Investors want growth. Specifically, they want growth-oriented stocks that will increase returns in their portfolios. But finding those is the trick, isn’t it? We can’t just look into a crystal ball and see the winner – we have to look into the data, and find out which stocks it’s pointing out.

Some stocks fall into a special category – Wall Street’s analysts are in unanimous agreement about them. And when that unanimous agreement falls on the Buy side, investors know that this particular name is something special.

How special? We’ve delved into the TipRanks database to find out. Using the Stock Screener tool, we’ve pulled up three tech stocks with unanimous Strong Buy consensus views and significant upside potentials. These are the stocks that the data, and the analysts, agree will boost your portfolio.

ACI Worldwide, Inc. (ACIW)

First on our list today is ACI Worldwide, a payment systems software provider based in Naples, Florida. ACI’s products facilitate electronic payments in real time for banks, merchants, corporations, and third-party payment processors. The company’s product line includes software used in ATM machines, merchant point-of-sale terminals, and mobile devices including smartphones and tablets. The company sees over $1 billion in revenues annually.

In a move underscoring ACI’s strength in its niche, the company acquired Speedpay for $750 million last year. Speedpay is best known as the business side of Western Union’s US bill-paying service. Western Union is one of the world’s largest money transfer services. By connecting with it, ACI demonstrates both that it can operate at a large scale and is able to move from payment software provider to payment facilitator.

ACIW’s strong niche position has supported the stock. The share price has grown steadily over the past five years, and in 2019, it posted a gain of 36%. January saw a 10% pullback in the price, however, as the company acknowledged that a large customer contract, expected in December, was not signed. While the announcement impacted the stock, in general, Wall Street is not worried.

5-star analyst Mark Palmer, writing from BTIG, described the general mood towards this stock in his recent research note: “We believe the pullback in ACIW’s shares has created an attractive buying opportunity in a stock that remains poised to generate solid organic revenue growth and adjusted EBITDA margin expansion…”

Palmer gives ACIW a $40 price target, suggesting a 12% upside, to support his Buy rating on the stock. (To watch Palmer’s track record, click here)

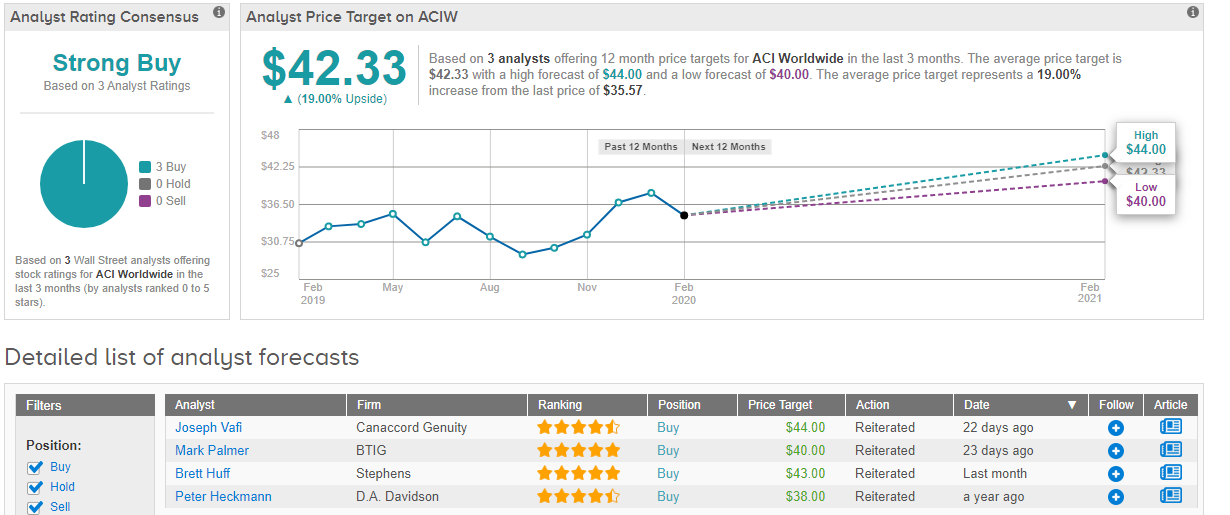

ACI Worldwide’s Strong Buy consensus rating is based on 3 Buy-side reviews. The stock is selling for $35.57 per share, and has an average price target of $42.33. This implies an upside potential of 19%. (See ACI stock analysis on TipRanks)

Lattice Semiconductor Corporation (LSCC)

With our next stock, we’re looking into the semiconductor chip industry. Lattice Semiconductor inhabits the market for customizable processor chips, the types used in programmable logic devices. Lattice’s chips are also popular in video connectivity products and millimeter wave devices. While these are not exactly household names, they are important in the tech field and filling this niche powered LSCC to a 185% gain in 2019.

Showing the potential strength of this stock, LSCC is attracting individual investors. Based on data derived from more than 48,000 investor portfolios, this stock shows increased investor purchases in both the last 30 and the last 7 days. While the numbers are small, it is an indicator that investors are interested in Lattice.

The quarterly earnings results are in line with the stock’s growth orientation. In Q3, the company beat both the revenue and earnings forecasts. Looking ahead to Q4, which will be reported next week, the good news is expected to continue. Revenues are estimated to come in at $100.07 million, a 4.3% year-over-year gain, while the EPS, predicted at 15 cents, should show an even better 87% year-over-year performance.

Baird analyst Tristan Gerra is impressed enough by Lattice to make the stock his top small-cap idea for 2020. In line with his bullish stance, he gives it a Buy rating and has raised his price target by 20% to $24. Gerra’s new target implies a possible upside of 22% for LSCC. (To watch Gerra’s track record, click here)

In his comments on the stock, Gerra explains his optimism: “Lattice’s competitive landscape is unobstructed, TAM is expanding with breakthrough new products targeting new market opportunities including edge AI and platform security. Key catalysts for 2020 include initial design win momentum for Nexus and ongoing operating leverage.”

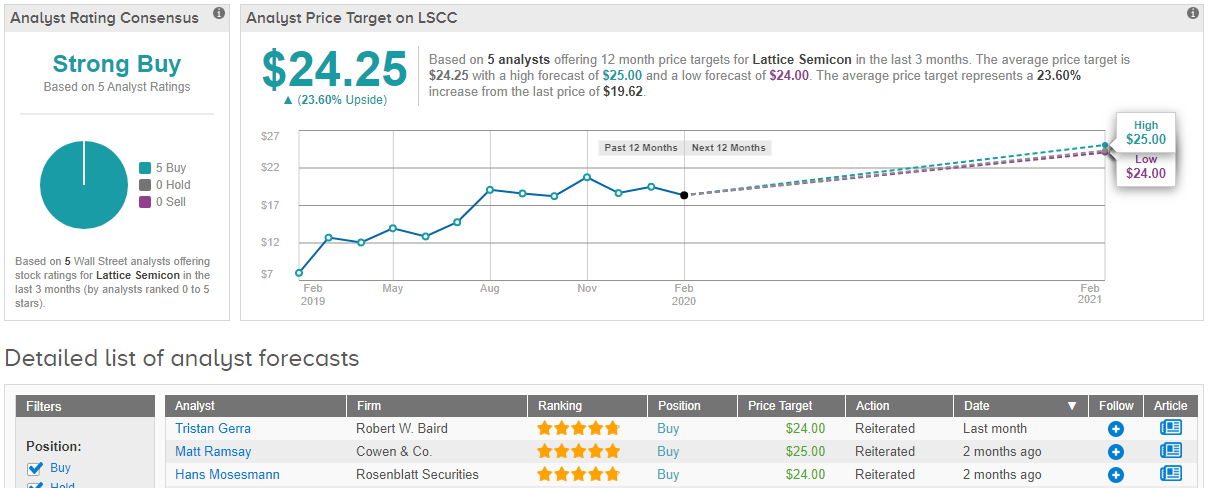

Lattice has 5 Buy ratings behind its Strong Buy consensus view, and an average price target of $24.25. This suggests an upside potential of 24% from the current share price of $19.62. (See Lattice Semiconductor stock-price forecast on TipRanks)

Telaria, Inc. (TLRA)

Third on our list is Telaria, a digital video advertising platform. The company offers a Video Management Platform, with which users can manage the premium ads in online videos to improve viewer targeting and monetize impressions. Essentially, Telaria’s software turns video ads into the users’ profit.

Like many small tech firms, Telaria usually operates at a net loss, with only one positive EPS in the last eight reported quarters. However, the upcoming Q4 report, to be released on February 25, is expected to be a positive one for the company. According to the Street consensus, TLRA will report a 2-cent EPS. While not high, and slightly lower than the 3-cent year ago number, a positive result will be a tonic for the stock. It’s important to remember here that TLRA’s previous positive earnings quarter was also Q4 – and that EPS, at 3 cents, beat the predicted loss by a wide margin.

Anticipating a strong quarter, TLRA shares rose sharply in January, and the stock has gained 22% so far this year. Stephens analyst Kyle Evans sees the stock as a Buy-side proposition, despite a recent announcement by Google that the search engine giant will phase out browser cookies in the next two years. That development will likely be a slight negative for TLRA, in Evans’ view, but the analyst describes concerns as “overblown” and maintains his Buy rating on the stock. (To watch Evans’ track record, click here)

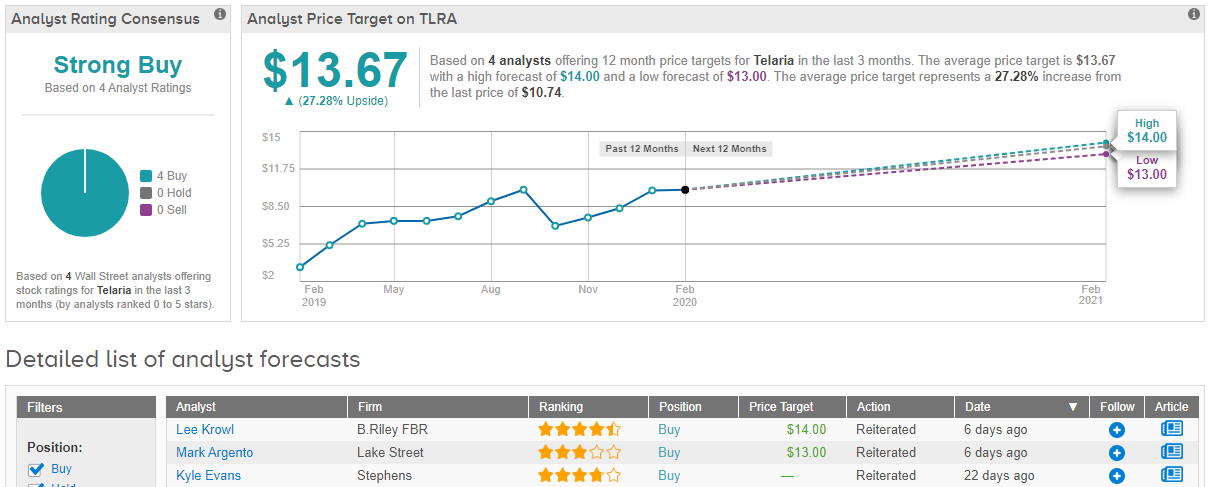

While Evans declined to set a price target on the stock, TLRA shares have a bullish profile. Wall Street’s analysts agree that the stock is one to Buy, and have given it 4 Buy ratings in recent weeks. Shares are priced at $10.74, and the average price target of $13.67 suggests room for 27% upside growth. (See Telaria price targets and analyst ratings on TipRanks)