John Templeton, the famous fund manager who created the Templeton Growth Fund, remarked, “The time of maximum pessimism is the best time to buy and the time of maximum optimism is the best time to sell.”

If you would like to follow Mr. Templeton’s advice, the casino sector is certainly a good place to start. Due to COVID-19, most, if not all casinos were closed for a significant period of time. Even after they re-opened, there is still concern regarding how long it will take for operations to normalize to pre-COVID-19 levels.

While there’s certainly a degree of risk involved, the down-trodden tickers can be the ones set to present intrepid investors with the most abundant returns. Where investing skill really comes into play, though, is finding the most compelling choices.

With this in mind, we used TipRanks’ database to identify three beaten-down gaming stocks that have earned a “Strong Buy” consensus rating from the analyst community.

Boyd Gaming (BYD)

We’ll start off with Boyd Gaming, which operates 29 gaming properties. The company is divided into three segments: Las Vegas Locals, Downtown Las Vegas, and Midwest and South.

Operating performance in the second quarter declined considerably, with all 29 of Boyd’s properties closed for most of the quarter because of the COVID-19 pandemic. Revenue dropped 75.2% to $209.9 million, while adjusted earnings plummeted 147% to a net loss of $110.5 million, versus the second quarter of 2019. Nevertheless, despite the poor showing, the company handily beat the consensus estimates for revenue and earnings by 25.7% and 47%, respectively.

5-star analyst Joseph Greff, of J.P. Morgan, commented, “Second quarter 2020 results were much better than we expected, with June generating levels of strong (and positive) EBITDAR following recent staggered property re-openings that followed widespread casino closures. Boyd, …reported meaningfully lower operating expenses allowing it to generate impressive year-over-year margin gains (1,000 bps+, wow)…”

The company’s stock is down 16% year-to-date. However, Greff predicts a rebound for Boyd based on its “localized/regional footprint predominantly focused on a drive-to, leisure gaming customer.” The company has an advantage over other gaming companies because it is less dependent on the travel and tourism industry.

According to the J.P. Morgan analyst, there is another catalyst that could propel the stock forward. “Furthermore, we see Boyd as a non-conventional way to play growth in U.S. sports betting, and note that its 5% stake in FanDuel is largely unappreciated/overlooked by investors,” he explained.

Based on all of the above, Greff rates Boyd an Overweight (i.e. Buy), along with a $30 price target, which adds up to upside potential of 21% from the current share price. (To watch Greff’s track record, click here)

Similarly, most of the Street is getting onboard. 8 Buys and 2 Hold assigned in the last three months add up to a Strong Buy analyst consensus. In addition, the $27.50 average price target puts the potential upside at 10.5%. (See Boyd stock analysis on TipRanks)

Las Vegas Sands (LVS)

Next on our list is Las Vegas Sands, the largest gaming company in the world, with a market cap of over $33 billion. The company operates gaming resorts in Asia and the United States. Besides gaming, its resorts feature entertainment, retail malls, restaurants and convention and exhibition facilities.

Consistent with the severe challenges the gaming industry has experienced, the pandemic had a devastating impact on the company in Q2. Revenue plunged 97.1% to $98 million, while LVS posted a net loss of $985 million, compared to net income of $1.11 billion in the prior-year quarter. Similarly, the stock has declined 35% year-to-date.

Howevere, Roth Capital analyst David Bain believes LVS is well positioned with “peer-best liquidity (could survive 18-months in zero revenue environment while still executing Macau and Singapore development projects), while longer-term large new project/M&A optionality remains strong.”

As a result of its strong liquidity, Bain is taking a long-term approach to the stock. “Longer-term investors should be rewarded significantly due long-term Macau structural advantages, mainly its peer-high hotel base and duopoly position in Singapore,” he stated.

Accordingly, the four-star analyst rates LVS a Buy and sets a price target of $52, which means there’s upside potential of 19%. (To watch Bain’s track record, click here)

Overall, LVS gets a Strong Buy consensus rating from the analyst community. This is based on 8 Buy ratings and 2 Holds. The average price target is $56.50, which is more optimistic than Bain’s, and suggests upside potential of 29%. (See LVS stock analysis on TipRanks)

Melco Resorts & Entertainment (MLCO)

Rounding out our list is Melco Resorts & Entertainment, which operates high-end integrated gaming and entertainment resorts in Asia and Europe.

The company has yet to announce second-quarter results. The consensus estimates, which are consistent with those for the rest of the casino industry, are disappointing to say the least. Revenue is expected to fall 81.4% to $268.94 million, and earnings are set to sink 562.5% to a loss of $1.11 per share. No surprise, the stock is down 30% year-to-date.

Despite all of the doom and gloom, Roth Capital analyst David Bain, who also covers LVS, is bullish on the stock. “The combination of MLCO’s valuation, player segment positioning, HK/China Headquarters (hedging concession renewals) …, positions it as the best ‘Macau stock’ to own,” he commented.

Given the challenging times, the company has taken steps to prop up its balance sheet. The Roth Capital analyst noted, “MLCO has taken prudent actions to ensure liquidity, including increasing its capacity (cash of $1.2 billion with revolver capacity of $1.6 billion; selling its 9.9% ownership in Crown; reducing its operating expense run-rate; suspending its regular dividend and implementing executive salary cuts.”

In line with his comments, Bain rates Melco a Buy. He also maintains a price target of $28, which implies hefty upside potential of 70%.

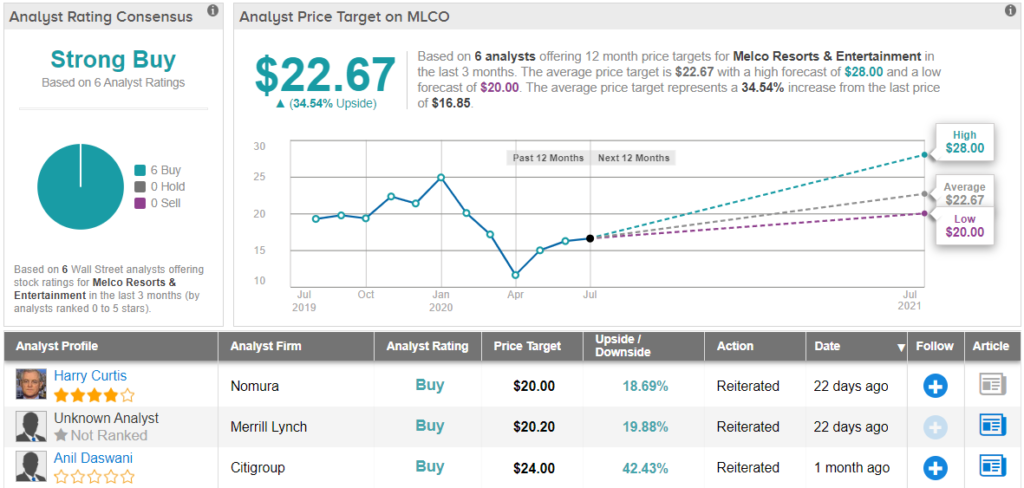

Looking at the consensus breakdown, other analysts like what they see. Melco’s Strong Buy consensus rating breaks down into 6 Buy ratings and no Holds or Sells. The average price target is $22.67, and while not as high as Bain’s, still signifies healthy upside potential of 34.5%. (See Melco stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.