Tech stocks are a staple among investors. This is because the industry is growing rapidly, with new technologies constantly revolutionizing the way once manual tasks were performed.

While it’s easy for investors to turn to well established names like tech giant Apple, these stocks don’t always represent the most compelling investments. For example, Apple has about 3% downside from the current share price, according to best-performing analysts on Wall Street.

So how are investors supposed to find the tech stocks with the best long-term growth prospects. That’s where TipRanks comes in. We used TipRanks’ Best Stocks to Buy tool to track down three tech stocks that offer the highest upside potential, more than 40% to be exact.

Additionally, each is backed by Wall Street analysts, with all of the stocks receiving “Strong Buy” consensus ratings. This consensus rating is based on all of the calls published by analysts over the last three months.

Dropbox (DBX)

Dropbox is an online file hosting service that also provides client software, cloud storage and file synchronization. While DBX has seen its fair share of shakiness recently, one analyst just gave the tech stock a vote of confidence by bumping up the rating.

Nomura’s Christopher Eberle argues that a turnaround is on the horizon. “We believe we are nearing an inflection in revenue after six quarters of deceleration as a public company coupled with attractive valuation,” he explained.

This rebound could be driven in part by its efforts to revamp its image. At the end of September, the company announced that the “new Dropbox” would be available for all users. The upgrade features a new interface and “Spaces” or collaboration hubs that come with comment streams, AI that can highlight files as well as Slack, Trello and G Suite integrations.

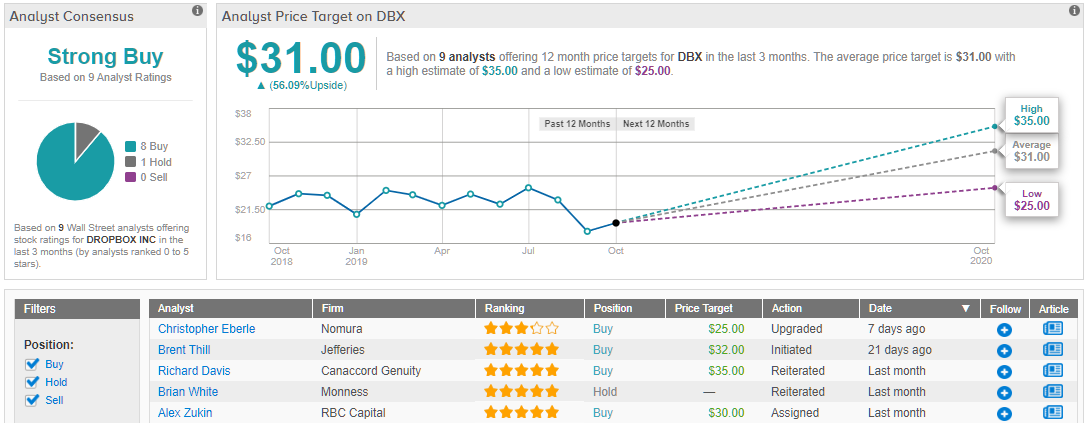

While DBX did increase its pricing, Eberle notes that “price increases have taken hold with manageable levels of churn”. As a result, the analyst upgraded the rating from a Hold to a Buy and set a $25 price target. (To watch Eberle’s track record, click here) In general, the rest of the Street is even more bullish than Eberle. The ‘Strong Buy’ stock’s $31 average price target suggests 56% upside potential. (See Dropbox stock analysis on TipRanks)

Zendesk (ZEN)

When investors think of workplace software, Salesforce is often the first name that comes to mind. That being said, Zendesk is a force to be reckoned with in the space.

The company offers both support ticketing system and customer service software to meet the needs of organizations of any size. However, ZEN has remained committed to expanding its product offerings. On October 3, the company unveiled its new API-based platform, Sunshine Conversations, which allows businesses to use social media and messaging services to communicate directly with their customers. Additionally, ZEN also announced the release of Gather, its new product for building online community forums, on the same day.

While CRM recently broke the news of its Lightning Order Management product that competes with Sunshine, 5-star William Blair analyst Bhavan Suri’s bullish thesis remains very much intact.

“The new solution from Salesforce appears to be a deeper data integration between its own Commerce and Service Cloud offerings. In our view, not every company will want to standardize on Salesforce, and for existing Zendesk customers, we see little immediate impact as these customers are still likely to adopt Sunshine to enhance their agent experience since they are current Zendesk users,” he commented. This prompted the analyst to reiterate his Buy rating. (To watch Suri’s track record, click here)

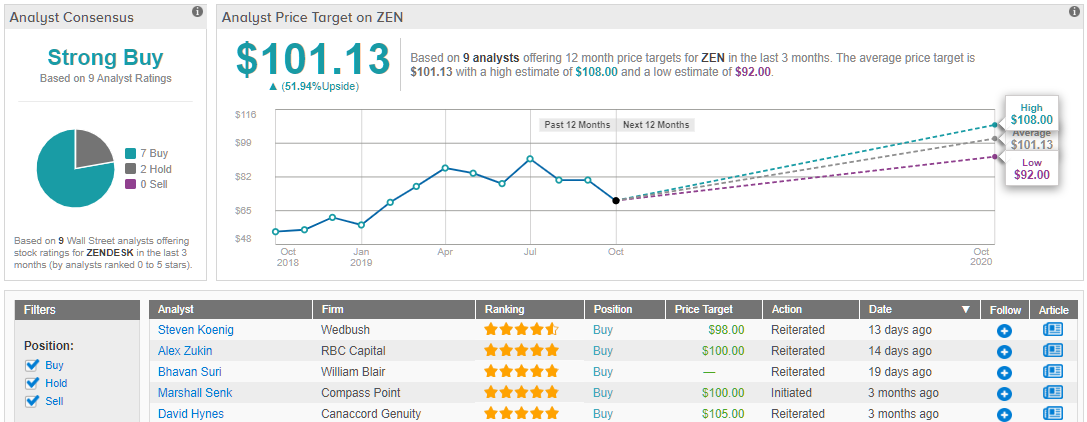

Like Suri, Wall Street is picking ZEN as a long-term winner. With 7 Buy ratings vs 2 Holds assigned over the last three months, the stock earns a ‘Strong Buy’ analyst consensus. Adding to the good news, its $101.13 average price target puts the upside potential at 52%. (See Zendesk stock analysis on TipRanks)

MongoDB (MDB)

MongoDB is a database program utilized by many application builders. Along with software, the company offers analytics, cloud solutions and other services. With shares jumping 50% year-to-date, it’s no wonder investors are getting excited.

Part of MDB’s success is tied to its Software-as-a-Service business model. This means that customers pay for its various solutions on a subscription-basis. The appeal of this model is that it requires a much lower upfront investment from customers.

With over 15,000 customers, this strategy appears to be working. Of these customers, more than 600 generate over $100,000 in annual recurring revenue for MDB. As the amount of data being produced is only expected to grow, 5-star Stifel Nicolaus analyst Brad Reback believes the company has a healthy long-term growth narrative.

“In our view, MDB has the ability to sustain more than 40% recurring revenue growth and improving profitability and remains a buyer of the shares,” he noted. With this in mind, the analyst reiterated his Buy rating while raising the price target from $180 to $185. According the Reback, shares could soar 47% over the next twelve months. (To watch Reback’s track record, click here)

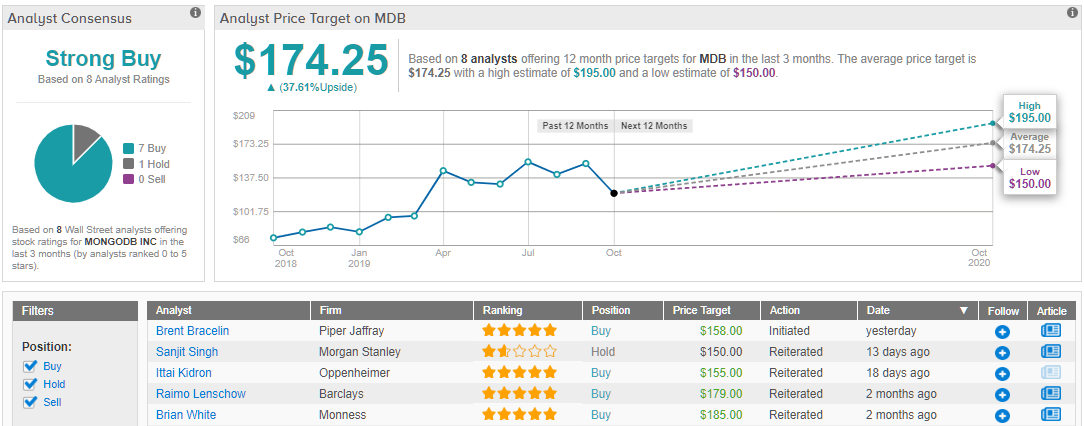

Other Wall Street analysts also take a bullish approach when it comes to MDB. 7 Buy ratings compared to 1 Hold received in the last three months add up to a ‘Strong Buy’ analyst consensus. Based on its $174.25 average price target, shares could gain 38% over the next twelve months. (See MongoDB stock analysis on TipRanks)