Finding a stock which will deliver enormous returns is the Street’s holy grail. Upon first glance, this task may seem rather simple. Step 1 is to pinpoint a company with a small market cap and low valuation, preferably one that remains a relatively well-kept secret. Step 2: invest in said undiscovered gem, and then sit back and watch in gleeful awe as the initial investment multiplies itself repeatedly.

While these thoughts are fanciful, they are not entirely unrealistic. Just ask anyone who invested in Netflix a decade ago, or in Amazon a decade before. It is possible to find other small-cap names poised to hand over similar returns these giants provided early investors, although admittedly, they are relatively rare and hard to come by. After all, if this was so easily achievable, we would all be filthy rich.

With this in mind, we went on our own intrepid search for small-cap stocks, specifically ones which the Street thinks have enormous growth potential. Using TipRanks’ Stock Screener, we were able to get the scoop on three promising tickers. It appears that apart from the upside potential, all three also currently boast a “Strong Buy” consensus rating from Wall Street analysts. Here are the details.

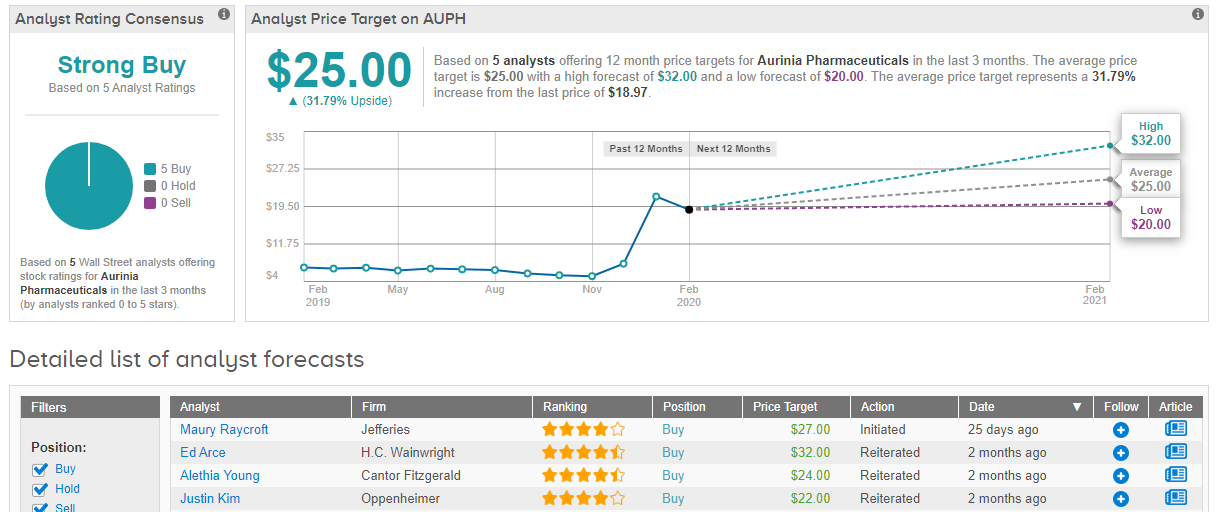

Aurinia Pharmaceuticals (AUPH)

As biotechs tend to do, Aurinia’s share price soared majestically in early December. The surge followed the news that positive efficacy and safety results were achieved in a Phase 3 trial using voclosporin, the company’s candidate for the treatment of lupus nephritis. By the end of the month, Aurinia stock was trading 141% higher than it was before the news broke. If the orphan disease-focused biopharma continues in the same vein, it won’t be long before it outstrips its $2.1 billion market cap.

Lupus (System Lupus Erythematosus – SLE) is a chronic condition which affects more than half a million people in the US, the majority of which are women. The disease can affect the heart, lungs and kidneys, amongst other parts of the body. Lupus nephritis (LN) is an inflammation of the kidney that represents a serious progression of SLE.

Aurinia is expected to file an NDA for voclosporin’s use in treating patients with LN sometime in the first half of 2020, with potential approval by 2021. The drug is currently in trials for other indications, with results from a Phase 2/3 study using ophthalmic voclosporin to treat dry eye syndrome expected in 2H20.

For Jefferies’ Maury Raycroft, the results were reason enough to take a bullish stance on Aurinia. The 4-star analyst said, “AUPH recently reported positive Phase 3 data that showed lead asset voclosporin (VCS) was effective and safe in lupus nephritis (LN) — removal of the safety overhang was critical. Given clear need for approved LN agents and VCS’ differentiated profile, we believe AUPH has an appealing opportunity ahead. After the LN Phase 3, we also believe VCS potential in FSGS and dry eye syndrome (DES) is more de-risked.”

Raycroft, therefore, initiated coverage on Aurinia with a Buy rating and set a price target of $27. The figure conveys the analyst’s belief that Aurinia has potential upside of 44% left in the tank. (To watch Raycroft’s track record, click here)

The biopharma gets total support from the Street as of now; 5 Buys add up to a unanimous Strong Buy consensus rating. At $25, the average price target suggests 32% will be added to Aurinia’s share price over the next 12 months. (See Aurinia stock analysis on TipRanks)

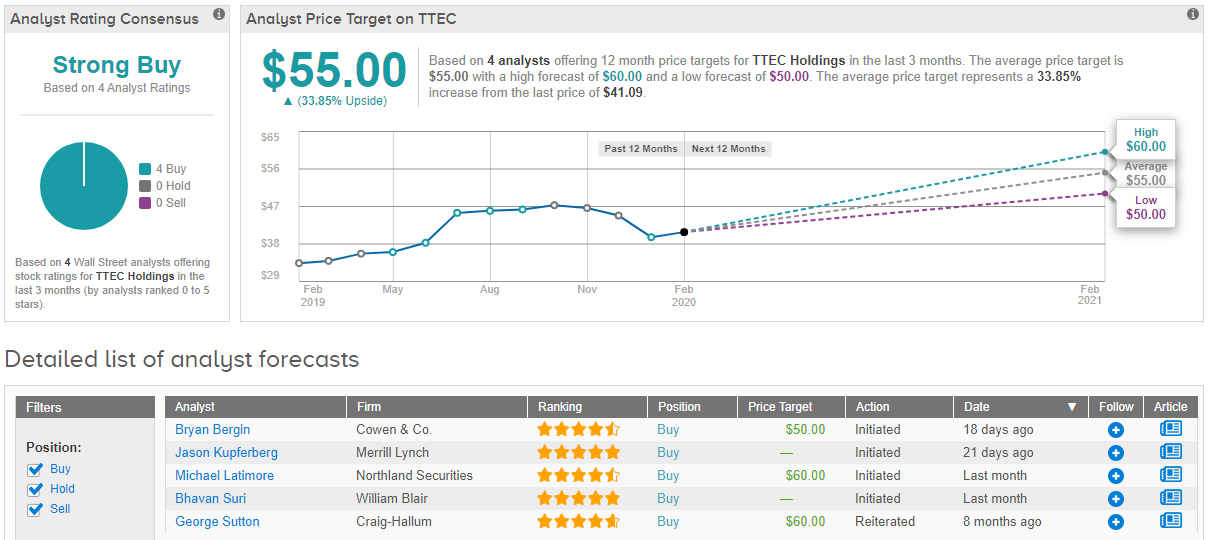

TTEC Holdings (TTEC)

Hovering around roughly the same market cap as Aurinia, we come across TTEC Holdings. The $1.9 billion company, though, is an entirely different beast.

TTEC deals in customer experience technology and services, with its digital offerings including AI enabled cloud platforms and CX (customer experience) consulting solutions. 2019 was a good one for TTEC, as its share price grew by 41% along the way. According to some fans on the Street, 2020 is shaping up to be much of the same.

The company has several partnerships with household names in place. On January 22, TTEC announced a new contract with Volkswagen Group UK to oversee its digital transformation and provide customer experience solutions. The contract comes hot on the heels of new strategic alliances with LivePerson and Cisco Contact Center. Additionally, in October, TTEC acquired FCR, a customer experience provider for a multitude of industries that include high tech, e-commerce and gaming, amongst others.

Northland’s Michael Latimore is a believer in the TTEC story. According to the 4-star analyst, the company’s expanded cloud contact center and AI partnerships are set to increase its growth opportunities. Latimore also notes that TTEC provides the highest-rated agent services to global 1,000 companies. This prompted the analyst to initiate coverage on the global tech services provider. The newly bestowed Outperform rating comes alongside a price target of $60. Bottom line? Latimore expects an 46% to be added to TTEC’s share price over the next year. (To watch Latimore’s track record, click here)

Merrill Lynch’s Jason Kupferberg is another analyst siding with the bulls. The 5-star analyst believes TTEC’s competitive positioning, key partnerships and market leading position in customer experience technology and services are good enough reasons to initiate coverage with a Buy rating and $48 price target. (To watch Kupferberg’s track record, click here)

And what about the rest of the Street? All good news, it appears. 4 Buy ratings coalesce into a Strong Buy consensus rating. The average price target comes in at $55, and implies further room for upside in the shape of 34%. (See TTEC stock analysis on TipRanks)

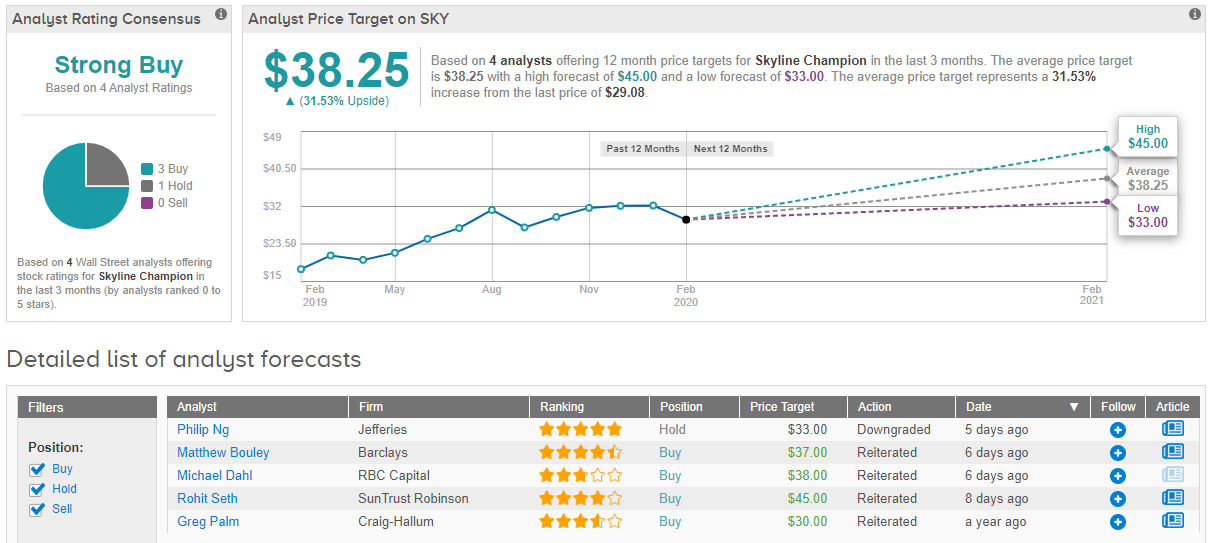

Skyline Champion Corporation (SKY)

SKY is in fact a relatively new company, created in June 2018 following a merger between Skyline and Champion Enterprises. Now, the company is one of the largest publicly traded factory-built-housing names in the US. With a market cap of $1.6 billion, it is the smallest company on our list. Don’t be fooled, though, by the relatively small figure, as this builder of manufactured and modular homes had a stellar 2019.

The rally, though, came to an end last week with the release of the company’s latest earnings report, following which, the share price has dropped by over 20%. Despite the fact that EPS of $0.30 beat the estimate, revenue came in below expectations, down by 3.5% year-over-year to $342.2 million.

So, following the earnings disappointment, should you stay away from the home builder? On the contrary, thinks SunTrust Robinson’s Rohit Seth. The 4-star analyst highlights Skyline’s M&A flexibility, superior positioning to cyclical and secular tailwinds, as well as its continued self-help opportunities as reasons for the company’s “significant estimate upside potential.”

As a result, the 4-star analyst kept his Buy rating on Sky and liked the company’s builder developer strategy enough to bump up his price target. The new target was raised from $40 to $45, and implies upside potential of 56% over the coming months. (To watch Seth’s track record, click here)

Skyline’s Strong Buy consensus rating breaks down into 3 Buys and 1 Hold. Analysts, on average, expect the share price to reach $38.25 over the next 12 months, a figure which could provide gains of 32%. (See Skyline stock analysis on TipRanks)