Sometimes, sentiment can turn on a dime. The Senate passed a coronavirus relief bill, and the stock markets responded with their third consecutive day of gains – the first time that has happened since mid-February. The passage of the Senate bill by a unanimous vote now sends the measure to the House. President Trump has already said that he will sign the measure when it reaches his desk.

The S&P 500 has gained 238 points in the last two sessions, the index’s best two-day gain since November 2008. The Dow Jones gained 2.4% yesterday, and stands at 21,200 after adding 2,600 points in the last two sessions. After weeks of mostly steady market declines, the gains of the past two sessions are a much-needed shot in the arm, boosting investor morale and raising hopes that now, at last, the worst of the bear market may be behind us.

Which means, investors need to decide where to allocate their funds. There’s no telling how long this high note will be sustained, so defensive stock plays are probably still a wise choice. We’ve pulled three such stocks out the of the TipRanks database, using the Dividend Calendar tool to find stocks that aren’t just showing a temporary gain but are also likely to continue paying out reliable returns.

Williams Companies, Inc. (WMB)

We’ll start in Oklahoma, where Tulsa-based Williams Companies operates in the utility realm, providing processing and transport services for natural gas. Among WMB’s assets, it controls gas pipelines from Rocky Mountain production regions to the Pacific Northwest, as well as pipelines and processing facilities connecting Appalachian and Texan drilling areas with each other and with export facilities on the Gulf and East coasts. Williams handles nearly one-third of the natural gas used by US commercial and residential customers.

The company showed revenue gains in the fourth quarter, which was a relief after it missed in Q3. The Q4 top line came in at $2.1 billion, beating the forecast by 2%, and growing a half-percent sequentially. EPS missed the forecast by one cent, coming in at 24 cents per share. That number was, however, up 26% year-over-year.

WMB also showed a yoy gain in distributable cash. The cash available grew more than 10% yoy, to $828 million. That is a good sign for income-minded investors, as it ensures the sustainability of WMB’s dividend.

That dividend currently yields over 12%, more than 6x times higher than the average dividend in the Basic Materials stock sector. The payment is $1.60 annualized, payed out at 40 cents per share quarterly. The company has raised the dividend payment three times in the past three years.

UBS analyst Shneur Gershuni covers this stock, and reiterates his Buy rating. His $28 price target suggests a powerful upside potential of 97%. (To watch Gershuni’s track record, click here)

In his comments on the stock, Gershuni notes the high dividend yield. More importantly for immediate conditions, he also notes the company’s flexibility in coping with the ongoing epidemic: “WMB has three different control rooms and can control G&P and pipelines remotely if needed. WMB doesn’t expect any supply disruption due to the Coronavirus.”

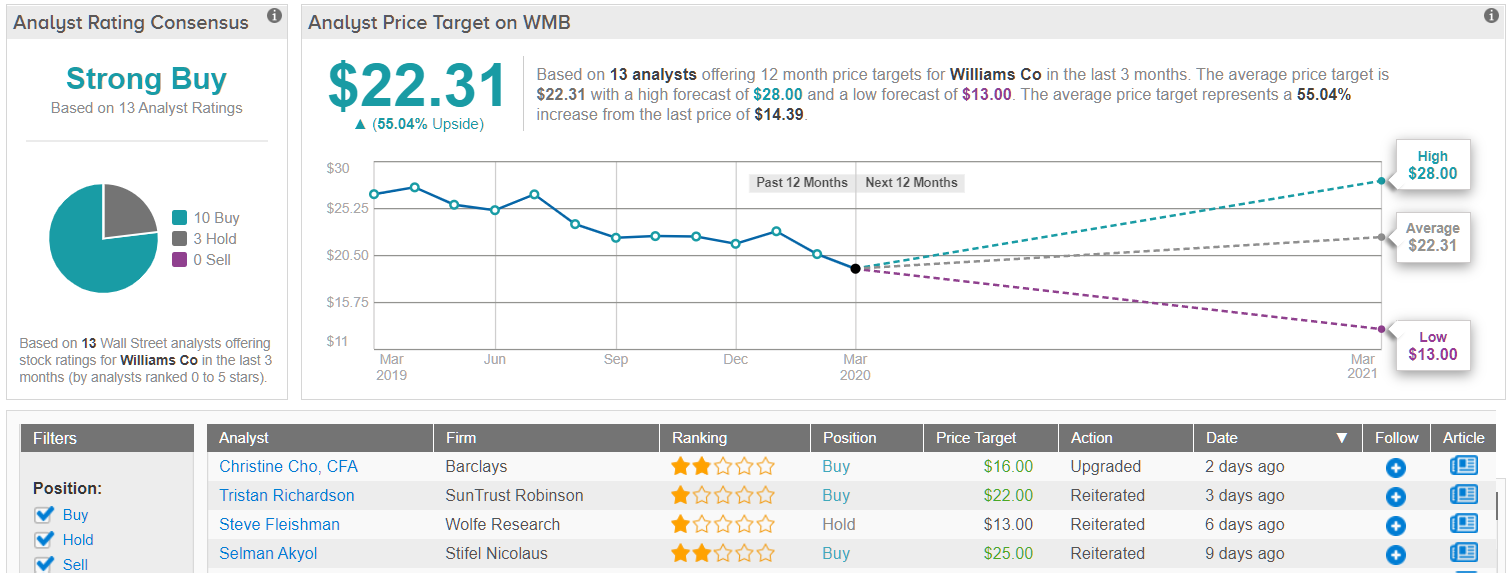

Williams gets a Strong Buy rating on the analyst consensus, based on 13 recent reviews. These include 10 Buys and 3 Holds. Shares are priced low, at $14.41, but the average price target of $22.31 indicates room for an impressive upside of 55%. (See Williams’ stock analysis at TipRanks.)

TC Pipelines LP (TCP)

The second company on our list is another major player in the natural gas pipeline network in the US and Canada. TC Pipelines is a holding company, acquiring, owning, and operating major interests in natural gas pipelines along the US-Canadian border and through the Midwest. TCP ended 2019 with $280 million in net income, up strongly from a $182 million net loss in 2018. Fourth quarter EPS was well above estimates, at 95 cents, and also up sequentially from 76 cents.

Better for investors, the company reported $340 million in distributable cash flow for 2019. That is key for investors – TCP’s greatest attraction as an investment is its 11.3% dividend, and the company’s high cash flow, combined with a dividend payout ratio of 68%, show that the payment is affordable. TCP pays out 65 cents quarterly, annualizing to $2.60, and has held the dividend steady since May 2018.

RBC analyst Elvira Scotto points out that TCP, focusing on transport pipelines for natural gas, is well protected from the low prices that have been plaguing the hydrocarbon industry. She says of the stock, “We think the regulated gas assets provide a valuation floor, and we think the steady cash flow profile should be attractive in a volatile commodity environment.”

Scotto is upbeat on TCP’s prospects, and shows it with a $44 price target that implies a 62% upside potential. In line with her optimism, Scotto upgrades TCP stock from neutral to Buy. (To watch Scotto’s track record, click here)

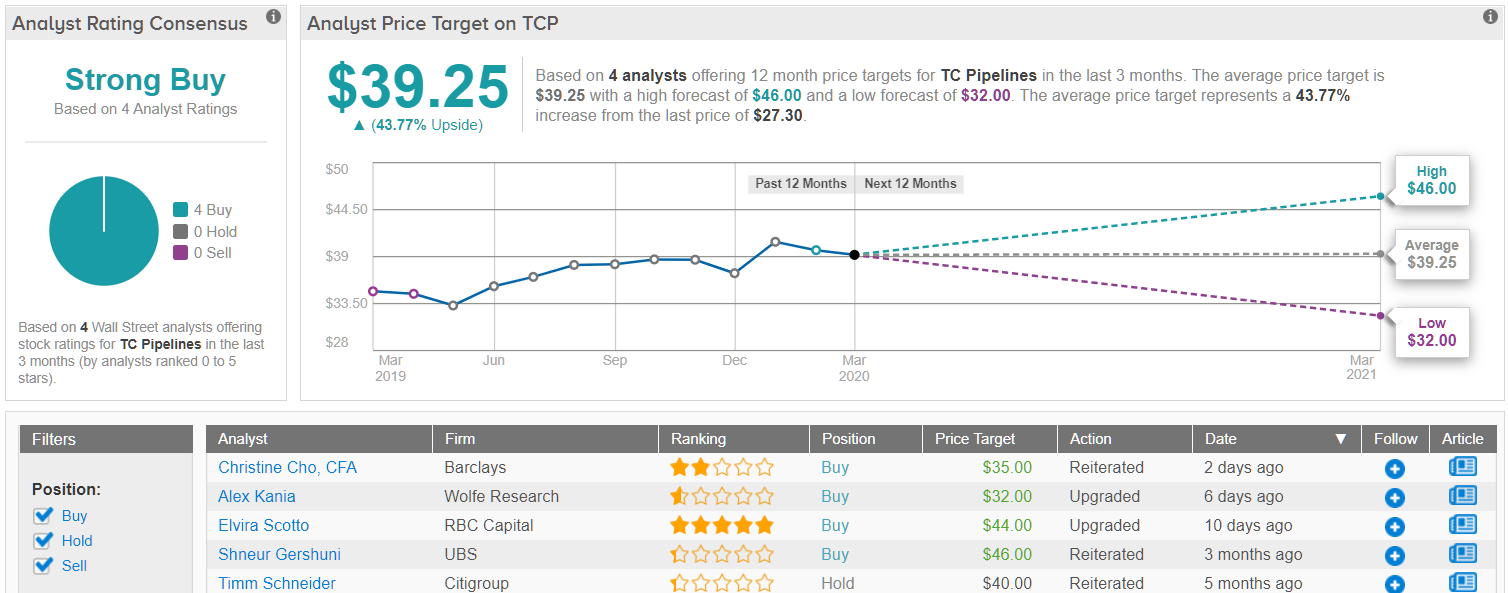

TC Pipelines has a unanimous Strong Buy consensus rating, based on 4 recent Buy-side reviews. The stock is selling for $26.82, and the average price target, $39.25, indicates room for a profitable 44% upside potential. (See TC Pipelines’ stock analysis at TipRanks)

EPR Properties (EPR)

We’ll wrap up this list of high-yield dividend stocks with a real estate investment trust, because you just can’t talk dividends without looking at at least one REIT. These companies have a legal requirement to return a certain percentage of their income with shareholders, and the usual mode chosen is the dividend. In EPR’s case, this leads to a spectacular yield of 17%.

In real terms, this comes out to per-share payment of 38.25 cents – paid out monthly, which is a nice touch for investors seeking a regular income stream. The annualized payment is $4.59. EPR has a 7-year history of maintaining – and gradually increasing – its dividend payment. The current yield is far higher than the sector average of 2.02%.

EPR supports its high dividend with a successful portfolio of amusement parks, theaters, ski resorts, and other entertainment properties. Among its assets, the company counts 179 theaters, 13 ski resorts. Among its other moves, EPR owns 1 casino property and 7 fitness and wellness centers.

EPR finished 2019 with EPS of $1.26, just missing the forecast and slipping 10 cents from the year before. The company’s quarterly revenue was up 6.3% year-over-year, reaching $154.77 million, although it was 3% below estimates. With the COVID-19 epidemic spreading, EPR’s focus on entertainment-related properties will likely prove a net negative in the short- to mid-term, but investors can expect a surge of pent-up demand when quarantines and lockdowns are lifted.

5-star analyst Ki Bin Kim, of SunTrust Robinson, notes that EPR is taking defensive measures to prevent deep losses during the current coronavirus environment. He writes of the stock, “Right now, FFO accretion is NOT the main concern. It’s about safety; it’s about the balance sheet. Keeping the $500m of cash on the balance sheet and 100% availability of the $1bn line of credit is much more important than trying to deploy capital…”

Kim sees the company’s defensiveness as a smart move, and maintains his Buy rating on the stock. His $60 price target suggests an upside here of 124%, showing the company’s underlying strength. (To watch Kim’s track record, click here)

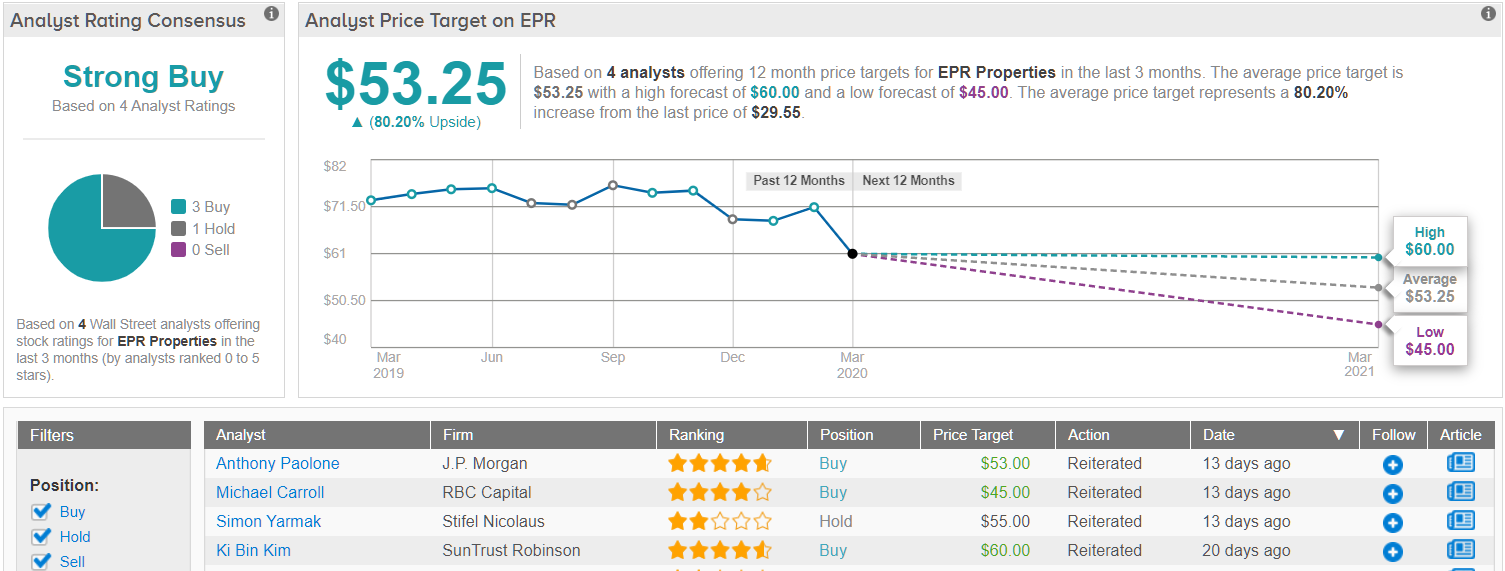

EPR’s 4 most recent reviews include 3 Buys and 1 Hold, making the analyst consensus rating a Strong Buy. Shares in this stock are selling for $29.55, while the $53.25 average price target implies a valuable 80% upside potential. (See EPR’s stock analysis at TipRanks)