Penny stocks are controversial, to say the least. When it comes to these under $5 per share investment opportunities, Wall Street observers usually either love them or hate them. The penny stock-averse point out that while the bargain price tag is tempting, there could be a reason shares are trading at such low levels like poor fundamentals or insurmountable headwinds.

However, the other side of the coin has merit as well. Naturally, with these cheap tickers, you get more bang for your buck in terms of the amount of shares. On top of this, other more expensive and well-known names aren’t as likely to produce the colossal gains that penny stocks are capable of.

Given the nature of these investments, Wall Street analysts recommend doing some due diligence before pulling the trigger, noting that not all penny stocks are bound for greatness.

With this in mind, we’ve dipped into the TipRanks database to find three penny stocks that offer a solid combination of risk and reward. With a low point of entry, and at least 30% upside potential, these stocks offer investors a chance to maximize their possible share appreciation while minimizing their initial outlay.

Montage Resources Corporation (MR)

We’ll start in the oil and gas sector, where Montage Resources is a small-cap player in Appalachia. The company engages in hydrocarbon exploration, production, and transport, with natural gas and crude oil operations in Pennsylvania, Ohio, and West Virginia. Montage boasts 325 actively producing wells and over 195,000 undeveloped acres.

The company finished 2019 with a gangbusters quarter, seeing EPS come in at 85 cents and revenues hit $174.1 million. EPS was a whopping 608% over the forecast. Both numbers were also up significantly year-over-year, by 67% and 34% respectively. Looking ahead to the Q1 report, due out in May, MR is projected to show an EPS of 25 cents.

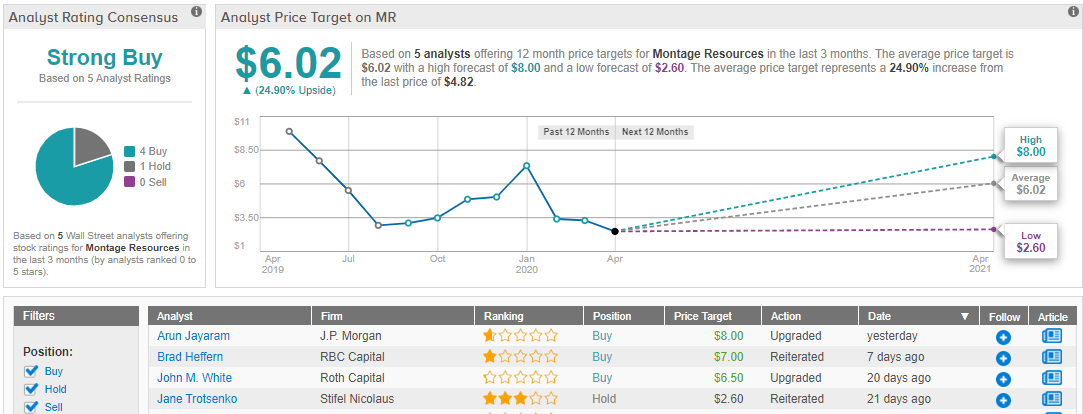

Despite the strong finish to 2019, MR shares are down 40% in 2020. That share depreciation has brought MR down to an attractive point of entry, just $4.82 per share. It’s not often that investors will find an oil play with so low a share price. Given the industry’s ability to generate both cash and profits, even when prices are down, it points to high potential from this company.

Roth Capital analyst John White agrees. He writes, “We estimate MR will generate $32 million of free cash flow in 2020… We note the bulk of this free cash flow, $20.4 million, occurs in 1Q due to robust production and much higher commodity prices versus the remaining quarters.”

But cash flow isn’t the only reason to buy into Montage. White also notes that while the world’s major oil suppliers are moving to cut production and boost prices, the cuts may not last – and if they resume their crude oil price war, Montage is well-positioned to gain: “Assuming OPEC+ continues to add incremental crude oil supply into a market with declining oil demand, we think gas weighted names have a positive outlook compared to oil weighted names and MR is 81% gas…”

In line with his outlook on the company, White gives MR shares a $6.50 price target implying an upside of 35%. He has also upgraded his stance on the stock, moving from Neutral to Buy. (To watch White’s track record, click here)

In general, the rest of the Street has an optimistic view of MR. The stock’s Strong Buy status comes from the 4 Buy ratings and a single Hold issued in the past 3 months. The upside potential lands at 25%. (See Montage stock analysis on TipRanks)

McEwen Mining (MUX)

From the black gold, we’re on to the yellow variety. McEwen Mining, based in Toronto, is another small-cap company in the natural resources sector, this time mining for both gold and silver in North and South America. The company pulled 174,420 gold equivalent ounces out of the ground last year, and generated a gross profit of $9 million.

In an unfortunate note, McEwen last month announced that it would scale down operations at two major mines, the Black Fox in Canada and Gold Bar in Nevada. Mexican operations would be unaffected by the scale back. The Black Fox mine was brought back to full capacity, starting on April 14. The mine scale backs coincided with the company’s withdrawal of forward guidance for 2020 production. The company cites the ongoing COVID-19 epidemic as the reason – and associated mine shut-downs at two sites in Argentina. McEwen did not issue new production guidance for the year.

Gold and silver, however, remain highly sought-after commodities, and the long-term outlook for the stock remains upbeat. Heiko Ihle, writing from H. C. Wainwright, says of the stock, “While the firm previously encountered a tumultuous FY19 that involved several operational issues, we note that the problems faced in FY20 thus far are mostly out of its control. In short, we continue to believe that we are on the cusp of a bull market for gold and that the current share price represents an attractive entry point.”

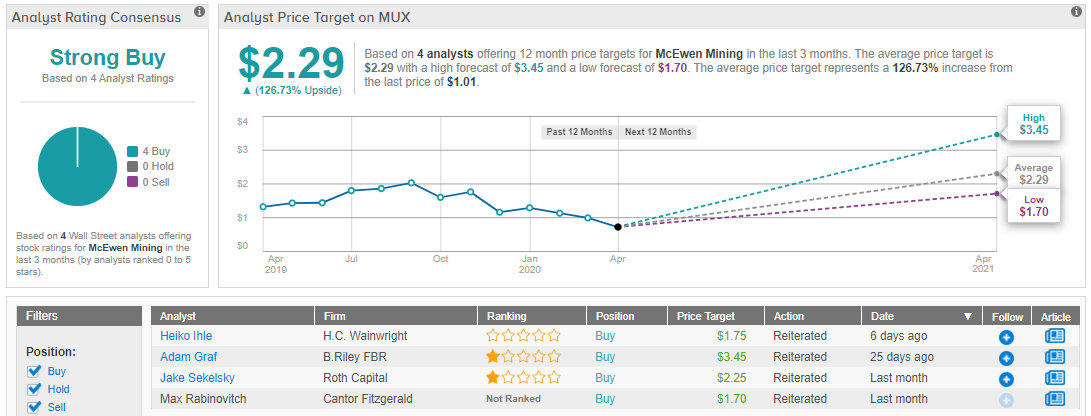

Ihle reiterates his Buy rating on MUX shares. While he did lower the price target from $2 to $1.75, he still sees an impressive 73% upside potential here. (To watch Ihle’s track record, click here)

McEwen has a unanimous analyst consensus rating, with 4 recent Buy reviews adding up to a Strong Buy. The company is a true penny stock, selling for only $1.01 per share in New York. The average price target shows the reward potential of a fundamentally sound penny stock: at $2.29, it indicates room for an incredible 127% upside for this year. (See McEwen Mining stock analysis on TipRanks)

Quantum Corporation (QMCO)

We’ll wrap up this list with another small-cap company, this time in the tech sector. Quantum Corp offers storage and archiving solutions for data streams, in both digital and virtual environments. The company’s products allow customers to store, preserve, and protect digital data for the long term.

Digital data storage is an essential service in today’s information age, and QMCO showed that in its last fiscal third-quarter report. The company turned a profit – its second in a row – and beat the earnings forecast by a wide margin. EPS came in at 7 cents, against estimates of only 1 cent. Net income nearly doubled, rising form $4.7 million to $9 million, derived from total revenue of $103.3 million. Gross margin was the best metric reported, at 45.6%, reflecting a value approach to selling a favorable product mix.

Craig Ellis, who reviewed the company for B. Riley FBR, notet: “We reflect sustained near-term business disruption in lower F1Q product sales, but then increase F2Q-4Q growth. Second, we believe relaxed F4Q loan amendments augur well for similar forward adjustments, noting MCHP (Neutral, $70 PT) recently achieved similar with key covenants. Third, we are unsurprised with logistics impacts to near-term product deliveries, an issue AMAT conveyed two weeks ago. We materially reduce near-term Product revenue but now expect a stronger snap-back beginning in F3Q20, for a v-shaped downturn and recovery for QMCO.

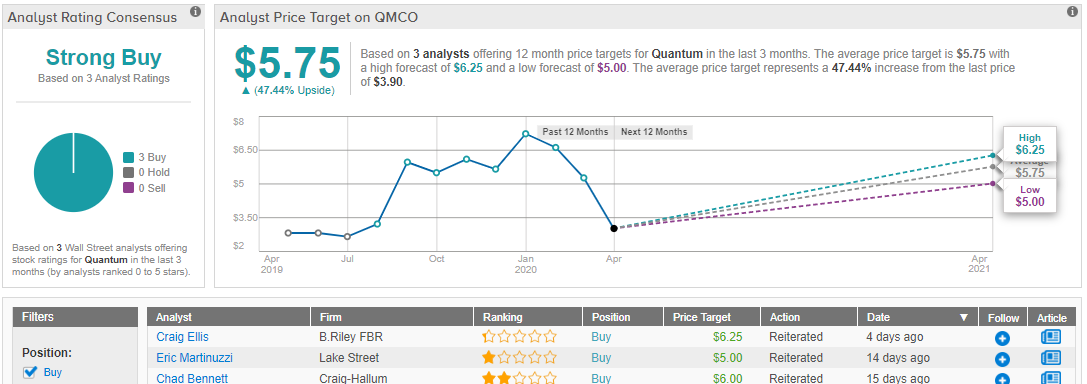

In line with his positive assessment of the company’s status, Ellis gives QMCO a Buy rating with a $6.25 price target, suggesting a 60% growth potential for the stock. (To watch Ellis’ track record, click here)

QMCO is another stock with a unanimous analyst consensus rating. The Strong Buy rating is based on 3 Buy reviews. The average price target, $5.75, indicates a premium of 47% from the current share price of $3.90. (See Quantum stock analysis at TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.