The new decade is set to open with the widespread deployment of 5G networks. The rollout of the 5th generation of wireless technology will improve many available services as well as support a million devices in the radius of a single kilometer. From downloading 4K movies on our smartphones in seconds, to remote surgery aided by VR headsets, to cars being able to talk to each other – all will reap the benefits of 5G networks.

As with any new technology, it can be hard at first to imagine the changes it will bring. Market incentives are sure to play their part in accelerating adoption and driving innovations that most aren’t able to fathom yet. Therefore, well positioned companies are set to make the most of the opportunity the new technology affords.

With the information about the lightning fast technology in hand, then, we opened TipRanks’ Stock Screener to get the scoop on 3 companies ready for the oncoming 5G onslaught. Coincidentally, right now, all 3 have a Strong Buy consensus rating from the Street. Let’s take a closer look.

Broadcom (AVGO)

As a developer and designer of semiconductor products, Broadcom is ideally positioned to benefit from the roll out of 5G networks. Apart from a core business which includes serving data centers, wired infrastructure and enterprise storage systems, Broadcom’s smartphone clients include Apple and Samsung. With Apple expected to launch a 5G-enabled phone in 2020, naturally, the semiconductor manufacturer stands to benefit.

As one of the decade’s best market performers, Broadcom’s 2019 has landed just shy of the S&P 500’s performance, adding over 25% to its share price. The company’s latest earnings report was in line with Street expectations, too. Strong quarter-over-quarter growth in its wireless sector and year-over-year growth in other segments both contributed to solid revenues of $5.78 billion, alongside EPS of $5.39.

RBC’s Mitch Steves thinks Broadcom is “an attractive asset.” The 5-star analyst highlights the company’s “potential for multiple expansion” and believes long-term EPS can easily grow into double digits.

“We see M&A integration, stock buybacks, and margin expansion driving EPS growth. We see the Symantec integration and margin expansion driving EPS upside in 2020/2021. On an annual basis, we see stable to slightly positive revenue trajectories for AVGO’s key businesses,” Steves said.

To this end, the 5-star analyst reiterated a Outperform on AVGO, alongside a price target of $360, indicating upside potential of 13%. (To watch Steves’ track record, click here)

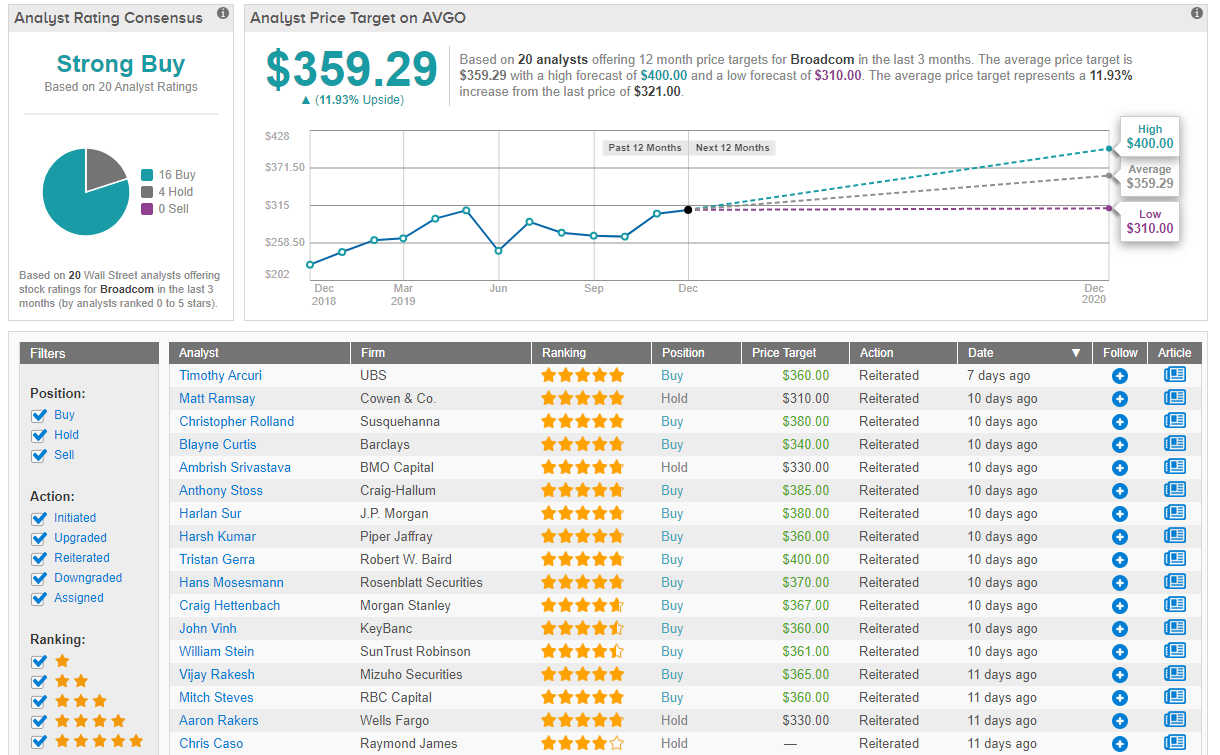

A flurry of analysts have recently been reiterating Buy ratings on this tech giant. Put together, the rest of the Street appears to be reading from the same hymn sheet as Steves. A Strong Buy consensus rating breaks down into 16 Buys and 4 Holds. The average price target almost matches Steves’ to a T, coming in at $359.29, and implying 12% upside. (See Broadcom stock analysis on TipRanks)

T-Mobile US (TMUS)

One of the companies already benefitting from 5G technology is communications giant T Mobile. The wireless network operator recently launched a nationwide 5G network that according to the company, already provides coverage to 200 million people in 5,000 cities and across rural areas. The large swathes of coverage can be enabled due to the network’s low-band spectrum, which isn’t as fast as other 5G millimeter wave-based networks. Nevertheless, the newly launched network also works indoors, a feat not possible so far, to a meaningful extent, with millimeter wave-based 5G counterparts.

A problem still facing 5G networks is the relative lack of 5G smartphones. Of course, this is all set to change as the new decade kicks into gear, and T-Mobile stands to benefit from the technology’s widespread adoption.

RBC’s Jonathan Atkin thinks so, too. The 5-star analyst expects T-Mobile to “outperform its peers based on favorable risk/reward characteristics” and believes “uncarrier initiatives have positioned T-Mobile as the ‘customer-friendly carrier’, attracting millennials.” Atkin also notes that, “Faster-than-anticipated postpaid growth could lead to greater out-year cash flow growth.”

“We expect continued subscriber momentum and churn improvement on the back of greater enterprise/SMB/public-sector penetration, network improvement, and retail expansion,” the analyst concluded.

The 5G rollout has the analyst betting on T-Mobile. Atkin reiterated an Outperform rating on the telecom leader, while also bumping up the price target from $87 to $94. If attained, investors could be lining their pockets with gains of 21% in the new year. (To watch Atkin’s track record, click here)

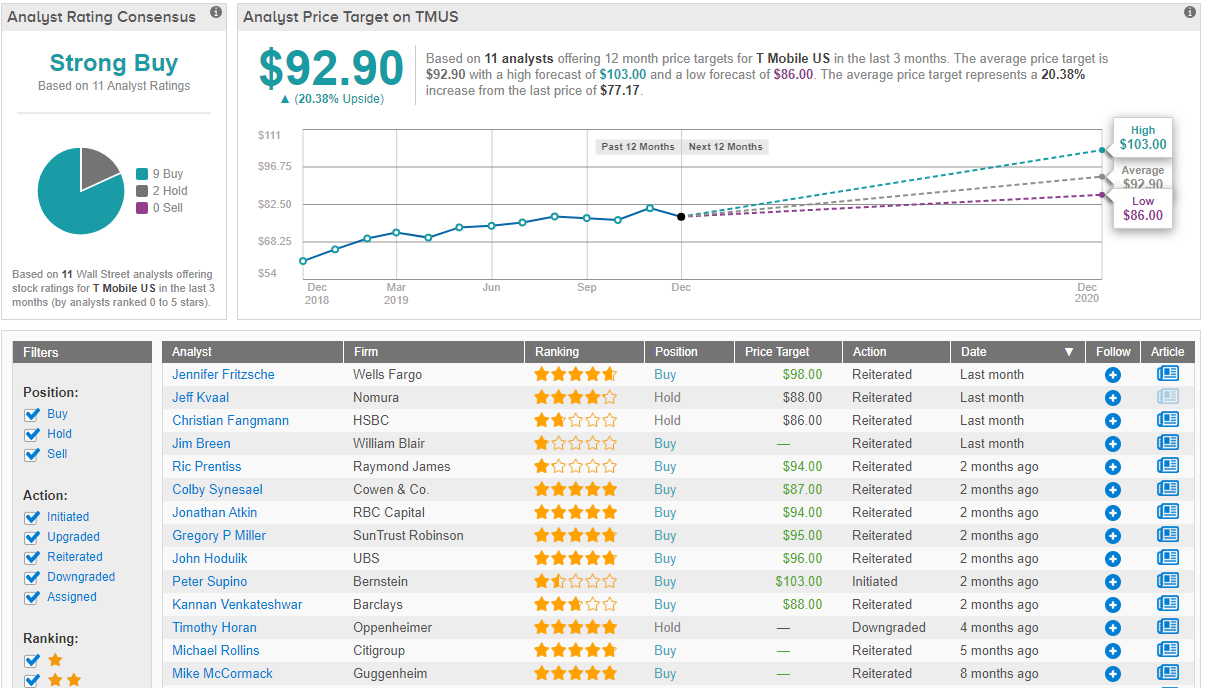

And where does the Street’s coverage of T-Mobile extend to? As it happens, to a Strong Buy consensus rating, formed of 9 Buys and 2 Holds. An average price target of $92.90 indicates upside potential of 20% over the next 12 months. (See T-Mobile stock analysis on TipRanks)

Keysight Technologies (KEYS)

As the name implies, Keysight unlocks “critical or key insights”. The electronic measurement leader has outrun the market in 2019 and is up by over 67% year-to-date. The company has consistently outperformed financial targets, including core revenue growth, gross margin, and operating margin. In the last three quarters, Keysight’s reported EPS has left estimates in the dust.

Among the company’s arsenal of software and tools are 5G solutions. With 5G rollout in its initial phase, Keysight is already benefiting, with the company’s software order book increasing 19% year-over-year in 2019 to reach $853 million.

Deutsche Bank’s Brian Yun thinks the company’s software is what separates Keysight from other test and measurement peers, due to the “depth of the software portfolio, design wins, industry partnerships.”

The analyst said, “KEYS continues to execute in the midst of an uncertain macro backdrop and a dynamic competitive environment. We highlight ongoing robust long-term demand trends across KEYS’ test and measurement end markets: 5G, 400G, IOT, connected cars, military modernization, etc. The company continues to win new customers and projects, which is driven by KEYS’ competitively differentiated portfolio in these secular growth themes and operational excellence across product and end market segments.”

Yun, therefore, kept his Buy rating on KEYS and raised his price target from $115 to $125, implying upside potential of 21%. (To watch Yun’s track record, click here)

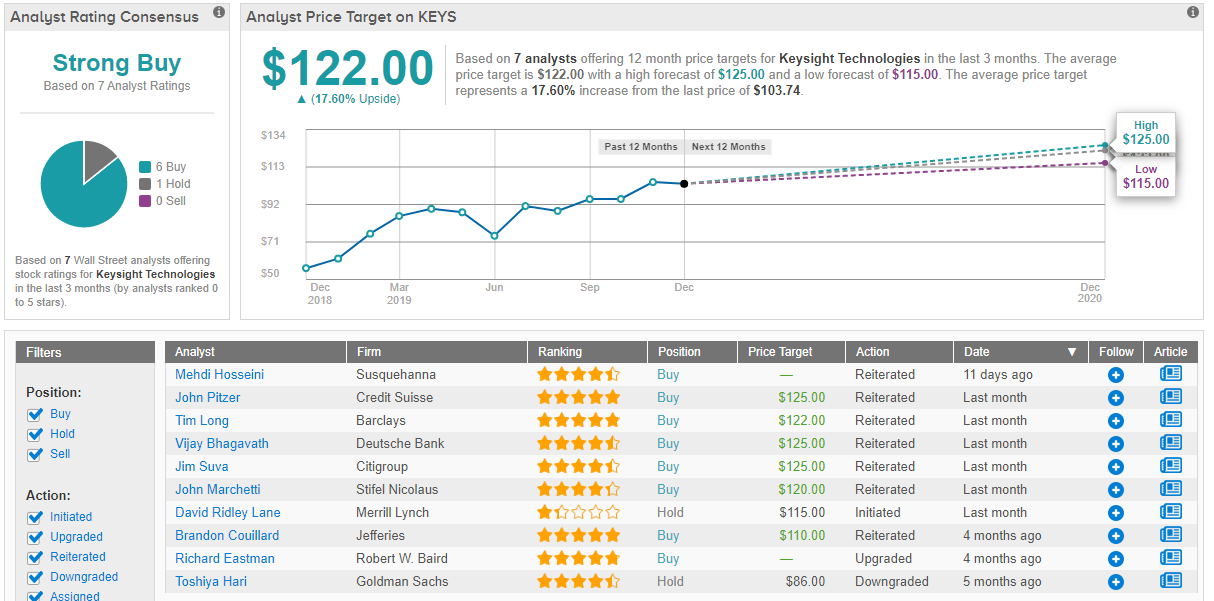

It looks like Yun’s upbeat take on the measurement solutions wiz is backed by the rest of the Street. With 6 Buys and a single Hold from the analysts over the last three months, the consensus is that Keysight is a Strong Buy. The average price target comes in a touch below Yun’s, at $122, indicating an increase of 18%, should the target be reached over the coming year. (See Keysight stock analysis on TipRanks)