The financial markets shifted into bear territory weeks ago, seeing the worst stock losses since the Great Depression. It’s clear now that the coronavirus pandemic has pushed us into recession; the unanswered question is, how long will it be? For now, though, we have a record to ponder: this has been the worst first quarter for US stocks since record keeping began.

Last week, however, the major indexes have showed some gains. Investors are uncertain if this marks a true turnaround, or just a short-lived rally in a larger bear market. The consensus seems to be toward the latter. Jeffrey Solomon, CEO of the Cowen investment bank, sums it up with great clarity: “I think the activity we’ve seen particularly over the last week has largely been a lot of index rebalancing. Obviously it feels a little bit like a bear market rally. We’ve seen those. They tend to be fast and furious and certainly there for the three days last week…”

Whether this is a short-term rally or the start of something bigger, market expert Jim Cramer believes that now is the time for dividend stocks. Not every stock pays out dividends, but those that do are generally outperforming all other asset returns. Cramer puts it this way: “The idea that you can pick an equity, pick a stock and have a good yield is something that’s very quaint and I think it’s a shame because it’s the way you can really make money now.” In his view, long-term commitment to dividend stocks are the way to go right now.

There are deals to be found in today’s market, and stocks that are practically begging investors to buy then. We’ve opened up the TipRanks database to find three of them, stocks with a combination of attractive features: low cost, high upside, and in a better feature for investors, dividend yields to provide sure returns. Let’s dive in.

Suncor Energy (SU)

We’ll start with a major player in Alberta’s oil industry. Calgary-based Suncor produces synthetic crude oil from the vast oil sands region of the Plains province. The deposits, also known as tar sands, are the world’s largest deposits of bitumen, a form of semi-solid heavy crude oil. Alberta’s oil sands put Canada’s petroleum industry on the global map. Altogether, the oil sands region contains approximately 178 billion barrels of economically recoverable reserves.

SU posted 39 cents EPS in Q4, more than enough to pay out the company’s 35 cent quarterly dividend. That dividend annualizes to $1.40, and like LADR above makes for a high payout ratio of 90%. Suncor has raised its dividend payment three times in the past three years, and has a reliable payment history stretching back to 2011.

The real attraction in SU’s dividend, however, is the yield. SU offers investors a high return of 10.38%. While not off the charts, it is still 5x higher than the 2% average yield among S&P listed companies – and it blows away US Treasure bonds, which are currently averaging below a 1% yield.

Writing on Suncor for Morgan Stanley, analyst Benny Wong sees some cause for concern in current low oil prices, but believes that Suncor has the resources to weather the storm. He says, “We believe the budget update is encouraging for Suncor and should help alleviate some concerns that the company would be unable/unwilling to cut back spending enough. The update brings SU’s budget into the C$3.5-4.5 Bn range and in line with the company’s disciplined capital allocation framework in a <US$45 WTI environment. However, if low prices continue to persist, we believe expectations for deeper cuts by all companies could start emerging…”

Wong puts a Buy rating on SU shares, with a C$30 (US$21.07) price target that implies an upside here of 34%. (To watch Wong’s track record, click here)

Randy Ollenberger, of BMO capital, puts the situation in simple terms: “Suncor is reducing capital spending and production guidance due to the sharp drop in crude oil prices… The company has available liquidity of roughly $8 billion and no debt maturities in 2020. We believe that the collapse in the company’s share price provides an attractive opportunity for long-term investors.”

Ollenberger’s Buy rating is backed by a C$32 (US$22.50) price target, suggesting an upside of 102%. (To watch Ollenberger’s track record, click here)

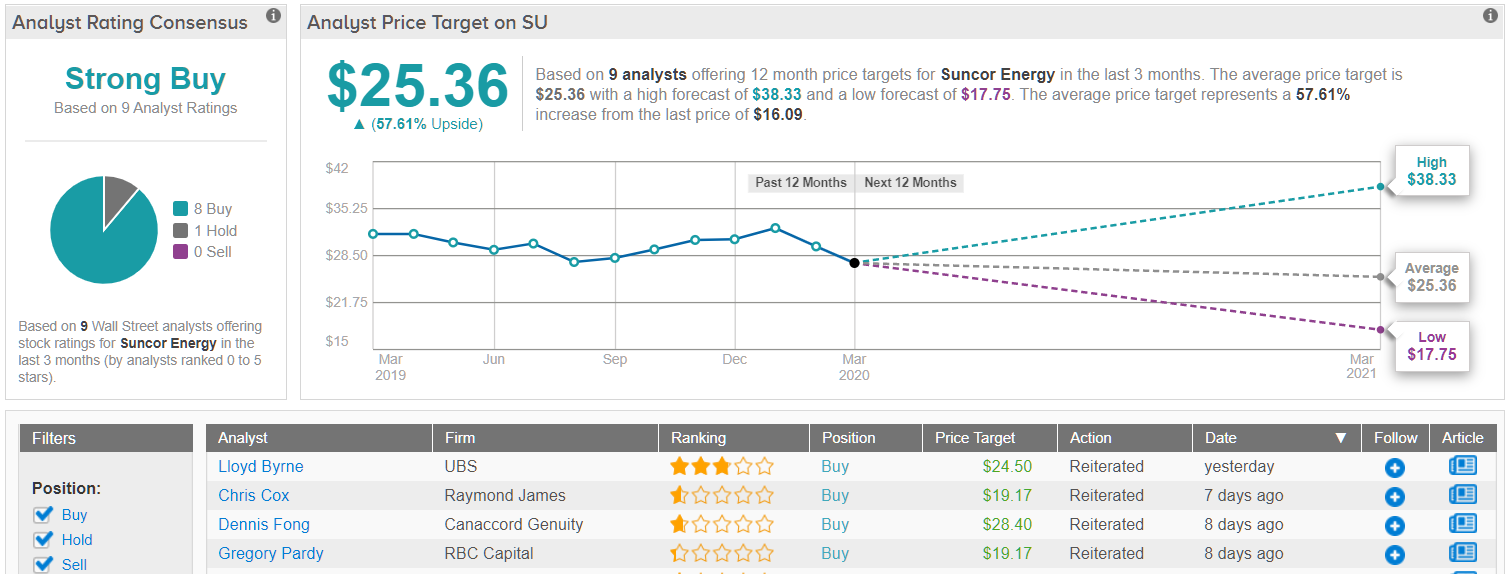

All in all, Suncor has 9 recent analyst reviews, including 8 Buys and a single Hold, giving the stock a Strong Buy rating from the analyst consensus. Shares are priced at just $15.92, and the average price target of $25.36 indicates room for a 57% potential upside in the coming 12 months. (See Suncor’s stock analysis on TipRanks)

Ladder Capital Corporation (LADR)

Ladder specializes in commercial mortgages, providing loans of $5 million to $100 million for customers in New York, Florida, and California. The company boasts a market cap of $573 million, and $58 million in cash on hand. Ladder holds and services mortgage loans worth more than $3.25 billion. Closing out 2019, Ladder saw $122.6 million in net income, making EPS $1.15. This was down 37% year-over-year. On a positive note, the company saw a return on average equity of 11.6%.

Management announced a boon for investors in Q1, with a dividend of 34 cents per share, for stockholders of record on March 10. This annualizes to $1.36, and gives the stock a powerful yield of 28.7%. That yield is simply stellar – there are few stocks, and few investments of any sort, that approach a yield of that magnitude. The payout ratio is high, however, at 92%, showing that while the company can afford the payment, there is little room for further increases.

Deutsche Bank analyst George Bahamondes writes of LADR, “We are upgrading LADR to Buy following a 19% decline since late last week… LADR currently trades at 1.01x of undepreciated book value and pays a well-covered 9.9% dividend yield. The company has a $41 million share buyback plan in place… In addition to potential buyback support, the current dividend yield provides some embedded downside protection should the stock continue to trade down near-term… we believe LADR’s held on balance sheet senior secured loan portfolio, CMBS holdings, and owned properties provide sufficient cash flow to cover the current 34c dividend over the next 12-18 months…”

Bahamondes backs his upgraded Buy rating with a price target of $18, implying an enormous upside of 298%. (To watch Bahamondes’ track record, click here)

5-star analyst Steven Delany, from JMP Securities, is also bullish. He rates the stock a Buy, and his $19 price target indicates an upside potential of 320%. (To watch Delany’s track record, click here)

Backing his stance, Delany says, “Core earnings were also still able to comfortably cover the cash dividend of $0.34/share, with a coverage ratio of ~118%. Core return on average equity for the fourth quarter was 11.5%, which marks the eleventh consecutive quarter with a double-digit core return on average equity.”

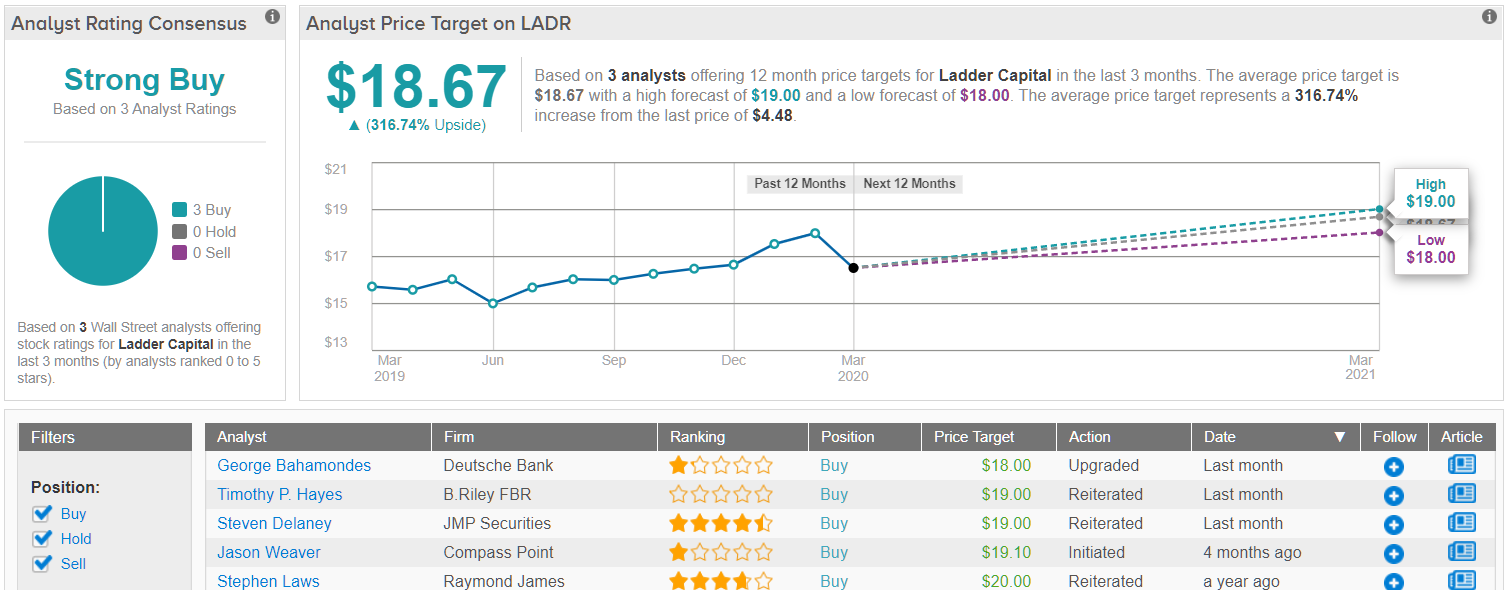

Overall, LADR shares have a Strong Buy rating from the analyst consensus, based on 3 recent reviews, all of which are on the Buy-side. The stock is selling for a discount after recent losses, at just $4.52, but the average price target of $18.67 shows a gigantic upside potential of 316%. (See Ladder stock analysis on TipRanks)

Apple Hospitality REIT, Inc. (APLE)

Last stock on our list is a real estate investment trust, which makes sense – these companies are required by tax law in most jurisdictions to return a high percentage of their income to shareholders, and dividends are a common vehicle for that return. APLE inhabits the commercial sector of its industry, owning, operating, and leasing hotels and other hospitality-related properties. The company’s properties boast over 30,000 guest rooms in more than 80 markets across 34 states.

The current downturn has not been good for APLE, as quarantines and lockdowns are hitting the hospitality industry harder than most other sectors. APLE’s last quarterly report covered Q4, just as the coronavirus was starting to spread, and showed FFO (funds from operations, the REIT equivalent to EPS) of 32 cents. This was 1 cent below the estimates, and down 11% year-over-year. Revenues were also down yoy, at $290 million, but edged over the forecast by 0.5%.

APLE shares bottomed out last week at just $4.84, but have since bounced back 89%. Where the shares really excel for investors, however, is in the dividend. The stock returns a 13% yield, based on an annualized payment of $1.20. The dividend is paid out monthly, at 10 cents, and the company shows a typically high – for REITs – payout ratio of 93%.

Analyst Brian Maher, of B Riley FBR, puts a $12 price target on this stock, implying a strong upside of 38% and backing his reiterated Buy rating. (To watch Maher’s track record, click here)

In his comments on the stock, Maher writes, “We are lowering our estimates and price target on Apple Hospitality REIT (APLE) to better reflect the impact of COVID-19… Given APLE’s portfolio positioning and strong balance sheet entering 2020, we believe it will be one of the more insulated hotel REITs… We believe APLE will perform better than most lodging REITs in 2020…”

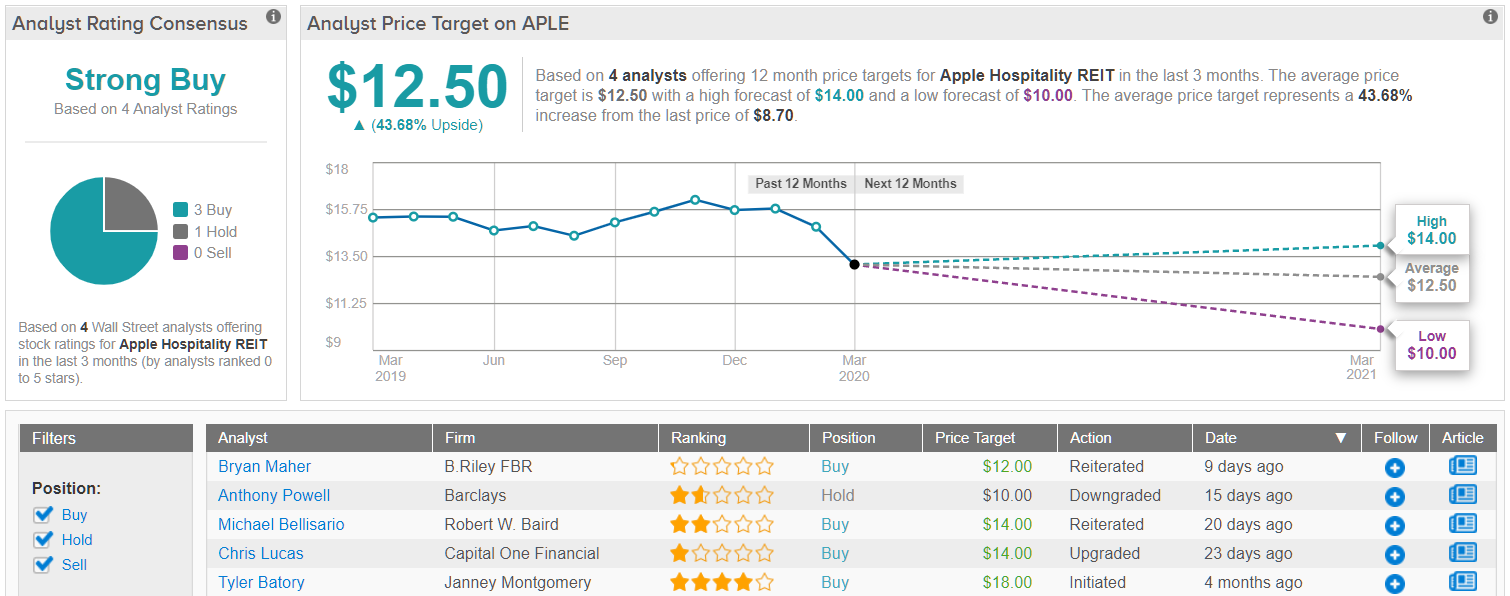

APLE shares keep a Strong Buy consensus rating, based on 4 reviews that break down to 3 Buys and 1 Hold. The stock is bargain priced at $8.72, while the average target of $12.50 suggests a 44% upside potential. (See Apple Hospitality’s stock analysis at TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.