pipeline, including RHB-104, a treatment for Crohn’s disease, which showed positive top-line results from a Phase 3 trial. This led Marai to conclude that there is “significant opportunity” over the next 12 months.

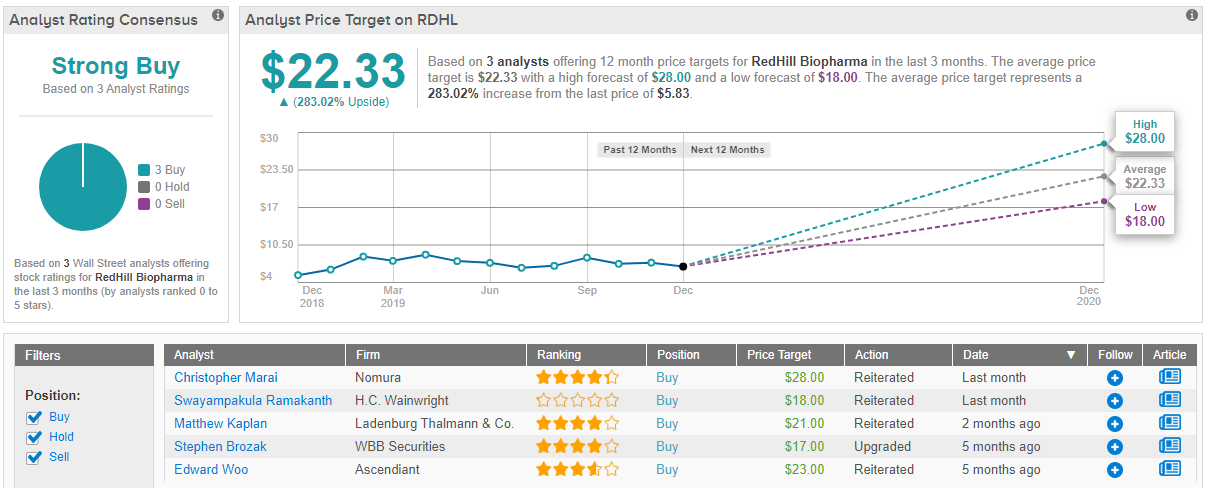

To this end, Marai reiterated a Buy rating on RedHill, alongside a price target of $28. This indicates upside potential of a massive 380%. (To watch Marai’s track record, click here)

Only two other analysts have thrown the hat in over the last three months with a view on the promising biopharma. Both, though, rate the stock a Buy, thus bestowing on RDHL a Strong Buy consensus rating. An average price target of $22.33, implies skyscraping upside potential of 283%. (See RedHill stock analysis on TipRanks)

Cabaletta Bio (CABA)

Fresh out of the box is newly listed biotech Cabaletta Bio. The micro-cap went public less than two months ago but is already drawing a small but vocal following on the Street.

CABA’s platform uses CAR T cell technology to selectively target B cell-mediated autoimmune diseases. The company’s vision is to “develop and launch the first curative targeted cellular therapies for patients with autoimmune diseases.”

According to Cabaletta, the CABA platform has applicability for more than two dozen B cell-mediated autoimmune diseases and the company has several drugs already in the pipeline. Its lead program is DSG3-CAART, a treatment for mucosal pemphigus vulgaris (mPV). The FDA has approved an IND (investigational new drug) application for the treatment, with clinical trials expected to start in 2020.

Evercore’s Joshua Schimmer thinks “there is strong rationale underlying CABA’s target indications.” The 5-star analyst said, “CABA has presented strong preclinical data suggesting that CAAR-T therapies should have utility for autoimmune diseases. However, clinical results will be needed to determine if complete depletion of pathogenic B-cells without relapse (a ‘cure’) is possible without preconditioning, the effect of soluble antibodies on potential for cytokine release syndrome and risk of initial disease flares. In our view, the preclinical data has been impressive, and the company has been thoughtful about potential process changes which could mitigate these risks if they do arise.”

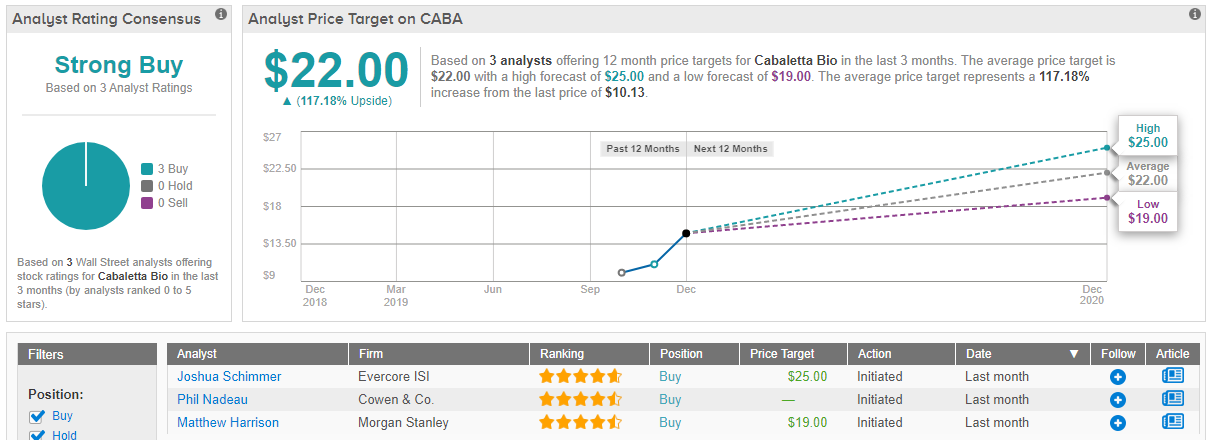

With this in mind, Schimmer initiated coverage on Cabaletta with an Outperform rating and set a price target of $25, implying huge upside potential of 147%. (To watch Schimmer’s track record, click here)

On the Street, there are currently only two other analysts tracking the fledgling biotech, both deeming CABA a Buy. Therefore, Cabaletta has a Strong Buy consensus rating. The average price target is $22, indicating gains of 117% could be in the cards over the next 12 months. (See Cabaletta stock analysis on TipRanks)

Village Farms International Inc (VFF)

Bucking the trend this year is cannabis producer Village Farms. Unlike the general downturn in the cannabis industry’s miserable 2019, VFF’s share price is up by 84% year-to-date.

What differentiates this company from other cannabis growers is VFF’s background. The company’s foray into the cannabis industry comes off the back of years growing and selling vegetables, and it has a reputation as a low-cost producer of tomatoes and cucumbers, amongst other produce.

Village Farms has a majority stake in Pure Sunfarms, one of the single largest cannabis growing operations in the world. The company has applied its growing expertise and greenhouse equipment to the new venture, an investment that is already bearing fruit; Pure Sunfarms recently signed an agreement with the Alberta Gaming, Liquor & Cannabis (AGLC) commission to supply recreational cannabis to licensed retailers in Alberta.

Raymond James analyst Rahul Sarugaser thinks VFF’s background bodes well for the future. The 4-atar analyst noted, “Village Farms is leveraging more than 30 years of fresh produce cultivation experience—30 years developing intimate knowledge of its greenhouses and region-specific climate— to pursue opportunities in cannabis… From VFF’s first announcement describing aspirations in the cannabis industry—less than three years ago—to the present, Pure Sunfarms has become the lowest cost greenhouse grower in Canada, averaging an all-in production cost of US$0.48/g (C$0.63/g) last quarter.”

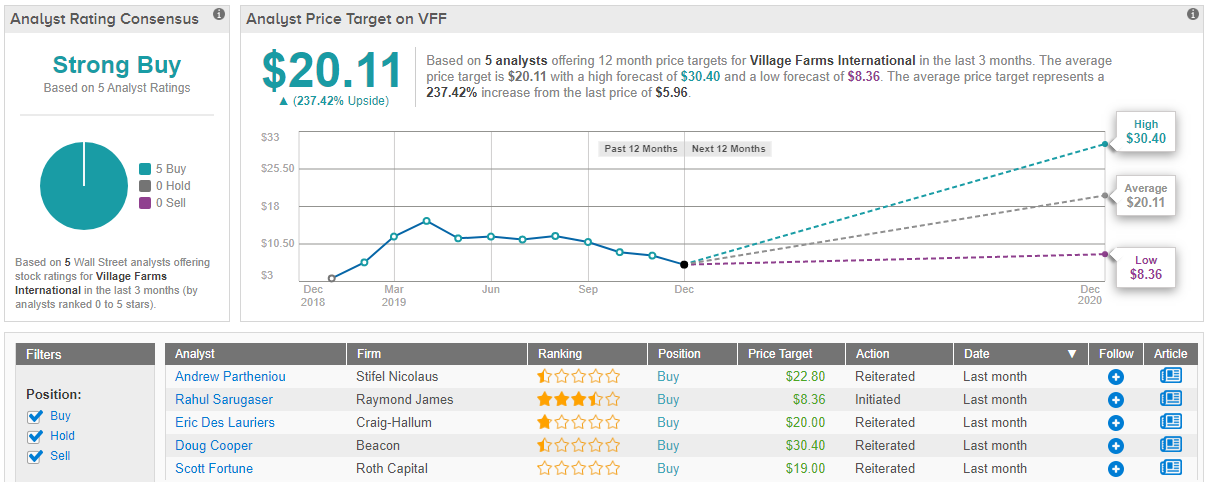

Therefore, Sarugaser initiated coverage of Village Farms with an Outperform rating and price target of $8.36. Should the target be met over the next 12 months, gains of 40% could be in place. (To watch Sarugaser’s track record, click here)

Sarugaser’s optimistic thesis is dwarfed by his colleagues’ target for the cannabis grower. A Strong Buy consensus rating breaks down into 5 Buys, with the average price target of $20.11 indicating upside potential of 237%. (See Village Farms stock-price forecast and analyst ratings)

To find good ideas for stocks trading at fair value or better, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.