Which names can step up to the plate and hit the ball right out of the park? We are referring to the stocks that have a long growth runway ahead of them, lining up to deliver a win in the long-run. While these kinds of investments are highly sought after, it doesn’t mean they are easy to find.

Luckily, TipRanks’ Stock Screener can help get the job done. The tool enabled us to filter our search by analyst consensus, price target and market cap as well as sort the results by upside potential from the current share price. As a result, we were able to identify 3 stocks primed for huge gains in the next twelve months.

Huge isn’t an exaggeration as the stocks boast triple digit upside potential. If you thought it couldn’t get any better, guess again. Each of these stocks has garnered enough bullish recommendations from Wall Street analysts over the previous three months to earn a “Strong Buy” consensus rating.

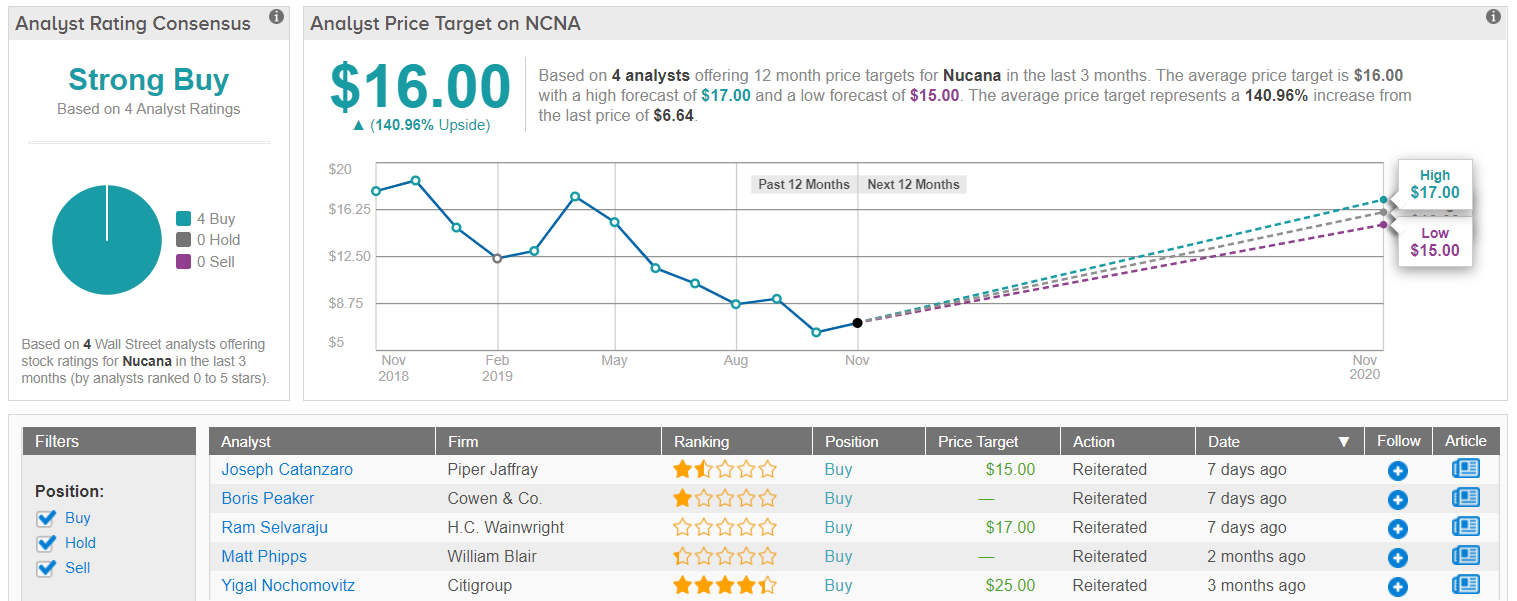

NuCana (NCNA)

The clinical-stage biopharmaceutical company uses its innovative ProTide technology to try and improve treatment outcomes for patients with cancer. The technology has captivated the Street as it can transform widely-prescribed chemotherapy agents (nucleoside analogs) into safer and more effective therapies.

While NuCana has found itself in hot water recently regarding the shift in priority for its Acelarin drug development, Piper Jaffray analyst Joseph Catanzaro tells investors not to forgot what the therapy’s implications could mean for NCNA shares. The company made the strategic decision to deprioritize the drug for ovarian cancer, and instead focus on its development as a first-line biliary tract cancer treatment.

With NCNA recently getting the go-ahead from the FDA to start its Phase 3 study evaluating the efficacy of Acelarin in patients with biliary tract cancer, it’s no wonder Catanzaro is staying with the bulls. He does however note that he would like to see the biopharma bump up the development pace.

To this end, the analyst lowered the price target from $25 to $15 to reflect that ovarian cancer can no longer be factored into his revenue model. Still, this target conveys his confidence in NCNA’s ability to soar 125% over the next twelve months. (To watch Catanzaro’s track record, click here)

Like Catanzaro, the rest of the Street is betting on NCNA as a long-term winner. With 5 Buy ratings received in the last three months compared to no Holds or Sells, the consensus is unanimous: the biopharma is a ‘Strong Buy’. Adding to the good news, the $16 average price target implies 141% upside potential. (See NuCana stock analysis on TipRanks)

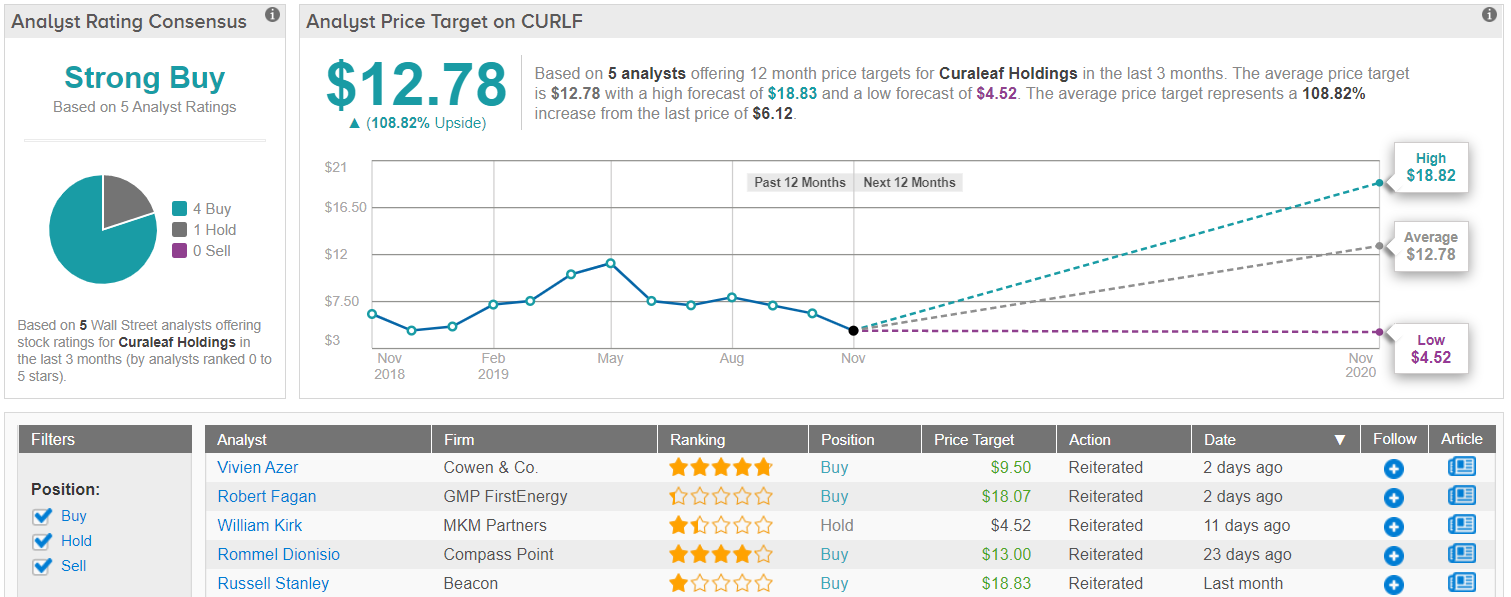

Curaleaf (CURLF)

Sure, Curaleaf is definitely beaten-down, but the cannabis company isn’t tapping out yet.

Based in Massachusetts, Curaleaf already has interests in 19 states and 71 dispensaries currently being operated, with licenses to add 60 more. On top of this, Curaleaf stands to cement its status as a key player in the space thanks to its M&A activity. As the 30-day waiting period under the Hart-Scott-Rodino (HSR) Antitrust Improvements Act has expired, it can proceed with its acquisition of the Select brand from Cura Partners Inc.

Originally announced back in May, the purchase would give Curaleaf access to Select’s manufacturing, processing, distribution, marketing and retailing operations as well as all its adult-use and medical cannabis products under the Select brand name, including all intellectual property.

GMP FirstEnergy’s Robert Fagan is one of the analysts that has been thoroughly impressed by the cannabis name: “We are generally encouraged by the rapid progress of the Select acquisition, representing a substantially quicker timeline than our current expectations for the Select acquisition to close during Q2/20. We are equally impressed with CURA’s ability to successfully amend the transaction terms on a fair basis for all parties, underpinning the company’s M&A expertise and providing CURA with downside protection while simultaneously incentivizing Select to maximize its performance.”

With the current valuation reflecting an attractive entry point, Fagan’s message is clear: now is the time to Buy. Attaching an $18 price target along with the rating, shares could skyrocket 214% in the coming twelve months. (To watch Fagan’s track record, click here)

Similarly, other analysts are in CURLF’s corner. 4 Buys and 1 Hold assigned in the last three months add up to a ‘Strong Buy’ consensus. Its $12.78 average price target indicates 109% upside potential. (See Curaleaf stock analysis on TipRanks)

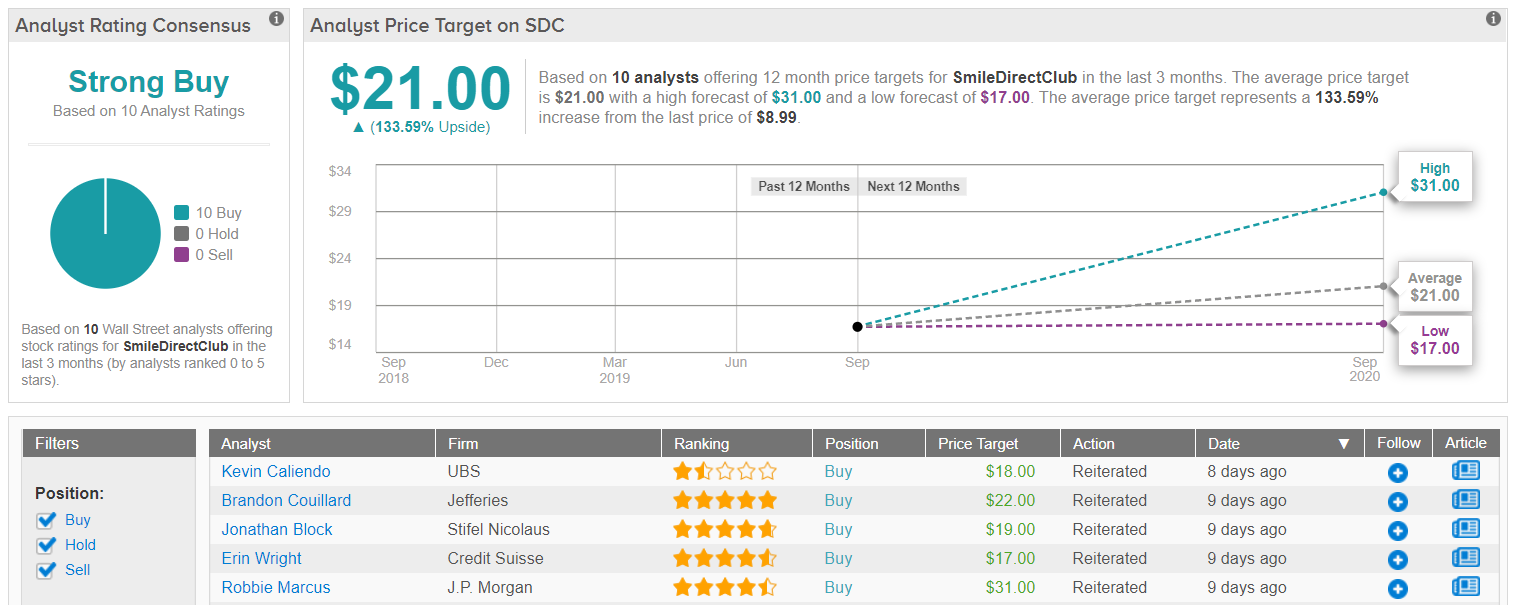

SmileDirectClub (SDC)

SmileDirectClub is giving consumers the confidence they need to keep on smiling, offering affordable teeth straightening aligners. While SDC’s performance following its September IPO has been rocky, several members of the Street say that the company’s strong long-term growth narrative should bring a smile to investors’ faces.

In its first quarter as a publicly traded company, Jefferies analyst Brandon Couillard reminds investors that SDC actually posted a “solid beat”, with revenue reaching $180.2 million vs the $165.4 million estimate. Not to mention the company was able to ship 106,070 teeth aligners in the quarter, up from 72,387 in the prior-year quarter.

Couillard adds that even though some thought the revenue guidance for the full year was somewhat underwhelming at $750 million to $755 million, these estimates are actually conservative in his view. “After a spate of headline noise, investor focus should pivot back to SmileDirectClub’s strong underlying fundamentals, attractive valuation and reaccelerating Q4 growth,” he commented. Bearing this in mind, the five-star analyst reiterated his Buy rating as well as his $22 price target, suggesting 170% upside potential. (To watch Couillard’s track record, click here)

Meanwhile, Stifel Nicolaus’ Jonathan Block argues that the stock is undervalued when you consider the large long-term opportunity for a $2,000 consumer clear aligner alternative. As a result, the five-star analyst maintains a bullish thesis. Based on the $19 price target, shares could climb 132% higher in the next twelve months.

The rest of the Street is in agreement. As 10 Buys vs no Holds or Sells have been given in the previous three months, SDC is a ‘Strong Buy’. Its $21 average price target brings the upside potential to 134%. (See SmileDirectClub stock analysis on TipRanks)