April has seen steady growth on the S&P 500, as the index gained nearly 15%. It’s yet another sign that the stock market, at least, is recovering from the coronavirus-induced crash that began in February. The jury is still out on the economy as a whole; Q1 GDP was down by 4.8%, and unemployment insurance claims exploded to record levels in recent weeks.

With such a clouded long-term forecast, and plenty of evidence for both the bulls and the bears, the smart play now is to buy into rising dividend stocks, shoring up the portfolio for whatever lies ahead. The advantage of such a fundamentally defensive strategy is obvious: stocks that are rising now will bring the immediate gains of share appreciation, while strong dividends will provide a steady income stream regardless of market conditions.

We’ve used TipRanks database to seek out small-cap stocks with high dividends – that is, with yields exceeding 10%. To narrow it further, we looked only at stocks with ‘Strong Buy’ consensus ratings that offer upside potential of 35% or more.

Great Ajax Corporation (AJX)

We’ll start with a real estate investment trust, as this is a segment that typically offers high dividend yields. These companies, which exist to invest in, own, manage, and operate a range of commercial and residential real estate assets, are required by law to return a high percentage of their profits directly to shareholders – and they usually use dividends as the vehicle for the return. Great Ajax focuses primarily on the single-family residential niche, investing in mortgage loans and securities backed by the homes.

Ajax had a rough time in the past couple of quarters. Q4 showed EPS of 31 cents, 24% below the forecasts, but also down 14% sequentially 9% year-over-year. Those numbers were recorded before the coronavirus epidemic forced the economic shutdown – and before millions of people were forced out of work, making it more difficult for them to meet and maintain mortgage payments. Looking ahead, the company is expected to show 34 cents EPS, above Q1’s number, but still down 5.5% yoy.

Perhaps a more important number for investors is the dividend. AJX paid out 32 cents per share in March, its regular quarterly dividend, despite the low Q1 results. The company has a long history of keeping its dividend reliable, and the payment has been set at 32 cents for the past 5 quarters. The annualized payment, $1.28, gives a yield of 14.4%. This is more than 7x higher than the average dividend yield among S&P-listed stocks.

After making the dividend payment, which exceeded available quarterly earnings, AJX completed an issuance of $80 million in private placement on common stock, a move undertaken to bring in new capital at affordable rates. The move also gives AJX flexibility in responding to market moves and economic conditions going forward.

5-star analyst Kevin Barker, of Piper Sandler, likes AJX shares, as he sees the company with a sound foundation for operations. He writes of Great Ajax’ portfolio, “The vast majority of AJX’s asset base consists of residential whole loans bought at a discount to par. These assets will see pressure on forward dividend yields due to an extended duration from forbearance programs and various other workouts, but the risk of a near-term impairment is low.”

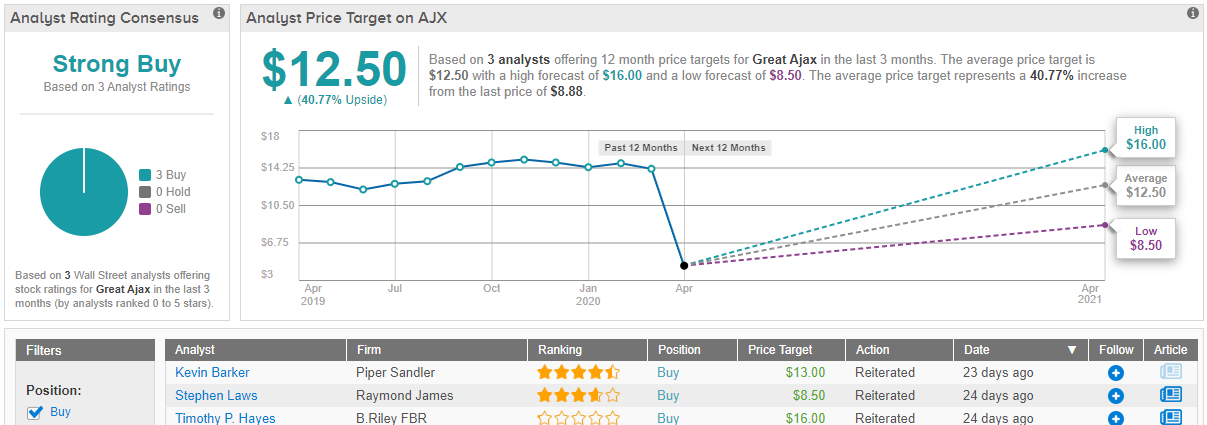

Barker puts a Buy rating on this stock, with a $13 price target that indicates 46% upside growth possible in the next 12 months. (To watch Barker’s track record, click here)

Wall Street seems to agree with Barker’s analysis of AJX. The stock has 3 recent analyst reviews, and all are Buys – making the consensus rating a Strong Buy. Shares are selling for just $8.88, and the average price target of $12.50 implies a robust upside of 40%. (See Great Ajax stock analysis on TipRanks)

Saratoga Investment Corporation (SAR)

From REITs we move to investment management. Saratoga invests in mid-market private companies, generating its own income through interest on debt, capital appreciation, and equity investments. The company’s investment team manages a total $487 million in assets, and the current portfolio reaches a wide variety of sectors, including software companies, waste disposal, home security, and industry.

In its most recent quarterly report, for fiscal Q3, SAR reported 61 cents in adjusted EPS, above the forecast of 59 cents, but down 6% yoy. Looking ahead to fiscal Q4, for the period ending in February and therefore including the initial stages of the coronavirus epidemic in the US, the company is expected to show 55 cents EPS – which would be a significant decline both sequentially and year-over-year.

Despite recent falloffs in earnings, SAR has kept up its dividend payments. The current payment, at 56 cents, represents a 14% yield, which is strong enough to offset the stock’s share price depreciation in the recent bear slide. At 91%, the payout ratio indicates that SAR can afford the dividend at current income levels, and the company has sufficient liquidity, including $81.1 million in cash on hand, to keep up the payments. Saratoga has been raising its dividend steadily over the past three years.

Compass Point analyst Casey Alexander notes an important, but obvious point, in his recent review of BDC stocks: “In what has become a complete business stoppage, assumption #1 is that no one gets out unscathed.”

Applying that logic to Saratoga, Alexander wrote on April 2, “SAR dodged a potentially fatal bullet with the sale of Easy Ice, a provider of ice-making machines for hotels, restaurants and bars. Still, we understand that lower middle market borrowers are more vulnerable to business stoppages. Access to SARs untapped SBA debentures could be critical in offering additional capital to distressed portfolio companies, but the stresses from the current stoppage may be too much for some of them.”

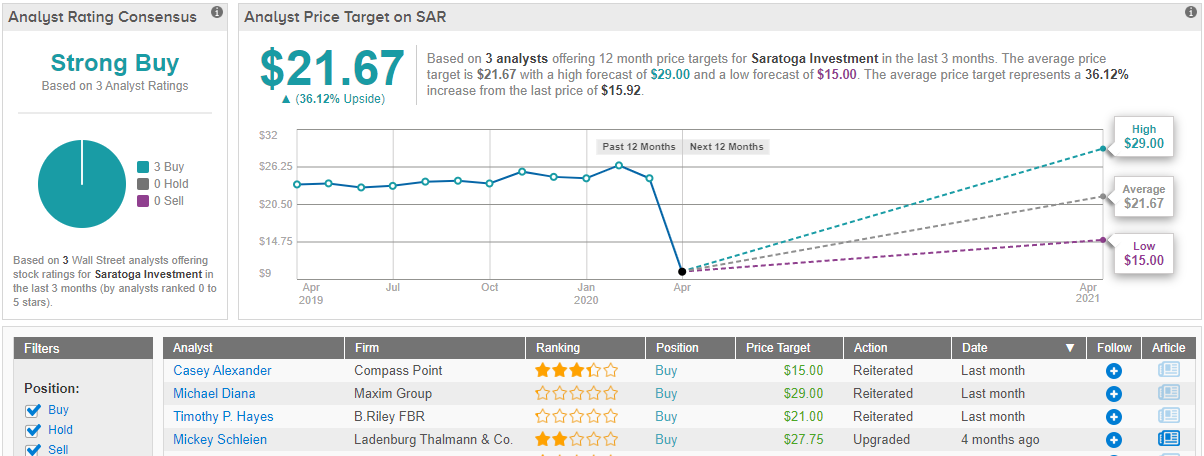

Even with that in mind, Alexander gave SAR shares a Buy rating. The stock was trading at $10.12 when he set a price target of $15, and it has since powered through that target. Look for this analyst to revisit his pricing on SAR in the near future. (To watch Alexander’s track record, click here)

Overall, SAR shares rate a Strong Buy from the analyst consensus, and that view is unanimous – all three of the most recent reviews are Buy. Shares are selling for $15.92, and the average price target is more bullish than Alexander’s. At $21.67, it implies an upside to the stock of 36%. (See Saratoga stock analysis on TipRanks)

Westlake Chemical PRN (WLKP)

The Westlake Chemical Corporation, a major producer of olefins and vinyls, spun off its ethylene business in 2014, forming a master limited partnership called Westlake Chemical Partners. WLKP, the ethylene spin-ff, controls, ethylene production facilities Kentucky and Louisiana, with an annual capacity of approximately 3.7 billion pounds and a 200-mile ethylene pipeline.

The parents company brings in over $8.6 billion in annual revenues; the ethylene Partnership reported $937.6 million in Q4 revenue, netting $61 million in quarterly income. The stock has proven resilient in recent weeks, and has regained almost $8.50 in value since dropping to just over $10 in the bear market crash of late February. That represents a gain of 79% since March 18.

WKLP currently pays out a dividend of 47.25 cents quarterly, or $1.89 annualized. This gives a dividend yield of 10.2%, 5x times higher than the S&P average, and more than 10x higher than Treasury bonds. With the Fed’s move cutting interest rates far down to nearly zero, dividend yields are naturally going to provide the better returns.

Westlake Chemical Partners has a strong position in its industry, as noted by Eduardo Seda, 4-star analyst with JonesTrading. Seda points out, “Under WLKP’s current 12-year ethylene sales agreement with its parent WLK (who is its largest customer as well), with a majority of WLKP’s revenues under this long-term fixed price contract structure, most of the ethylene production is insulated against frequent and often substantial commodity price fluctuations.”

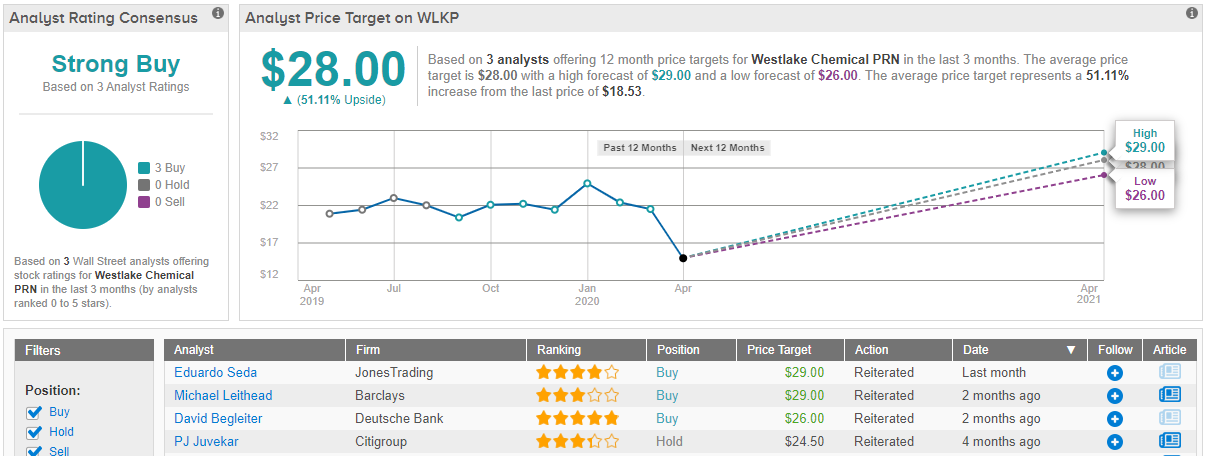

Ensured income is always good for a company, and Seda gives WKLP a Buy rating, along with a $29 price target implying a hefty 56% upside potential. (To watch Seda’s track record, click here)

WKLP, like the stocks above, shows a unanimous Strong Buy consensus view based on 3 Buy ratings. The stock’s shares price is the highest on this list, at $18.53, and the $28 price target suggests room for 51% upside growth this year. (See WKLP stock analysis on TipRanks)