The oil industry in North America has grown dramatically in the last decade. The rapid expansion of fracking technology has opened previously non-viable oil reserves, and discoveries of recoverable shale oil in Texas and the Dakotas have made the US into the world’s largest oil producer six years running. In fact, this past September, the US exported more crude oil than in imported – the first time that has happened since records began in 1949.

The boom has not been without growing pains. Expansion of supplies on the market have pushed prices down, negatively impacting oil companies’ incomes and stock prices in recent months. Data for the first week of December showed a surprise build of 800,000 barrels in US stockpiles, a sharp reversal from the expected 2.8-million-barrel reduction. The news put further downward pressure on oil prices.

But oil isn’t just a commodity, it’s a necessity in today’s world. According to Norwegian energy consulting firm Rystad, “North American shale supply will continue growing even in an environment with lower oil prices.” The firm sees shale production’s robust growth continuing into 2022.

So, the main variable for oil prices heading into next year and beyond is likely to be demand. Oil producers and midstream suppliers will continue to see a profitable environment despite the headwinds as long as economic conditions remain firm. And given last week’s jobs report from the US, that looks to be a sound prediction for the near-term – making the energy sector attractive for investors.

To help that along, we’ve used the TipRanks Stock Screener tool to pick out three energy sector players that fit a bullish investment profile. These are Strong Buy stocks with upside potentials exceeding 30%, and the recent price pressure in the oil markets has pushed share prices down, making them bargains to boot.

WPX Energy (WPX)

WPX is typical of the small- to medium-cap extraction companies that are hard at work exploiting the resources of Texas and North Dakota. WPX operates in the Bakken Formation, one of the early oil patches to benefit from the fracking revolution, but most of the company’s operations are centered in the Delaware Basin of West Texas, a component of the larger Permian Basin that holds the largest recoverable reserves in North America.

Recoverable reserves are a key metric in the oil industry, defining the potential resources a company can tap for production and profit. WPX, in its two areas of operation, as more than 480 million barrels of oil equivalent in proved reserves, of which 61% is crude oil and the rest is split between natural gas and natural gas liquids. WPX operates over 700 wells on its land holdings.

Strong reserves and strong production have made WPX profitable. The company brought in $2.3 billion in total revenues in calendar year 2018, with a net income exceeding $150 million. Turning to more recent financial results, WPX showed a Q3 EPS of 9 cents per share, missing the 7-cent forecast but beating the year-ago quarter’s 7 cents. Revenues were even better. The $795 million for the quarter beat the forecast by 25%, and beat the year-ago result by an even more impressive 64%.

Wall Street is understandably sanguine about WPX shares looking forward. Neal Dingmann, from SunTrust Robinson, writes of the stock, “Given the company’s position as one of the strong operators in both the Williston and Delaware, in our opinion, we believe the company could look to act as a consolidator while noting we don’t see the need to make any large acquisitions in the next 6-12 months.”

Dingmann backs up his Buy rating with a $16 price target, implying room for 47% growth on the upside. (To watch Dingmann’s track record, click here)

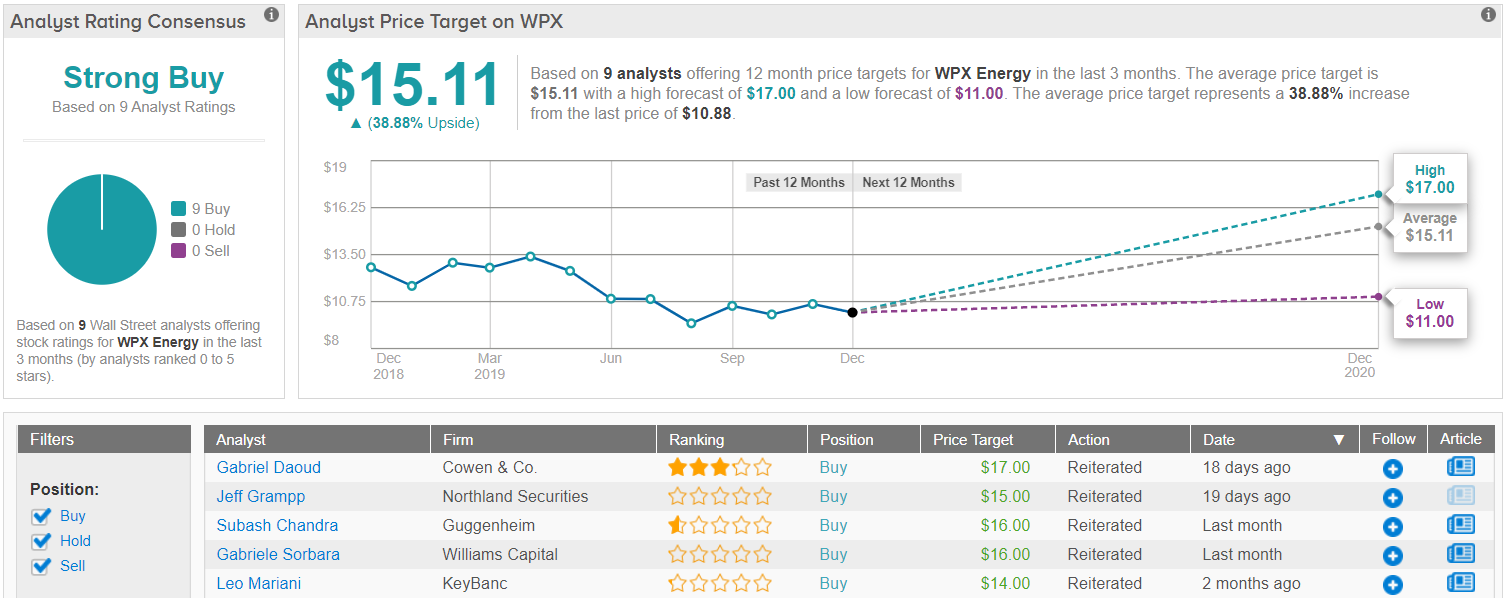

The consensus view on WPX is a unanimous Strong Buy – 9 analysts have given this stock a Buy in recent months. The stock’s low price offers investors a chance to ‘buy the dip’ on a high-upside opportunity. Shares are priced at $10.89, and the average price target of $15.11 indicates potential for nearly 40% growth. (See WPX stock analysis on TipRanks)

Liberty Oilfield Services (LBRT)

Exploration, and proving reserves, is only part of the game in the oil business. Owning a barrel’s worth of oil is no use if it can’t be brought to the surface and shipped to market. This is where the oilfield service companies step in. Production companies own wells and drilling machinery and technology; the services companies provide the specialized equipment, tech, and know-how to conduct fracking operations and activate the wells.

Liberty occupies this niche. The company supplies the water, sand, chemicals, piping equipment, and engineering knowledge to conduct and maintain fracking operations. It’s a difficult sector in which to operate. Overhead is high, while income can vary based on the price oil, and LBRT has seen both top-line revenues and bottom-line EPS decline year-over-year. In the recent Q3 report, the company showed revenues of $515 million, 1.3% below the forecast, and EPS of 15 cents, 44% below expectations.

The poor quarterly results, released at the end of October, hurt share prices, temporarily pushing the stock down by 11%. Share price has since recovered, and surpassed the pre-report values. On a high note, from an investor’s perspective, the current EPS is more enough to sustain the company’s quarterly dividend payout of 5 cents per share. Annualized, this gives LBRT a dividend yield of 2.1%, higher than the average yield among S&P listed companies.

Analyzing the company for JPMorgan, analyst Sean Meakim sets out a bullish case: “The company’s differentiated focus on technology, data analytics, and talent has allowed it to deliver peer-leading profitability and return metrics through the cycle… Liberty’s strong customer relationships should help the company maintain margins above the peer group.”

Meakim gives LBRT a Buy rating with a $12 price target, indicating confidence in an 18% upside. (To watch Meakim’s track record, click here)

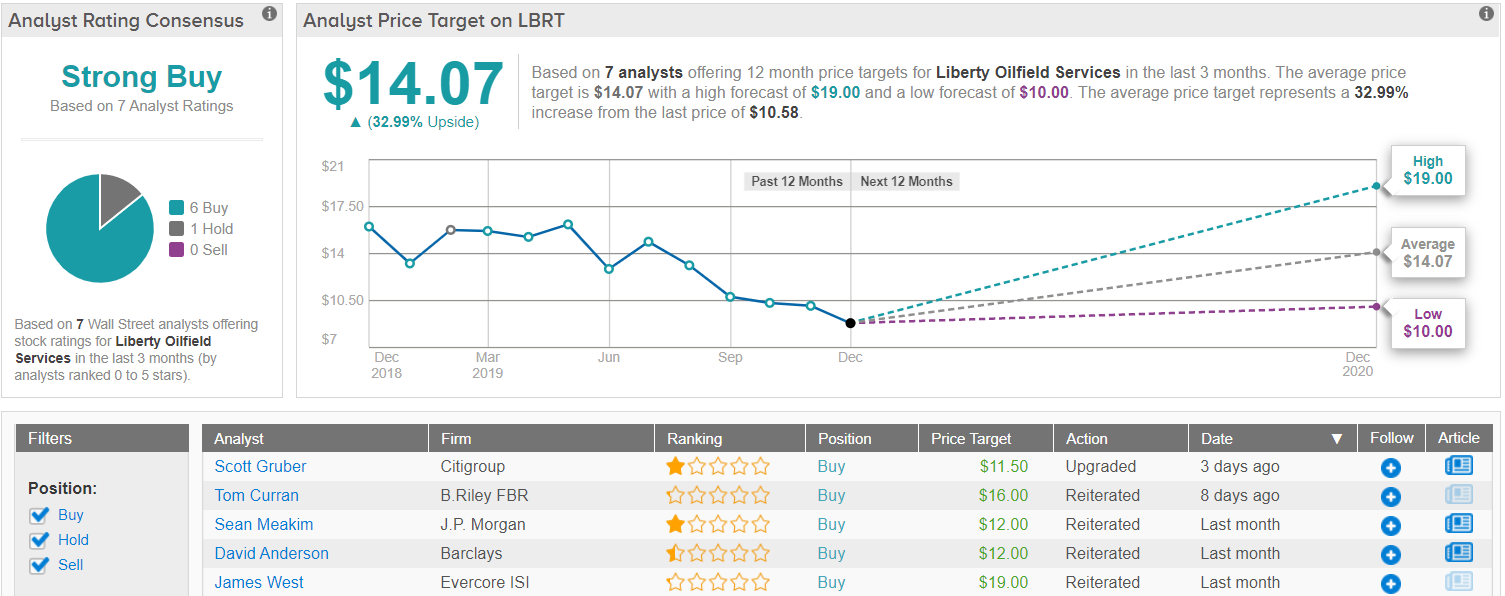

With 6 Buy and 1 Hold ratings given in the past 3 months, LBRT stock gets a Strong Buy from the analyst consensus. The stock’s recent headwinds have pushed the share price down to an affordable $10.62, offering a low point of entry for investors. The average price target of $14.07 suggests an upside potential of 33%. (See Liberty stock analysis on TipRanks)

Cheniere Energy (LNG)

Petroleum isn’t the only product that comes out of oil wells. Oil patches product natural gas and related products in large quantities, sometimes even exceeding the percentage of oil extracted. The flood of natural gas into the markets has driven a revolution in clean energy, as gas burns cleaner than oil. Increased use of natural gas has helped the US to greatly reduce carbon emissions in recent years.

Cheniere Energy, based in Texas, is a leading producer of liquefied natural gas (LNG). Liquified gas is less volatile and more easily transported than the gaseous product, and is the chief form in which gas is conveyed to market. Cheniere buys gas from producers, liquifies the product, and loads it onto ocean-going vessels. The company also owns rail cars and pipelines for overland transport within the US. Cheniere has been exporting LNG from the US since 2016, when it became the first company to do so.

Falling prices, the flip side of high production, have pushed the company into net loss in the last two quarters. In Q3, the company showed an EPS net loss of $1.25, a severe blow when compared to the expected 8-cent per share profit. Revenues, however, were up, at $2.17 billion beating the estimate by 2.4% and gaining 19% year-over-year.

LNG has a great deal of potential, however, even in a low-price regime. Wolfe analyst Steve Fleishman says of the stock, “We believe that upsides are underappreciated by the market including at least one more train and a reversion to wider global gas spreads. We also expect new management to boost visibility and focus on operations and capital efficiency.” Fleisman puts an Outperform rating and $80 price target on LNG, indicating his confidence and a 36% upside. (To watch Fleishman’s track record, click here)

5-star analyst Elvira Scotto, of RBC Capital, agrees that LNG is a Buy proposition. She wrote, in a note last month, “We believe LNG can generate highly visible cash flow growth and return significant cash to shareholders via buybacks and dividends longer-term.” In line with her Buy rating, Scotto sets an $84 target on the stock, suggesting a 38% upside potential. (To watch Scotto’s track record, click here)

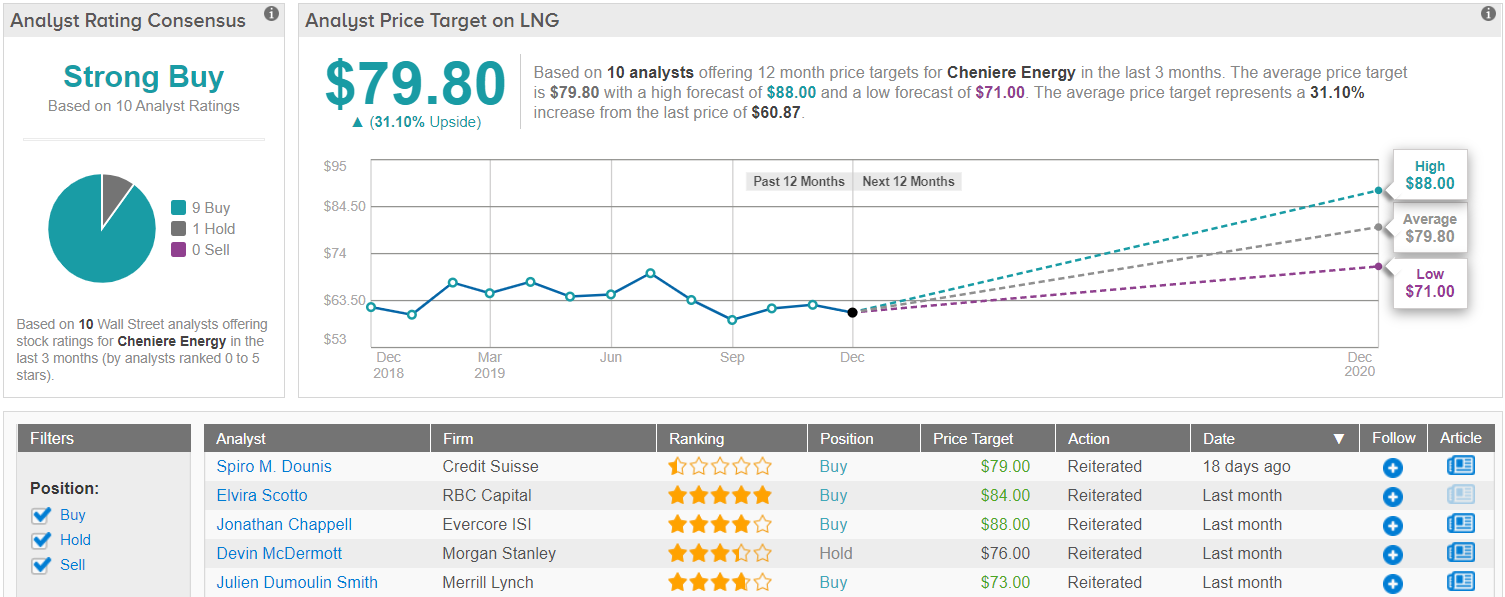

All in all, this natural gas has earned one of the best analyst consensus ratings on the Street. Out of 10 analysts tracked in the last 3 months, 9 are bullish on LNG’s prospects, with just 1 on the sidelines, highlighting a strong bullish backing here. With a healthy return potential of 31%, the stock’s consensus target price stands at $79.80.

Check out these 5 ‘Strong Buy’ stocks that top Wall Street analysts recommend.