Tech heavy weights have undoubtedly revolutionized the world we live in. Household names like Apple (AAPL) and Microsoft (MSFT) are widely considered to be disruptive forces in the industry, offering innovative approaches with their respective products. This is perhaps why investors will often turn to these more well-known tech giants when searching for investments capable of bringing home the bacon.

However, the pros on Wall Street suggest going about this in a different way. Many analysts believe that while harder to spot, lesser-known tech stocks can make more compelling investments as some offer significantly larger upside potential than other top dogs. But how are investors supposed to find the tech stocks that have largely escaped media attention? We recommend using TipRanks.com.

The platform’s wealth of market data helped us zero in on 3 tech stocks set to reward investors handsomely through the next year and beyond. It also doesn’t hurt that each of the tickers has amassed enough support from analysts over the last three months to earn a “Strong Buy” consensus rating. With that in mind, let’s dive right in.

Cerence (CRNC)

The Nuance Communications spin-off is a digital AI assistant for vehicles, built to improve overall customer safety. When considering the technology’s potential implications, it’s easy to see why the Street’s focus has locked in on CRNC.

Raymond James analyst Brian Gesuale tells investors that the tech company is a stand-out because it will likely benefit from the fact that cars can now be thought of as mobile devices. This is on top of its ability to generate margins closer to that of vertical software and automation names.

“The market is valuing CRNC like a high-end Tier 1 auto supplier, and we believe the multiple will re-rate higher and converge with the automation and vertical software group as the market figures out the story,” he commented.

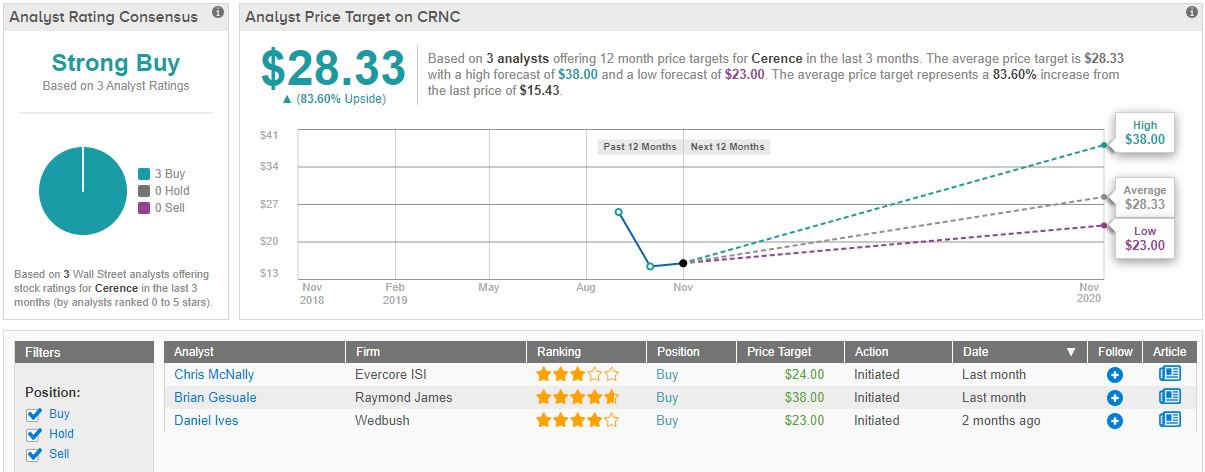

This prompted the five-star analyst to initiate a bullish call on CRNC stock. His $38 price target conveys his confidence in CRNC’s ability to soar 145% over the next twelve months. (To watch Gesuale’s track record, click here)

Meanwhile, Wedbush analyst Daniel Ives agrees that CRNC has the potential to dish out returns in the long run. To this end, the four-star analyst started coverage with a Buy and attached a $23 price target. While less than Gesuale’s, he still sees substantial upside of 45%.

It’s not often that the analysts all agree on a stock, so when it does happen, take note. CRNC’s Strong Buy consensus rating is based on a unanimous 3 Buys. The stock’s $28.33 average price target suggests about 84% and a change from the current share price of $15.42. (See Cerence stock analysis on TipRanks)

Medallia (MDLA)

Medallia is best known for its Software-as-a-Service platform, the Medallia Experience Cloud, which has allowed the company to lead the way in business analytics. Following its recent IPO, MDLA has impressed to say the least.

With customer usage levels that rival social media networks, MDLA has the advantage in the space as a result of its unique approach to tracking customer signals, or what it calls experience management. Adding to the good news, analysts believe the strong management team as well as the vast market opportunity could propel MDLA to new heights.

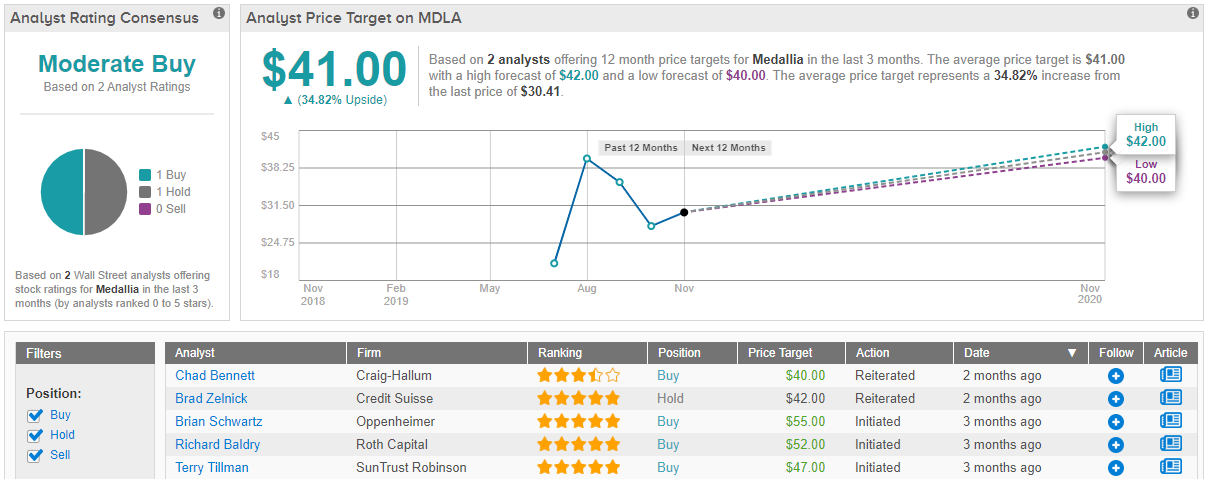

Craig-Hallum’s Chad Bennett is one of the analysts getting excited about MDLA after its noteworthy performance in its most recent quarter. The analyst not only highlights its “sizeable” EPS and revenue beat but also management’s guidance that surpasses consensus estimates across the board. He interprets this as a signal that MDLA could be a long-term winner.

As a result, Bennett kept his Buy recommendation while lowering the price target from $45 to $40. Even at this new target, shares could surge 42% in the coming twelve months. (To watch Bennett’s track record, click here)

In general, other Wall Street analysts take a similar approach when it comes to MDLA. 8 Buy ratings and 2 Holds add up to a ‘Strong Buy’ consensus. Its $46 average price target brings the upside potential to 63%. (See Medallia stock analysis on TipRanks)

Opera Limited (OPRA)

Opera designs web browsers for mobile phones and PCs, equipped with built-in ad blockers, free VPNs, unit converters, social messengers, battery savers as well as several other features. Ahead of its November 14 earnings release, investors want to know if the stock will see further gains on top of its already posted 67% year-to-date growth.

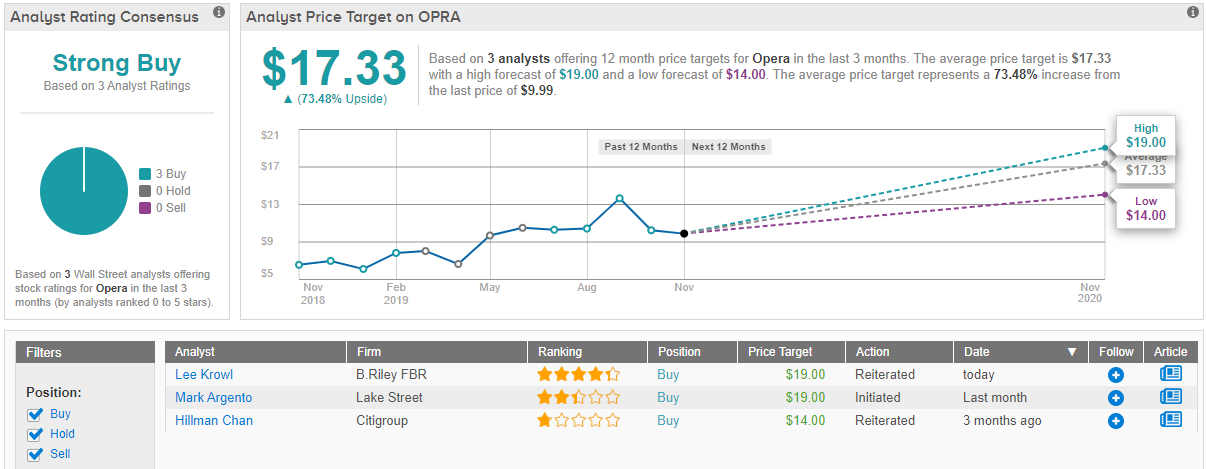

According to Lake Street analyst Mark Argento, OPRA is the epitome of an “overlooked” internet company. While he does acknowledge that the company could improve the monetization of its “massive” installed base through its advertising, his bullish thesis remains firmly intact.

Argento argues that his bullish take has to do with OPRA’s valuation, which is significantly more attractive than that of its competitors in the sector. Considering that his estimates call for 30% growth and expanding margins, this makes sense.

If this wasn’t promising enough, the company’s newest feature stands to deliver another win. Just last month, OPRA unveiled its new tracker blocker, which will increase browsing speeds by about 20%.

With this in mind, Argento initiated coverage with a Buy and set a $19 price target. This implies that shares could skyrocket 105% over the next twelve months. (To watch Argento’s track record, click here)

Based on all the above factors, Wall Street also has high hopes for OPRA. As 3 Buy ratings were assigned in the last three months compared to no Holds or Sells, the consensus is unanimous: the stock is a ‘Strong Buy’. To top it all off, its $17 average stock-price forecast puts the potential twelve-month gain at a whopping 87%. (See Opera stock analysis on TipRanks)