Wall Street’s analysts have built their collective reputation on the cumulative quality of their stock recommendations. These notes and ratings, based on close research of the stocks and companies involved, are an invaluable tool for retail investors seeking the best portfolio additions.

So, let’s take a moment to check in with the very best of the Street’s analysts. Quinn Bolton, covering the markets for Needham, is an expert on tech stocks with his specialty being the semiconductor chip makers. It’s a fitting topic for the top stock watcher in the business; semiconductor chips are an essential lynchpin in the modern economy. Bolton carries the highest rating from TipRanks, #1 out of more than 7,500 professional stock analysts.

Bolton, who averages a 78% success rate in his recommendations, also boasts a 45.6% average one-year return on his stock picks. An investor who has built a portfolio based solely on Bolton’s choices would have seen it more than triple the S&P’s return over the past 12 months.

We’ve used the data tools in the TipRanks platform to take a look under the hood on three of Bolton’s recent picks. These are Strong Buy stocks, and while the average upside potential on them ranges from 13% to 63%, Bolton sees them growing in a narrower range, between 20% and 50% for the year ahead. Here are the details.

Cohu, Inc. (COHU)

We’ll start with Cohu, a company that occupies a unique niche in the chip industry, producing the test and inspection equipment that is necessary to maintain quality control on the production lines. Cohu’s products include visual and MEMS test solutions, test contacting, and thermal subsystems, all vital equipment in the back-end of semiconductor chip manufacturing.

Cohu’s testing products, while vital in the chip industry, are not limited to that field. The company has product lines for the industrial and medical, computer and networking, and automotive fields, and Cohu gear can be found behind IoT, IoV, and optoelectronic systems. The company bills itself as a ‘one-stop shop’ for the high-tech testing and inspection systems.

Stepping back and taking a long view, we see that Cohu has a truly global presence. The company’s product development centers are located in the US, in Poway and Milpitas, California, as well as St. Paul, Minnesota and Norwood Massachusetts. Manufacturing facilities are located in Asia, in Malaka, Malaysia; Laguna, Philippines; and in Osaka, Japan. Sales and service offices are located across North American and East Asia, and the Mediterranean.

In a move to raise capital for repayment of outstanding loan principal, Cohu last month reached an agreement with the Swedish firm Mycronic, under which Mycronic will acquire Cohu’s printed circuit board test group business (PTG). The purchase price is $125 million in cash, of which Cohu will realize between $95 million and $100 million. For the 12 months ending this past March, the PTG segment showed total sales of $52.9 million.

The effect of this sale showed up in Cohu’s Q1 financial results. The company reported paying down its Term Loan B debt by $102 million in the first quarter. Also in Q1, Cohu reported record revenue of $225.5 million, up 11.4% sequentially and 62% year-over-year. EPS came in a 61 cents, compared to a 42-cent EPS loss in the year-ago quarter.

Quinn Bolton updated his model on COHU shares after the PTG divestiture. Reviewing that transaction, Bolton wrote, “Since PCB [printed circuit board – ed.] Test was not a core business for Cohu, the business only accounted for 8% of Cohu’s revenue in 2020, and the business would only account for 6% of Cohu’s original $940MM revenue target by 2023, the divestiture in our view should not change Cohu’s long-term outlook. In addition, since the GM of the PCB Test business has historically been below 40% and carried ~$10MM in annual OPEX, we believe the divestiture will only reduce Cohu’s 2H21 EPS by ~$0.05 and 2022 EPS by ~$0.10. In other words, delivering the 2023 target model that calls for a NG EPS of $3.60 remains primarily dependent on the growth of Cohu’s core semiconductor business.”

In line with these comments, Bolton maintained his Buy rating on the stock. His $55 price target implies a one-year upside of ~51%. (To watch Bolton’s track record, click here)

COHU shares have 6 recent ratings, which include 5 to Buy and 1 to Hold, giving the stock its Strong Buy consensus. The shares are priced at $36.50 and their $59 average price target suggests an upside slightly more bullish than Bolton’s, ~62%, for the year ahead. (See COHU stock analysis on TipRanks)

Semtech Corporation (SMTC)

The next Bolton pick we’re checking out is Semtech, a $4.3 billion chip maker that produces chips analog and mixed signal chips for communications, enterprise computing, and industrial markets. The company’s products include lines for discrete and integrated circuits. In 2019, the company saw $617 million in total revenue; in 2020, that number slipped 3.7% to $595 million.

Semtech is a leader in low power, wide area networking, owning the patents on LoRa (long range) technology that has revolutionized IoT applications. The company’s proprietary LoRa technology allows long range data communications without excess power consumption, improving function while reducing electricity costs. The technology has applications in a range of ‘smart’ tech, including smart homes and smart utility metering.

The first quarter of fiscal year 2022 showed results that bode well for the company going forward, as top line revenue, at $170.4 million, marked the fourth consecutive quarter-over-quarter increase in a row. Year-over-year, quarterly revenues were up 28%. EPS, at 36 cents, more than doubled yoy.

During the quarter, Semtech saw a 78% yoy gain in Wireless and Sensing product sales. This included record sales on LoRa products. Quarterly bookings, or product orders, for LoRa also reached a record, as did bookings for Industrial Protection devices. In a move to shore up the share price, Semtech spent $25 million on share buybacks, repurchasing over 360K SMTC shares.

Describing Semtech’s quarterly report as ‘solid,’ Bolton writes of the company’s sales expansion, “…Semtech’s FY21 LoRa business grew 19% to ~$88MM. We believe Semtech’s LoRa business will see share gains and revenue growth as an increasing number of industrial, smart home and consumer devices adopt this long-range IoT connectivity standard, particularly with the recent launch of Amazon’s LoRa enabled products, which started in late FY21. Looking into FY22, Semtech expects its LoRa revenue to grow at a 40% five-year CAGR…. Further, we believe Semtech Signal Integrity business is poised for solid growth over the next few years with 5G, PON and data center end markets expected to drive growth.”

Bolton gives SMTC shares an $86 price target, indicating confidence in 28% share appreciation this year, along with a Buy rating.

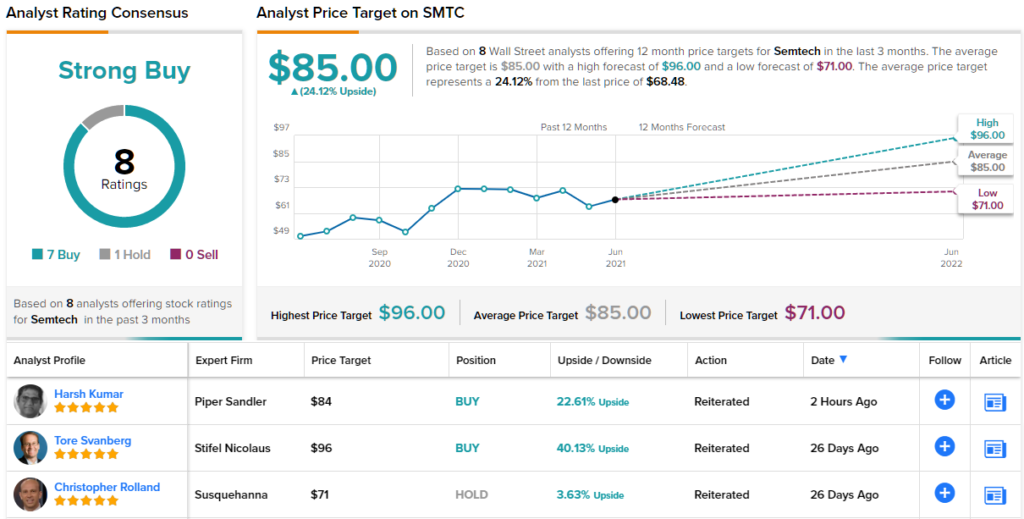

Overall, Semtech’s Strong Buy consensus rating is based on 7 positive reviews – out of 8 recent stock analyses on file. The average price target, at $85, implies a 24% upside from the current share price of $68.55. (See SMTC stock analysis on TipRanks)

MaxLinear, Inc. (MXL)

We’ll wrap up this list with MaxLinear, a $3.1 billion company that has been building integrated radio-frequency analog and mixed-signal semiconductors since 2003. MaxLinear’s products are used in broadband communications systems, including router and extender hardware, automotive and industrial connectivity, and wireless access and ethernet switch systems. The company’s chipsets are widely used in 4G and 5G infrastructure.

Since the second quarter of 2020, MaxLinear’s business has seen a strong rebound. The most recent quarter, for 1Q21, was the third in a row to show strong sequential revenue growth. The total revenues came in at $209.4 million, up an impressive 237% from the $62 million reported in the year-ago quarter. EPS showed an equally dramatic boost, as the previous seven quarters all showed net losses – but the 1Q21 quarter showed a profit of 5 cents per share. One year ago, the net loss was 21 cents per share.

The company’s cash flow also showed strong improvement. Net cash from operations was $6.6 million in 1Q20 – but it was up to $40.3 million in the first quarter of this year.

MaxLinear has new products to drive further sales, including the industry’s first 5nm CMOS 800G DSP, announced on June 1. Also this month, the company announced a collaboration with MACOM on interoperability of MXL’s PAM4 DSPs and MACOM’s 100G/lane transimpedance amplifiers. The two companies with work on 100G, 400G, and 800G solutions for the data center market.

Bolton is impressed with MaxLinear’s solid growth and strong prospects, writing, “Demand remains strong, but supply constraints were a headwind in 1Q21, specifically in Connectivity. While Connectivity is expected to rebound Q/Q, MaxLinear expects Broadband will be impacted by the constraints in 2Q21. Despite these challenges, Infrastructure grew 61% Q/Q in 1Q21 as wireless backhaul and HPA sales grew the company’s 5G cellular transceiver entered production….

“[We] believe MaxLinear is well positioned in fast growing secular markets once the global macro environment begins to normalize. We believe MaxLinear’s high margin Infrastructure business is positioned for solid growth over the long term due to share gains with its microwave products and the ramps of its massive MIMO 5G cellular transceiver and 400G PAM4 Telluride DSP family.”

These comments back up Bolton’s Buy rating on the stock, and his price target of $50 implies an upside of 21% for the next 12 months. (To watch Bolton’s track record, click here.)

The 8 recent reviews on this stock break down to 6 Buys and 2 Holds, for a Strong Buy analyst consensus rating. MXL shares are priced at $42.4 and the $47 average price target suggests ~11% one-year upside potential from that level. (See MXL stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.